Sajal BRM final.pdf

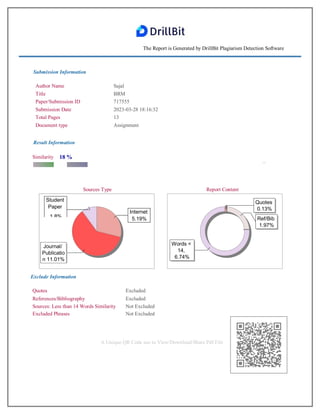

- 1. n 11.01% Publicatio Journal/ The Report is Generated by DrillBit Plagiarism Detection Software Submission Information Author Name Sajal Title BRM Paper/Submission ID 717555 Submission Date 2023-03-28 18:16:32 Total Pages 13 Document type Assignment Result Information Similarity 18 % 90 Sources Type Report Content Exclude Information Quotes Excluded References/Bibliography Excluded Sources: Less than 14 Words Similarity Not Excluded Excluded Phrases Not Excluded A Unique QR Code use to View/Download/Share Pdf File Student Paper 1.8% Internet 5.19% Quotes 0.13% Ref/Bib 1.97% Words < 14, 6.74%

- 2. DrillBit Similarity Report 18 22 B A-Satisfactory (0-10%) B-Upgrade (11-40%) C-Poor (41-60%) D-Unacceptable (61-100%) SIMILARITY % MATCHED SOURCES GRADE LOCATION MATCHED DOMAIN % SOURCE TYPE www.diva-portal.org 2 Publication GROWTH OF MOBILE PAYMENTS BY 18C61E0042 Yr - 2020 2 Student Paper Fusion confusion exploring ambisonic spatial localisation for audio- visual imme by Siddig-2019 1 Publication media.unpad.ac.id 1 Publication eprints.ums.ac.id 1 Publication a8t61i.myq-see.com 1 Internet Data blog.ipleaders.in 1 Internet Data adoc.pub 1 Internet Data ijartet.com 1 Publication www.emerald.com 1 Internet Data Funny money the attentional role of monetary feedback detached from expected va by Roper-2016 1 Publication theaims.ac.in 1 Internet Data Records Of The Geological Survey Of India Vol-52 - 1921 , krishikosh <1 Publication 3 4 5 6 7 8 9 10 11 12 13 14 15

- 3. scholar.sun.ac.za <1 Internet Data Thesis Submitted to Shodhganga, shodhganga.inflibnet.ac.in <1 Publication discoveryjournals.org <1 Publication epw.in <1 Internet Data Mobile applications for postoperative monitoring after discharge by Semple-2017 <1 Publication www.slideshare.net <1 Internet Data Thesis Submitted to Shodhganga Repository 1 Publication Thesis Submitted to Shodhganga Repository 1 Publication 16 17 18 19 20 21 22 23

- 4. BUSINESS RESEARCH MANAGEMENT -2 SUBMITTED TO: SUBMITTED BY: DR. BHAJNEET KAUR SAJAL AGARWAL ROLL NO : (22PGDM026) 1 | P a g e A 2 STUDY ON IMPACT OF MOBILE PAYMENT WITH SPECIAL REFERENCE TO YOUTHS

- 5. INDEX Sr CONTENTS PAGE No. NO. 1 ABSTRACT 3 2 INTRODUCTION 3 3 REVIEW OF LITERATURE 4 4 OBJECTIVE 5 5 RESEARCH METHODOLOGY 6 6 HYPOTHESIS 6 7 CASE PROCESSING SUMMARY WITH INTERPRETATION 7 8 ASSOCIATION B/W AGE AND MODE OF PAYMENT 8 9 INTERPRETATION 9 10 RELATION B/W AGE OF RESPONDENT AND PERIOD OF USAGE 9 11 FINDINGS AND SUGGESTIONS 10 12 CONCLUSION 11 13 REFERENCES 12 2 | P a g e

- 6. Th of A STUDY ON IMPACT OF MOBILE PAYMENT WITH SPECIAL REFERENCE TO YOUTHS : ABSTRACT: A mobile wallet is a catch-all word for the assortment of technologies that makes it possible to store financial data and conduct transactions online. It takes on new meaning for payments made without cash. Smart and simple purchases are improved by M-Wallet everywhere. Through M-Wallet, millions of people can receive benefits with just a few clicks. It promotes economic and commercial activity. The use of M-Wallet, which is the fastest-evolving technology, will gradually replace the current transaction and payment systems and fortify the digital payment infrastructure. It turns into a platform for storing digital transactions and streamlining and improving banking processes. It focuses on meeting the requirements of contemporary enterprises. It aids in making routine financial transactions less difficult. Numerous mobile applications are available to consumers on a single device. Keywords: M-Wallet, Mobile Payments, Youth perception, User preference, Future growth, mobile application. INTRODUCTION: According to a recent World Bank report, India has overtaken China as the country with the world's fastest-growing economy over the past several years. Nearly 40 million people in India currently use the MWallet system, which has been embraced by 2 lakh retailers. It offers services like online banking, bill paying, and tax filing. The employment of advanced technology in the modern day facilitates corporate operations and financial transactions in all sectors. It has a significant impact on commercial activities. M-Wallet has anything to do with information technology. Users can do any national or international financial transaction while seated at home. An individual required to visit the bank in the past in order to conduct any type of banking transaction. However, at this time, technological advancement has replaced such a conventional method with M-Wallet. M-Wallet is widely used and gaining popularity in the business world quickly. It enhances the security features when handling money matters. India has replaced China as the country with the world's fastest-growing economy in recent years, according to a recent World Bank report. 2 lakhs of merchants in India use the M-Wallet system, which has been embraced by around 40 million individuals. It offers services including online banking, bill payment, tax payment, and other things. With the amazing technical breakthroughs of the current world, managing company and financial activities is simpler. M-Wallet has to do with information technology, which has a big impact on business operations. Customers can conduct any financial transaction from the convenience of their homes, both domestically and abroad. The revenue from mobile payments has nearly tripled globally over the previous five years, showing 6 that the industry is expanding at an incredible rate. e reasons behind this phenomena are still unidentified, though. The purpose of this essay is to identify the key factors that have the greatest 2 impact on the success of mobile payments. We'll start by looking at the condition mobile payments right now. With this brief background in mind, we then address numerous queries 3 | P a g e

- 7. pertaining to the three major players in the mobile payment ecosystem: m-payment service 5 providers, consumers, and merchants. Consumer preferences, business models for mobile payments (including value proposition, market participation, and revenue source), and mobile payments business models. A mobile payment system is a piece of technology that enables online shopping and conducting electronic commerce transactions. The use of a digital wallet that is connected to a person's bank account is also permitted. Customers can avoid entering information every time they complete a transaction by storing payment data in digital wallets. An example of electronic data interchange (EDI) is a digital payment system. (EDI). Mobile payment solutions have become more and more popular as a result of the widespread use of online banking and shopping. Since the Indian rupee was demonetized on November 8, 2016, its appeal has increased. REVIEW OF LITERATURE Sanghita Roy and Dr. Indrajit Sinha (2014) : : A study on the factors influencing client acceptance of electronic payment systems in Indian banks was conducted in 2014 by Sanghita Roy and Dr. Indrajit Sinha. The goal o 6 f this study is to determine which electronic payment system is used the most frequently among all available payment options. Ensure that you are using and are aware of electronic payment methods. The study's primary objective was to list every aspect that influences consumer approval. Prof. Hariom Tyagi and Dr. Abhishek Shukla (2016): research was done on the electronic payment system. This study aims to pinpoint the issues and difficulties facing the electronic payment system and to offer suggestions to enhance its performance. The management of security and privacy issues is key to a successful implementation that increases customer satisfaction. Dr Hem Shweta Rathore (2016): consumer acceptance of digital wallets was studied. This study concentrated on the variables that affect a consumer's choice of a digital payment option. The study offered suggestions for educating consumers about the advantages of using digital wallets and came to the conclusion that, because of its acceptance and simplicity, digital wallets will fast become a common payment option. N Ramya D Sivasakthi and Dr. M Nandhini (2017): carried out study on Cashless Transactions: Methods, Benefits, and Drawbacks. The goal o 6 f this study is to create a "less liquid society" by examining the RBI and Indian government's efforts to promote digital payment alternatives. It investigated various cashless payment systems, including mobile wallets, UPI apps, and debit/credit cards. Sujith T S, Julie C D (2017) conducted research on opportunities and challenges of electronic payment system in India. This study focuses to identify the problems and challenges of the electronic payment system and propose solutions to improve it. Research shows that the reach of mobile networks, internet and electricity is extending digital payments to remote areas, which will increase t 2 he number of digital payments. 4 | P a g e

- 8. th Ashish Baghla (2018) conducted research on the Future of Digital Payments in India. This study focus on the adoption of digital payments in India. This study focuses to understand people's attitudes towards the adoption of digital payment methods in India. It concluded that government efforts to make India cashless are going well, but it will take time to become completely cashless due to other challenges. K. Suma Vally and Dr. K. Hema Divya (2018) conducted research on a study of digital payments in India with perspectives of consumers. This study focuses to verify the perception of customers about digital payment in India and suggest appropriate steps to raise awareness and security of using digital payments. Prof. Sana Khan and Ms. Shreya Jain (2018) conducted research on the use of electronic payments for sustainable online business growth. This study focuses on the frequency and problems that consumers face when using payment methods. The researchers also examined the influence of the contribution of electronic payments on the sustainability of business growth in India. Priyanka S Kotecha (2018) conducted research on empirical Study of Mobile Wallets in India. This study examines the importance of M-Wallet in India and highlights its pros and cons. It also shows the growth of mobile wallets in India from 2012 to 2016, mainly due to the convenience of mobile wallets. PROBLEM STATEMENT/RATIONALE OF THE STUDY: The reason for conducting this research is to know about impact of smart phones in mobile 5 payments, their acceptability, to examine e impact of age in online payment method. OBJECTIVES OF THE STUDY: To understand how smartphone use affects the utilization of mobile payments among today's young, India To determine whether the mobile payment system is acceptable. To learn if cashless transactions have benefited the Indian economy. To investigate how age affects digital payments. To examine the development of mobile payment apps. To study the awareness of youth towards different services in mobile payments. To study the satisfaction of services offered in MobilePayments. To analyze the factors influencing usage of Mobile payments RESEARCH METHODOLOGY: Research Design 2 5 | P a g e

- 9. This research is based on Descriptive Research method. Sources of Data The study is based on primary and secondary data. Primary data would be collected by using a questionnaire from an age group between15-35. Secondary data would be collected from various published sources like articles, newspapers, magazines, etc. and through the internet. The sample size was 84, convenience sampling technique was used to obtain data. Data collection method In this research, we use Survey and Questionnaire methods for data collection. Sampling method Simple Random Sampling method is used. Sampling frame The sample size for the research includes 84 respondents. Tool used 9 Statistical tools are involved in carrying out a study include planning, designing, collecting data, analysing, drawing meaningful interpretation and reporting of the research findings. The tools are used is Chi-Square test HYPOTHESIS: 2 Null hypothesis (H0): There is no positive relation between the gender who use mobile payment Alternative hypothesis (H1): There is positive relation between the gender who use the mobile payment. 6 | P a g e

- 10. 8 Case Processing Summary Cases Valid N Percent Missing N Percent Total N Percent gender * Which of these84 Mobile payment 100.0% 0 0.0% 84 100.0% gateways are you prefer using the most Gender * Which of these Mobile payment gateways are you prefer using the most Crosstabulation Which of these Mobile payment gateways are you Total prefer using the most Chi-Square Tests Value Df Asymp. Sig. (2-sided) Pearson Chi-Square 5.459a 3 .141 Likelihood Ratio N of Valid Cases 5.742 84 3 .125 Interpretation Null Hypothesis is accepted Since p value is greater than 0.05, we accept Null hypothesis and reject Alternative hypothesis. Therefore, there is a no positive relation between the gender who use mobile payment. 2 Table showing association between age and mode of payment 7 | P a g e Googl Phone pe e Pay Paytm Any other Gender Male Count 21 11 11 1 44 Expected Count 24.6 10.5 7.3 1.6 44.0 Female Count 26 9 3 2 40 Expected Count 22.4 9.5 6.7 1.4 40.0 Total Count 47 20 14 3 84 Expected Count 47.0 20.0 14.0 3.0 84.0 7

- 11. Chi-Square Tests 3 Null hypothesis (HO): There is no significant difference between the Age and Mode of payment. Alternative hypothesis (H1): There is significant difference between the Age and Mode of Payment. 8 Case Processing Summary Cases Valid Missing Total N Percent N Percent N Percent Age * Mode 84 of payment 100.0% 0 0.0% 84 100.0% Age * Mode of payment Crosstabulation Mode of payment Total 3 Debit Credit Mobile Any card card payment other Age 18-30 Count 8 1 66 2 77 Expected Count 8.3 .9 64.2 3.7 77.0 31-50 Count 1 0 4 2 7 Expected Count .8 .1 5.8 .3 7.0 Total Count 9 1 70 4 84 Expected Count 9.0 1.0 70.0 4.0 84.0 7 Value Df Asymp. Sig. (2-sided) Pearson Chi-Square 9.901a 3 .019 Likelihood Ratio 5.700 3 .127 2 8 | P a g e

- 12. N of Valid Cases 84 Interpretation 3 Alternative hypothesis is accepted Since p value is lesser than 0.05, we accept Alternative hypothesisand reject Null hypothesis. Therefore, there is significance difference between Age of the respondents and the mode of payment. To find out the relation between the age of the respondent and the period of usage: Chi Square A Chi-square test was conducted to find out the relation between the age of the respondent and the period of usage Showing the Ages of the respondents and Periods of usage Period of usage 2 Months 6Months-2 Years 2-3 Years Above3 Years Total Age of the 1 8 25 10 10 respondents 2 10 4 3 4 3 2 5 1 2 Total 20 34 14 16 84 7 a. 7 cells (58.3%) have an expected count of less than 5. The minimum expected count is Pearson Chi-Square Likelihood Ratio N of Valid Cases Value 9.901a 5.700 84 df Significance 3 .001 3 .001 1.25. The test result shows that, X2 = 9.901 df = 3, p-value = 0.001 3 Since the P-value of the above test is 0.001, which is greater than 0.05, it is Significant. Null Hypothesis H0 is rejected. It is concluded that there is an association between the age of the respondent and the period of usage of mobile payment. FINDINGS AND SUGGESTIONS: 2 9 | P a g e

- 13. The majority of the respondents are within the age group of 15-23, that is 88.7% and2.5% of the respondents are of the age above 36. Among 84 respondents 67.2 % are female and 32.9% are male. 2 The majority of the respondents describe their current level of usage of mobile payments as satisfied. The majority of the respondents use Google pay as their mobile payment app. Majority of the respondents that is about 30% of the respondents are aware of the transaction limits of the mobile payment. 4 The majority of the respondents; about 40% of the respondents use mobile payments for bill payments. The majority of the respondents, that is, 20% use mobile payments for fund transfers. 15% and 8% of the respondents use mobile payments for banking facilities and credit facilities. Most of the respondents 58.9% stands strongly agree with the statement - Payment saves your time Most of the respondents 47.7% stands agree with the statement -Payment systems are better than cash Most of the respondents 52.7% stands agree with the statement -Payment systems offer a greater choice Most of the respondents 49.5% stands agree with the statement -Payment system scan be easily Easiness of the app, the safety and security, cashback and voucher facility of the app motivated respondents to use this app. CONCLUSION From the research, it can be concluded that the usefulness of mobile payment platforms is one of the main drivers of their business. The level of access, convenience and comfort as 2 10 | P a g e

- 14. well as the monetary and non-monetary incentives offered by these companies are 1 decisive factors. Income was not related to the choice of mobile payments, but education and awareness turned out to be the deciding factors. As the introduction of smartphones has changed numerous matters in our everyday lives like an alarm clock, watch, track player, and tape recorder it appears that money and wallets are quick to be delivered to this list. Payment methods have been through a sequence of evolutions from cash to checks, to debit cards and credit cards, and now to e- commerce and mobile banking. This study finds that consumers are increasing the use of mobile payment methods for their routine online purchases and their on- site purchases as well. With growing advanced technology that supports mobile transactions and makes them transparent and more convenient, consumers have evolved their trust and behavior in using mobile payment systems. The changing behavior of consumers making a shift from conventional payment methods to more advanced online payment systems is quite evident in banking and retailing and with most of the mobile devices available. side and the opportunities this technology enables for online and offline payment regarding convenience and security, it is unavoidable that the use of mobile payment systems will further rise with the ambition to surpass or even replace cash and other cashless payment option. This research also concluded that for a promising future in this industry, mobile payment systems have to be better integrated with present telecommunication and financial infrastructures. Enhancing the compatibility with a wide range of users, the use of the latest era and establishing common standards for various service providers, and overcoming the security and privacy issues could help in facilitating faster adoption of digital payment methods and advance the rising market of mobile payments. This research aimed to embrace a brief spectrum of possible issues with electronic payment methods and consumer adoption of e- commerce to make payments for their purchases. Future research may focus on the validation of factors that can contribute to the successful adoption of mobile fee methods across the globe. REFERENCES 1. https://acadpubl.eu/hub/2018-119-15/3/546.pdf 2. https://ijcrt.org/papers/IJCRT2105774.pdf 11 | P a g e

- 15. 3. https://ijcrt.org/papers/IJCRTIEPE027.pdf 4. https://www.ijsrm.in/index.php/ijsrm/article/downloa d/698/616/1198 5. https://ijaem.net/issue_dcp/A%20Study%20on%20Di gital%20Payments%20in%20India%20and%20Its%2 0Impact%20on%20Consumers.pdf 6. https://www.inspirajournals.com/uploads/Issues/8982 76372.pdf 7. https://www.iosrjournals.org/iosr- jbm/papers/Conf.18011-2018/Volume- 2/Marketing/10.%2074-81.pdf 8. https://www.ijbmi.org/papers/Vol(7)7/Version- 12 | P a g e

- 16. 13 | P a g e