Foreign exchange market and different economics scenarios.pdf

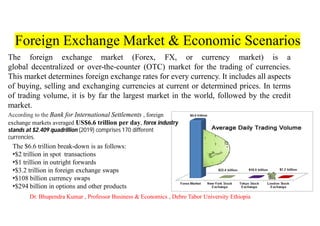

- 1. Foreign Exchange Market & Economic Scenarios The foreign exchange market (Forex, FX, or currency market) is a global decentralized or over-the-counter (OTC) market for the trading of currencies. This market determines foreign exchange rates for every currency. It includes all aspects of buying, selling and exchanging currencies at current or determined prices. In terms of trading volume, it is by far the largest market in the world, followed by the credit market. According to the Bank for International Settlements , foreign exchange markets averaged US$6.6 trillion per day, forex industry stands at $2.409 quadrillion (2019) comprises 170 different currencies. The $6.6 trillion break-down is as follows: •$2 trillion in spot transactions •$1 trillion in outright forwards •$3.2 trillion in foreign exchange swaps •$108 billion currency swaps •$294 billion in options and other products Dr. Bhupendra Kumar , Professor Business & Economics , Debre Tabor University Ethiopia

- 2. The foreign exchange market is unique because of the following characteristics: Its huge trading volume, representing The largest asset class in the world leading to high liquidity; Its geographical dispersion; Its continuous operation: 24 hours a day except for weekends, i.e., trading from 22:00 UTC on Sunday (Sydney) until 22:00 UTC Friday (New York); The variety of factors that affect exchange rates; The low margins of relative profit compared with other markets of fixed income; and The use of leverage to enhance profit and loss margins and with respect to account size. Traders include governments and central banks, commercial banks, other institutional investors and financial institutions, currency speculators, other commercial corporations, and individuals. As such, it has been referred to as the market closest to the ideal of perfect competition, notwithstanding currency intervention by central banks.

- 3. Top 10 Currency Traders & Currencies Dr. Bhupendra Kumar Debre Tabor University Ethiopia

- 4. Dr. Bhupendra Kumar Debre Tabor University Ethiopia

- 5. Dr. Bhupendra Kumar Debre Tabor University Ethiopia

- 6. US Dollar Dominance &How Long Will The U.S. Dollar Reign? Today’s shifting geopolitical and economic landscape presents challenges to the U.S. dollar’s global status. China has overtaken the U.S. as the world’s major trading partner, and is looking to leverage its power to expand the presence of the RMB. Two factors that limit the RMB’s potential as an international currency are tight government controls and a lack of transparency. Another threat to the USD’s dominance is the use of financial sanctions, which limit foreign access to the U.S. financial system. While these sanctions may be effective from a foreign policy perspective, they can also undermine the global role of the USD. America’s M2 money supply has grown significantly since the 2008 global financial crisis, and even more so during the COVID-19 pandemic. M2 includes cash, checking deposits, and liquid vehicles such as money market securities. Dr. Bhupendra Kumar Debre Tabor University Ethiopia

- 7. US Dollar Dominance &How Long Will The U.S. Dollar Reign? U.S. inflation is expected to accelerate .The U.S. debt to GDP ratio is currently over 100%, and by 2050, it’s expected to reach 195%. With so much debt being issued, sustained inflation can gradually undermine the real value of these liabilities. The tradeoff, of course, is a further weakening of the U.S. dollar Dr. Bhupendra Kumar Debre Tabor University Ethiopia

- 8. Dr. Bhupendra Kumar Debre Tabor University Ethiopia

- 9. Dr. Bhupendra Kumar Debre Tabor University Ethiopia

- 10. Dollar dominance and the international adjustment to global risk The US and the dollar play a special role in the global economy, both for trade and for financial flows (Rey 2013, Maggiori et al. 2018, Gopinath 2020). The dollar’s dominance also manifests itself in times of elevated global risk. Figure 1 illustrates this for the Global Financial Crisis and the early stage of the COVID-19 pandemic in March 2020. In both instances, global risk, measured by the VIX, increases sharply while the dollar appreciates strongly. At a theoretical level, co-movement between the dollar and measures of global risk can be rationalized on the ground that some US assets are particularly safe and/or liquid (Farhi and Gabaix 2016, Bianchi et al. 2021, Jiang et al. 2021a). Dr. Bhupendra Kumar Debre Tabor University Ethiopia

- 11. 6000 BC – Barter System and The Introduction of Gold Coins The Mesopotamia tribes introduced the oldest method of exchange, the barter system, in 6000 BC. The barter system involved the exchange of goods via ships. As the system evolved, salt and spices emerged as the most popular methods of exchange. Introduced by Mesopotamia tribes, bartering was adopted by Phoenicians. Phoenicians bartered goods to those located in various other cities across oceans. Babylonians also improvised their existing bartering system wherein goods were exchanged for food, tea, weapons, and spices. The barter system saw a significant change with the widespread adoption of gold coins in the 6th century BC. Gold Coin became a mode of exchange because of its durability, divisibility, acceptability, and uniformity. The wide popularity of metal as a medium of exchange formed the foundation of coinage. Ancient Egypt used gold bars of predetermined weight from the 4th millennium BC and finally developed gold rings as currency3. However, coinage was not part of foreign trade until the late 4th century AD. Gold rings served dual purposes for a long time as an accessory and currency. Gold and silver bars which could be cut into segments also supplemented gold coins. The availability of metal determined the material that would be used. Coins or bars became a challenging mode of exchange in international trade because there was no standardized method to ascertain their value. This authentication problem could be solved by using coins produced by a single, trusted issuer. The first coin to be widely accepted for international trade was the Aegina “turtle” coin, a silver coin minted on the island of Aegina. Dr. Bhupendra Kumar Debre Tabor University Ethiopia

- 12. Dr. Bhupendra Kumar Debre Tabor University Ethiopia

- 13. History of USD-INR Exchange Rate 1947 till 1971,-Par value system :The Rupee’s external par value was fixed at 4.15 grains of fine gold within the permitted margin of ±1% using pound sterling as the intervention currency. The devaluation of the rupee in September 1949 and June 1966 in terms of gold resulted in the reduction of the par value of rupee in terms of gold to 2.88 and 1.83 grains of fine gold, respectively. Since 1966, the exchange rate of the rupee remained constant till 1971. With the breakdown of the Bretton Woods System, in December 1971, the rupee was linked with pound sterling. Sterling being fixed in terms of US dollar under the Smithsonian Agreement of 1971and than basket of Currencies ,confidential by the Reserve Bank to discourage speculation. CAD 3% of GDP and Forex reserves USD 1 billion , BoP problems. Dr. Bhupendra Kumar Debre Tabor University Ethiopia

- 14. Chronology of the Indian Exchange Rate Year The Foreign Exchange Market and Exchange Rate 1947-1971 Par Value system of exchange rate. Rupee’s external par value was fixed in terms of gold with the pound sterling as the intervention currency. 1971 Breakdown of the Bretton-Woods system and floatation of major currencies. Rupee was linked to the pound sterling in December 1971. 1975 To ensure stability of the Rupee, and avoid the weaknesses associated with a single currency peg, the Rupee was pegged to a basket of currencies. Currency selection and weight assignment was left to the discretion of the RBI and not publicly announced. 1978 RBI allowed the domestic banks to undertake intra-day trading in foreign exchange. 1978-1992 Banks began to start quoting two-way prices against the Rupee as well as in other currencies. As trading volumes increased, the ‘Guidelines for Internal Control over Foreign Exchange Business’ were framed in 1981. The foreign exchange market was still highly regulated with several restrictions on external transactions, entry barriers and transactions costs. Foreign exchange transactions were controlled through the Foreign Exchange Regulations Act (FERA). These restrictions resulted in an extremely efficient unofficial parallel (hawala) market for foreign exchange. 1990-1991 Balance of Payments crisis July 1991 To stabilize the foreign exchange market, a two step downward exchange rate adjustment was done (9% and 11%). This was a decisive end to the pegged exchange rate regime. March 1992 To ease the transition to a market determined exchange rate system, the Liberalized Exchange Rate Management System (LERMS) was put in place, which used a dual exchange rate system. This was mostly a transitional system. March 1993 The dual rates converged, and the market determined exchange rate regime was introduced. All foreign exchange receipts could now be converted at market determined exchange rates. Source : Reserve Bank of India Dr. Bhupendra Kumar Debre Tabor University Ethiopia

- 15. The Report of the High Level Committee on Balance of Payments (Chairman Dr. C. Rangarajan) laid the framework for a credible macroeconomic, structural and stabilization programme encompassing trade, industry, foreign investment, exchange rate and the foreign exchange reserves. With regard to the exchange rate policy, the committee recommended that consideration be given to (i) A realistic exchange rate, (ii) Avoiding use of exchange mechanisms for subsidization, (iii) Maintaining adequate level reserves to take care of short-term fluctuations, (iv) Continuing the process of liberalization on current account, and (v) Reinforcing effective control over capital transactions. The key to the maintenance of a realistic and a stable exchange rate is containing inflation through macro- economic policies and ensuring net capital receipts of the scale not beyond the expectation. Dr. Bhupendra Kumar Debre Tabor University Ethiopia

- 16. Determinants of Exchange rates In a fixed exchange rate regime, exchange rates are decided by the government, while a number of theories have been proposed to explain (and predict) the fluctuations in exchange rates in a floating exchange rate regime, including: •International parity conditions: 1- Relative purchasing power parity, 2- Interest rate parity 3- Domestic Fisher effect 4- International Fisher effect. To some extent the above theories provide logical explanation for the fluctuations in exchange rates, yet these theories falter as they are based on challengeable assumptions (e.g., free flow of goods, services, and capital) which seldom hold true in the real world. •Balance of payments model: This model, however, focuses largely on tradable goods and services, ignoring the increasing role of global capital flows. It failed to provide any explanation for the continuous appreciation of the US dollar during the 1980s and most of the 1990s, despite the soaring US current account deficit. •Asset market model : It views currencies as an important asset class for constructing investment portfolios. Asset prices are influenced mostly by people's willingness to hold the existing quantities of assets, which in turn depends on their expectations on the future worth of these assets. The asset market model of exchange rate determination states that “the exchange rate between two currencies represents the price that just balances the relative supplies of, and demand for, assets denominated in those currencies.” Dr. Bhupendra Kumar Debre Tabor University Ethiopia

- 17. None of the models developed so far succeed to explain exchange rates and volatility in the longer time frames. For shorter time frames (less than a few days), algorithms can be devised to predict prices. It is understood from the above models that many macroeconomic factors affect the exchange rates and in the end currency prices are a result of dual forces of supply and demand. The world's currency markets can be viewed as a huge melting pot: in a large and ever- changing mix of current events, supply and demand factors are constantly shifting, and the price of one currency in relation to another shifts accordingly. No other market encompasses (and distills) as much of what is going on in the world at any given time as foreign exchange. Supply and demand for any given currency, and thus its value, are not influenced by any single element, but rather by several. These elements generally fall into three categories: 1. Economic factors, 2. Political conditions and 3. Market psychology. Determinants of Exchange rates Dr. Bhupendra Kumar Debre Tabor University Ethiopia

- 18. • Economic factors • Economic factors include: (a) economic policy, disseminated by government agencies and central banks, (b) economic conditions, generally revealed through economic reports, and other economic indicators. • Economic policy comprises government fiscal policy (budget/spending practices) and monetary policy (the means by which a government's central bank influences the supply and "cost" of money, which is reflected by the level of interest rates). • Government budget deficits or surpluses: The market usually reacts negatively to widening government budget deficits, and positively to narrowing budget deficits. The impact is reflected in the value of a country's currency. • Balance of trade levels and trends: The trade flow between countries illustrates the demand for goods and services, which in turn indicates demand for a country's currency to conduct trade. Surpluses and deficits in trade of goods and services reflect the competitiveness of a nation's economy. For example, trade deficits may have a negative impact on a nation's currency. • Inflation levels and trends: Typically a currency will lose value if there is a high level of inflation in the country or if inflation levels are perceived to be rising. This is because inflation erodes purchasing power, thus demand, for that particular currency. However, a currency may sometimes strengthen when inflation rises because of expectations that the central bank will raise short-term interest rates to combat rising inflation. • Economic growth and health: Reports such as GDP, employment levels, retail sales, capacity utilization and others, detail the levels of a country's economic growth and health. Generally, the more healthy and robust a country's economy, the better its currency will perform, and the more demand for it there will be. • Productivity of an economy: Increasing productivity in an economy should positively influence the value of its currency. Its effects are more prominent if the increase is in the traded sector Dr. Bhupendra Kumar Debre Tabor University Ethiopia

- 19. • Political conditions • Internal, regional, and international political conditions and events can have a profound effect on currency markets. • All exchange rates are susceptible to political instability and anticipations about the new ruling party. Political upheaval and instability can have a negative impact on a nation's economy. For example, destabilization of coalition governments in Pakistan , Russia, Ukraine, Thailand can negatively affect the value of their currencies. Similarly, in a country experiencing financial difficulties, the rise of a political faction that is perceived to be fiscally responsible can have the opposite effect. Also, events in one country in a region may spur positive/negative interest in a neighboring country and, in the process, affect its currency. Dr. Bhupendra Kumar Debre Tabor University Ethiopia

- 20. • Market psychology Market psychology and trader perceptions influence the foreign exchange market in a variety of ways: Flights to quality: Unsettling international events can lead to a "flight-to-quality", a type of capital flight whereby investors move their assets to a perceived "safe haven". There will be a greater demand, thus a higher price, for currencies perceived as stronger over their relatively weaker counterparts. The US dollar, Swiss franc and gold have been traditional safe havens during times of political or economic uncertainty Long-term trends: Currency markets often move in visible long-term trends. Although currencies do not have an annual growing season like physical commodities, business cycles do make themselves felt. Cycle analysis looks at longer-term price trends that may rise from economic or political trends. Dr. Bhupendra Kumar Debre Tabor University Ethiopia

- 21. • Market psychology "Buy the rumor, sell the fact": This market truism can apply to many currency situations. It is the tendency for the price of a currency to reflect the impact of a particular action before it occurs and, when the anticipated event comes to pass, react in exactly the opposite direction. This may also be referred to as a market being "oversold" or "overbought". To buy the rumor or sell the fact can also be an example of the cognitive bias known as anchoring, when investors focus too much on the relevance of outside events to currency prices Economic numbers: While economic numbers can certainly reflect economic policy, some reports and numbers take on a talisman-like effect: the number itself becomes important to market psychology and may have an immediate impact on short-term market moves. "What to watch" can change over time. In recent years, for example, money supply, employment, trade balance figures and inflation numbers have all taken turns in the spotlight. Technical trading considerations: As in other markets, the accumulated price movements in a currency pair such as EUR/USD can form apparent patterns that traders may attempt to use. Many traders study price charts in order to identify such patterns. Dr. Bhupendra Kumar Debre Tabor University Ethiopia

- 22. Financial instruments for Forex market Spot : A spot transaction is a two-day delivery transaction (except in the case of trades between the US dollar, Canadian dollar, Turkish lira, euro and Russian ruble, which settle the next business day), as opposed to the futures contracts, which are usually three months. This trade represents a “direct exchange” between two currencies, has the shortest time frame, involves cash rather than a contract, and interest is not included in the agreed-upon transaction. Spot trading is one of the most common types of forex trading. Often, a forex broker will charge a small fee to the client to roll-over the expiring transaction into a new identical transaction for a continuation of the trade. This roll-over fee is known as the "swap" fee. Forward: One way to deal with the foreign exchange risk is to engage in a forward transaction. In this transaction, money does not actually change hands until some agreed upon future date. A buyer and seller agree on an exchange rate for any date in the future, and the transaction occurs on that date, regardless of what the market rates are then. The duration of the trade can be one day, a few days, months or years. Usually the date is decided by both parties. Then the forward contract is negotiated and agreed upon by both parties. Non-deliverable forward (NDF) : Forex banks, ECNs, and prime brokers offer NDF contracts, which are derivatives that have no real deliver-ability. NDFs are popular for currencies with restrictions such as the Argentinian peso. In fact, a forex hedger can only hedge such risks with NDFs, as currencies such as the Argentinian peso cannot be traded on open markets like major currencies. Dr. Bhupendra Kumar Debre Tabor University Ethiopia

- 23. Swap: The most common type of forward transaction is the foreign exchange swap. In a swap, two parties exchange currencies for a certain length of time and agree to reverse the transaction at a later date. These are not standardized contracts and are not traded through an exchange. A deposit is often required in order to hold the position open until the transaction is completed. Futures: Futures are standardized forward contracts and are usually traded on an exchange created for this purpose. The average contract length is roughly 3 months. Futures contracts are usually inclusive of any interest amounts. Currency futures contracts are contracts specifying a standard volume of a particular currency to be exchanged on a specific settlement date. Thus the currency futures contracts are similar to forward contracts in terms of their obligation, but differ from forward contracts in the way they are traded. In addition, Futures are daily settled removing credit risk that exist in Forwards. They are commonly used by MNCs to hedge their currency positions. In addition they are traded by speculators who hope to capitalize on their expectations of exchange rate movements. Option: A foreign exchange option (commonly shortened to just FX option) is a derivative where the owner has the right but not the obligation to exchange money denominated in one currency into another currency at a pre- agreed exchange rate on a specified date. The FX options market is the deepest, largest and most liquid market for options of any kind in the world. Financial instruments for Forex market Dr. Bhupendra Kumar Debre Tabor University Ethiopia

- 24. Speculation Controversy about currency speculators and their effect on currency devaluations and national economies recurs regularly. Economists, such as Milton Friedman, have argued that speculators ultimately are a stabilizing influence on the market, and that stabilizing speculation performs the important function of providing a market for hedgers and transferring risk from those people who don't wish to bear it, to those who do. Other economists, such as Joseph Stiglitz, consider this argument to be based more on politics and a free market philosophy than on economics. Large hedge funds and other well capitalized "position traders" are the main professional speculators. According to some economists, individual traders could act as "noise traders" and have a more destabilizing role than larger and better informed actors. Currency speculation is considered a highly suspect activity in many countries. While investment in traditional financial instruments like bonds or stocks often is considered to contribute positively to economic growth by providing capital, currency speculation does not; according to this view, it is simply gambling that often interferes with economic policy. For example, in 1992, currency speculation forced Sweden's central bank, the Riksbank , to raise interest rates for a few days to 500% per annum, and later to devalue the krona. Mahathir Mohamad, one of the former Prime Ministers of Malaysia, is one well-known proponent of this view. Dr. Bhupendra Kumar Debre Tabor University Ethiopia

- 25. Gregory Millman reports on an opposing view, comparing speculators to "vigilantes" who simply help "enforce" international agreements and anticipate the effects of basic economic "laws" in order to profit. In this view, countries may develop unsustainable economic bubbles or otherwise mishandle their national economies, and foreign exchange speculators made the inevitable collapse happen sooner. A relatively quick collapse might even be preferable to continued economic mishandling, followed by an eventual, larger, collapse. Mahathir Mohamad and other critics of speculation are viewed as trying to deflect the blame from themselves for having caused the unsustainable economic conditions. Dr. Bhupendra Kumar Debre Tabor University Ethiopia

- 26. Why are Parity Models Important? • Testing the “correctness” of a spot rate. • Could be important for a trading strategy. • Is the currency overvalued or undervalued? • Overvalued: perhaps a sell short strategy. • Undervalued: perhaps a buy long strategy. • Establishing a future spot rate • Could be important for: • International capital budgeting decisions • Converting estimated foreign currency cash flows into MNC’s home currency as part of the capital budgeting process (location decision). • Investment and Financing decisions • Converting estimated investment inflows from investments into home currency equivalents and converting estimated financing outflows into home currency equivalents. Dr. Bhupendra Kumar Debre Tabor University Ethiopia

- 27. What are Parity Models? • Parity is defined as a state of equilibrium. • Foreign exchange parity models “estimate” what the equilibrium spot exchange rate should be (under the model’s assumptions): • (1) Is today’s spot rate appropriate? • (2) What might the spot rate be in the future (forecasting future spot rates). • Generally involving a long term forecasting horizon. • Parity models have an economic basis (i.e., theory) for their spot rate determination. Dr. Bhupendra Kumar Debre Tabor University Ethiopia

- 28. Purchasing Power Parity Theory • The Purchasing Power Parity (PPP) explains and quantifies the relationship between inflation and spot exchange rates. • The theory of Purchasing Power Parity says that in the long run, differences in inflation rates between countries are transmitted through changes in relative exchange rates. I • The theory states that the spot exchange rate between two currencies should be equal to the ratio of the two countries’ price levels. • Idea was first proposed by the classical economist, David Ricardo, in the 19th century. • The concept was expanded by the Swedish economist, Gustav Cassel, during the years after WW1 (1918 -) when countries in Europe were experiencing hyperinflation. Dr. Bhupendra Kumar Debre Tabor University Ethiopia

- 29. Two Forms of PPP • Absolute PPP: • At a point in time, the equilibrium spot exchange rate is that rate which results in the prices of similar goods in two different countries being equal. • This form of the PPP can be used to test how “appropriate” a current spot exchange rate is and to indicate a future move in the exchange rate. • Relative PPP: • Over time, the change in the exchange rate between two currencies should be equal to the rate of change in the prices of similar goods between the two countries. • This form of the PPP is used to forecast the equilibrium spot exchange rate in the future and generally over a long time horizon. Dr. Bhupendra Kumar Debre Tabor University Ethiopia

- 30. Rationale Behind the PPP: The Law of One Price • The Purchasing Power Parity model is based on the Law of One Price: • The Law of One Price states that all else equal (i.e., no transaction costs or other frictions, like tariffs or cultural differences) a product’s price (adjusted by the exchange rate) should be the same in all markets. • Why will the product’s price be the same? • The principle of competitive markets assumes that prices will equalize as consumers shift their purchases to those markets (or countries) where prices are the lowest. • Also arbitrage activities will (might) result in similar prices. Dr. Bhupendra Kumar Debre Tabor University Ethiopia

- 31. OECD PPP Exchange Rates and Actual Rates FX 2005 2006 2007 2008 2009 2010 USD/JPY 110.22 116.30 117.75 103.36 93.57 87.78 PPP: 129.55 124.61 120.16 116.84 115.35 111.38 USD/CHF 1.2452 1.2538 1.2004 1.0831 1.0881 1.0429 PPP: 1.7427 1.6593 1.5997 1.5505 1.5313 1.5104 USD/CNY 8.1943 7.9734 7.6075 6.9487 6.8314 6.7703 PPP: 3.448 3.465 3.622 3.821 3.764 3.946 EUR/USD 1.2436 1.2545 1.3687 1.4648 1.3892 1.3244 PPP: 1.1670 1.2035 1.2157 1.2383 1.2505 1.2357 GBP/USD 1.8182 1.8400 2.0001 1.8384 1.5578 1.5452 PPP: 1.5719 1.5949 1.5506 1.5638 1.5570 1.5349 AUD/USD 0.7637 0.7530 0.8368 0.8388 0.7799 0.9173 PPP: 0.7203 0.7095 0.7008 0.6761 0.6887 0.6611 Dr. Bhupendra Kumar Debre Tabor University Ethiopia

- 32. Relative Purchasing Power Parity • The second PPP model, the Relative Purchasing Power Parity model, is concerned with the “change” in the exchange rate over time. • The Relative Purchasing Power is not assessing the “correctness” of the current spot rate. • The relative PPP model suggests that spot exchange rates move in a manner opposite to the inflation differential between the two countries. • Specifically, the Relative PPP model suggests that the percent change in a spot exchange rate should be equal to, but opposite in direction to, the difference in the rates of inflation between countries. • This is a model which may be used to forecast an actual future spot rate. Dr. Bhupendra Kumar Debre Tabor University Ethiopia

- 33. Dr. Bhupendra Kumar Debre Tabor University Ethiopia

- 34. • Foreign exchange risk is the risk that the value of an asset or liability will change because of a change in exchange rates. • Because these international obligations span time, foreign exchange risk can arise. • Sources of Risk • Transaction Exposure: The risk that the domestic cost or proceeds of a transaction may change. • Translation Exposure: The risk that the translation of value of foreign-currency- denominated assets is affect by exchange rate changes. • Economic Exposure: The risk that exchange rate changes may affect the present value of future income streams. Dr. Bhupendra Kumar Debre Tabor University Ethiopia

- 35. Forward Premium • The difference between the spot and forward rates is expressed as the standard (or annualized) forward premium or discount. • The standard premium is calculated as the difference between the two rates as a percent of the spot rate, which is then annualized (simple basis). For example, suppose the spot rate is 1.6035 ($/£) and the 3-month forward rate is 1.6050. The forward premium on the pound is: [(1.6050-1.6035)/1.6035]*(12/3)*100 = 0.37% Dr. Bhupendra Kumar Debre Tabor University Ethiopia

- 36. Example • For example, suppose the spot rate is 1.6035 ($/£) and the 3-month forward rate is 1.6050. • The forward premium on the pound is: [(1.6050-1.6035)/1.6035]*(12/3)*100 = 0.37% Dr. Bhupendra Kumar Debre Tabor University Ethiopia

- 37. S0 = Current spot S1 = Expected future spot hb = Inflation rate in country for which the spot is quoted (base currency) hc = Inflation rate in the other country. (counter currency) F0 = Forward rate ib = interest rate for base currency ic = interest rate for counter currency Dr. Bhupendra Kumar Debre Tabor University Ethiopia

- 38. Dr. Bhupendra Kumar Debre Tabor University Ethiopia

- 39. Dr. Bhupendra Kumar Debre Tabor University Ethiopia

- 40. Dr. Bhupendra Kumar Debre Tabor University Ethiopia

- 41. Dr. Bhupendra Kumar Debre Tabor University Ethiopia

- 42. Dr. Bhupendra Kumar Debre Tabor University Ethiopia

- 43. Capital Flows and Exchange Rates: The Indian Experience Dr. Bhupendra Kumar Debre Tabor University Ethiopia

- 44. The balance of payments (BOP) of a country records all economic transactions of a country (that is, of its individuals, businesses and governments) with the rest of the world during a defined period, usually one year. These transactions are broadly divided into two heads – current account and capital account. The current account covers exports and imports of goods and services, factor income and unilateral transfers. The capital account records the net change in foreign assets and liabilities held by a country. Convertibility refers to the ability to convert domestic currency into foreign currencies and vice versa to make payments for balance of payments transactions. Current account convertibility is the ability or freedom to convert domestic currency for current account transactions while capital account convertibility is the ability or freedom to convert domestic currency for capital account transactions. The Tarapore Committee (2006), for instance, defined capital account convertibility as the “freedom to convert local financial assets into foreign financial assets and vice versa.” The degree of BOP convertibility of a country usually depends on the level of its economic development and degree of maturity of its financial markets. Therefore, advanced economies (AEs) are almost fully convertible while emerging market economies (EMEs) are convertible to different degrees. Dr. Bhupendra Kumar Debre Tabor University Ethiopia

- 45. Free capital mobility, or internationalization of capital markets is commonly recognized as an engine of global growth. Specifically, benefits of internationalization of capital markets are well accepted, in terms of broadening the investor base for recipient country financial assets, improved liquidity in financial markets and positive pressures for market infrastructure and market practices. International capital markets, by enabling access to a global savings pool and to different currencies, can potentially reduce borrowing costs, facilitate better risk allocation and enhance global liquidity (OECD, 2017). The various currency and banking crises experienced over the last few decades have simultaneously highlighted the costs and risks of internationalization such as exposure to global shocks, credit and asset bubbles, exchange rate volatility associated with sudden exit of capital and higher refinancing risk. Increased globalization has brought to the fore the vulnerability to contagion effects. While it was argued that such risks are the short- term pains needed to reap long term gains (Kaminsky and others, 2008). Dr. Bhupendra Kumar Debre Tabor University Ethiopia

- 46. There is now a wider acceptance that benefits of internationalization are not an unmixed blessing and that there is a nuanced trade off between growth and crisis risk. Such awareness has led to policy focus on three fronts. • a. First, that benefits of internationalization presupposes sound macroeconomic fundamentals, a well developed financial system and a sound market infrastructure, including efficient markets for funding and risk transfer. • b. Second, that countries need to develop appropriate tools to deal with the risks of internationalization, in particular, tools to manage the volume and composition of capital inflows and macro prudential tools. • c. And third, that different types of capital flows carry different risks – some are riskier than others. The agreed hierarchy of capital flows is that foreign direct investment is the least risky, followed by equity investment, followed by debt capital. While FDI is seen to contribute to long-run growth, portfolio equity gives a shorter run boost. Debt flows, while necessary, are susceptible to be volatile. Understandably, the focus of capital flow regulations, and macro-prudential regulations, has been debt flows. Dr. Bhupendra Kumar Debre Tabor University Ethiopia

- 47. Capital Inflows Cumulative Dr. Bhupendra Kumar Debre Tabor University Ethiopia

- 48. Dr. Bhupendra Kumar Debre Tabor University Ethiopia

- 49. References • Kumar Sanjeev, Kumar B. et al. (2022). The continuous investment in artificial intelligence and its impact on ensuring customer satisfaction. Korea review of international studies, ISSN - 1226-4741 Volume 15, Special Issue 03 • Kumar Sumit, Kumar B. et al. (2022). Application of blockchain technology as a support tool in economic & financial development. Manager- The British Journal of Administrative Management, ISSN:1746-1278, Volume 58 Special Issue 01 • Kumar B. et al. (2022). The Role of IOT and Cyber Warfare in Developing the Health Care Devices. Mathematical Statistician and Engineering Applications, Page Number: 1185-1194 Publication Issue: Vol. 71 No. 3s (2022) • Bala B., Kumar B. et al.(2021). Cyber Security in African Union and Ethiopia and Its anticipation. International Journal of Mechanical Engineering, ISSN: 0974-5823 Vol. 6 (Special Issue, Nov.-Dec. 2021) • Kumar B. et al. (2022). The Role of IOT and Cyber Warfare in Developing the Health Care Devices. Mathematical Statistician and Engineering Applications, Page Number: 1185-1194 Publication Issue: Vol. 71 No. 3s (2022) • Bala B., Kumar B. et al.(2021). Cyber Security in African Union and Ethiopia and Its anticipation. International Journal of Mechanical Engineering, ISSN: 0974-5823 Vol. 6 (Special Issue, Nov.-Dec. 2021) • Kumar Bhupendra (2016). Exchange traded fund in India - Performance analysis with mutual fund and global perspectives. International Journal of Marketing & Financial Management, Volume 4, Issue 7, Oct-2016, pp 22-35, ISSN: 2348 –3954 (Online) ISSN: 2349 –2546 (Print) • Rajshree Sharma, Shivani Gupta, Bhupendra Kumar (2016). Satyam computer scam – pre and post diagnosis. International Journal of Marketing & Financial Management, Volume 4, Issue 9, Dec- 2016, pp 53-68 ,ISSN: 2348 –3954 (Online) ISSN: 2349 –2546 (Print) • Rajesh Kumar, Kumar Bhupendra (2018). Study on role of banking institutions in rural development – an evaluation. International Journal of Marketing & Financial Management, Volume 6, Issue 1, Jan -2018, pp 52-57 , ISSN: 2348 -3954 (Online) ISSN: 2349 - 2546 (Print) • Kumar B. (2021). Determinants of internet financial reporting: in the case of Ethiopian insurance and banking sector companies. Innovations , Journal article • Kumar B.(2020). Determinants of dividend payout ratio: empirical evidence from Ethiopian private banks. Palarch’s Journal of Archaeology of Egypt/Egyptology • Kumar B. (2019). The effect of remittance on economic growth of eastern African countries. International Journal of Social Science & Management Studies Vol. - 6, No. – 1 Page-13-26 • Kumar Bhupendra (2011). Special Economic Zones – a comparative study of export and FDI performance with India. Metamorphosis- A Journal of Management Research, Vol. 2, pp. 18-28 Dr. Bhupendra Kumar Debre Tabor University Ethiopia

- 50. • Kumar B. (2021). Innovation in corporate cash holding & management: an empirical investigation. Empirical Economics Letters, ISSN 1681 8997 • Kumar B. & D. Singh (2021). The impact of branch expansion dimensions on deposit mobilization with special reference Dashen bank S.C, Ethiopia. International Journal of Mechanical Engineering I ISSN: Vol. 6 P.625-636 • Srivastava A.K., Kumar B. et al. (2014). Special Economic zones- Overview on Growth and Export performance. European Journal of Academic Essays 1(9): 15-19, 2014 ISSN (online): 2183-1904 ISSN (print): 2183-3818 • G. B. Bezabh , Kumar B. (2020). The Effect of Remittance on Economic Growth of Eastern African Countries. International Journal of Social Science & Management Studies, ISSN : 2454 - 4655, Vol. - 6, No. – 1, Feb. 2020 Page-13- 26 • Abebaw Yenesew, Kumar B. (2018). A study of micro finance institutions and their financial performance with special reference to Ethiopia. International Journal of Research and Analytical Reviews, Volume 5, Special Issue, April 2018, E- ISSN 2348 –1269, Print ISSN 2349-5138 • Umamaheswari K. , Kumar B., et al. (2021). Money Management Among the Individual Working Personnel in India – A Study with Special Reference to Coimbatore District. PSYCHOLOGY AND EDUCATION, 58(2): 376-389, www.psychologyandeducation.net • Neha Saini, Kumar Bhupendra, et al. (2017). A Conceptual study of Micro Finance in India. International Journal of Marketing & Financial Management, Vol. 5, pp. 75-82. ISSN: 2348 -3954 (Online) ISSN: 2349 - 2546 (Print). • Kumar T., Kumar B. et al. (2022). Optimal Facial Feature Based Emotional Recognition Using Deep Learning Algorithm. Computational Intelligence and Neuroscience. Hindawi Volume 2022, Article ID 8379202, 10 pageshttps://doi.org/10.1155/2022/8379202 • Kumar B. (2022) . The Impact of Covid 19- Towards Insurance and its Benefits to the Public. Mathematical Statistician and Engineering Applications ISSN: 2094-0343 2326-9865 . Page Number: 1484 – 1491 Publication Issue: Vol. 71 No. 3s (2022) Dr. Bhupendra Kumar Debre Tabor University Ethiopia