Tpl oct 22 17

- 1. ABRAHAM GULKOWITZ abe@gulkowitz.com 917-402-9039 2017 issue 19October 22, 2017 Seeking Magic… Despite a string of unusual natural disasters, U.S. growth remains on a solid trajectory. Indeed, world growth has picked up and for the first time since the Great Recession and Global Financial Crisis, all 45 industrialized OECD and related emerging-market countries are on a synchronized expansion path. Financial markets have applauded this renewed potential and even more is likely if Washington finally proves able to deliver on meaningful changes in taxes and other key agenda items. Inflation remains muted in the traditional sense, though many wonder whether asset inflation is the real concern. One has to be leery of current benign financial conditions, an extraordinary run in the markets, with the alternative scenario in which all these could be gone in a heartbeat. In many ways the current environment is unprecedented, with high policy uncertainties and hair-trigger geopolitical tensions; accordingly, serious policy missteps could take a toll on market confidence. Storms, earthquakes, Nkorea, Vegas, wildfires... 'What's next?' Federal Reserve does little to shake ‘buy the dip’ mindset US central bank raises expectations for December rate rise without rattling markets Federal Reserve policymakers had a prolonged debate about the prospects of a pickup in inflation and slowing the path of future interest rate rises if it did not, according to the minutes of the U.S. central bank's last policy meeting on Sept. 19-20… Major automakers posted higher U.S. new vehicle sales in September as consumers in hurricane-hit parts of the country rushed to replace flood-damaged cars. Will winning run for US equities continue? Cash pours out of Spanish equity funds amid crisis Despite the Hurricane Disasters, US Oil Exports are Breaking Records Exports had risen to a 1.1 million barrel a day level by the time Hurricane Harvey hit the Texas coast. The hurricane slashed exports dramatically for a brief period… Record levels were reached in each of the last two weeks. U.S. Oil Imports From Saudi Arabia Hit a 30-Year Low NO JOKE US 2018 midterms may yet weaken Democrats' clout Sears Canada to Shut Down, Leaving 12,000 Out of Work Kurdish Oil Is a Wild Card for Markets As crisis at Kobe Steel deepens, CEO says cheating engulfs 500 firms The cheating discovery just got bigger… Wal-Mart sees 40 percent online sales growth next year Saudi Arabia’s economy is in recession Disaster recoveries to boost sales Senate Passes Budget Proposal Passage of budget blueprint clears hurdle in GOP push to overhaul U.S. tax code

- 2. The PunchLine... 2 October 22, 2017 In This Issue Headlines and data appearing in The Punch Line came from widely available publications including national and international newspapers, trade journals, economic and industrial bulletins and news websites. • The Future Ain’t… (pg 8) • Households… (pg 9) • Household Perspectives (pg 10) • The Likelihood of Unlikely Events... (pg 11) • Credit (pg 12) • The DNA of Business… (pg 13) • Tech and Business Cycle (pg 14) • The Market Roar… (pg 15) • Real Estate and Construction… (pg 16) • Select Real Estate (pg 17) • Will Life Ever be the Same? (pg 18) • Seeking Magic. . . Despite a string of unusual natural disasters, U.S. growth remains on a solid trajectory. Indeed, world growth has picked up and for the first time since the Great Recession and Global Financial Crisis, all 45 industrialized OECD and related emerging-market countries are on a synchronized expansion path. Financial markets have applauded this renewed potential and even more is likely if Washington finally proves able to deliver on meaningful changes in taxes and other key agenda items. Inflation remains muted in the traditional sense, though many wonder whether asset inflation is the real concern. One has to be leery of current benign financial conditions, an extraordinary run in the markets, with the alternative scenario in which all these could be gone in a heartbeat. In many ways the current environment is unprecedented, with high policy uncertainties and hair-trigger geopolitical tensions; accordingly, serious policy missteps could take a toll on market confidence. (pg 1) • In This Issue (pg 2) • Dislocation, Dislocation (pg 3) • A Fuller View… (pg 4) • You Can’t Handle the Truth ! (pg 5) • SuperVision… (pg 6) • Engines of Growth Despite a run of global statistics offering relief, confusing stress signals are still emanating from around the globe . Uncertainties -- particularly from natural disasters, terror and geopolitical concerns here and abroad, Brexit, and now in Spain, dangerous issues regarding N Korea, China, Iran and others - - continue to confound investors and contribute to intermittent bouts of haven seeking investment moves. But let’s not forget that the political agenda in Washington is a significant one and much of the political bickering may not be resolved easily or quickly… (pg 7) Contact information: Abraham Gulkowitz phone: 917-402-9039 email: abe@gulkowitz.com

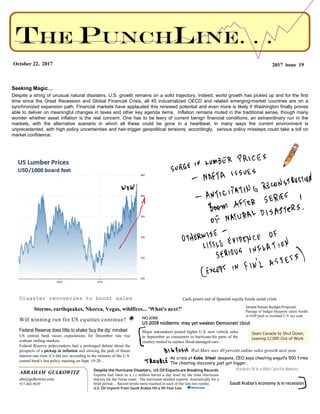

- 3. The PunchLine... 3 October 22, 2017 Dislocation, Dislocation, Dislocation U.S. retail sales recorded their biggest increase in 2-1/2 years in September likely as reconstruction and clean-up efforts in areas devastated by Hurricanes Harvey and Irma boosted demand for building materials and motor vehicles. The Commerce Department said on Friday retail sales jumped 1.6 percent last month also buoyed by a surge in receipts at services stations, which reflected higher gasoline prices after Harvey disrupted production at oil refineries in the Gulf Coast. Retail sales increased 4.4 percent on an annual basis. US lumber futures have surged to a 13-year high as disaster rebuilding looms and in light of the many obstacles in the NAFTA negotiations… The cost of new home construction (as well as renovation) will climb. Lumber increased 427.60 USD/1000 board feet Shares of US homebuilders are soaring despite the slowing residential construction activity. Short interest in the retail sector remains elevated

- 4. The PunchLine... 4 October 22, 2017 A Fuller View… Data Insights The Catalan crisis poses a threat to the European order Fed must hike rates in face of hot U.S. labor market: (Fed Official Rosengren) The Federal Reserve must respond to "very tight" U.S. labor markets by gradually raising interest rates or risk halting the economic recovery, a hawkish Fed official said U.S. employment fell in September for the first time in seven years as Hurricanes Harvey and Irma left displaced workers temporarily unemployed and delayed hiring, the latest indication that the storms undercut economic activity in the third quarter. U.S. nonfarm payrolls declined by 33, 000 in September, the first negative reading in seven years, largely reflecting the effects of hurricanes Harvey and Irma. Nonfarm payroll growth for August was revised up from 156,000 to 169,000. The unemployment rate fell 0.2 percentage point to 4.2 percent in September, the lowest since 2001, while labor force participation rate rose to 63.1 percent from 62.9 percent in August. Meanwhile, average private hourly earnings increased 2.9 percent (y/y) in September, up from 2.7 percent in August.

- 5. The PunchLine... 5 October 22, 2017 You Can’t Handle the Truth… Let'sTake the “Con” out of Economics Bankrupt U.S. retailers begin to catch a break An unexpected helping hand from creditors, landlords and vendors is allowing more U.S. retailers to stay in business following bankruptcy with most of their stores and employees in the fold. The new approach marks a turning point for the beleaguered sector, which has seen at least 19 brick-and- mortar retail chains shut down the bulk of their operations since 2014. Until this year, most bankrupt retailers, including American Apparel, Sports Authority and The Limited, were dismantled during their bankruptcy process. Investors and companies acquired their intellectual property and other assets, but refused to take on their business as a going concern because they saw little value in assuming costly store leases. Instead, they often opted to revamp some of the battered brands online The U.S. consumer price index (CPI) rose 2.2 percent (y/y) in September - - up from 1.9 percent in August . The pickup in inflation reflected a surge in gasoline prices after Hurricane Harvey disrupted production in several major refineries. The core CPI, which excludes food and energy, rose only 1.7 percent (y/y), the same pace as in the previous four months.

- 6. The PunchLine... 6 October 22, 2017 Super Vision - Select Signals OPEC Secretary General urges U.S. shale oil producers to help cap global supply OPEC's Secretary General Mohammed Barkindo on Tuesday called on U.S. shale oil producers to help curtail global oil supply, warning extraordinary measures might be needed next year to sustain the rebalanced market in the medium to long term. ⁎ But the number of US drilled but uncompleted (DUC) wells continues to climb, especially in the Permian Basin. At higher prices, many of these will be activated Mexican vehicle exports have been trending higher… This trend could get disrupted if the NAFTA negotiations fall apart. SPAIN Catalan business exodus signals deep corporate concerns China’s export growth picked up from 5.5 percent (y/y) in August to 8.1 percent in September in U.S. dollar terms, but still market expectations. Meanwhile, import growth accelerated from 13.3 percent (y/y) in August to a stronger- than-expected 18.7 percent in September (Figure 2). China’s trade balance narrowed from $41.9 billion in August to $28.5 billion in September, the lowest level since March. China’s 10yr government bond yield hit the highest level since late 2014

- 7. The PunchLine... 7 October 22, 2017 Engines of Growth… The Italian unemployment rate is drifting lower but remains above 11%. Major auto makers posted mostly solid sales gains in September amid heavier consumer discounts and surging demand to replace hurricane-damaged vehicles, giving the industry relief from months of declining results. Japan's Tankan survey turned out much stronger than expected. The closely-watched manufacturing gauge for large enterprises in Q3 soared to a reading of 22, up from 17 in Q2 which in turn had risen from 12 in Q1. The Tankan has been making great strides. The quarterly manufacturing reading's q/q gain ranks as in the top 21st percentile of all quarterly changes back to 2004. The four-quarter change ranks in the top 16th percentile. The level of the reading for the large enterprise gauge in Q3 2017 stands in its 72nd queue percentile and is the highest reading in 40 quarters making it last higher before the onset of the global recession and financial crisis in late-2007. Connecticut Towns Grapple With Big Funding Cuts Amid Budget Deadlock European airlines face more cuts and consolidation Panel finds U.S. washing machine makers hurt by LG, Samsung imports The U.S. International Trade Commission found on Thursday that surging imports of large residential washing machines harmed domestic producers, a major step toward the imposition of broad duties or quotas on foreign-made Samsung- and LG-brand machines. Firmer data and brimming optimism over tax cuts have powered renewed market momentum Thyssenkrupp sees 'gigantic' demand for new-generation elevators Thyssenkrupp is seeing strong demand for its new generation of elevators that operate without steel cables or ropes, the unit's chief executive said on Friday. The Fed chief is going to find 2018 hard going Tax cuts will only complicate a difficult picture for the Federal Reserve next year the Caixin manufacturing PMI, which tracks smaller private comp anies, dropped from 51.6 in August to 51 in September, pointing to softer activity in China’s smaller businesses. The latest World Economic Outlook (IMF) has upgraded its global growth projections to 3.6 percent for this year and 3.7 percent for next— in both cases 0.1 percentage point above our previous forecasts, and well above 2016’s global growth rate of 3.2 percent, which was the lowest since the global financial crisis. The current global acceleration is also notable because it is broad-based—more so than at any time since the start of this decade. Christine Lagarde already has thrown down the gauntlet to urge countries not to waste this opportunity of ongoing growth to make some of the needed changes they postponed during recession and in the weaker portions of the recovery. S Korea’s Kospi closed up at an all-time high as investors expect strong third-quarter earnings from local companies such as Samsung Electronics. The U.S. central bank said the "continued effects of Hurricane Harvey and, to a lesser degree, the effects of Hurricane Irma combined to hold down the growth in total production in September by a quarter percentage point." Chinese exporters at the country's biggest trade fair are more optimistic about global demand now than six months ago but Beijing's crackdown on pollution is ramping up costs and product prices, hurting smaller factories and foreign buyers.

- 8. The PunchLine... 8 October 22, 2017 The Future Ain’t What It Used To Be US oil rig count still isn’t growing. Deliveries of new private jets are forecast to drop to 630 this year, from 657 last year and 689 in 2015 Crashing Prices for Used Jets… A five-year-old jet sold in 2016 was worth only 56% of its original list price, on average. That’s down from 64% in 2012, according to a report by plane broker Jetcraft. The value retention was as high as 91 percent in 2008. Luxury jet buyers think resale value in tough market Members of the elite private jet set are customizing their planes with full-sized showers, beds and windows - but when it comes to decorating, an increasing number are steering clear of gold panels and gaudy features, opting instead for the airborne equivalent of beige.

- 9. The PunchLine... 9 October 22, 2017 Households – Brave New World GREAT? Holiday spending expected to increase More than last year… Walmart buys Brooklyn startup for same-day NYC deliver There’s still no Walmart anywhere in New York City, but that hasn’t stopped the superstore from trying to get its goods to your doorstep. The retail giant — in a move that looks like a direct swipe at Amazon — will soon offer same-day delivery to certain Big Apple customers, thanks to its acquisition of Brooklyn-based startup Parcel In a broad display of economic optimism, for the first time in six years, a majority of respondents to McKinsey’s latest survey on economic conditions say their home economies are on the right track.1 Moreover, nearly as many respondents expect their economies to continue improving in the months ahead. The buoyancy is especially pronounced in developed economies, where respondents’ current views on domestic conditions surpass by far what, earlier this year, they expected would be the case now. Their views on the world economy also remain more positive than negative. But in respondents’ estimation, geopolitical instability and asset bubbles have become more pressing risks to near-term global growth in the time since our previous survey. Household reliance on credit is mounting… Much of the increase comes from “nonrevolving” debt, which is mostly auto financing and student loans The NFIB's Index of Small Business Optimism in the US slipped to 103 in September 2017 from a six-month high of 105.3 in August, and below market expectations of 105.1. It was the lowest reading since November last year, as 6 of 10 index components declined: Higher sales expectations (-12 pp to net 15 percent); good time to expand (-10 pp to 17 percent); plans to make capital outlays (-5 pp to 27 percent); expectations the economy will improve (-1 pp to 30 percent); current job openings (-1 pp to 30 percent); and expected credit conditions (-1 pp to -3 percent). On the other hand, earnings trends were flat (at -11 percent) and improvement was observed for: Plans to increase inventories (+5 pp to 7 percent); current inventory (+2 pp to -3 percent); and plans to raise employment (+1 pp to 19 percent). The University of Michigan's consumer sentiment for the United States rose to 101.1 in October 2017 from 95.1 in September, way above market expectations of 95. It was the highest level since January 2004. The current conditions index rose to 116.4 from 111.7 in September and the gauge of consumer expectations increased to 91.3 from 84.4. Credit card delinquency rose for the third straight month in September, data from JPMorgan Chase & Co and card issuer Discover Financial Services suggested US rent inflation seems to have leveled off, but is very elevated, compared to other inflation components… USA Is Smashing Its Clean Energy Targets

- 10. The PunchLine... 10 October 22, 2017 Household Perspectives

- 11. The PunchLine... 11 October 22, 2017 The Likelihood of Unlikely Events Regulators Fret About Cyber Risk After SEC Hack Can Germany Make an Unwieldy Coalition Work? ► For weeks, the Brits and the Europeans have been talking at cross purposes in the Brexit negotiations. ► EU toughens demands in draft conclusions ahead of summit Yahoo now says every single account was affected by 2013 attack — 3 billion in all The jitters around Spanish assets persist US cuts back visas after Turkish embassy arrest Thousands blocked from travelling as diplomatic crisis escalates Erdogan raises stakes in US spat with spies jibe Turkish president challenges ambassador’s credentials after suspension of visa process Deutsche Börse intensifies efforts to pull euro clearing from UK German exchange draws up plan to share profits from the business with its members PUERTO RICO Puerto Rico’s Health Care in Crisis, Three Weeks After Maria Years of borrowing left the economy in a precarious state. Puerto Rico’s $74 Billion Burden… Helpless When Maria Hit Now in need of multibillion-dollar aid, will it ever be able to pay its debts? Puerto Rico warns island on brink of 'massive liquidity crisis' RISKS ► Rough end to easy money in which investors and policy makers aren’t prepared for shocks as central bank normalization unfolds… ► Asset bubbles… ► Surprising developments in new growth path as China slows… ► Disruption out of the rise of populism; ► Ugly BREXIT outcome with Britain’s move to leave the EU; ► Sectoral upheavals – retailing, auto sector , tech and media, etc… ► Severe consequences with debt problems in several regions – Hartford, CT or Japan, etc ► A host of geopolitical concerns here and abroad entail dangerous consequences… regarding N Korea, China, Iran and others - - and will continue to confound investors and contribute to intermittent bouts of haven seeking investment moves ► Financial markets that ignore these risks are susceptible to disruptive repricing, and are sending [a] misleading message to policy makers California Hepatitis A Outbreak on Verge of Statewide Epidemic THE NAPA FIRES OF HELL... Tens of thousands of airline passengers have been told their flights have been cancelled by the latest French air traffic control strikes. The main air-traffic controllers' unions are stopping work as part of a national strike against the labour reform policies of President Emmanuel Macron. Spain's Catalonia crisis will likely be be delayed, not resolved How big is the risk of another Black Monday equities crash? Thirty years on, the market is different but has some similar characteristics, from high valuations to trading strategies that could accelerate a sell-off Crude prices rose as Iraqi forces entered the oil-rich city of Kirkuk, seizing territory from Kurdish fighters and briefly cutting some crude output from OPEC's second-largest producer. Venezuela's deteriorating oil quality riles major refiners Venezuela's state-run oil firm, PDVSA, is increasingly delivering poor quality crude oil to major refiners in the United States, India and China, causing repeated complaints, canceled orders and demands for discounts, according to internal PDVSA documents and interviews with a dozen oil executives, workers, traders and inspectors. Americans are taking a knee on following football We recently marked the 30th anniversary of the stock market crash of 1987. October 19, 1987’s massive one day plunge included a -20.5% plummet by the S&P 500. It was also on October 19, 1987 that the 10-year Treasury yield was last at or above 10%. Moody's Warns of 'Likely' Hartford Default, Decades of Deficits Ahead

- 12. The PunchLine... 12 October 22, 2017 Credit Matters - Know Risk Many Excel in Strategy, Few in the Management of Risk International Paper unloads $1.3 billion in pension liabilities International Paper Co , a fiber-based packaging, pulp and paper producer, said on Monday it would transfer $1.3 billion in pension obligations to No. 2 U.S. life insurer Prudential Financial . U.S. insurers have been buying corporate pension plans at a record clip as rising interest rates and all-time high stock-market values give companies an opportunity to offload them. Calculating they can make more money from selling companies an annuity to cover the cost of the pension plans, and then invest the proceeds in bonds and other securities, insurers are competing to persuade corporate America to sell them their pensions. Pension transfers of $13.7 billion were finalized last year, up 1 percent from 2015, according to LIMRA, an industry trade group. The figure is the second highest annual total ever recorded, LIMRA said. The average corporate pension fund was 83 percent funded in May, according to Mercer Investment Consulting. In June, consulting and outsourcing services provider Accenture Plc transferred $1.6 billion in pension obligations to insurers American International Group Inc and MassMutual. National regulators in Europe have clashed over whether asset managers should face more stringent scrutiny after Brexit, as concerns mount that the UK’s vote to leave the EU will trigger upheaval in the fund industry. Luxembourg’s financial watchdog, the Commission de Surveillance du Secteur Financier, warned Brussels against introducing stricter regulation of mutual funds on the back of Brexit, arguing this could cause irreparable damage to the EU’s position as a leading centre for asset management globally. Its warning came after the European Commission, the EU’s executive arm, put forward proposals to beef up the powers of the pan-European financial watchdog, the European Securities and Markets Authority. Caesars Entertainment Corp has an eye on expanding its Caesars, Harrah’s and Horseshoe brands in the United States and abroad after its casino operating unit emerges from nearly three years of bankruptcy with $10 billion less in debt. Industry analysts said it may be too late to catch up with rivals like MGM Resorts International, Wynn Resorts Ltd and Las Vegas Sands Corp that have spent years investing in high-growth Asian markets like Macau as U.S. gambling has cooled. “Twenty-five years ago Caesars was the premiere name internationally but they dropped the ball,” said Greg Bousquette of investment banking firm G.C. Andersen Partners, which advised unsecured creditors during the Caesars bankruptcy. Caesars has spent years struggling to manage more than $25 billion in debt, much of it taken on in 2008 when Apollo Global Management and TPG Capital led a leveraged buyout of the company. The operating unit filed for bankruptcy in early 2015. Caesars emerges from Chapter 11 with a simplified structure by merging with Caesars Acquisition Corp and other affiliates, and former creditors will hold a majority of the stock. Bond ETFs have performed well, even under difficult market conditions. That has fueled their growth even more with over $600bn outstanding. This success, and the fallacy of composition that if each ETF is liquid, the overall market is, may be a fundamental vulnerability if a significant economic shock hits bonds. Puerto Rico The 8%-coupon bond “maturing” in 2035 is trading at 33 cents on the dollar Venezuela’s longer-dated bond yield is approaching 35% European junk bonds are yielding 2.2%. India’s non-performing loan balances have been rising quickly over the past few years. “Dry powder” (uninvested capital or uncalled commitments) for private debt funds hit a new high. China’s ratio of household debt to gross domestic product rose to 45 per cent in the first quarter of this year — far beyond the emerging market average of 35 per cent. And total debt, including for companies, is now more than three times GDP

- 13. The PunchLine... 13 October 22, 2017 The DNA of Business Reconfiguring Industries to Define Growth Safran hopes new fuel-efficient jet engine can reshape air travel French aero engine maker Safran unveiled a new engine prototype on Tuesday that would radically cut fuel consumption, potentially reshaping air travel from 2030. The Open Rotor engine, which places previously hidden whirring parts on the outside to capture more air, was developed with European Union backing and is being tested in specially built facilities at a French military base near Marseille. Shaped like an elongated egg with two rows of blades at the back, the engine aims to burn 15 percent less fuel than current conventional turbofan engines, which have also improved significantly in recent years. Clara de la Torre, a top European Union research official, said the new type of engine could help airlines cut air fares because it requires less fuel. Whether the engine enters service, however, depends on the strategies of airplane makers such as Airbus and Boeing, whose best-selling single-aisle planes are expected to be renewed in around 2030. Ford to cut costs $14 billion, invest in trucks, electric cars: CEO Ford Motor Co plans to slash $14 billion in costs over the next five years, Chief Executive Officer Jim Hackett told investors on Tuesday, adding that the No. 2 U.S. automaker would shift capital investment away from sedans and internal combustion engines to develop more trucks and electric and hybrid cars. Hackett told investors that Ford will be open to more partnerships to spread the costs and risks of simultaneously developing new technology while still churning out profits from its legacy business of selling trucks and sport utility vehicles in North America. He cited a partnership with ride services company Lyft to develop technology to deploy self-driving cars. Hackett, former CEO of office furniture maker Steelcase Inc, took the top post at Ford in May, after his predecessor Mark Fields was pushed out. At the time, Hackett promised investors a statement within 100 days as to how he would improve the "fitness" of Ford to compete as the auto industry becomes more digital, more electric and less wedded to selling one vehicle at a time to individuals. Thyssenkrupp is seeing strong demand for its new generation of elevators that operate without steel cables or ropes, the unit's chief executive said US autos’ average fuel efficiency remains stuck at around 25 mpg since 2014 Amazon’s potential foray into the prescription drug market is pressuring US pharmacy shares Costco’s entry into the grocery delivery business wasn’t helpful for the stock price Wal-Mart sees U.S. online sales soaring 40 percent in fiscal year 2019 The Nordstrom family has suspended efforts to take the department- store chain private after struggling to raise enough financing for the leveraged buyout, in the latest sign of how much investors have soured on the retail industry. The Kobe Steel problems have expanded… with hundreds of companies effected globally. As an example, Boeing may have to swap out falsely certified aircraft parts. Kobe Steel’s stock continues to tumble, and the company’s bond yields have spiked Netflix Inc added more subscribers than expected around the world in the third quarter and projected growth in line with Wall Street forecasts, saying it had a head start on rivals as internet television explodes globally Ford to recall about 1.3 million vehicles in North America The No.2 U.S. automaker said the safety recall is due to frozen door latch or a bent or kinked actuation cable in the affected vehicles, that may result in a door not opening or closing. GE Slashes Outlook, Will Exit Businesses Totaling $20 Billion

- 14. The PunchLine... 14 October 22, 2017 Tech and the Business Cycle Click on the Revolution As part of its focus on virtual and augmented reality, Microsoft has acquired Altspace VR, a struggling virtual reality social network that had been set to shut down until Redmond came calling. Microsoft also used a San Francisco event to show off the latest Windows-based virtual reality headsets, including a new $499 model from Samsung and announced a free Halo-themed VR game. Also at the event, Intel announced it would broadcast some of the upcoming Winter Olympics in virtual reality. ► VC companies have the money to stay private longer, delaying exits Tech stocks have seen more upside earnings surprises than the overall market The e-commerce giant is asking cities to bid to be home to its second North American headquarters

- 15. The PunchLine... 15 October 22, 2017 The Market Roar… History May Not Repeat, But It Often Rhymes History Receipts Itself The tax-reform expectations (and to some extent the renewed strength in the dollar) have been helping small caps The STLFSI measures the degree of financial stress in the markets and is constructed from 18 weekly data series: seven interest rate series, six yield spreads and five other indicators. Each of these variables captures some aspect of financial stress. Accordingly, as the level of financial stress in the economy changes, the data series are likely to move together. Nikkei 225 Posts Longest Winning Streak Since 1988 Latest = 1509

- 16. The PunchLine... 16 October 22, 2017 Real Estate and Construction Outlook Landlords of strip malls are trying to take the chill out of the air by adding outdoor entertainment programs, in hopes of attracting more shoppers in an era of declining foot traffic Canadian pension fund OMERS and U.S. buyout group Madison (MCN.N) are acquiring Berlin’s landmark property Sony Center from Korea’s national pension fund NPS for 1.1 billion euros ($1.3 billion), the companies said on Monday. The eight buildings at Berlin’s central square Potsdamer Platz include BahnTower, the headquarters of national railway company Deutsche Bahn [DBN.UL], as well as office and retail space used by tenants such as Sony, Sanofi, Facebook and WeWork. They also house cinemas and residential units. NPS had bought the property for $767 million from Morgan Stanley in 2010. Ontario Municipal Employees Retirement System (OMERS) will acquire the property through its Oxford Properties unit, which recently invested in Paris’ La Defense district and after the Berlin deal will have 2.3 billion in continental European investments. Most of its other assets are located in London. Retail vacancies are up 10% in Manhattan and Brooklyn US retail vacancies held flat in Q3 amid rampant store closures Fitch predicts correction in ‘Highly overvalued’ London office market

- 17. The PunchLine... 17 October 22, 2017 Select Real Estate Reference Points… Vacancy rate for apartments across the U.S. climbed to 4.5% in the third quarter. The apartment market in the U.S. remained sluggish in the third quarter as the vacancy rate climbed to its highest level in five years. In all, apartment vacancy rates increased in 50 of 79 metropolitan areas, with many major cities experiencing high levels of construction that outstripped demand, according to data released this week by apartment-tracker Reis Inc. Even as apartment supply ticked up in many markets, just six of 79 metro areas saw declines in effective rents for the third quarter, writes Barbara Byrne Denham at Reis. The multifamily sector is containing the effects of increased supply on occupancy, as the national vacancy rate increased by just 10 basis points during the third quarter to 4.5%, a smaller-than- expected uptick, Reis said Tuesday. Even as vacancies rose during Q3, so did both asking and effective rents on a national basis. REITs have been on a tear in 2017 Through the end of September, REITs have issued a record $37.7 billion in unsecured notes.

- 18. The PunchLine... 18 October 22, 2017 Will Life Ever Be the Same? This publication is provided to you for information purposes and is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The information contained herein has been obtained from sources believed to be reliable but is not necessarily complete and its accuracy cannot by guaranteed. The views reflected herein are subject to change without notice. No one connected to this publication accepts any liability whatsoever for any direct or consequential loss arising from any use of this publication or its contents. This publication may not be reproduced, distributed to any person for any purpose without express permission from TPL Advisory, LLC. Please cite source when quoting. All rights are reserved.