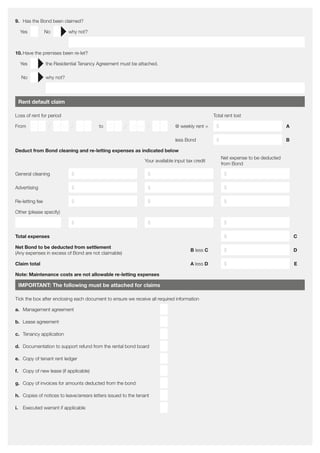

This document provides information about making an insurance claim for residential property damage through CGU Insurance. It outlines the claims process, including that CGU will contact the claimant about the claim, may inspect damage before authorizing repairs, and may appoint a loss adjuster. It advises claimants not to authorize repairs themselves and to provide documentation like receipts or photos to support the claim. Disputes can be resolved through CGU or referred to the Financial Ombudsman Service. The second page is a claims report form for claimants to provide details of the damaged property, tenants, costs, and other relevant information to support their claim.