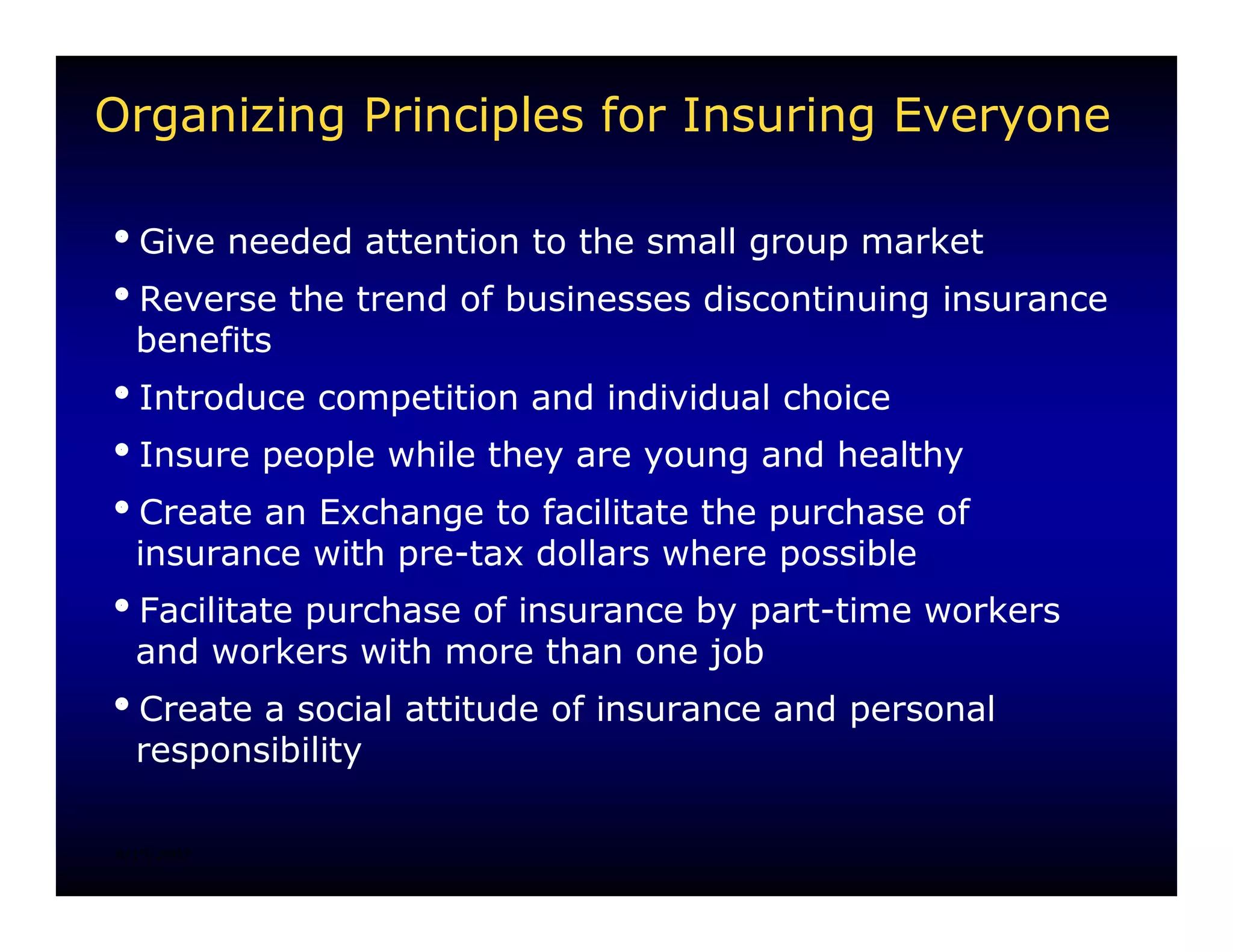

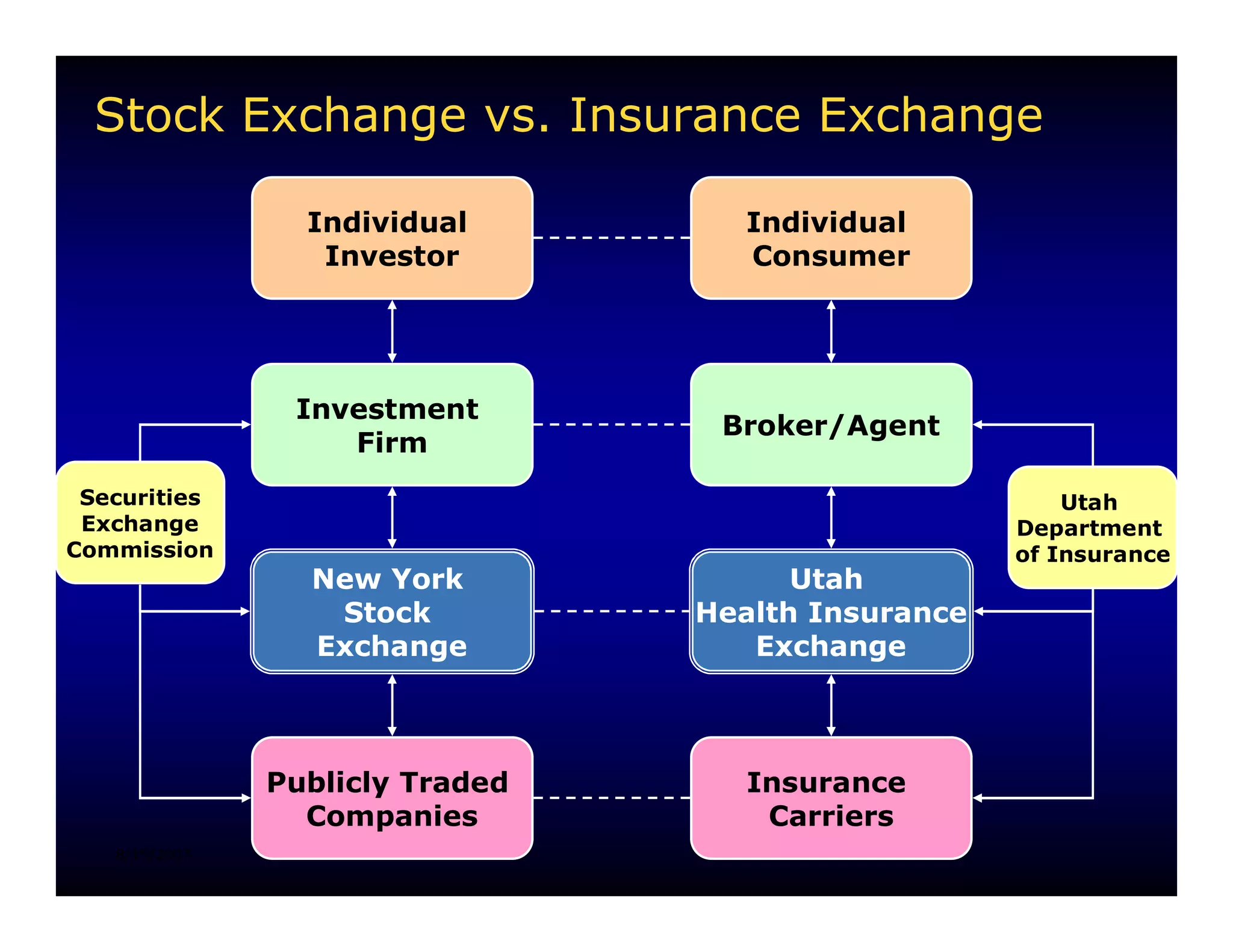

The document outlines a proposal for expanding health insurance coverage for Utah's uninsured citizens, comprising 11.9% of the population, with a focus on young adults and those in small businesses. It details the establishment of the Utah Health Insurance Exchange as a mechanism to facilitate private health plan purchases while promoting personal responsibility and providing public subsidies. The exchange aims to simplify insurance access for individuals and employers, enhance competition among insurers, and ultimately reduce the uninsured rate in Utah.