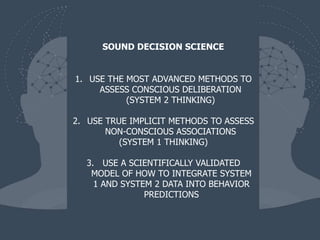

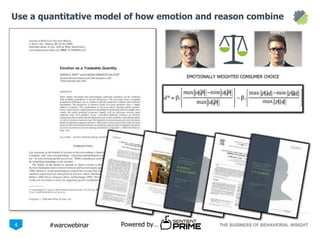

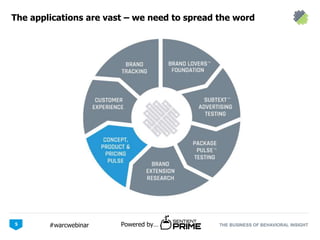

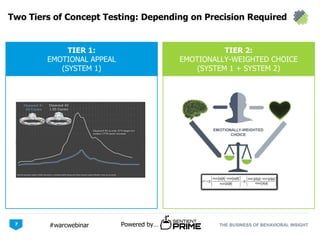

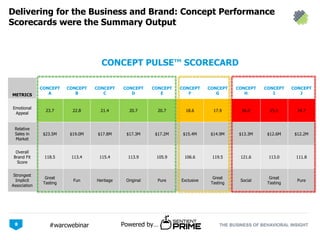

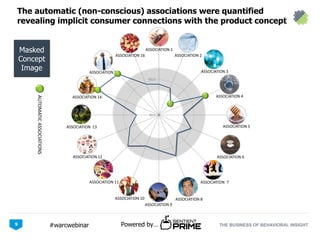

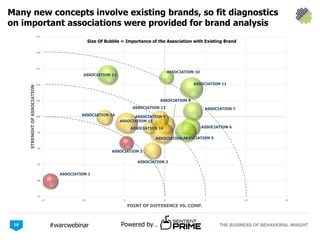

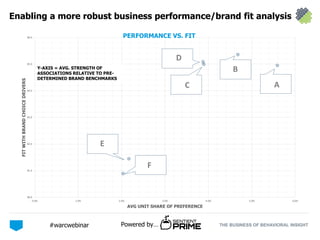

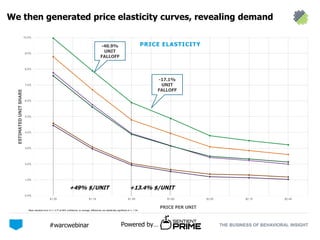

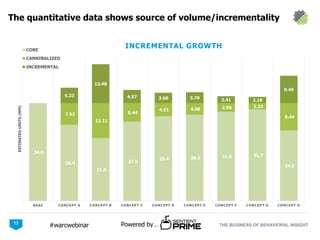

The document discusses the importance of implicit concept testing in consumer neuroscience, highlighting three keys for broader adoption: sound science, application awareness, and market validation. It emphasizes the integration of conscious and non-conscious consumer data in predicting behavior, and includes a case study demonstrating successful brand positioning based on implicit insights. The findings illustrate the effectiveness of emotional associations in consumer choice and the predictive power of quantitative models in understanding market dynamics.