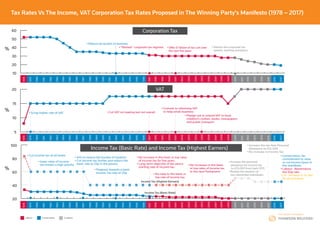

Thomson Reuters Infographic Showing the UK Tax Rates vs the Winning Party Manifesto (1978 - 2017)

- 1. 20 40 60 80 100 Income Tax (Basic Rate) and Income Tax (Highest Earners) • Cut income tax at all levels • lower rates of income tax remain a high priority • Aim to reduce the burden of taxation • Cut income tax further and reduce the basic rate to 25p in the pound. • Progress towards a basic Income Tax rate of 20p • No increase in the basic or top rates of income tax for five years. • Long-term objective of ten pence starting rate of income tax. • No raise to the basic or top rate of income tax • No increases in the basic or top rates of income tax in the next Parliament • Increase the tax-free Personal Allowance to £12,500 • No increase in Income Tax • Conservative: No commitment to raise or cut income taxes in the manifesto • Labour: Reintroduce the 50p rate • LD : Increase in 1p rate for all taxbands Income Tax (Basic Rate) Income Tax (Highest Earners) 5 10 15 20 VAT • Scrap higher rate of VAT • Cut VAT on heating but not overall • Commit to reforming VAT to help small business • Pledge not to extend VAT to food, children’s clothes, books, newspapers and public transport 10 20 30 40 50 60 Corporation Tax • Reduce tax burden on business • “Review” corporate tax regimes • Offer £1 billion of tax cuts over the next five years • Reform the corporate tax system, tackling avoidance • Increase the personal allowance for income tax to £10,000 from April 2011. • Review the taxation of non-domiciled individuals. % % % 1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2003 2004 2006 2007 2008 2009 2015 2002 2005 2016 2017 2010 2011 2012 2013 2014 1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2003 2004 2006 2007 2008 2009 2015 2002 2005 2016 2017 2010 2011 2012 2013 2014 1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2003 2004 2006 2007 2008 2009 2015 2002 2005 2016 2017 2010 2011 2012 2013 2014 Labour Conservative Coalition Tax Rates Vs The Income, VAT Corporation Tax Rates Proposed in The Winning Party's Manifesto (1978 – 2017)