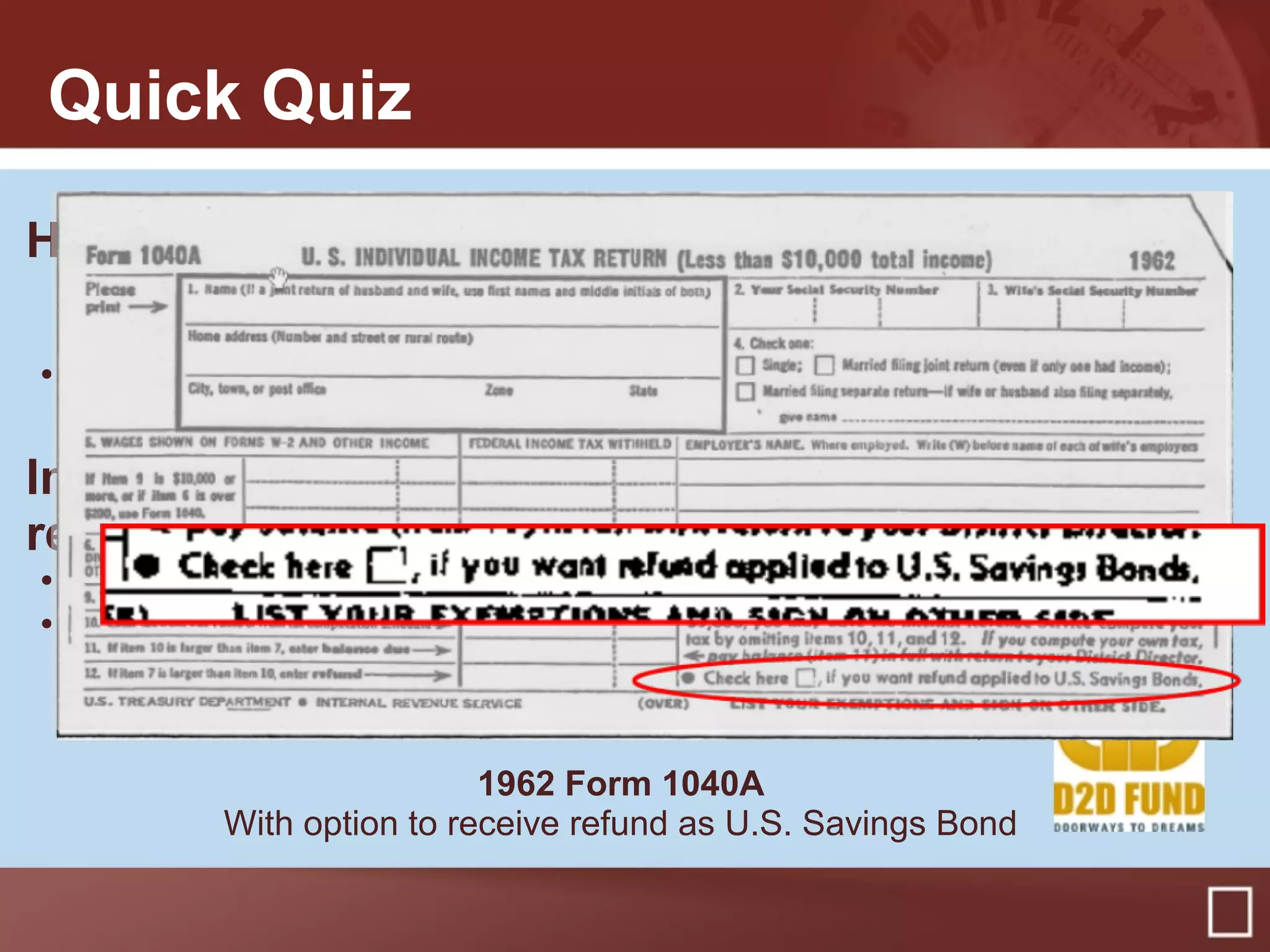

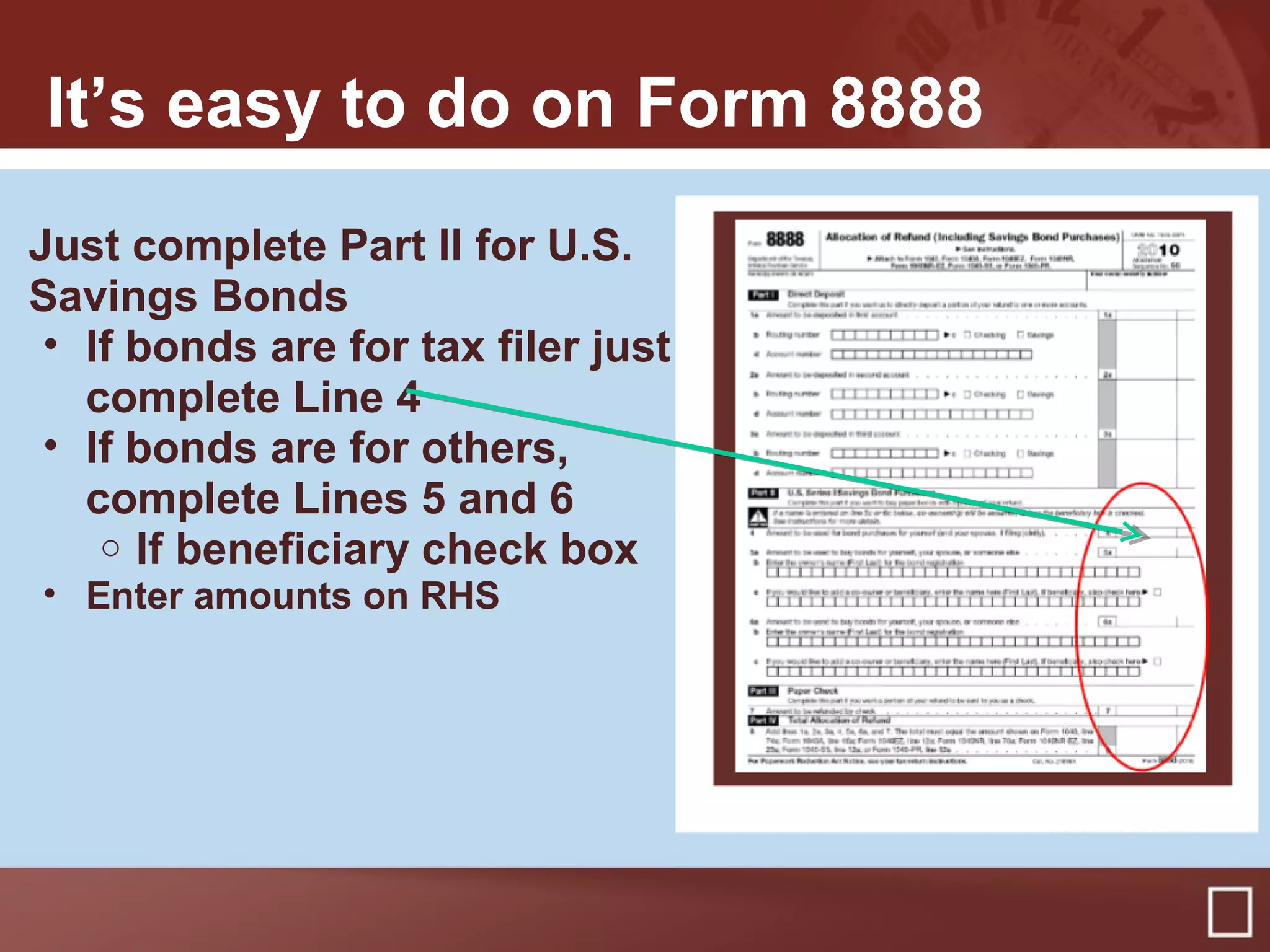

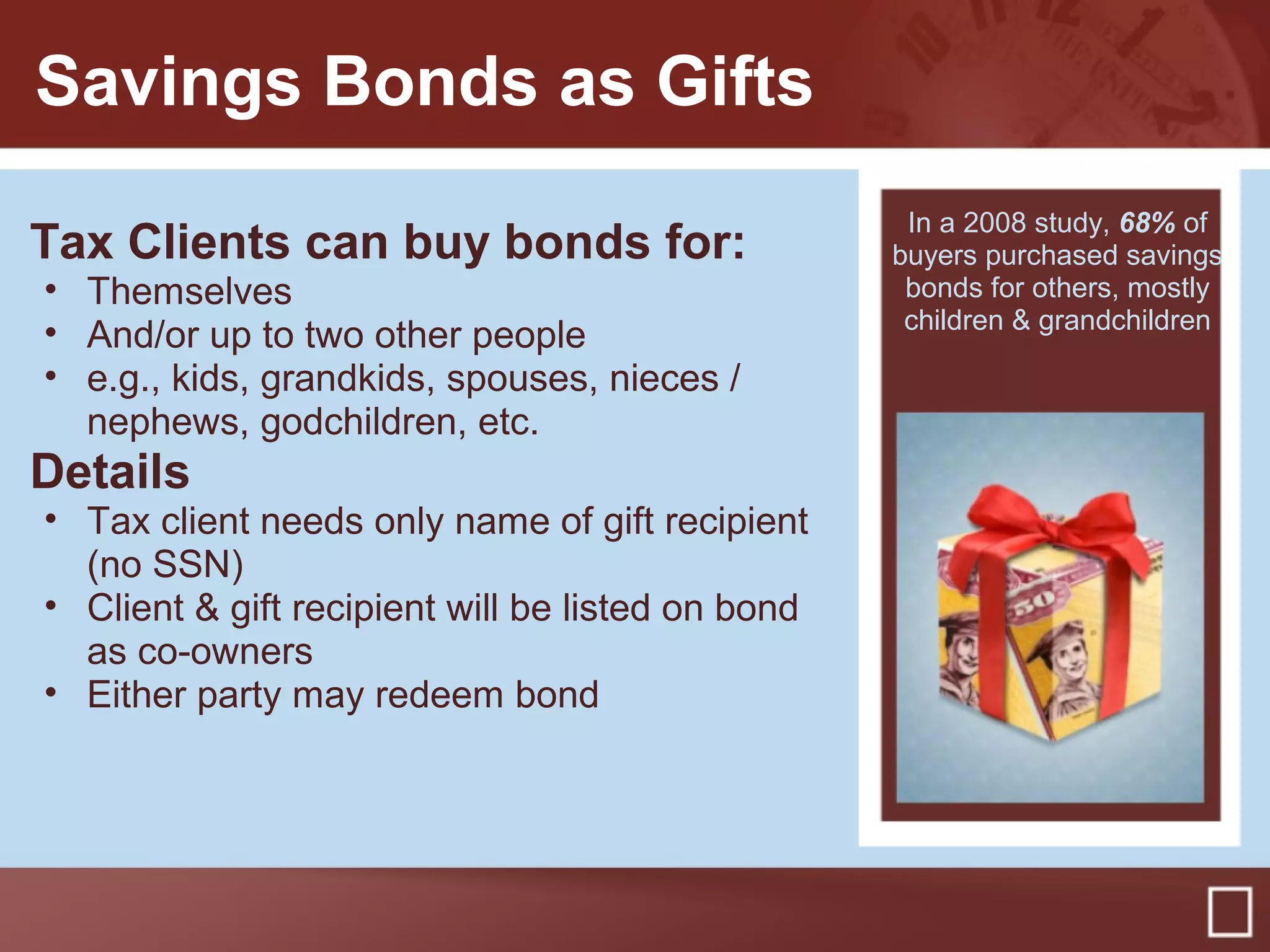

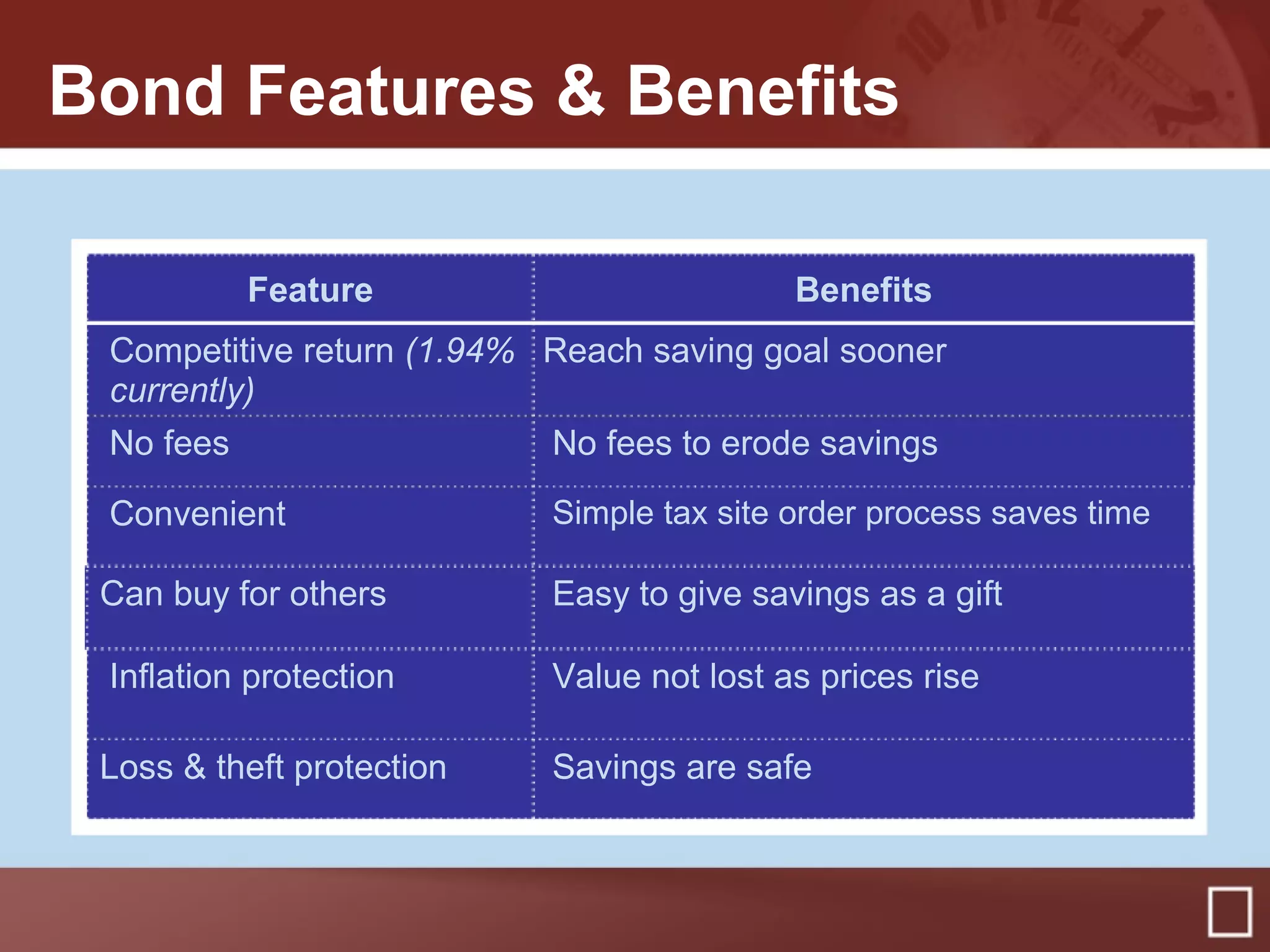

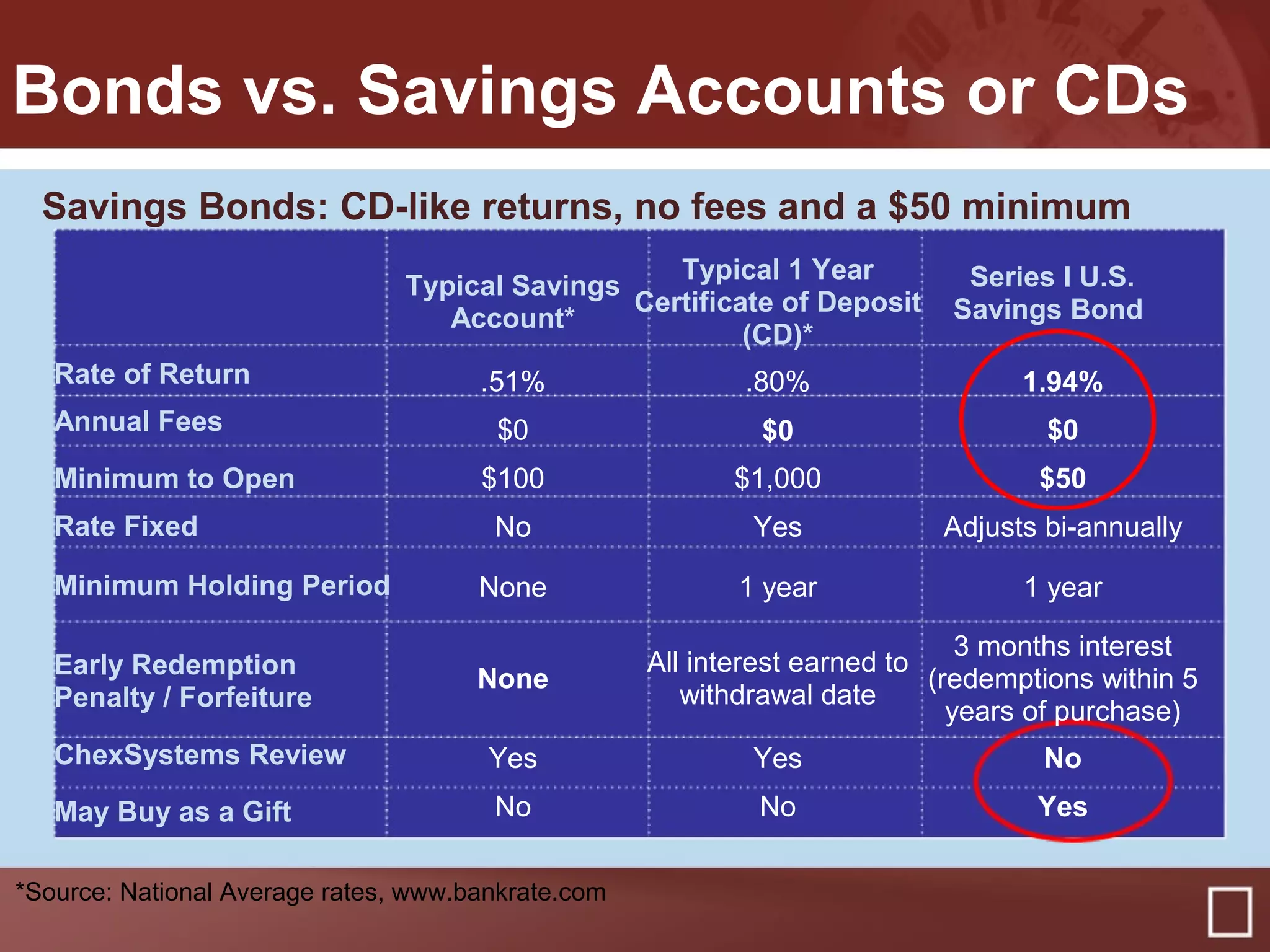

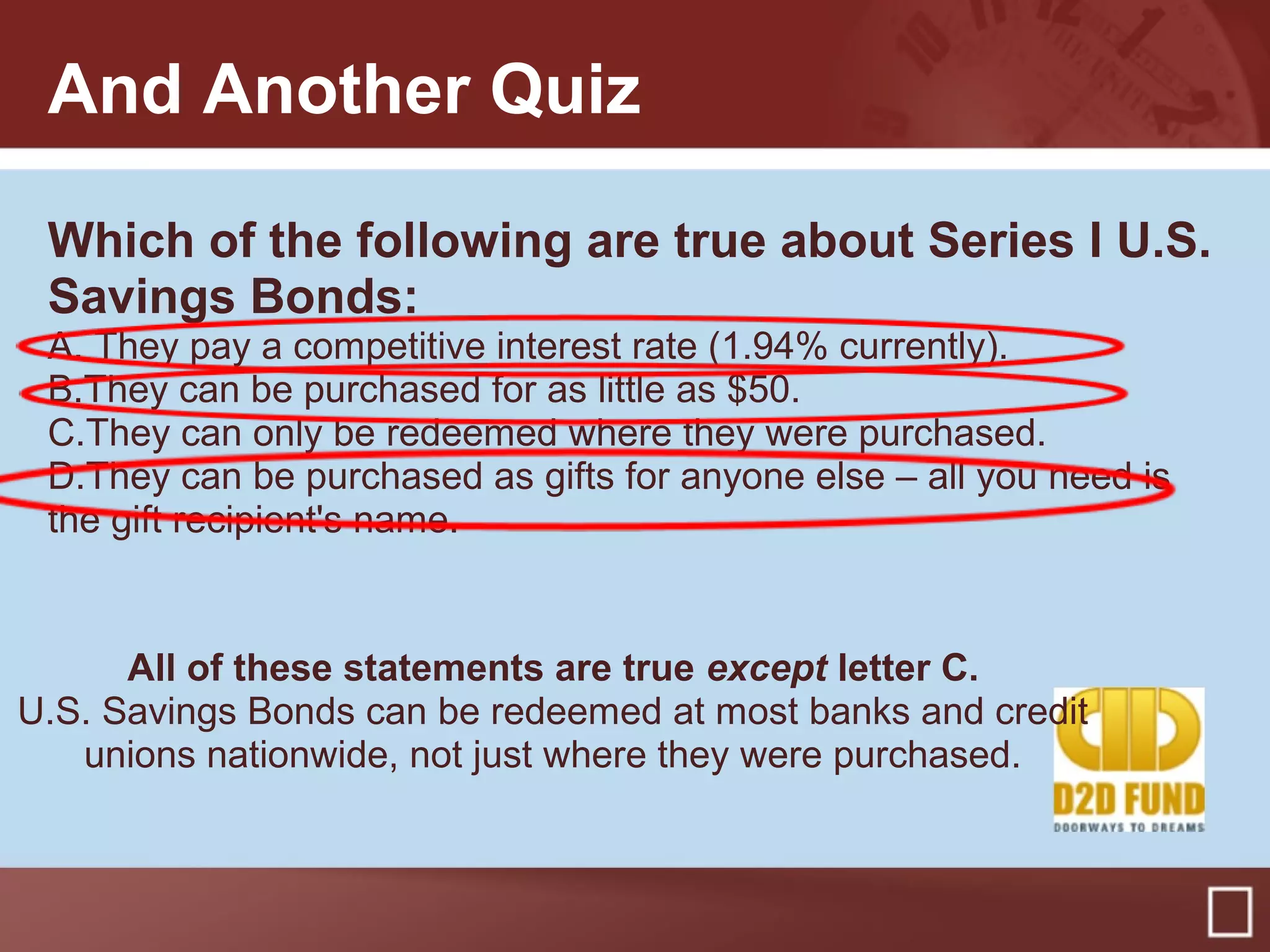

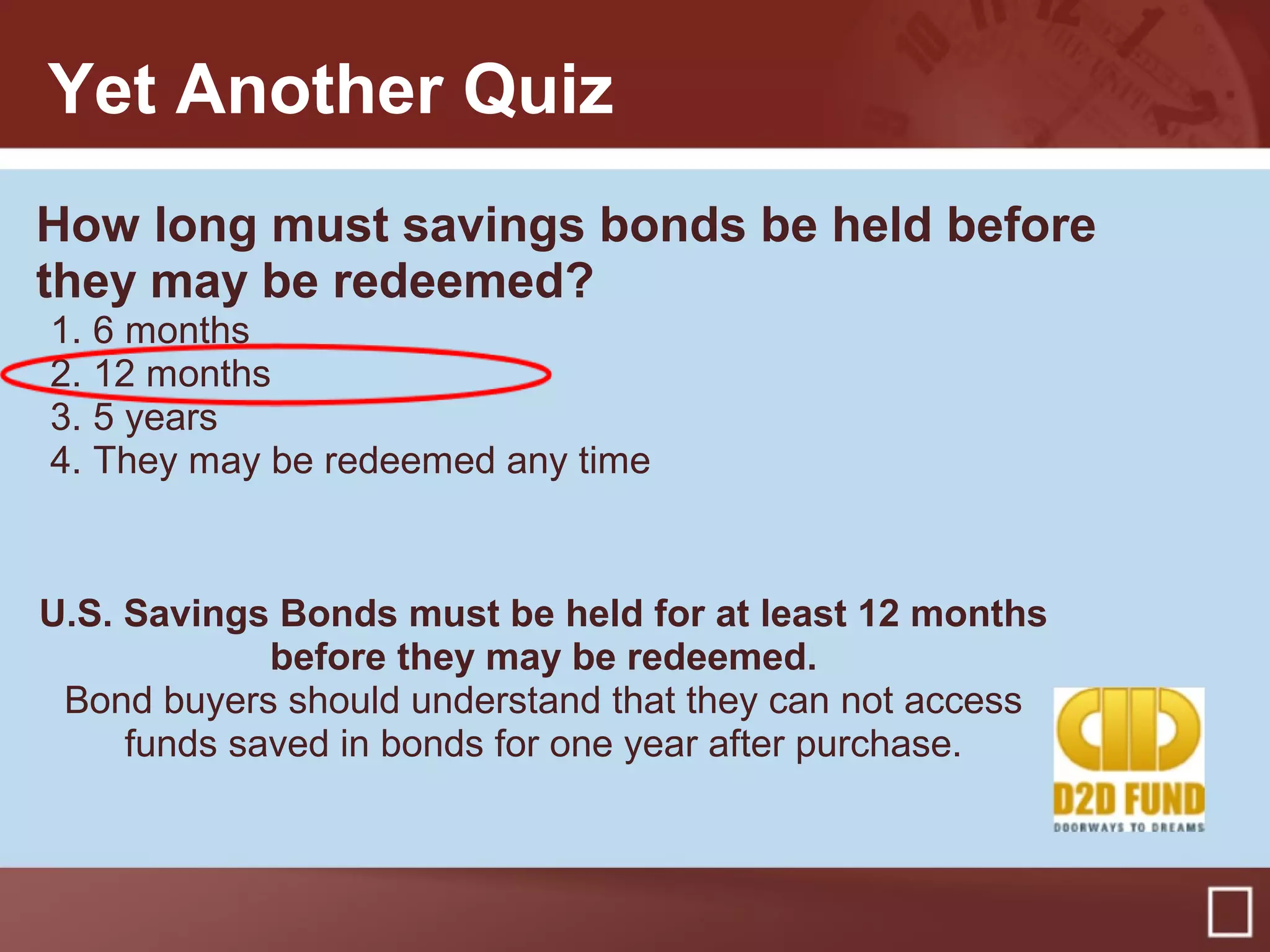

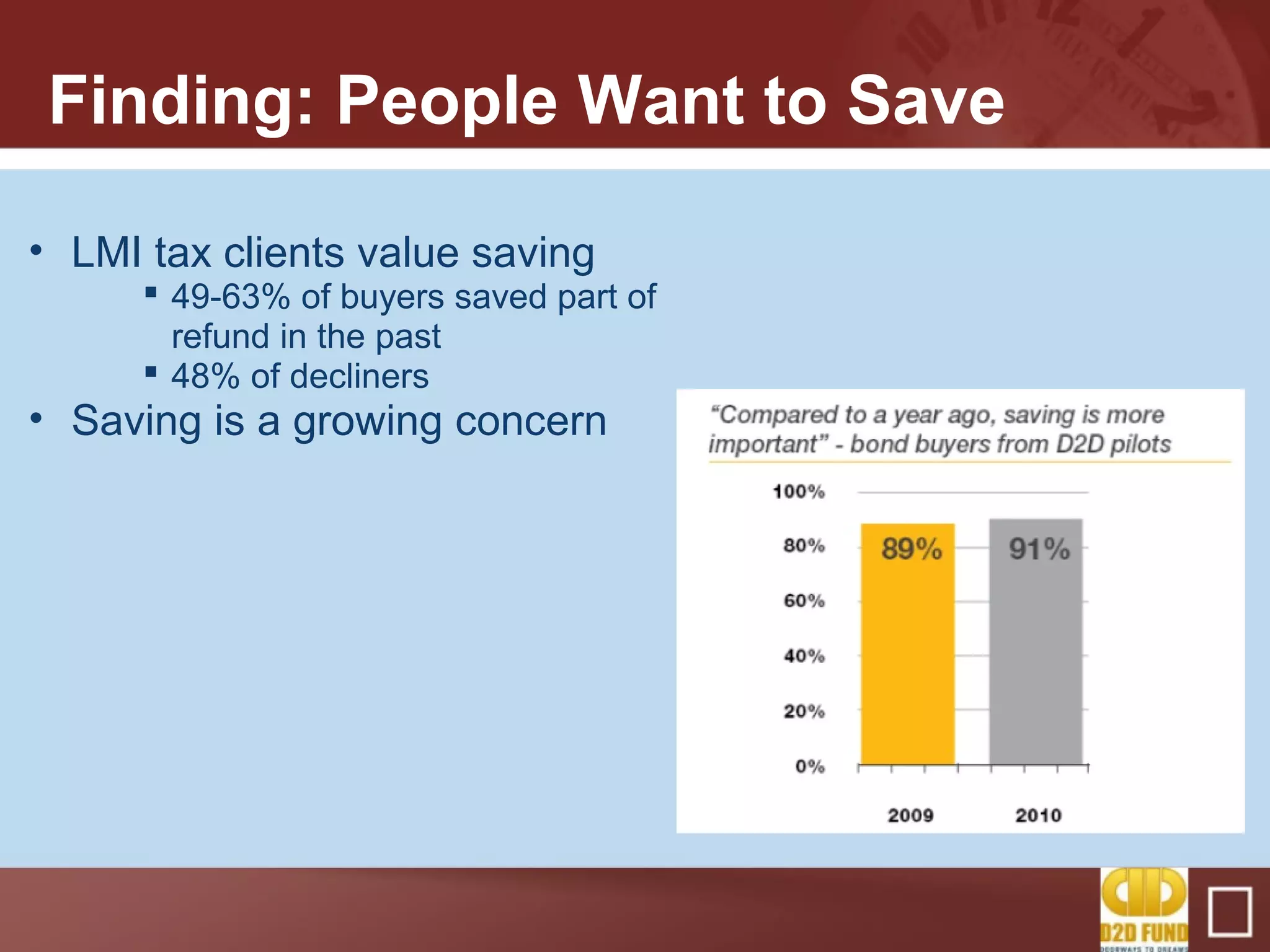

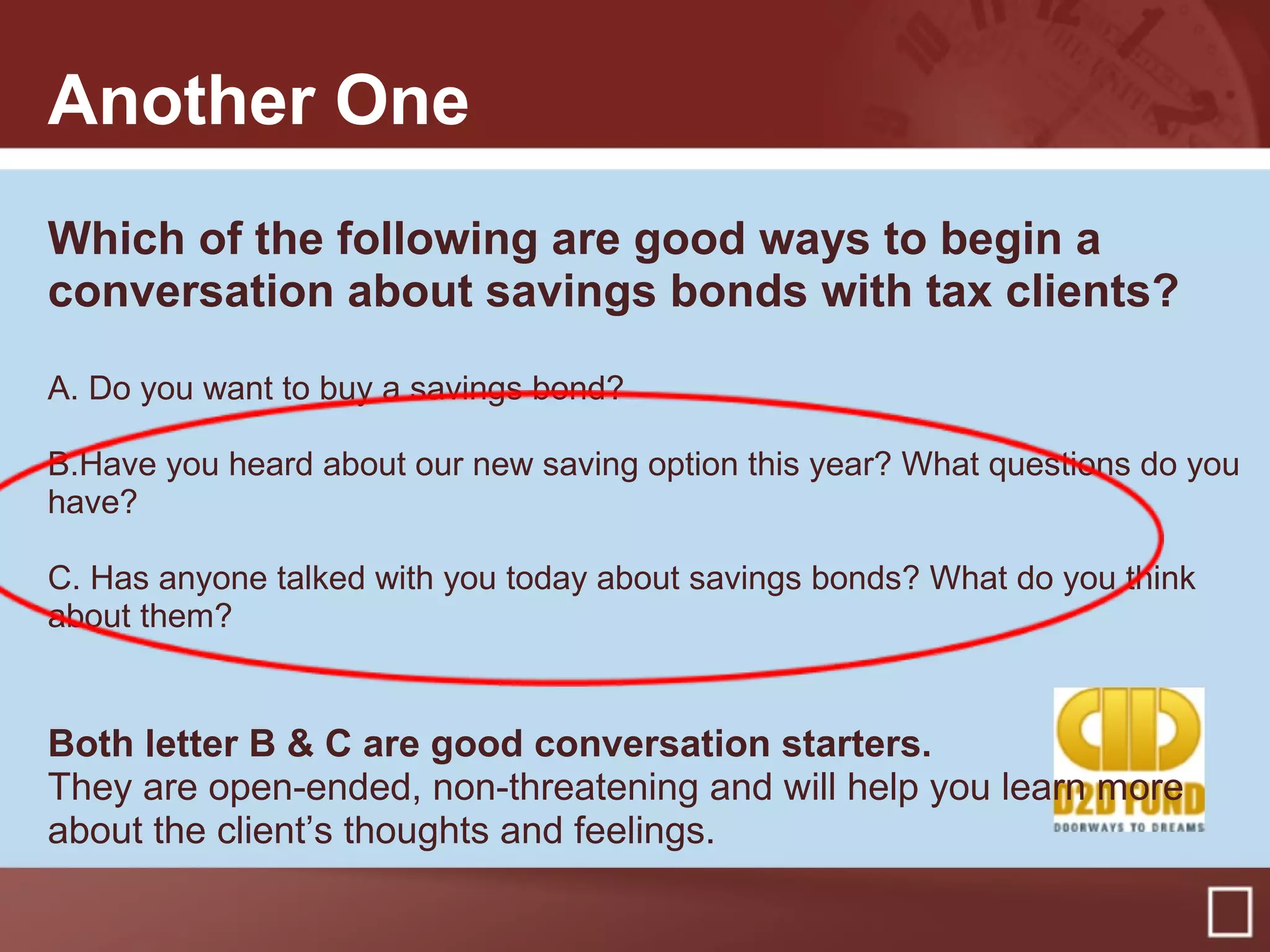

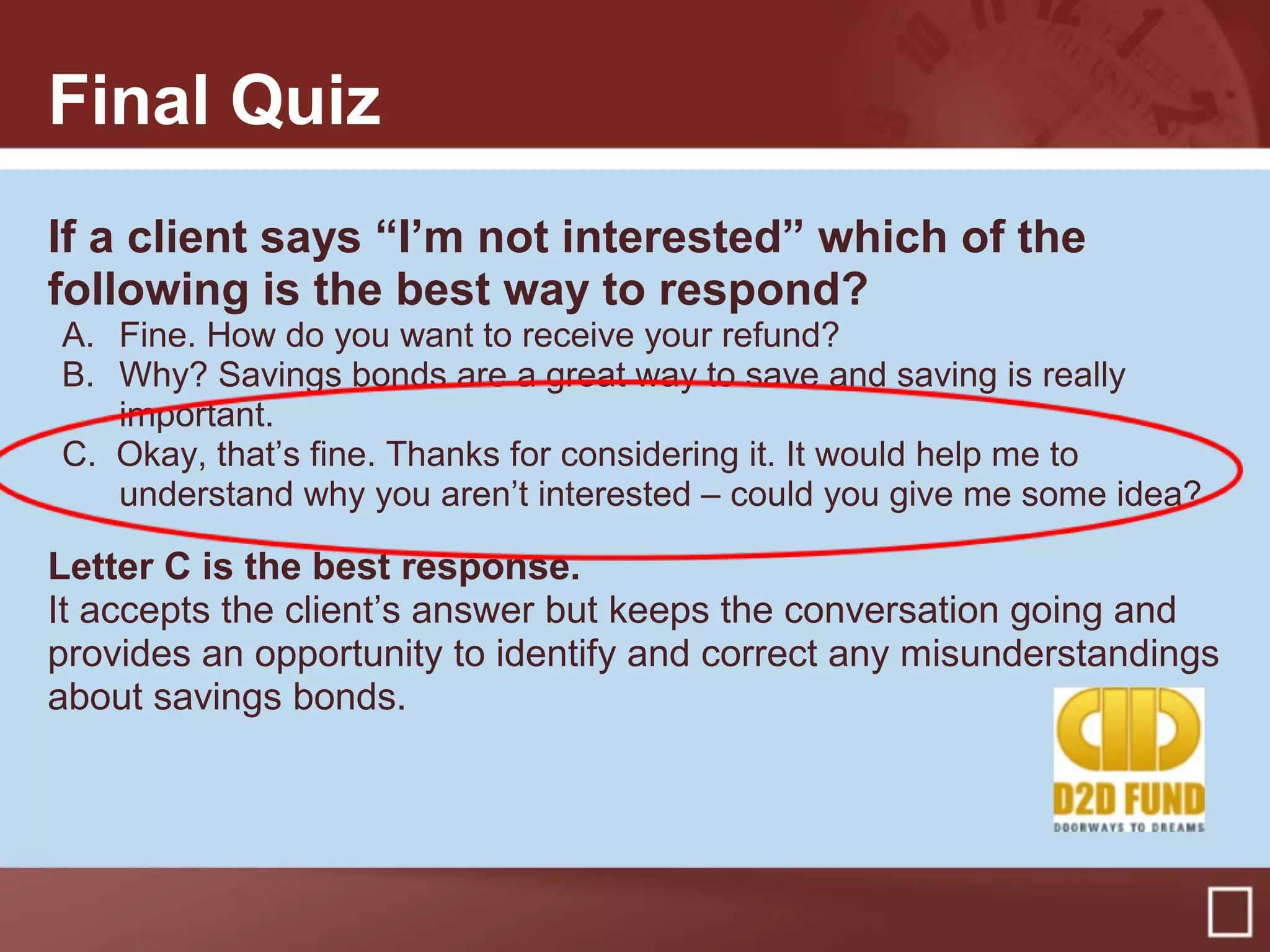

The document discusses promoting savings among lower-income tax filers by having them purchase U.S. Savings Bonds with their tax refunds, noting that tax preparers play an important role by explaining the savings bond option and encouraging clients to consider purchasing bonds which provide safety, competitive returns, and can be bought for as little as $50. It provides tips for tax preparers on discussing savings bonds with clients and addressing potential concerns clients may have about purchasing bonds.