Key Success Factors

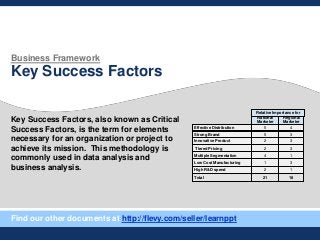

- 1. Business Framework Key Success Factors Key Success Factors, also known as Critical Success Factors, is the term for elements necessary for an organization or project to achieve its mission. This methodology is commonly used in data analysis and business analysis. Relative Importance for Effective Distribution Strong Brand National Marketer 5 Regional Marketer 4 5 3 Innovative Product Tiered Pricing 2 3 2 3 Multiple Segmentation Low Cost Manufacturing 4 1 1 3 High R&D spend Total 2 1 21 18 Find our other documents at http://flevy.com/seller/learnppt

- 2. 3 Key success factors and index of key success factors – how to apply them Key Success Factors Index of Key Success Factors Determining KSFs requires a thorough understanding of a business or segment, and therefore draws on several of other analytics in the toolkit. Relevant issues in understanding the business or segment are: – How customers buy, and what’s important to them in the purchase decision: • See key purchase criteria – Who’s successful in the business or analytic segment, and why. See: • Company analysis • Financial analysis – Trends within the business or segment Other sources of insights into key success factors are: – Client’s executives/staff – Industry analysts or commentators Determining KSFs is an iterative process: initial research, developing draft hypotheses, testing and, refining these hypotheses The purpose of developing an index of KSFs is to understand: – Which ones are most important – How competitors perform relative to each key success factor Ranking KSFs, and scoring competitors, requires a good understanding of the business or segments Key steps in the process for ranking and weighting KSFs: – Identify KSFs (see box, left) – Give each KSFs a weighting reflecting its relative importance (this is a non-trivial task): • How would you allocate investment resources for a competitor? – Score each competitor against each key success factor: • Document the rationale for each score – Add up the total scores for each competitor – Convert the total for each competitor into a percentage (i.e. what proportion of the perfect score it achieved?) The resulting percentages indicate the relative performance of each competitor

- 3. 5 Key success factors & index of key success factors – guidelines Key Success Factors – Identification Techniques I II III IV Technique Focus Environmental analysis (e.g. PEST) Macro Analysis of industry structure (e.g. Porter, Value Chain) Industry Macro Industry/business experts Industry Micro Analysis of competition (focus is limited to the competitive environment, how firms compete) Industry Micro Sources Advantages Disadvantages • Environment scanning (Corp. Staff) • Econometric models • Socio-political consulting services • Future orientation • Macro orientation: analysis goes beyond industry-firm focus • Can be linked to threats/ opportunity evaluation • More difficult to operationalise into specific industry or firm KSFs • Results may not lend themselves to incorporate usage in current timeframe (today’s KSFs) • A variety of industry structure frameworks • Specific focus is on industry • Frameworks allow user to understand interrelationships between industry structural components • Can force more macro level focus (beyond industry boundaries) • While excellent source for industry-wide KSFs not so useful in determining firm-specific KSFs • Industry association executives • Financial analysts specialising in industry • Outsider familiar with firms in industry • Knowledgeable insiders who work in industry • Means of soliciting ―conventional wisdom‖ about industry and firms • Subjective information often not discovered with more objective, formal and analytical approaches • Lack of objectivity often leads to questions in verifying/justifying • Staff specialities • Line managers • Internal consultants • External consultants • Narrowness of focus, offers, advantage of detailed, specific data • Depth of analysis leads to better means of justification • Narrowness of focus – KSF development limited to competitive arena (as opposed to industry structure approach) Note ―CSFs‖ = Critical Success Factors. Source: Leidecker and Bruno, Identifying and using Critical Success Factors, 1984.

- 4. 7 Key success factors and index of key success factors – top tips Potential Insights Hints Determining key success factors, based on a thorough understanding of a business or segment, can highlight areas on which clients should focus: – Strengthen capabilities – Defend capabilities Helps determine which competitors are well positioned to compete successfully, and estimate the relative performance of competitors Do: Focus on drawing up the right key success factors Choose a simple scale for weighting criteria Recognize that the index largely involves quantifying judgments: – Where possible, try to obtain quantitative data on each competitors performance against each key success factor