Big Island Real Esate Report-january-31-2013 Statistics, Trends, Sales, Kona

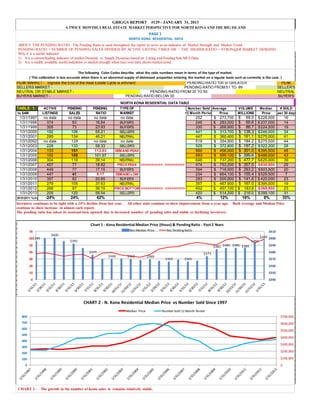

- 1. GRIGGS REPORT #129 - JANUARY 31, 2013 A TWICE MONTHLY REAL ESTATE MARKET PERSPECTIVE FOR NORTH KONA AND THE BIG ISLAND PAGE 1 NORTH KONA RESIDENTIAL DATA ABOUT THE PENDING RATIO: The Pending Ratio is used throughout the report to serve as an indicator of Market Strength and Market Trend.. PENDING RATIO = NUMBER OF PENDING SALES DIVIDED BY ACTIVE LISTING TIMES 100 / THE HIGHER RATIO = STRONGER MARKET DEMAND. Why it is a useful indicator: 1) It is a current leading indicator of market Demand vs. Supply Dynamics based on Listing and Pending Sale MLS Data. 2) It is a readily available useful indication or market strength when tract over time shows market trend. The following Color Codes describe what the ratio numbers mean in terms of the type of market. ( This calibration is less accurate when there is an abnormal supply of distressed properties entering the market on a regular basis such as currently is the case. ) PEAK MARKET - Signals the End of the Real Estate Cycle is eminent PENDING RATIO 100 or GREATER PEAK SELLERS MARKET PENDING RATIO FROM 51 TO 99 SELLER'S NEUTRAL OR STABLE MARKET PENDING RATIO FROM 30 TO 50 NEUTRAL BUYERS MARKET PENDING RATIO BELOW 30 BUYER'S NORTH KONA RESIDENTIAL DATA TABLE TABLE 1 ACTIVE LISTINGS PENDING SALES PENDING RATIO 1/31/1997 1/31/1998 1/31/1999 1/31/2000 1/31/2001 1/31/2002 1/31/2003 1/31/2004 1/31/2005 1/31/2006 1/31/2007 1/31/2008 1/31/2009 1/31/2010 1/31/2011 1/31/2012 1/31/2013 no data 374 305 192 290 no data 228 133 152 304 407 449 447 397 279 268 205 no data 63 73 106 134 129 133 151 155 119 77 77 41 82 105 97 120 no data 16.84 23.93 55.21 46.21 no data 58.33 113.53 101.97 39.14 18.92 17.15 9.17 20.65 37.63 36.19 58.54 2010/2011 %chg -24% 24% 62% to $4M TYPE OF MARKET Num ber Sold Average 12 Month Period Price no data BUYER'S BUYER'S SELLER'S NEUTRAL no data SELLER'S DEMAND PEAK SELLER'S NEUTRAL PRICE PEAK >>>>>>>>>> >>>>>>>>> BUYER'S DEMAND LOW BUYER'S NEUTRAL PRICE BOTTOM >>>>>>>>>> >>>>>>>>> SELLER'S 252 246 330 441 447 519 529 660 683 648 474 394 234 283 357 402 420 $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ 4% VOLUME MILLIONS 273,700 283,000 268,900 313,700 360,400 354,900 372,800 456,000 585,100 737,200 753,200 718,900 664,100 500,900 467,900 457,100 514,200 12% Inventory continues to be tight with a 24% decline from last year. All other stats continue to show improvement from a ye ar ago. continue to show increase in almost each report. The pending ratio has taken its seasonal turn upward due to increased number of pending sales and stable or declining invent ory. Median # SOLD Price Last 30 days $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ 69.0 $ 228,000 69.6 $ 237,000 88.7 $ 224,500 138.3 $ 246,000 161.1 $ 275,000 184.2 $ 275,000 197.2 $ 322,200 301.0 $ 395,500 399.6 $ 498,000 477.7 $ 625,000 357.0 $ 630,000 283.2 $ 603,500 155.4 $ 529,500 141.8 $ 420,000 167.0 $ 395,000 $ $ 183.8 216.0 $ 368,500 $ 399,100 16 14 19 34 41 44 28 48 43 39 29 20 7 23 19 23 31 8% 35% 18% Both Average and Median Price Chart 1 - Kona Residential Median Price (thous) & Pending Ratio - Past 2 Years 70 60$395 Res-Median Price Res Pending Ratio $410 $400 $391 $393 $383 $385 $385 $385 50 40 30 $375 $369 $369 $369 $373 $365 $365 $399 $400 $390 $380 $370 20 $360 10 $350 0 $340 CHART 2 - N. Kona Residential Median Price vs Number Sold Since 1997 Median Price Number Sold 12 Month Period 800 $700,000 700 $600,000 600 $500,000 500 $400,000 400 $300,000 300 200 $200,000 100 $100,000 0 CHART 2 - $- The growth in the number of home sales is remains relatively stable.

- 2. PAGE 2 NORTH KONA RESIDENTIAL PRICE RANGE TABLE AND BIG ISLAND RESIDENTIAL LISTINGS, PENDING SALES AND SALES Year To Date TABLE 2 KONA Residential NUMBER PRICE RANGE ACTIVE TO $ 400,000 $ 401,000 $ 500,000 $ 501,000 $ 700,000 $701,000 $ 900,000 $ 901,000 $1,500,000 $1.5M $ 4.0M $4.001 M or GREATER NORTH KONA RESIDENTIAL PRICE RANGE DATA NORTH KONA RESIDENTIAL PRICE RANGE DATA AVERAGE PRICE NUMBER PENDING 33 30 38 34 $ 322,600 $ 452,900 $ 625,900 $ 827,900 40 $ 1,165,300 30 $ 2,278,500 36 $ 7,833,800 AVERAGE PRICE 65 $304,800 21 $ 445,600 14 $ 600,000 12 $ 783,100 5 $1,197,000 3 $ 2,716,700 5 $ 9,189,000 PENDING VOL MILLIONS $ $ $ $ $ $ $ KONA RES 2012 232 61 52 26 25 8 19 19.8 9.4 8.4 14.4 13.6 8.2 45.9 NUMBER SOLD PENDING 2013 RATIO 214 80 57 36 25 11 12 196.97 70.00 36.84 35.29 12.50 10.00 13.89 TABLE 2 - The under $400,000 inventory now stands at only 33 homes. ....WOW! The over $4.0M market has had quite a lift in its seasonal sales with decline in inventory and nice spike in pending sales of 5 homes. This is up from 0 one month ago. Pink "Buyers" market is only indicated in 3 price ranges now, all above CHART 3 - NORTH KONA RESIDENTIAL NUMBER SOLD PAST 12 MONTHS BY PRICE RANGE - Number, Percent of Total 11, 3% 12, 3% TO $400,000 25, 6% $401,000 $500,000 $501,000 $700,000 36, 8% $701,000 $900,000 $901,000 $1,500,000 $1.5M $ 4.0M $4.001 M or GREATER 214, 49% 57, 13% 80, 18% TABLE 3 3-1 TO 3-4 ALL EAST HI RESIDENTIAL 3-5 TO 3-9 ALL WEST HI RESIDENTIAL ALL BIG ISLE ALL BIG ISLE ALL BIG ISLE BIG ISLE R ES ACTIVE PENDING SOLD YTD ACTIVE PENDING SOLD YTD ACTIVE PENDING SOLD YTD BIG ISLAND LISTING, PENDING SALES AND SALES YEAR TO DATE NUMBER LOW 562 AVERAGE MEDIAN NORTH KONA HIGH RESIDENTIAL PRICE RANGE DATA MODE $25,500 $5,900,000 $374,694 $255,000 N/A 186 $42,000 $1,995,000 $240,703 $175,000 N/A 46 $46,500 $575,000 $221,767 $200,500 $230,000 655 $19,600 $25,000,000 $1,257,135 $519,000 $695,000 230 $30,000 $11,900,000 $644,924 $368,500 $399,000 VOLUME (M) PENDING $ 210.6 RATIO $ 44.8 $ 10.2 33.10 55 $50,000 $3,300,000 $468,814 $350,000 $350,000 1217 $19,600 $25,000,000 $849,631 $369,000 $30,000 $11,900,000 $464,190 $266,500 $299,000 101 $46,500 $3,300,000 $356,298 $282,500 $230,000 148.3 25.8 $1,034 $ $ 193.1 36.0 $299,000 416 $823 $ $ 35.11 34.18 CHART 4 - West HI, East HI and Hawaii Island - Residential Pending Ratio over the Past Two Years 45.00 40.00 35.00 30.00 25.00 20.00 15.00 West Hawaii Ratio East Hawaii Ratio Big Is Res Ratio 10.00 5.00 - CHART 4 - A seasonal increase in Pending Ratio is on cue with both East and West sides showing nice increase in Pending Ratio. 1/31/12 Island wide inventory is down 17% from

- 3. PAGE 3 CHART 5 - Percentage of ISLAND DISTRESSED RESIDENTIALsales Listings that are Short Sales or REO BIG Total MLS Active, Pending or 90 PROPERTIES TREND 60.00% 50.00% 40.00% N. KONA 3-7 WAIKOLOA 3-6-8 30.00% WAIMEA 3-6-4,5,6 S HILO 3-2 PUNA 3-1 20.00% 10.00% 0.00% CHART 3: THIS CHART IS PROBABLY THE BEST INDICATOR OF THE ISLAND WIDE DESTRESSED PROPERTY TREND. All market areas covered showed declines in the percentage of MLS listing that are either REO or Short Sales. Chart 6 - Number of REO Properties By District , Owned by: Fed. National Mortgage Assn. (FANNIE MAE), Deutsche Bank, Wells Fargo & Bank of America # of REO Properties 60 Puna 50 S Hilo 40 30 S Kohala 20 10 01/31/12 02/29/12 03/31/12 04/30/12 05/31/12 06/30/12 07/31/12 08/31/12 09/30/12 10/31/12 11/30/12 12/31/12 N Kona S Kona, Kau 0 01/31/13 CHART 4: THIS CHART LOOKS AT THE FORECLOSURE TREND AS REFLECTED IN THE NUMBER OF Fannie Mae, Deutsche Bank, Wells Fargo and Bank of America OWNED PROPERTIES. MUCH OF THE DECLINE IS DUE THE PASSAGE OF ACT 48. THIS INCLUDES ALL PROPERTY TYPES, BUT IS DOMINATED BY RESIDENTIAL. By far the greatest number of REO's are in the Puna market area. Island wide the numbers haven't decline much since last summer. Current total is 75. PAGE 4

- 4. PAGE 4 TABLE 4 to $1.5M ACTIVE LISTINGS PENDING SALES no data no data 297 200 154 no data 178 60 112 279 407 413 367 300 234 176 147 2012/2013 %chg -16% TYPE OF MARKET no data no data 78 78 62 no data 193 202 202 72 45 26 19 65 60 61 65 7% 1/31/1997 1/31/1998 1/31/1999 1/31/2000 1/31/2001 1/31/2002 1/31/2003 1/31/2004 1/31/2005 1/31/2006 1/31/2007 1/31/2008 1/31/2009 1/31/2010 1/31/2011 1/31/2012 1/31/2013 PENDING RATIO no data no data 26.26 39.00 40.26 no data 108.43 336.67 180.36 25.81 11.06 6.30 5.18 21.67 25.64 34.66 44.22 28% Number Sold AVERAGE 12 Month Period Price no data no data BUYER'S NEUTRAL NEUTRAL no data PEAK DEMAND PEAK PEAK BUYER'S PRICE PEAK >>>>>>>>>> >>>>>>>>> BUYER'S DEMAND LOW BUYER'S BUYER'S PRICE LOW >>>>>>>>>> >>>>>>>>> NEUTRAL 310 312 370 470 483 391 500 614 609 662 398 251 184 166 295 303 322 6% $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ 139,700 128,700 131,200 149,900 169,500 188,800 208,400 236,400 315,000 435,400 443,500 406,400 346,200 276,300 229,600 199,400 224,900 13% VOLUME MILLIONS $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ 43 40 49 70 82 74 104 145 192 288 177 102 64 46 68 60 72 20% Price # SOLD Last 30 days $ 126,000 $ 108,500 $ 115,000 $ 131,000 $ 137,500 $ 150,000 $ 183,000 $ 205,000 $ 290,000 $ 395,000 $ 400,000 $ 360,000 $ 330,000 $ 242,500 $ 199,000 $ 163,500 $ 187,300 15% 24 20 41 39 30 24 52 58 34 44 29 12 10 21 23 33 23 -30% MEDIAN Chart 7 - Kona Condo Median Price( thous) & Pending Ratio - Past 2 Years Median Price Condo Pending Ratio 60 50 $250 $186 $180 40 $175 $172 $168 $165 $162 $165 $172 $171 $173 $175 $180 $187 $200 $150 30 $100 20 $50 10 0 $- CHART 7 - Like Residential the N. Kona condo inventory shows a Year over Year decline. Unlike residential the number pending sales and sales is not much different than a year ago. Median price is up a healthy 15% percent now compared to median price in previous twelve months. CHART 8 NORTH KONA CONDO MEDIAN PRICE vs NUMBER SOLD 700 600 9/ 10/ 11/ 12/ 1/31/201 $450,000 $400,000 $350,000 500 $300,000 400 $250,000 300 $200,000 Number Sold 12 Month Period $150,000 200 MEDIAN Price $100,000 100 0 CHART 8 - Condo price appears to be on an increasing trend due to strong sales numbers and declining inventory. $50,000 $-

- 5. PAGE 5 NORTH KONA LAND DATA TABLE 5 to $1.5M 1/31/1997 1/31/1998 1/31/1999 1/31/2000 1/31/2001 1/31/2002 1/31/2003 1/31/2004 1/31/2005 1/31/2006 1/31/2007 1/31/2008 1/31/2009 1/31/2010 1/31/2011 1/31/2012 1/31/2013 2012/2013 %chg ACTIVE no data no data 372 262 290 no data 187 80 55 127 198 267 236 292 193 187 198 6% PENDING SALES PENDING RATIO TYPE OF MARKET no data no data 41 61 84 no data 88 118 43 39 17 13 12 15 11 8 24 no data no data 11.02 23.28 28.97 no data 47.06 147.50 78.18 30.71 8.59 4.87 5.08 5.14 5.70 4.28 12.12 no data no data 200% 183% Year over year stat's actual show an increase in inventory . Num ber Sold 12 Month Period 89 142 BUYER'S 141 BUYER'S 229 Neuatral 287 no data 206 Neuatral 294 DEMAND PEAK 272 Seller's 277 BUYER'S 150 PRICE PEAK >>>>>>>>>>>>>>>>>>> >>>>>>>>>>>>>>> 97 BUYER'S 57 DEMAND LOW 44 BUYER'S 50 BUYER'S 55 PRICE BOTTOM >>>>>>>>>>>>>>>>>>>>>>>>>>> 69 BUYER'S 90 30% Average Price $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ 212,200 194,700 147,800 157,900 210,800 195,200 199,500 265,800 362,600 510,000 531,500 463,400 405,200 290,800 256,000 272,400 220,100 -24% VOLUME MILLIONS Median # SOLD Price Last 30 days $ 18.9 $ 27.6 $ 20.8 $ 36.2 $ 60.5 $ 40.2 $ 58.7 $ 72.3 $ 100.4 $ 76.5 $ 51.6 $ 26.4 $ 17.8 $ 14.5 $ 14.1 $ 18.8 $ 19.8 $ 135,000 $ 125,000 $ 100,000 $ 116,000 $ 160,000 $ 170,000 $ 155,000 $ 225,000 $ 316,000 $ 435,000 $ 500,000 $ 420,000 $ 300,000 $ 272,000 $ 200,000 $ 180,000 $ 189,900 3 11 13 20 20 15 19 27 16 9 11 5 1 7 4 6 6 6% 6% 0% The up side of this is there is also double the number of escrows and sales are up 24%. Chart 9 - Kona Land Median Price (thous) & Pending Ratio Past 2 Years LAND-Median Price 18 16 LAND Ratio $250 $215 $199 14 $190 $184 $189 $175 $190 $190 $200 $178 $189 $190 $183 $188 $200 12 $150 10 8 $100 6 4 $50 2 0 $- CHART 10 - NORTH KONA LAND MEDIAN PRICE vs NUMBER SOLD 350 $600,000 300 $500,000 250 $400,000 200 $300,000 Median Price 150 $200,000 100 $100,000 50 0 Number Sold 12 Month Period $- Sales numbers and overall demand increase has not been enough to change the land markets price direction. Price seems to be relatively stable but not on increasing path seen wtih Residential and Condos. There is still a substantial general over supply. PAGE 6 4/30/11 5/31/11 6/30/11 7/31/11 8/31/11 9/30/11 10/31/11 11/30/11 12/31/11 1/31/12 2/29/12 3/31/12 4/30/12 5/31/12 6/30/12 7/31/12 8/31/12 9/30/12 10/31/12 11/30/12 12/31/12 1/31/13 2/28/13 3/30/13 4/30/13 5/30/13

- 6. PAGE 6 SUMMARY TABLE OF PENDING RATIO TRENDS FOR NORTH KONA RESIDENTIAL, CONDO AND LAND , BIG ISLAND RESIDENTIAL AND COLOR GUIDE FOR MARKET TYPE: PEAK KONA RES , CONDO, LND & BIG IS PENDING RATIO TRENDS TABLE 6 1/31/2005 1/31/2006 1/31/2007 1/31/2008 1/31/2009 1/31/2010 1/31/2011 1/31/2012 2/29/2012 3/31/2012 4/30/2012 5/31/2012 6/30/2012 7/31/2012 8/31/2012 9/30/2012 10/31/2012 11/30/2012 12/31/2012 1/31/2013 KONA RES 101.97 39.15 18.92 17.15 9.17 20.65 37.6 36.19 44.36 47.01 47.76 KONA CND 180.36 25.8 11.06 6.30 5.18 21.67 25.64 34.66 31.64 34.83 43.45 KONA LND 78.18 30.71 8.59 4.87 5.08 5.14 5.7 4.28 5.56 5.64 5.95 51.72 53.7 52.09 50.23 57.55 60.30 62.25 53.62 53.5 43.37 38.46 41.72 44.93 35.66 37.16 32.89 6.19 14.22 12.50 15.38 7.41 10.17 10.99 9.09 58.54 44.22 12.12 Average All Three 120.17 31.89 12.86 9.44 6.48 15.82 22.98 25.04 27.19 29.16 32.39 SELLERS NEUTRAL BUYERS KONA RESIDENTIAL PRICE RANGE PENDING RATIO'S TO $400K $401K-$500K $501K-$700K$701K-$900K $901-$1.5M $1.501M-$4.0M Big Is RES 10.98 18.87 23.89 25.03 30.56 30.56 32.83 52.38 92.86 124.07 115.25 121.05 120.34 27.27 56.25 48.48 65.38 70.97 63.33 11.86 11.11 21.21 12.90 21.31 21.43 20.37 4.62 4.76 7.69 13.89 21.88 24.24 25 2.17 10.45 10.53 2.08 16.67 14.63 10.26 0 10.13 3.13 2.86 5.41 3.13 12.9 37.14 37.10 34.35 35.78 36.63 35.38 36.80 31.87 33.72 33.28 34.17 34.19 37.93 36.25 35.90 32.03 148 169.77 180.00 180.49 168.18 160.87 178.00 186.11 65.52 67.86 41.94 30.56 86.67 82.14 82.14 58.62 18.75 20.83 17.65 18.33 24.07 32.56 45.00 31.71 30 23.33 44.00 57.14 33.33 25.00 21.43 19.35 12 16.22 13.16 5.41 5.26 5.13 15.38 15.00 5.8 3.33 6.67 3.70 8.00 4.17 3.57 6.67 38.29 34.18 196.97 70.00 36.84 35.29 12.50 10.00 61.76% 27.58% 183.18% 52.91% 36.56% 58.76% 44.39% 185.58% 154.07% 500.96% 249.65% TABLE # 6 - Higher Ratio = Stronger Market. BIG ISLAND PENDING RATIO CONTINUES TO STRENGTHEN AND IS AT NEW HIGH. 12' vs 13' Year over Year improvement is substantial in all catagories except Kona Condos is only slightly improved from a year ago. Notice as the recovery progresses the increasing Pending Ratios in Residential Price Ranges spreads to higher price levels. Three yea r ago all price range colomns were pink with the exception for under $400,000. CHART 6 - Kona Residential and Condo Pending Ratios for the past 12 Months 70.00 60.00 50.00 40.00 KONA RES 30.00 KONA CND 20.00 10.00 0.00 250.00 Chart 7 - North Kona Residential Pending Ratio by Price Range 200.00 TO $400K 150.00 $401K-$500K $501K-$700K 100.00 $701K-$900K $901-$1.5M 50.00 $1.501M-$4.0M 0.00 Chart 7 - As mentioned the year over year improvement is substantial. fairly dramatically going forward? The year end and first two weeks of the new year are fairly flat. We should expect this to change

- 7. PAGE 7 TABLE 1 - KONA & WEST COAST CITIES RESIDENTIAL INVENTORY - January 31, 2013 COUNTY KONA POPULATION 2010 Realtor.com - Market Area Peak Inventory Date Inventory PEAK Inventory 12 months ago to date CURRENT INVENTORY % Change 12 m onths % CHANGE FROM PEAK TO CURRENT LA VEGAS SAN DIEGO SAN FRAN 33,300 KONA Mar-09 475 268 205 -23.51% 9.819M LA Aug-07 6875 3918 2124 -45.79% 1.95M VEGAS Oct-07 16423 13011 9903 -23.89% 3.095M SAN DIEGO Sep-07 4302 2240 1233 -44.96% 805,000 SAN FRAN Oct-08 949 416 262 -37.02% -56.84% -69.11% -39.70% -71.34% -72.39% PORTLAND,O 2.260M PORTLAND Aug-08 5992 2658 1933 -27.28% SANTA FE, NM 144,170 SANTA FE, NM Aug-08 1797 1073 956 -10.90% -67.74% -46.80% TABLE & CHART 1 COMMENTS: Declining inventory trend continues in Kona and all other market areas on the West Coast followe d in this report. The inventory on the West Coast are showing the typical season decline couple by sharp Year over Year declines. Kona's i nventory decline is not at the pace of the CA metro's. San Diego and San Francisco showing very sharp declines. DQNEWS.COM comments below the Price chart indicate the Bay Area price appreciation greatest in 25 years at 20% Year over Yea r. Data is residential listing inventory from REALTOR.COM CHART 1 - Single Family Residential Inventory - KONA , SAN FRANCISCO, SAN DIEGO & L A KONA SAN FRAN SAN DIEGO LA DATE PRICE TREND COMMENTS: Each of the 20 cities in the Case Shiller study as of September shows price increase over the past 12 months. * Kona home price data from Hawaii Information Service and is Median Price. * San Diego , LA and San Francisco is a home price index from Case Shiller Home Price index. CHART 2 - Three Year Price Trend for Kona, San Diego, Los Angeles and San Francisco San Diego LA San Francisco Kona Home Price $400,000 200.00 180.00 160.00 $390,000 140.00 $380,000 120.00 100.00 $370,000 80.00 $360,000 60.00 $350,000 40.00 20.00 San Diego & L.A. Home Prices Index KONA $410,000 1 1 1 $340,000 0.00 Jan-11 Feb-11 Mar-11 Apr-11 May-11 Jun-11 Jul-11 Aug-11 Sep-11 Oct-11 Nov-11 Dec-11 Jan-12 Feb-12 Mar-12 Apr-12 May-12 Jun-12 Jul-12 Aug-12 Sep-12 Oct-12 Nov-12 Dec-12 Jan-13 CURRENT DQNEWS.COM HEADLINES RELATED TO CALIFORNIA MARKETS: SEE FULL STORY ON WEBSITE - DQNews.com 1) An estimated 39,760 new and resale houses and condos sold statewide last month, up 6.1 percent from 37,481 in November, and u p 5.4 percent from 37,734 sales in December 2011 2) The pace at which the Bay Area housing market is making up for lost ground quickened at the end of 2012 as sales increase d year-over-year for the 18th month in a row and the median price rose at its fastest rate in more than 25 years. The market remained constrained by a tight supply of homes for sale and a fussy home loan environment interest 3) The number of Golden State homes sold for a million dollars or more rose to its highest level since 2007, fueled by a rec overing economy, rising home prices and a record number of cash purchases. The number of homes sold for more than $5 million rose to an all -time high 4) The number of California homeowners pushed into the foreclosure process fell last quarter to the lowest level in six years, t he result of rising home values, an improving economy and a shift toward short sales . 5)The number of California homes purchased with cash reached an all -time high last year, the result of high investor interest, a difficult mortgage environment, and perceived higher returns on 1 1 1 1 1

- 8. PAGE 8 USEFUL WEBSITES: A www. dqnews.com/ - Western metros sales data and trends. B. www.housingtracker.net - Listing inventory and average list prices for 52 large cities. C. www. nahb.org - National Association of Home Builders. D.www.mbaa.org - Mortgage Bankers Association - loan activity and loan forecasts. E. www.fhfa.gov - Federal Housing Finance Agency - GOVERNMENT DATA ON HOUSING MARKET F. Google search - "Case-Shiller Home Price Indices" G. www.realtytimes.com - Real Estate Agents perspective of local markets. H. www.realtor.org - NAR - Select "News Media" and look for "Economic Housing Indicators". I. www.hawaii.gov/dbedt - Dept. of Business and Economic Development J. www.federalreserve.gov K. www.eia.doe.gov - Energy Information Agency - Oil and Gas prices and forecasts. L. www.hawaii-county.com/info/stats.html - Hawaii County statistics. Updates monthly. M. www.uhero.hawaii.edu/ Very good Hawaii State Economic reports DATA TABULATED BY: MICHAEL B. GRIGGS, R, CRA, GRI , Clark Realty Corporation THANK YOU FOR YOUR WORDS OF ENCOURAGEMENT, SUGGESTIONS AND COMMENTS THAT CONTINUE TO IMPROVE THE REPORTMike Griggs - mikegriggs@hawaiiantel.net cell ph. 808 936-8134 ALL HAWAII DATA HAS BEEN COLLECTED FROM MLS HAWAII, HAWAII INFORMATION SERVICE, REALTORS.COM AND OTHER SOURCES NAMED IN THE REPORT. NOTES: 1) PAGE 1- TABLE 1 - RESIDENTIAL DATA COLLECTED IS LIMITED TO $4M AND UNDER PRICE RANGE IN ORDER TO SCREEN OUT RECENT HIGH END ACTIVITY AT KUKIO AND HUALALAI RESORT AREA'S. SIMILARLY THE CONDO AND LAND DATA HAS AN UPPER LIMIT OF $1.5M. 2) NUMBER SOLD, AVERAGE PRICE AND MEDIAN PRICE IS DATA IS FROM A MOVING 12 MONTH PERIOD. UPDATED EVERY TWO WEEKS THIS I S A VERY ACCURATE METHOD OF TRACKING THE SALES PRICE TRENDS. 3) THE PENDING RATIO MAYBE A GOOD LEADING INDICATOR OF MARKET STRENGTH AND PRICE DIRECTION. THE MARKET TYPE DESIGNATION, EG. SELLER, BUYER MARKET, NEUTRAL AND PEAK IS BASED ON CALIBRATION IS USING PENDING RATIO DATA IN THE PAST MARKET CYCLE. 3) PAGE 1-TABLES 1 , 2 and 3 REPRESENTS THE ENTIRE NORTH KONA MARKET. IT SHOULD NOT BE CONSTRUED TO BE AN INDICATOR OF THE MARKET CONDITION IN ALL SUBMARKETS WITHIN THE MARKET AREA OR FOR DIFFERENT MARKET AREAS ON THE ISLAND. MICHAEL B. GRIGGS, RB AND CLARK REALTY CORPORATION ASSUMES NO RESPONSIBILITY FOR IT'S USE BY OTHERS. OTHERS. MAHALO! YOUR ARE WELCOME TO SHARE THE REPORT WITH 1 1 1 1 1 1