Vantiv Leads Payment Processing Industry

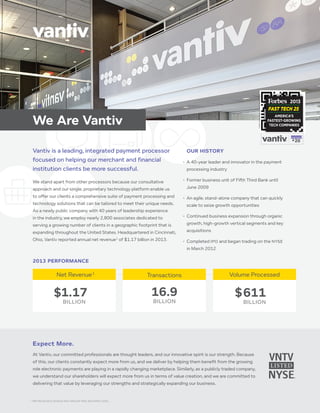

- 1. Expect More. At Vantiv, our committed professionals are thought leaders, and our innovative spirit is our strength. Because of this, our clients constantly expect more from us, and we deliver by helping them benefit from the growing role electronic payments are playing in a rapidly changing marketplace. Similarly, as a publicly traded company, we understand our shareholders will expect more from us in terms of value creation, and we are committed to delivering that value by leveraging our strengths and strategically expanding our business. 2013 PERFORMANCE Net Revenue 1.17 billion Transactions 16.9 billion Volume Processed 611 billion $$ Vantiv is a leading, integrated payment processor focused on helping our merchant and financial institution clients be more successful. We stand apart from other processors because our consultative approach and our single, proprietary technology platform enable us to offer our clients a comprehensive suite of payment processing and technology solutions that can be tailored to meet their unique needs. As a newly public company with 40 years of leadership experience in the industry, we employ nearly 2,800 associates dedicated to serving a growing number of clients in a geographic footprint that is expanding throughout the United States. Headquartered in Cincinnati, Ohio, Vantiv reported annual net revenue1 of $1.17 billion in 2013. OUR HISTORY • A 40-year leader and innovator in the payment processing industry • Former business unit of Fifth Third Bank until June 2009 • An agile, stand-alone company that can quickly scale to seize growth opportunities • Continued business expansion through organic growth, high-growth vertical segments and key acquisitions • Completed ipo and began trading on the nyse in March 2012 We Are Vantiv 1 Net Revenue is revenue less network fees and other costs. 1 ®

- 2. Developed and implemented Jeanie®, the nation’s first shared online atm network Processing volume hits $1 billion Expanded product offerings to include merchant services Introduced a state-of- the-art online system for data management and reporting Processed for more than 130,000 merchant and financial institution locations Jeanie® recognized as the seventh- largest eft network2 FINANCIAL INSTITUTION SERVICESMERCHANT SERVICES THE VANTIV DIFFERENCE Many payment processors are limited to providing services in only specific areas of the payment processing value chain, such as merchant acquiring or payment network and issuer processing services. Vantiv has the capabilities to provide products and services across the entire payments value chain, serving as a single, scalable and efficient payment processing provider to meet clients’ needs. We have driven many of the changes that prompted the shift from cash to electronic payments, and that innovative spirit continues to be our strength. 1 Source: The Nilson Report 2 Source: Media’s Card Industry Directory 3 Net Revenue is revenue less network fees and other costs. 4 Source: The Nilson Report, March 2011, 2012 and 2013, Issues 967, 990 and 1013, respectively The industry reached $4.48 trillion in 2009 and is projected to reach $7.23 trillion in 20151 , driven by the secular shift from cash and checks toward card-based and other forms of electronic payments. The electronic payments industry is large and growing. FOUR DECADES OF INNOVATION 1977 1988 1991 1998 2005 2009 Financial Institution Consumer Issuer Processor Payment Network Merchant Acquirer MerchantConsumer Payment Processing Value Chain We Stand Apart from the Rest Introduced innovative Mobile Acceptance and Mobile Wallet Products Certified by major card networks to process EMV transactions 2012 2013

- 3. #1 Ranked U.S. Merchant Acquirer in pin debit transactions 5 #2 Ranked U.S. Merchant Acquirer in transaction growth (2010-2011) 5 #3 Ranked U.S. Merchant Acquirer in total transactions5 8 of the top 25 national retailers are clients of Vantiv SERVICES CLIENTS MARKET LEADERSHIP 4 Small to mid-sized merchants and top-tier regional and national retailers Approximately 60% of our merchant transactions are driven by “everyday” spend categories, such as grocery and drug purchases, which limits our economic exposure. Community banks, credit unions, large and regional financial institutions and regional pin debit networks Many financial institutions do not have the scale or infrastructure to support their payment processing needs and are likely to outsource this function. 10% market share in the U.S. based on number of financial institution clients 1,400 financial institution relationships across the U.S. $838 MILLION 71% OF NET REVENUE 3 29% OF NET REVENUE3 $335 MILLION We help strengthen our merchant clients with industry-specific solutions and value-added services. We provide integrated card issuer processing, payment network processing and value-added services to financial institutions. Financial Institution ServicesMerchant Services VANTIV FAMILY OF BRANDS 5 Purchase transactions represent number of transactions and include all general purpose credit, debit and prepaid card transactions, including signature and pin debit; First Data includes Citi, SunTrust and Sovereign. Vantiv numbers are not Pro Forma for npc acquisition. Vantiv’s single, proprietary technology platform provides a suite of comprehensive services to merchants and financial institutions of all sizes through both direct and indirect distribution channels. We Offer Comprehensive Solutions • Prepaid • Data Security • Data & Reporting • Advisory Services • eCommerce • Remote Check Capture • Fraud & Data Security • Loyalty Programs • Advisory Services • Data & Reporting • Mobile Wallet Services • Credit • PIN Debit • Electronic Check • Mobile Acceptance Applications • Card Not Present • Payment Processing – Debit & Credit • ATM Solutions • Merchant Services • Prepaid

- 4. We Drive Success VANTIV, INC. 8500 Governors Hill Drive Symmes Township, OH 45249 www.vantiv.com Our Mission: To create market-leading payment solutions that help our clients compete and win. Dedicated to doing the job right down to the last detail; focused and accountable Integrated within Vantiv; in lockstep with clients; in constant contact with other experts and partners across the industry Leading the way for clients and pushing the envelope with our thinking; empowered to take action Finding new ways to improve our offering, drive insights and anticipate needs Knowing that we, and our clients, succeed when we are proactive, flexible and adaptive We are commited We are connected We are bold We are progressive We are agile Vantiv’s accomplished professionals, thought leaders and experienced strategists understand the needs of our clients and are dedicated to helping them succeed by making payment processing more efficient and profitable. Over the last 15 years, we have received 24 Quality Service and Data Integrity awards from Visa® and MasterCard® for our best-in-class customer service and support. Our drive for success is deeply rooted in our culture as we pursue an ambitious strategy of value creation for our clients and shareholders. This is reflected by our brand attributes: