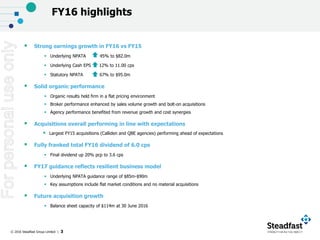

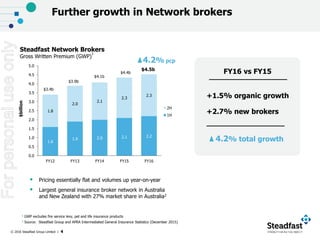

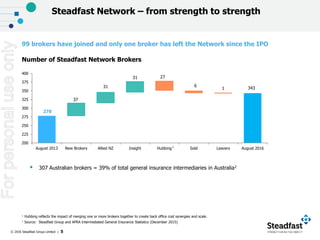

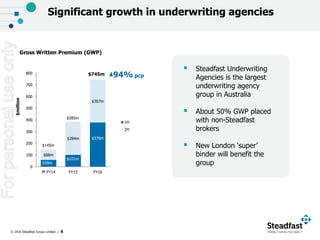

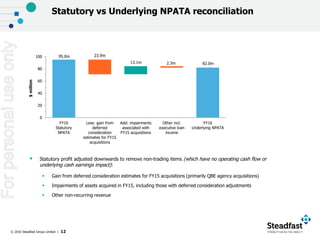

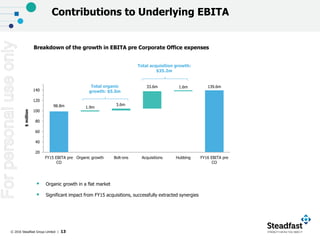

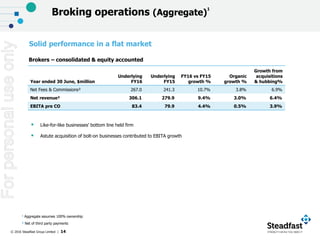

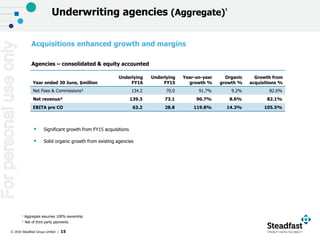

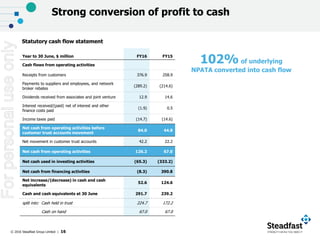

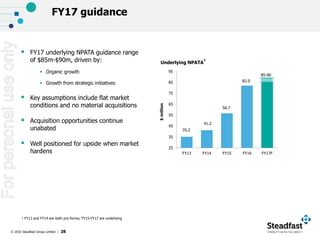

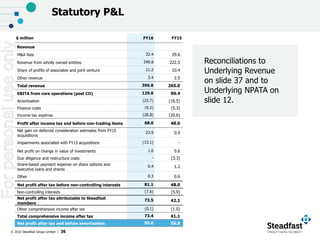

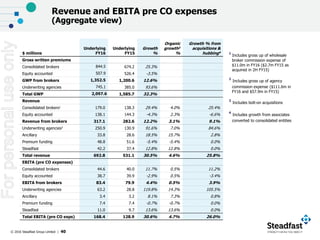

Robert Kelly and Stephen Humphrys presented Steadfast Group's financial results for FY2016. Key highlights included strong earnings growth, with underlying NPATA up 45% and underlying cash EPS up 12%. Statutory NPATA was up 67%. The results demonstrated solid organic performance and growth from acquisitions. Steadfast provided FY2017 underlying NPATA guidance of $85-90 million, assuming flat market conditions.