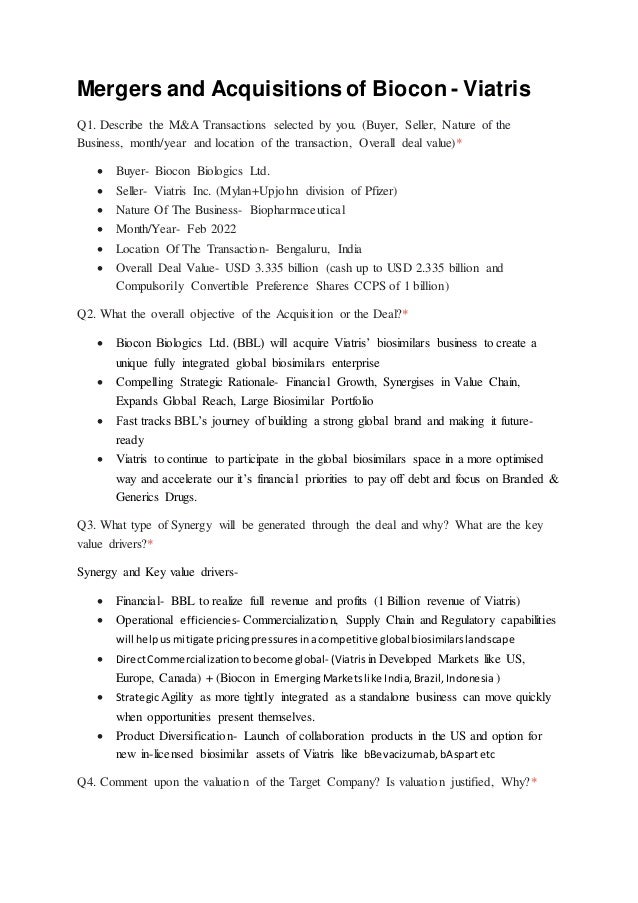

Mergers and Acquisitions Deal Analysis of Biocon and Viatris

- 1. Mergers and Acquisitions of Biocon - Viatris Q1. Describe the M&A Transactions selected by you. (Buyer, Seller, Nature of the Business, month/year and location of the transaction, Overall deal value)* Buyer- Biocon Biologics Ltd. Seller- Viatris Inc. (Mylan+Upjohn division of Pfizer) Nature Of The Business- Biopharmaceutical Month/Year- Feb 2022 Location Of The Transaction- Bengaluru, India Overall Deal Value- USD 3.335 billion (cash up to USD 2.335 billion and Compulsorily Convertible Preference Shares CCPS of 1 billion) Q2. What the overall objective of the Acquisition or the Deal?* Biocon Biologics Ltd. (BBL) will acquire Viatris’ biosimilars business to create a unique fully integrated global biosimilars enterprise Compelling Strategic Rationale- Financial Growth, Synergises in Value Chain, Expands Global Reach, Large Biosimilar Portfolio Fast tracks BBL’s journey of building a strong global brand and making it future- ready Viatris to continue to participate in the global biosimilars space in a more optimised way and accelerate our it’s financial priorities to pay off debt and focus on Branded & Generics Drugs. Q3. What type of Synergy will be generated through the deal and why? What are the key value drivers?* Synergy and Key value drivers- Financial- BBL to realize full revenue and profits (1 Billion revenue of Viatris) Operational efficiencies- Commercialization, Supply Chain and Regulatory capabilities will helpusmitigate pricingpressuresinacompetitive global biosimilarslandscape DirectCommercializationtobecome global- (Viatrisin Developed Markets like US, Europe, Canada) + (Biocon in EmergingMarketslike India,Brazil,Indonesia ) StrategicAgility as more tightly integrated as a standalone business can move quickly when opportunities present themselves. Product Diversification- Launch of collaboration products in the US and option for new in-licensed biosimilar assets of Viatris like bBevacizumab,bAspartetc Q4. Comment upon the valuation of the Target Company? Is valuation justified, Why?*

- 2. The deal will increase Biocon Biologics EBITDA and strengthen profitability, for sustained long- term growth. Hence valuation is justified for the following reason as BBL acquires- Viatris’ global commercial infrastructure in developed markets Estimated Revenue Of Acquired Biosimilars Business USD 1 billion next year Viatris’ rights in all biosimilars assets including its in-licensed portfolio, including bAflibercept Transition services for an expected two-year period to ensure a seamless transition at cost plus $44m p.a Q5. What is the structure of the deal? (Type of entity, payment composition, cash, exchange of shares, payment timing and other T&Cs)* Type of entity- Acquisition of Viatris Biosimilar Assests by Biocon Biologics Payment composition- Considerations to Viatris: It will Receive up to USD 3.335 billion in Cash & Stock. USD 2 Bn Cash Payment at Closing + USD 335 Mn Cash additional payments + USD 1 Bn in Equity* (CCPS) Compulsorily Convertible Preference Shares (CCPS) to Viatris, equivalent to an equity stake of at least 12.9% in the Company, on a fully diluted basis Payment timing- Transaction is expected to close in the H2-2022. USD 335 Mn Cash additional payments to be paid in 2024. Other T&Cs- The transaction is expected to close with subject to satisfaction of closing conditions (including certain regulatory approvals). The companies will also enter into a Transition Services Agreement for two-year. Viatris also will pay USD 50 million to BBL to fund certain capital expenditures. Viatris will have one nominee i.e. Rajiv Malik, President on the Board of Biocon Biologics. Option to acquire bAflibercept. Q6. What are the risks and challenges that the Acquirer Company / Entity is likely to encounter?* Risky Transaction- Reduce rating on Biocon stock as Investors worry that the large transaction, worth more than half of Biocon’s market value itself, is risky. The thus- far debt-free company has to borrow big loans for it. Biocon Biologics to raise $1.2 billion overseas loan for Viatris deal- In the aftermath of the Russia-Ukraine war, Indian companies are increasingly tapping offshore loans instead of bonds. Since the geopolitical conflict broke out in the last week of February, the US Treasury benchmark surged nearly 100 basis points to 2.83%. Viatris acquisition would forward-integrate Biocon in the biosimilar value chain with additional responsibility of commercializing the products it develops

- 3. Execution Risk- Success will depend on flawless execution of a plan to expand into the US market on the back of Viatris’s presence, in competition with some of the world’s biggest drug companie Other challenges- persistent price erosion and regulatory issues Q7. What are the risks and challenges that the Target Company / Entity is likely to encounter?* Low growth- Viatris branded generic business has lot of price erosion due to fierece competition. Given the growth of the biosimilars market, the deal to sell its biosimilars unit to Biocon Biologics, one of its most progressive divisions is unattractive to investors. This would cause a lower revenue forecast for Viatris, selling a large part of the business. Viatris will retain a 12.9% stake in the Biocon, and that stake will be “nondilutive”. It is going from a biosimilar developer and distributor to a biosimilars investor and will suffer loses if Biocon Biologics fails to execute the business growth. Viatris is a high debt company hence bankruptcy is a possibility if everything does not takes off well. Q8. What is your overall assessment of the M&A Deal? What are your key learning / thoughts? Acquisition Brings Together Complementary Capabilities and Strengths Acquired Biosimilars Business to Add Financial Depth and Commercial Capabilities Value Creation for Shareholders of Biocon & Biocon Biologics Deal to Provide Seamless Transition- 2 years service by Viatris and Minimal overlap of roles in 2 organizations due to complementary nature of teams In Biosimilar Market, “the bigger companies tend to survive longer”- Therefore the deal with Viatris is a move by Biocon to increase its standing within the market in terms of size, footprint, portfolio, choice, and to compete with the bigger companies. So it made a huge amount of sense to me