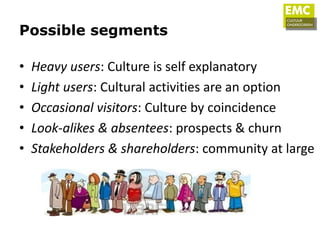

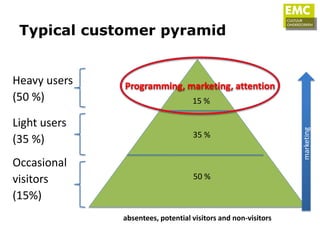

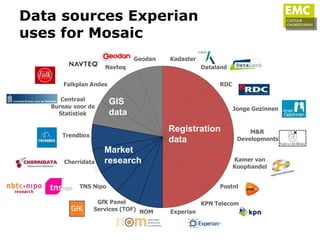

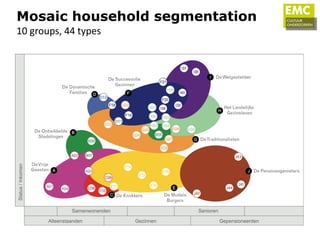

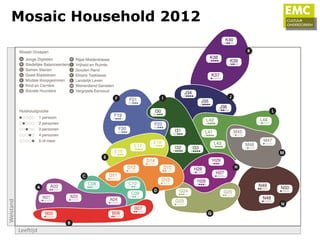

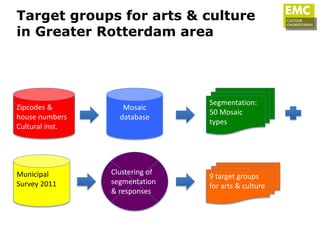

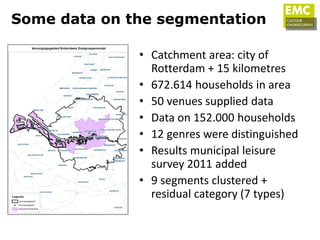

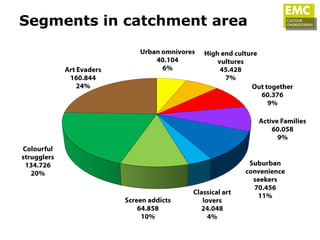

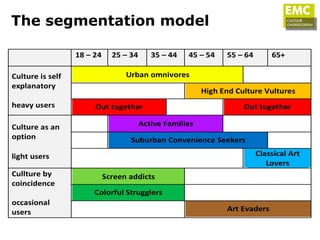

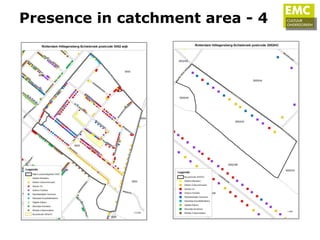

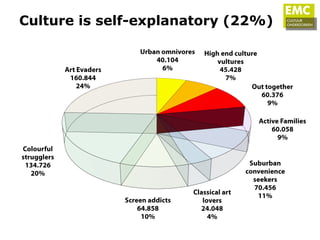

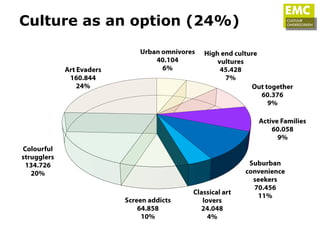

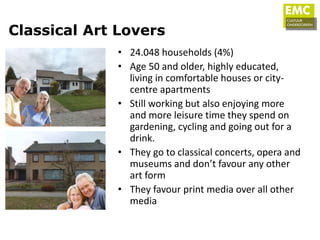

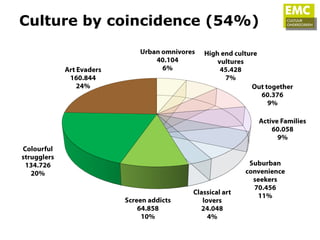

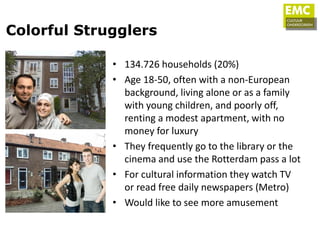

This document presents a segmentation model developed by EMC Cultuuronderzoeken to help cultural organizations in the Rotterdam area more effectively market to their audiences. The model divides the target population into 9 audience segments based on demographic, socioeconomic, and behavioral data. It shows the relative size and characteristics of each segment as well as their current and potential interest in different cultural genres. Implementing a segmentation approach allows organizations to better understand their audiences and tailor their programming, marketing, and fundraising to different segments.