More Related Content Similar to Duke-Energy 04 Stat_Supplement Similar to Duke-Energy 04 Stat_Supplement (20) 1. CONTENTS

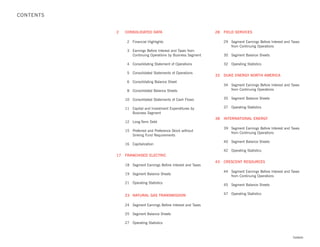

2 CONSOLIDATED DATA 28 FIELD SERVICES

2 Financial Highlights 29 Segment Earnings Before Interest and Taxes

from Continuing Operations

3 Earnings Before Interest and Taxes from

Continuing Operations by Business Segment 30 Segment Balance Sheets

4 Consolidating Statement of Operations 32 Operating Statistics

5 Consolidated Statements of Operations

33 DUKE ENERGY NORTH AMERICA

6 Consolidating Balance Sheet

34 Segment Earnings Before Interest and Taxes

from Continuing Operations

8 Consolidated Balance Sheets

35 Segment Balance Sheets

10 Consolidated Statements of Cash Flows

37 Operating Statistics

11 Capital and Investment Expenditures by

Business Segment

38 INTERNATIONAL ENERGY

12 Long-Term Debt

39 Segment Earnings Before Interest and Taxes

15 Preferred and Preference Stock without

from Continuing Operations

Sinking Fund Requirements

40 Segment Balance Sheets

16 Capitalization

42 Operating Statistics

17 FRANCHISED ELECTRIC

43 CRESCENT RESOURCES

18 Segment Earnings Before Interest and Taxes

44 Segment Earnings Before Interest and Taxes

19 Segment Balance Sheets

from Continuing Operations

21 Operating Statistics

45 Segment Balance Sheets

47 Operating Statistics

23 NATURAL GAS TRANSMISSION

24 Segment Earnings Before Interest and Taxes

25 Segment Balance Sheets

27 Operating Statistics

Contents

2. Duke Energy Corporation

FINANCIAL HIGHLIGHTS

Years ended December 31

2004 2003 2002 2001 2000

(In millions, except per share amounts)

COMMON STOCK DATA a

Earnings (loss) per share (from continuing operations)

$ 1.31

Basic . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (1.13) $ 1.53 $ 2.59 $ 2.42

$ 1.27

Diluted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (1.13) $ 1.53 $ 2.57 $ 2.41

Earnings (loss) per share (from discontinued operations)

$ 0.28

Basic . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (0.17) $ (0.31) $ (0.01 ) $ (0.03)

$ 0.27

Diluted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (0.17) $ (0.31) $ (0.01) $ (0.03)

Earnings (loss) per share (before cumulative effect of change in

accounting principle)

$ 1.59

Basic . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (1.30) $ 1.22 $ 2.58 $ 2.39

$ 1.54

Diluted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (1.30) $ 1.22 $ 2.56 $ 2.38

Earnings (loss) per share

$ 1.59

Basic . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (1.48) $ 1.22 $ 2.45 $ 2.39

$ 1.54

Diluted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (1.48) $ 1.22 $ 2.44 $ 2.38

957

Shares outstanding at year end . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 911 895 777 739

931

Weighted average shares outstanding . . . . . . . . . . . . . . . . . . . . . . . . . 903 836 767 736

$1,065

Dividends paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $1,051 $ 938 $ 871 $ 828

$ 1.10

Dividends paid (per share) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1.10 $ 1.10 $ 1.10 $ 1.10

$17.18

Book value (per share) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $15.09 $16.70 $16.33 $ 13.60

Historical Reference b

Market price (per share)

$26.16

High . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $21.57 $40.00 $47.74 $ 44.97

$18.85

Low . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $12.21 $16.42 $32.22 $ 23.19

$25.33

Close . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $20.45 $19.54 $39.26 $ 42.63

a Amounts prior to 2001 were restated to reflect the two-for-one common stock split effective January 26, 2001.

b As of 2001, data reflects the intra-day high and low stock price.

2 Consolidated Data

3. Duke Energy Corporation

EARNINGS BEFORE INTEREST AND TAXES FROM CONTINUING OPERATIONS BY BUSINESS SEGMENT

Consolidated

Earnings (Loss)

EBIT

Interest Expense, from Continuing

Franchised Natural Gas Field Duke Energy International Minority Interest Operations before

Electric Transmission Services North America Energy Crescent Expense & Other Income Taxes

(In millions)

2004 QUARTERS ENDED

$ (558 )a

March 31 . . . . . . . . . . . . . . . $ 424 $ 398 $ 91 $ 29 $ 60 $ (347 ) $ 97

June 30 . . . . . . . . . . . . . . . . 338 311 95 (37 ) 68 87 (321) 541

Sept 30 . . . . . . . . . . . . . . . . 453 265 66 (17 ) 64 43 (345) 529

Dec 31 . . . . . . . . . . . . . . . . 252 336 128 77 61 50 (299) 605

Total . . . . . . . . . . . . . . . . . . $1,467 $1,310 $380 $ (535 ) $222 $240 $(1,312) $ 1,772

2003 QUARTERS ENDED

$ 587

March 31 . . . . . . . . . . . . . . . $ 454 $ 423 $ 29 $ 23 $ 40 $ 1 $ (383)

597

June 30 . . . . . . . . . . . . . . . . 316 306 55 211 91 21 (403)

(17)

Sept 30 . . . . . . . . . . . . . . . . 436 280 52 (411 )b 44 40 (458)

(2,877)

Dec 31 . . . . . . . . . . . . . . . . . 197 308 51 (3,164 )c 40 72 (381 )

$(1,710)

Total . . . . . . . . . . . . . . . . . . $1,403 $1,317 $187 $(3,341 ) $215 $134 $(1,625 )

2002 QUARTERS ENDED

$ 538

March 31 . . . . . . . . . . . . . . . $ 384 $ 266 $ 36 $ 54 $ 49 $ 2 $ (253)

715

June 30 . . . . . . . . . . . . . . . . 388 313 43 196 61 23 (309)

357

Sept 30 . . . . . . . . . . . . . . . . 575 288 21 (107 ) (31) 16 (405 )

296

Dec 31 . . . . . . . . . . . . . . . . . 248 294 48 26 23 117 (460 )

$ 1,906

Total . . . . . . . . . . . . . . . . . . $1,595 $1,161 $148 $ 169 $102 $158 $(1,427)

2001 QUARTERS ENDED

$ 873

March 31 . . . . . . . . . . . . . . . $ 459 $ 175 $124 $ 384 $ 56 $ 3 $ (328 )

667

June 30 . . . . . . . . . . . . . . . . 358 141 84 272 61 31 (280)

1,264

Sept 30 . . . . . . . . . . . . . . . . 607 142 70 654 52 50 (311 )

343

Dec 31 . . . . . . . . . . . . . . . . . 202 149 55 177 67 83 (390 )

$ 3,147

Total . . . . . . . . . . . . . . . . . . $1,626 $ 607 $333 $ 1,487 $236 $167 $(1,309 )

a Includes an approximate $360 million charge associated with the sale of DENA’s Southeast Plants

b Includes a $254 million goodwill writeoff

c Includes $2,903 million of impairments (related to DENA’s plants and redesignation of power contracts to mark-to-market)

3

Consolidated Data

4. Duke Energy Corporation

CONSOLIDATING STATEMENT OF OPERATIONS

Year Ended

Natural

December 31,

Franchised Gas Field Duke Energy International Eliminations/

2004

(In millions) Electric Transmission Services North America Energy Crescent Other Adjustments

OPERATING REVENUES a

$14,275

Non-regulated electric, natural gas, natural gas liquids and other . . . . . . . . . $ — $ — $10,104 $2,294 $619 $437 $1,144 $(323 )

5,111

Regulated electric . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,069 — — 67 — — — (25 )

3,117

Regulated natural gas . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 3,290 — — — — — (173 )

22,503

Total operating revenues . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,069 3,290 10,104 2,361 619 437 1,144 (521 )

OPERATING EXPENSES

11,335

Natural gas and petroleum products purchased . . . . . . . . . . . . . . . . . . . . . — 758 8,614 1,398 4 — 946 (385 )

3,568

Operation, maintenance and other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,264 701 550 419 164 343 264 (137 )

2,098

Fuel used in electric generation and purchased power . . . . . . . . . . . . . . . . 1,206 — — 665 228 — — (1 )

1,851

Depreciation and amortization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 863 418 298 173 58 2 39 —

539

Property and other taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 280 156 47 34 8 6 8 —

65

Impairment and other related charges . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — 22 1 — 42 — —

19,456

Total operating expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,613 2,033 9,531 2,690 462 393 1,257 (523 )

GAINS ON SALES OF INVESTMENTS IN COMMERCIAL

AND MULTI-FAMILY REAL ESTATE . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 192

— — — — 192 — —

GAINS (LOSSES) ON SALES OF OTHER ASSETS, NET . . . . . . . . . . . . . . . (225 )

3 17 2 (248 ) (3 ) — 4 —

OPERATING INCOME (LOSS) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,014

1,459 1,274 575 (577 ) 154 236 (109 ) 2

OTHER INCOME AND EXPENSES

161

Equity in earnings of unconsolidated affiliates . . . . . . . . . . . . . . . . . . . . . . — 25 60 5 51 3 17 —

(4 )

Gains (Losses) on sales and impairments of equity investments . . . . . . . . . . — 16 (23 ) — 2 — 1 —

145

Other income and expenses, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8 17 — 7 25 — 14 74

302

Total other income and expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8 58 37 12 78 3 32 74

MINORITY INTEREST EXPENSE (BENEFIT) b . . . . . . . . . . . . . . . . . . . . . . — 22 232 (30 ) 10 (1 ) —

EARNINGS BEFORE INTEREST AND TAXES FROM

CONTINUING OPERATIONS (EBIT) . . . . . . . . . . . . . . . . . . . . . . . . . . . . $1,467 $1,310 $ 380 $ (535 ) $222 $240 $ (77)

INTEREST EXPENSE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,349

MINORITY INTEREST EXPENSE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 195

EARNINGS FROM CONTINUING OPERATIONS BEFORE INCOME TAXES . . 1,772

INCOME TAX EXPENSE FROM CONTINUING OPERATIONS . . . . . . . . . . . 540

INCOME FROM CONTINUING OPERATIONS . . . . . . . . . . . . . . . . . . . . . . 1,232

DISCONTINUED OPERATIONS

(10 )

Net operating loss, net of tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

268

Net gain on dispositions, net of tax . . . . . . . . . . . . . . . . . . . . . . . . . . . .

INCOME FROM DISCONTINUED OPERATIONS . . . . . . . . . . . . . . . . . . . . 258

NET INCOME . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,490

DIVIDENDS AND PREMIUMS ON REDEMPTION OF

PREFERRED AND PREFERENCE STOCK . . . . . . . . . . . . . . . . . . . . . . . . 9

EARNINGS AVAILABLE FOR COMMON STOCKHOLDERS . . . . . . . . . . . . . $ 1,481

a Presentation does not reflect certain immaterial reclassifications that were made in the Form 10-Q for the quarter ended March 31, 2005.

b Includes minority interest expense (benefit) related to EBIT and excludes minority interest expense (benefit) related to interest and taxes.

4 Consolidated Data

5. Duke Energy Corporation

CONSOLIDATED STATEMENTS OF OPERATIONS

Years ended December 31

2004 2003 2002 2001

(In millions)

OPERATING REVENUES a

$14,275

Non-regulated electric, natural gas, natural gas liquids and other .............................................................. $14,178 $8,780 $11,879

5,111

Regulated electric ................................................................................................................................ 4,960 4,880 5,088

3,117

Regulated natural gas .......................................................................................................................... 2,942 2,200 922

22,503

Total operating revenues........................................................................................................................ 22,080 15,860 17,889

OPERATING EXPENSES

11,335

Natural gas and petroleum products purchased ...................................................................................... 11,419 5,360 6,865

3,568

Operation, maintenance and other.......................................................................................................... 3,796 3,304 3,706

2,098

Fuel used in electric generation and purchased power .............................................................................. 2,075 2,191 2,022

1,851

Depreciation and amortization................................................................................................................ 1,792 1,506 1,252

539

Property and other taxes........................................................................................................................ 526 533 430

65

Impairment and other related charges .................................................................................................... 2,956 364 —

Impairments of goodwill ........................................................................................................................ — 254 — 36

19,456

Total operating expenses........................................................................................................................ 22,818 13,258 14,311

GAINS ON SALES OF INVESTMENTS IN COMMERCIAL AND MULTI-FAMILY REAL ESTATE ...................... 192 84 106 106

(LOSSES) GAINS ON SALES OF OTHER ASSETS, NET............................................................................ (225 ) (199 ) 32 238

OPERATING INCOME (LOSS)................................................................................................................ 3,014 (853 ) 2,740 3,922

OTHER INCOME AND EXPENSES

161

Equity in earnings of unconsolidated affiliates .......................................................................................... 123 218 164

(4 )

(Losses) Gains on sales and impairments of equity investments ................................................................ 279 32 —

145

Other income and expenses, net ............................................................................................................ 182 129 147

302

Total other income and expenses............................................................................................................ 584 379 311

INTEREST EXPENSE............................................................................................................................ 1,349 1,380 1,097 760

MINORITY INTEREST EXPENSE b ........................................................................................................ 195 61 116 326

EARNINGS (LOSS) FROM CONTINUING OPERATIONS BEFORE INCOME TAXES ...................................... 1,772 (1,710 ) 1,906 3,147

INCOME TAX EXPENSE (BENEFIT) FROM CONTINUING OPERATIONS.................................................... 540 (707 ) 611 1,149

INCOME (LOSS) FROM CONTINUING OPERATIONS .............................................................................. 1,232 (1,003 ) 1,295 1,998

DISCONTINUED OPERATIONS

Net operating loss, net of tax .............................................................................................................. (10 ) (27 ) (261 ) (4 )

Net gain (loss) on dispositions, net of tax.............................................................................................. 268 (131 ) — —

INCOME (LOSS) FROM DISCONTINUED OPERATIONS .......................................................................... 258 (158 ) (261 ) (4 )

INCOME (LOSS) BEFORE CUMULATIVE EFFECT OF CHANGE IN ACCOUNTING PRINCIPLE .................... 1,490 (1,161 ) 1,034 1,994

CUMULATIVE EFFECT OF CHANGE IN ACCOUNTING PRINCIPLE, NET OF TAX AND MINORITY INTEREST — (162 ) — (96 )

NET INCOME (LOSS) .......................................................................................................................... 1,490 (1,323 ) 1,034 1,898

DIVIDENDS AND PREMIUMS ON REDEMPTION OF PREFERRED AND PREFERENCE STOCK .................. 9 15 13 14

EARNINGS (LOSS) AVAILABLE FOR COMMON STOCKHOLDERS ............................................................ $1,481 $(1,338 ) $1,021 $1,884

a Presentation does not reflect certain immaterial reclassifications that were made in the Form 10-Q for the quarter ended March 31, 2005.

b Minority Interest Expense includes dividends of $55 million in 2003, $108 million in 2002 and $108 million in 2001 related to trust preferred securities.

5

Consolidated Data

6. Duke Energy Corporation

CONSOLIDATING BALANCE SHEET - ASSETS

Natural

December 31,

Franchised Gas Field Duke Energy International Eliminations/

2004

Electric Transmission Services North America Energy Crescent Other Adjustments

(In millions)

CURRENT ASSETS

$ 533

Cash and cash equivalents . . . . . . . . . . . . . . . $ 14 $ (44 ) $ 59 $ 57 $ 301 $ 25 $ 124 $ (3 )

1,319

Short-term investments . . . . . . . . . . . . . . . . . . 185 — 265 1 — — 868 —

3,237

Receivables, net . . . . . . . . . . . . . . . . . . . . . . . 1,015 638 1,300 446 603 95 (265 ) (595 )

942

Inventory . . . . . . . . . . . . . . . . . . . . . . . . . . . . 405 324 74 98 34 — 7 —

40

Assets held for sale . . . . . . . . . . . . . . . . . . . . . — — — 18 22 — — —

Unrealized gains on mark-to-market

962

and hedging transactions . . . . . . . . . . . . . . . . — 7 59 868 — — 30 (2 )

938

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13 45 17 338 18 — 105 402

7,971

Total current assets . . . . . . . . . . . . . . . . . . . . . 1,632 970 1,774 1,826 978 120 869 (198 )

INVESTMENTS AND OTHER ASSETS

1,292

Investments in unconsolidated affiliates . . . . . . . — 772 157 152 167 20 24 —

Investments and advances in (from) subsidiaries 12,439 10,983 10,832 4,275 (79 ) 772 22,621 (61,843 ) —

1,374

Nuclear decommissioning trust funds . . . . . . . . 1,374 — — — — — — —

4,148

Goodwill . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 3,398 498 — 245 7 — —

232

Notes receivable . . . . . . . . . . . . . . . . . . . . . . . — 57 — 52 68 55 — —

Unrealized gains (losses) on mark-to-market

1,379

and hedging transactions . . . . . . . . . . . . . . . . 2 — (9 ) 1,294 — — 92 —

84

Assets held for sale . . . . . . . . . . . . . . . . . . . . . — — 37 47 — — — —

Investments in residential, commercial and

1,128

multi-family real estate, net . . . . . . . . . . . . . . — — — — — 1,104 24 —

1,896

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,077 (10 ) 96 45 198 9 481 —

11,533

Total investments and other assets . . . . . . . . . . 14,892 15,200 11,611 5,865 599 1,967 23,242 (61,843 )

PROPERTY, PLANT AND EQUIPMENT

46,806

Cost . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20,950 13,309 6,146 3,917 2,189 — 295 —

13,300

Less accumulated depreciation and amortization 7,830 2,521 1,890 548 371 — 140 —

33,506

Net property, plant and equipment . . . . . . . . . . 13,120 10,788 4,256 3,369 1,818 — 155 —

REGULATORY ASSETS AND DEFERRED DEBITS

297

Deferred debt expense . . . . . . . . . . . . . . . . . . . 231 53 — — — — 13 —

1,269

Regulatory asset related to income taxes . . . . . . 376 893 — — — — — —

894

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 701 185 — 4 — — 7 (3 )

2,460

Total regulatory assets and deferred debits . . . . 1,308 1,131 — 4 — — 20 (3 )

TOTAL ASSETS . . . . . . . . . . . . . . . . . . . . . . . 55,470

30,952 28,089 17,641 11,064 3,395 2,087 24,286 (62,044 )

(12,753 ) (10,983 ) (10,831 ) (4,327 ) (66 ) (772 ) (22,457 ) 62,189 —

Intercompany balances . . . . . . . . . . . . . . . . . .

REPORTABLE SEGMENT ASSETS . . . . . . . . . . $55,470

$18,199 $17,106 $ 6,810 $6,737 $3,329 $1,315 $ 1,829 $ 145

6 Consolidated Data

7. Duke Energy Corporation

CONSOLIDATING BALANCE SHEET - LIABILITIES AND COMMON STOCKHOLDERS’ EQUITY

Natural

December 31,

Franchised Gas Field Duke Energy International Eliminations/

2004

Electric Transmission Services North America Energy Crescent Other Adjustments

(In millions)

CURRENT LIABILITIES

$ 2,414

Accounts payable . . . . . . . . . . . . . . . . . . . . . . $ 444 $ 209 $ 1,175 $ 546 $ 35 $ (1 ) $ 203 $ (197 )

68

Notes payable and commercial paper . . . . . . . . — 213 — — — — 146 (291 )

273

Taxes accrued (prepaid) . . . . . . . . . . . . . . . . . . 9 231 75 (475 ) 212 9 (338 ) 550

287

Interest accrued . . . . . . . . . . . . . . . . . . . . . . . 75 87 59 14 1 1 67 (17 )

30

Liabilities associated with assets held for sale . . — — — 5 25 — — —

1,832

Current maturities of long-term debt and preferred stock 506 157 607 121 61 11 369 —

Unrealized losses on mark-to-market and

819

hedging transactions . . . . . . . . . . . . . . . . . . . — 3 84 542 — — 191 (1)

1,815

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 347 425 275 332 53 147 154 82

7,538

Total current liabilities . . . . . . . . . . . . . . . . . . . 1,381 1,325 2,275 1,085 387 167 792 126

LONG-TERM DEBT

16,932

Long-term debt . . . . . . . . . . . . . . . . . . . . . . . . 5,646 5,396 1,649 75 513 23 3,630 —

Intercompany debt . . . . . . . . . . . . . . . . . . . . . 10 3,178 — 3,452 — — 7,463 (14,103 ) —

16,932

Total long-term debt . . . . . . . . . . . . . . . . . . . . 5,656 8,574 1,649 3,527 513 23 11,093 (14,103 )

DEFERRED CREDITS AND OTHER LIABILITIES

5,228

Deferred income taxes . . . . . . . . . . . . . . . . . . . 2,223 1,980 933 549 96 — (264 ) (289 )

154

Investment tax credit . . . . . . . . . . . . . . . . . . . . 154 — — — — — — —

Unrealized losses (gains) on mark-to-market

971

and hedging transactions . . . . . . . . . . . . . . . . 22 — (27 ) 886 — — 90 —

14

Liabilities associated with assets held for sale . . — — — 14 — — — —

1,926

Asset retirement obligations . . . . . . . . . . . . . . . 1,864 6 55 1 — — — —

4,646

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,211 639 56 41 56 28 656 (41 )

12,939

Total deferred credits and other liabilities . . . . . 7,474 2,625 1,017 1,491 152 28 482 (330 )

MINORITY INTERESTS . . . . . . . . . . . . . . . . . . — 1,486

354 850 94 132 59 (3 ) —

PREFERRED AND PREFERENCE STOCK

WITHOUT SINKING FUND REQUIREMENTS . . — 134

— — — — — 134 —

COMMON STOCKHOLDERS’ EQUITY

11,252

Common stock . . . . . . . . . . . . . . . . . . . . . . . . 11,252 3 1 120 124 1 11,253 (11,502 )

Additional paid-in capital . . . . . . . . . . . . . . . . . — 9,393 9,190 5,614 2,974 545 454 (28,170 ) —

4,539

Retained earnings (deficit) . . . . . . . . . . . . . . . . 5,189 4,761 2,589 (1,115 ) (415 ) 1,264 (569 ) (7,165 )

— 650

Accumulated other comprehensive income (loss) 1,054 70 248 (472 ) — 650 (900 )

16,441

Total common stockholders’ equity . . . . . . . . . . 16,441 15,211 11,850 4,867 2,211 1,810 11,788 (47,737 )

TOTAL LIABILITIES AND COMMON

STOCKHOLDERS’ EQUITY . . . . . . . . . . . . . . 55,470

30,952 28,089 17,641 11,064 3,395 2,087 24,286 (62,044 )

(12,753 ) (10,983 ) (10,831 ) (4,327 ) (66 ) (772 ) (22,457 ) 62,189 —

Intercompany balances . . . . . . . . . . . . . . . . . .

REPORTABLE SEGMENT LIABILITIES AND

COMMON STOCKHOLDERS’ EQUITY . . . . . . . $18,199 $17,106 $ 6,810 $6,737 $3,329 $1,315 $ 1,829 $ 145 $55,470

7

Consolidated Data

8. Duke Energy Corporation

CONSOLIDATED BALANCE SHEETS - ASSETS

December 31

2004 2003 2002 2001 2000

(In millions)

CURRENT ASSETS

$ 533

Cash and cash equivalents . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 397 $ 382 $ 290 $ 622

1,319

Short-term investments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 763 492 — —

3,237

Receivables, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,953 4,861 5,301 8,648

942

Inventory . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 941 971 863 659

40

Assets held for sale . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 361 — — —

962

Unrealized gains on mark-to-market and hedging transactions . . . . . . . . . . . . . . . 1,566 2,144 2,326 11,038

938

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 694 887 667 1,466

7,971

Total current assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7,675 9,737 9,447 22,433

INVESTMENTS AND OTHER ASSETS

1,292

Investments in unconsolidated affiliates . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,398 2,015 1,480 1,387

1,374

Nuclear decommissioning trust funds . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 925 708 716 717

4,148

Goodwill . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,962 3,747 1,730 1,566

232

Notes receivable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 260 589 576 462

1,379

Unrealized gains on mark-to-market and hedging transactions . . . . . . . . . . . . . . . 1,857 2,480 3,117 4,218

84

Assets held for sale . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,444 — — —

1,128

Investments in residential, commercial and multi-family real estate, net . . . . . . . . 1,353 1,440 1,253 1,150

1,896

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,137 1,645 1,612 1,447

11,533

Total investments and other assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13,336 12,624 10,484 10,947

PROPERTY, PLANT AND EQUIPMENT

46,806

Cost . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 45,987 47,368 38,345 33,501

13,300

Less accumulated depreciation and amortization . . . . . . . . . . . . . . . . . . . . . . . . 12,139 11,266 9,936 9,075

33,506

Net property, plant and equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33,848 36,102 28,409 24,426

REGULATORY ASSETS AND DEFERRED DEBITS

297

Deferred debt expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 275 263 203 208

1,269

Regulatory asset related to income taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,152 936 510 506

894

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 939 460 571 756

2,460

Total regulatory assets and deferred debits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,366 1,659 1,284 1,470

TOTAL ASSETS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $55,470 $57,225 $60,122 $49,624 $59,276

8 Consolidated Data

9. Duke Energy Corporation

CONSOLIDATED BALANCE SHEETS - LIABILITIES AND COMMON STOCKHOLDERS’ EQUITY

December 31

2004 2003 2002 2001 2000

(In millions)

CURRENT LIABILITIES

$ 2,414

Accounts payable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2,317 $ 3,637 $ 4,231 $ 7,733

68

Notes payable and commercial paper . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 130 915 1,603 1,826

273

Taxes accrued . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14 156 443 261

287

Interest accrued . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 304 310 239 208

30

Liabilities associated with assets held for sale . . . . . . . . . . . . . . . . . . . . . . . . 651 — — —

1,832

Current maturities of long-term debt and preferred stock . . . . . . . . . . . . . . . . . 1,200 1,331 274 470

819

Unrealized losses on mark-to-market and hedging transactions . . . . . . . . . . . . 1,283 1,918 1,519 11,070

1,815

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,849 1,770 2,146 1,769

7,538

Total current liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7,748 10,037 10,455 23,337

LONG-TERM DEBT, Including debt to affiliates of $876 at 2003 . . . . . . . . . . 16,932 20,622 20,221 12,321 10,717

DEFERRED CREDITS AND OTHER LIABILITIES

5,228

Deferred income taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,120 4,834 4,307 3,851

154

Investment tax credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 165 176 189 211

971

Unrealized losses on mark-to-market and hedging transactions . . . . . . . . . . . . 1,754 1,548 2,212 3,581

14

Liabilities associated with assets held for sale . . . . . . . . . . . . . . . . . . . . . . . . 737 — — —

1,926

Asset retirement obligations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,707 — — —

4,646

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,789 4,893 3,564 3,435

12,939

Total deferred credits and other liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . 13,272 11,451 10,272 11,078

GUARANTEED PREFERRED BENEFICIAL INTERESTS IN SUBORDINATED

NOTES OF DUKE ENERGY CORPORATION OR SUBSIDIARIES . . . . . . . . . . — — 1,408 1,407 1,406

MINORITY INTERESTS IN FINANCING SUBSIDIARY . . . . . . . . . . . . . . . . . . — — — 1,025 1,025

MINORITY INTERESTS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,486 1,701 1,904 1,221 1,410

PREFERRED AND PREFERENCE STOCK

Preferred and preference stock with sinking fund requirements a . . . . . . . . . . . —

— 23 25 38

134

Preferred and preference stock without sinking fund requirements . . . . . . . . . . 134 134 209 209

134

Total preferred and preference stock . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 134 157 234 247

COMMON STOCKHOLDERS’ EQUITY

11,252

Common stock . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9,519 9,236 6,217 4,797

4,539

Retained earnings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,060 6,417 6,292 5,379

650

Accumulated other comprehensive income (loss) . . . . . . . . . . . . . . . . . . . . . . 169 (709 ) 180 (120 )

16,441

Total common stockholders’ equity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13,748 14,944 12,689 10,056

TOTAL LIABILITIES AND COMMON STOCKHOLDERS’ EQUITY . . . . . . . . . . . $55,470 $57,225 $60,122 $49,624 $59,276

a Reclassified to Long-Term Debt as a result of the adoption of Statement of Financial Accounting Standards No. 150, “Accounting for Certain Financial Instruments with

Characteristics of Both Liabilities and Equity” which was effective July 1, 2003.

9

Consolidated Data