DDT abolishment - Budget 2020

•

0 likes•19 views

Dividend Distribution Tax in India has been abolished by the Finance Act 2020 and what does it mean for the US investors / parent co is captured in a single slide.

Report

Share

Report

Share

Recommended

More Related Content

What's hot

What's hot (20)

Latest Updates And All Latest Issues Of Income Tax India

Latest Updates And All Latest Issues Of Income Tax India

Heads of income in India (salaries,house property, business and profession)

Heads of income in India (salaries,house property, business and profession)

Presentation On Income Tax (A.Y. 2009 10 & 2010 11)

Presentation On Income Tax (A.Y. 2009 10 & 2010 11)

Income Tax Provisions related to Taxation of Non-Resident Indians

Income Tax Provisions related to Taxation of Non-Resident Indians

Similar to DDT abolishment - Budget 2020

Similar to DDT abolishment - Budget 2020 (20)

Legal overview star camp royse - may 2020 4839-7571-5260-1

Legal overview star camp royse - may 2020 4839-7571-5260-1

Direct-Tax-In-India-2021-Coinmen-Consultant-LLP.pdf

Direct-Tax-In-India-2021-Coinmen-Consultant-LLP.pdf

Get Income Tax Interview Question Answer | Academy Tax4wealth

Get Income Tax Interview Question Answer | Academy Tax4wealth

Get Income Tax Interview Question Answer | Academy Tax4wealth

Get Income Tax Interview Question Answer | Academy Tax4wealth

Get Top 30 Income Tax Interview Questions Answers at Academy Tax4wealth

Get Top 30 Income Tax Interview Questions Answers at Academy Tax4wealth

Income Tax - Meaning, Implementation and Exempted Incomes

Income Tax - Meaning, Implementation and Exempted Incomes

Compliance Errors - The expensive poison pill to avoid.pptx

Compliance Errors - The expensive poison pill to avoid.pptx

More from Tilak Agarwal

More from Tilak Agarwal (7)

Equalisation Levy - Newly introduced - scope and nuances final

Equalisation Levy - Newly introduced - scope and nuances final

Recently uploaded

A thorough discussion of professional ethics for Bankruptcy Attorneys. It’s Not Easy Being Green: Ethical Pitfalls for Bankruptcy Novices

It’s Not Easy Being Green: Ethical Pitfalls for Bankruptcy NovicesLugenbuhl, Wheaton, Peck, Rankin & Hubbard

Recently uploaded (20)

Understanding the Role of Labor Unions and Collective Bargaining

Understanding the Role of Labor Unions and Collective Bargaining

Sangyun Lee, Duplicate Powers in the Criminal Referral Process and the Overla...

Sangyun Lee, Duplicate Powers in the Criminal Referral Process and the Overla...

judicial remedies against administrative actions.pptx

judicial remedies against administrative actions.pptx

Philippine FIRE CODE REVIEWER for Architecture Board Exam Takers

Philippine FIRE CODE REVIEWER for Architecture Board Exam Takers

It’s Not Easy Being Green: Ethical Pitfalls for Bankruptcy Novices

It’s Not Easy Being Green: Ethical Pitfalls for Bankruptcy Novices

CASE STYDY Lalman Shukla v Gauri Dutt BY MUKUL TYAGI.pptx

CASE STYDY Lalman Shukla v Gauri Dutt BY MUKUL TYAGI.pptx

DDT abolishment - Budget 2020

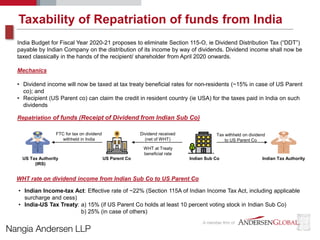

- 1. Taxability of Repatriation of funds from India India Budget for Fiscal Year 2020-21 proposes to eliminate Section 115-O, ie Dividend Distribution Tax (“DDT”) payable by Indian Company on the distribution of its income by way of dividends. Dividend income shall now be taxed classically in the hands of the recipient/ shareholder from April 2020 onwards. Mechanics • Dividend income will now be taxed at tax treaty beneficial rates for non-residents (~15% in case of US Parent co); and • Recipient (US Parent co) can claim the credit in resident country (ie USA) for the taxes paid in India on such dividends Repatriation of funds (Receipt of Dividend from Indian Sub Co) Indian Sub CoUS Parent Co Indian Tax AuthorityUS Tax Authority (IRS) Dividend received (net of WHT) Tax withheld on dividend to US Parent Co WHT at Treaty beneficial rate FTC for tax on dividend withheld in India WHT rate on dividend income from Indian Sub Co to US Parent Co • Indian Income-tax Act: Effective rate of ~22% (Section 115A of Indian Income Tax Act, including applicable surcharge and cess) • India-US Tax Treaty: a) 15% (if US Parent Co holds at least 10 percent voting stock in Indian Sub Co) b) 25% (in case of others)

- 2. Points to Ponder 1. What would be the tax treatment of dividends in the US for the dividends received from Indian Sub Co, assuming that the Indian Sub Co is substantially owned (> 90 percent) by the US Co? 2. What would be the mechanism of claiming Foreign tax credit (FTC) for the withholding done by Indian Sub Co on payments of dividends to US Co? 3. Would the tax treatment/ mechanism be different if the US shareholder is an individual or a PE investor and not a corporation? 4. How should the Federal Agency (Internal Revenue Service) be looking at this move of the Indian Government of shifting the tax incidence on dividends to the shareholders? 5. In case there is an excess withholding done by the Indian Sub Co as per the tax treaty provisions vis-à-vis tax applicable to the US shareholder as per US domestic tax laws, would such excess tax be available as a refund to the US shareholder in the home country (ie the US) or would that be a sunk cost? 6. Broadly, what would be the local tax filing/ reporting compliances for the US shareholders (corporations, individuals or PE) in case of such dividend repatriation from India?

- 3. Thank you Sandeep Jhunjhunwala Director Nangia Andersen LLP sandeep.jhunjhunwala@nangia-andersen.com +91 97401 55469