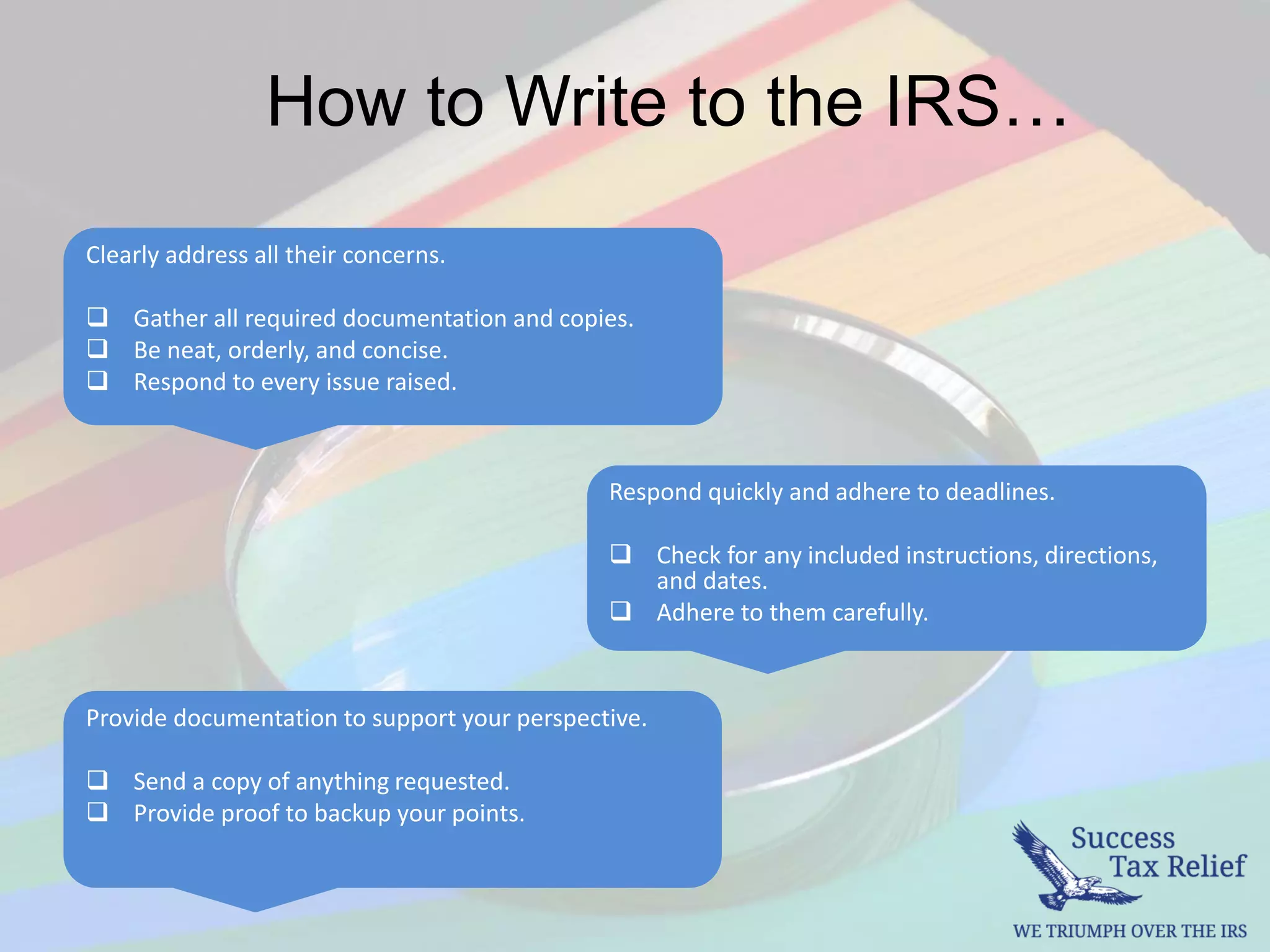

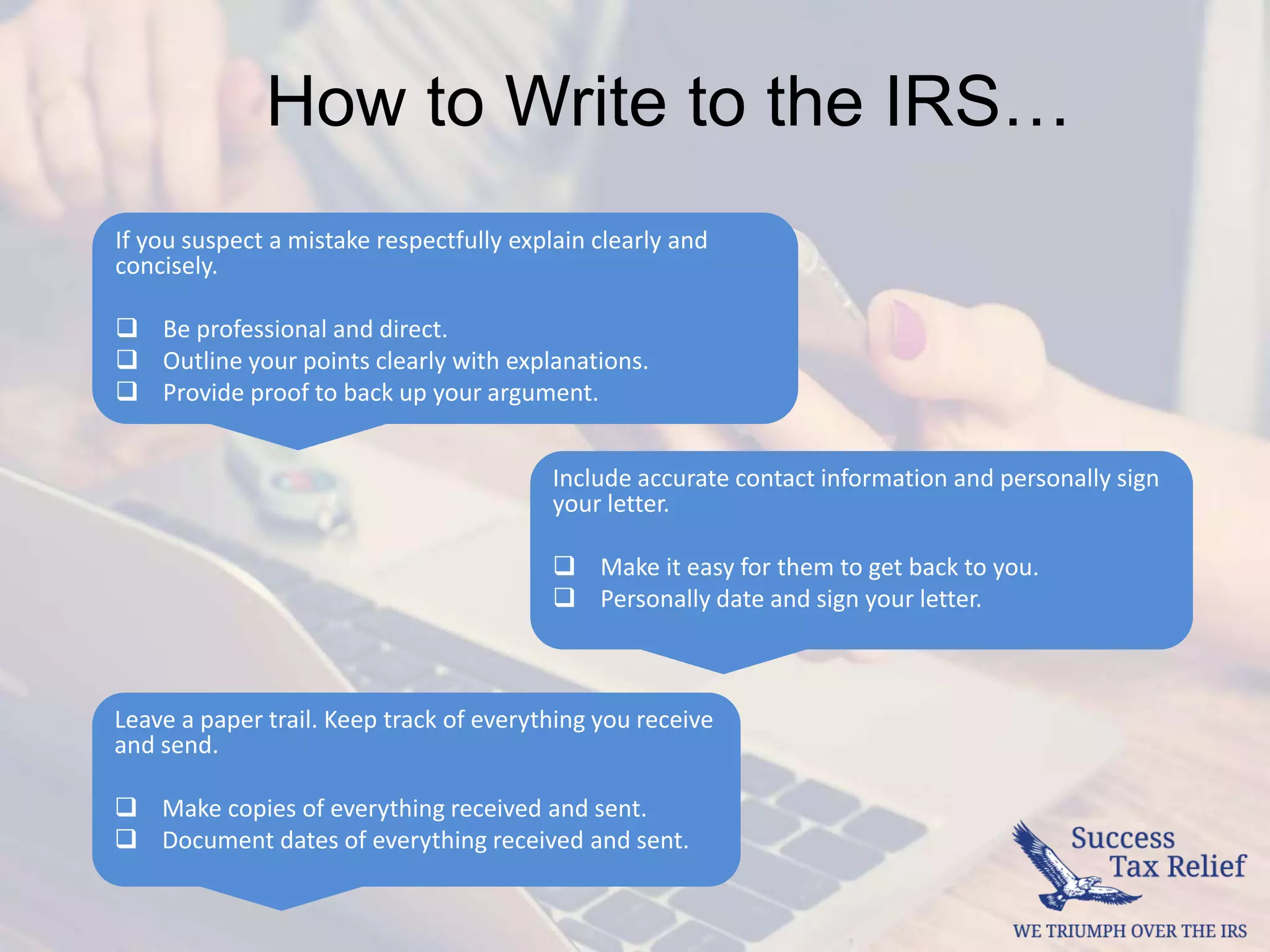

This document provides guidance on how to write a letter of explanation to the IRS in response to inquiries such as adjustments, documentation requests, or late payments. It emphasizes the importance of being timely, detailed, and professional while addressing all concerns raised by the IRS. It also suggests keeping a record of all correspondence and offers a sample letter format for clarity.

![Sample Letter

Date

Internal Revenue Service

Street Address

City, State, Zip Code (This address should be the same one featured on the letter you received personally)

Taxpayer

SSN:

Street Address

City, State, Zip Code

Tax Period:

Tax Form:

Tax Period Ending:

To Whom It May Concern:

I am writing in response to the letter dated --/--/---- from you concerning ----.

I have carefully reviewed the information provided to me in this letter, which indicates that I [failed to report income related to

a small contract position.] My records indicate that this income was included in my tax return and I have included an additional

copy of the tax records that reference this income. Please adjust your records to reflect this and do not hesitate to contact me

at the address listed above with any additional questions. I can also be reached by phone at (###) ###-####. Many thanks for

your attention to this matter.

Sincerely,

Your Name

(enclosed)](https://image.slidesharecdn.com/successtaxrelief-150501105931-conversion-gate01/75/How-To-Write-a-Letter-of-Explanation-to-the-IRS-From-Success-Tax-Relief-5-2048.jpg)