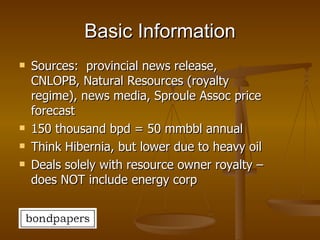

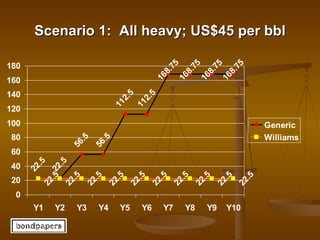

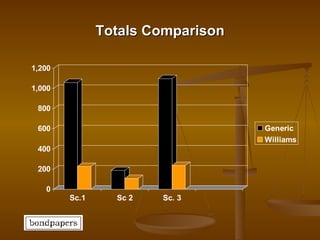

This document compares the generic royalty regime typically applied to offshore oil projects in Newfoundland and Labrador with the customized royalty regime negotiated for the Hebron oil field. The generic regime starts at 1% royalty in early years, increasing over time to 7.5% after simple payout is achieved. In contrast, the Hebron regime maintains a flat 1% royalty until simple payout, after which further details of the multi-tiered post-payout structure are not publicly available. Scenario analyses considering different oil price and production assumptions suggest the generic regime would generate greater revenue for the provincial treasury over time compared to the flat 1% Hebron royalty. More information is needed to fully assess the

![Contact Sir Robert Bond Papers http://bondpapers.blogspot.com [email_address] [email_address]](https://image.slidesharecdn.com/hebron-slides-with-voice-22302/85/Hebron-basic-royalty-a-preliminary-assessment-22-320.jpg)