SAP Automation - Customer's Credit Balance

•

0 likes•76 views

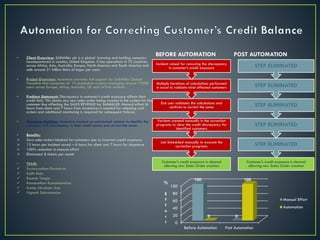

SABMiller is a global brewing company with operations in 75 countries. Accenture provided application management support for SABMiller's systems managing 19,000 users. A problem was that discrepancies in customer credit exposures blocked new sales orders, costing 13 hours per incident to manually resolve. Accenture created an automated solution to identify and correct discrepancies in customer credit exposures, eliminating all manual effort and blocked sales orders.

Report

Share

Report

Share

Download to read offline

Recommended

Recommended

More Related Content

Similar to SAP Automation - Customer's Credit Balance

Similar to SAP Automation - Customer's Credit Balance (20)

Rtprt025awdstoreopsuperstarsaug2014final 140825094806-phpapp01

Rtprt025awdstoreopsuperstarsaug2014final 140825094806-phpapp01

Business Growth Strategy " ACE Klub program" in Britannia New Delhi

Business Growth Strategy " ACE Klub program" in Britannia New Delhi

Digital B2B Credit Best Practices | Emagia Credit Automation | Emagia MasterC...

Digital B2B Credit Best Practices | Emagia Credit Automation | Emagia MasterC...

Running Head FINAL PROJECT PLAN1TECHNICAL PAPER FINAL PROJEC.docx

Running Head FINAL PROJECT PLAN1TECHNICAL PAPER FINAL PROJEC.docx

Customer Satisfaction Survey & Loyalty Program - CSnLP Solutions

Customer Satisfaction Survey & Loyalty Program - CSnLP Solutions

Estudio: "Detrás de un Intraemprendedor Social". -MILAN SAMANI

Estudio: "Detrás de un Intraemprendedor Social". -MILAN SAMANI

Customer Churn Management For Profit Maximization PowerPoint Presentation Slides

Customer Churn Management For Profit Maximization PowerPoint Presentation Slides

SAP Automation - Customer's Credit Balance

- 1. • Client Overview: SABMiller plc is a global brewing and bottling company headquartered in London, United Kingdom. It has operations in 75 countries across Africa, Asia, Australia, Europe, North America and South America and sells around 21 billion liters of lager per year. • Project Overview: Accenture provides AM support for SABMiller Global Template that comprises of 14 production systems managing around 19000 users across Europe, Africa, Australia, UK and LATAM markets. • Problem Statement: Discrepancy in customer’s credit exposure affects their credit limit. This blocks any new sales order being created in the system for that customer thus affecting the SALES REVENUE for SABMILLER. Manual effort (6 hours from client and 7 hours from Accenture) is needed for releasing such orders and additional monitoring is required for subsequent failures. • Accenture Solution: Accenture created an automated solution to identify the customers with discrepancy in their credit scores and correct the same. • Benefits: Zero sales orders blocked for customers due to incorrect credit exposure 13 hours per incident saved – 6 hours for client and 7 hours for Accenture 100% reduction in manual effort Eliminated 8 tickets per month • TEAM: Swamynathan Ravindran Sujith Raja Raunak Tongia Ramanathan Ramachandran Sreeju Abraham Jose Vignesh Subramanian BEFORE AUTOMATION POST AUTOMATION Customer’s credit exposure is cleared allowing new Sales Order creation STEP ELIMINATED STEP ELIMINATED STEP ELIMINATED STEP ELIMINATED STEP ELIMINATED Customer’s credit exposure is cleared allowing new Sales Order creation Job Scheduled manually to execute the correction programs Variants created manually in the correction programs to clear the credit discrepancy for identified customers End user validates the calculations and confirms to correct the same Multiple iterations of calculations performed in excel to validate total affected customers Incident raised for removing the discrepancy in customer’s credit exposure 0 20 40 60 80 100 Before Automation Post Automation 100 00 100 % E f f o r t Manual Effort Automation