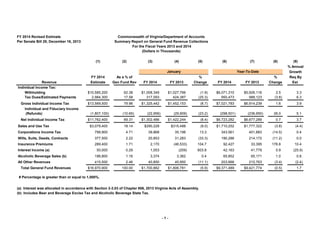

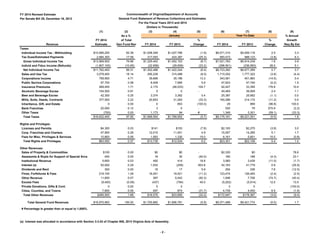

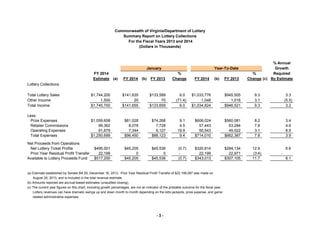

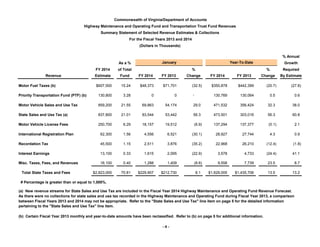

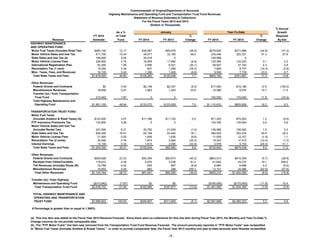

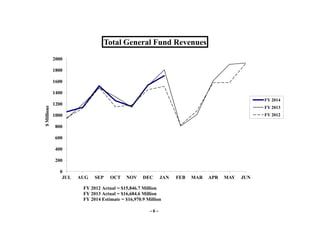

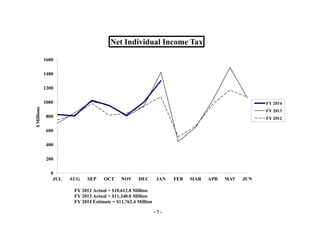

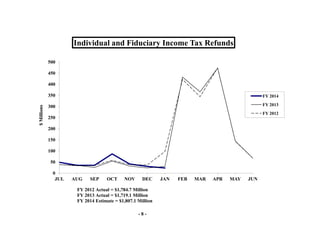

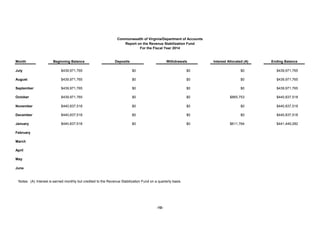

The document provides a detailed summary report of general fund revenue collections for the Commonwealth of Virginia for fiscal years 2013 and 2014. It includes estimates and actual revenues from various sources such as individual income tax, corporations income tax, and lottery collections, highlighting year-to-date changes and required annual growth rates. Additionally, it presents information on revenue trends and comparisons to previous years.