Global ARC Boston 2018 - FULL AGENDA (2nd Sept)

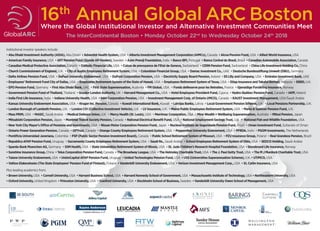

- 1. 16th Annual Global ARC BostonWhere the Global Institutional Investor and Alternative Investment Communities Meet nd th Institutional investor speakers include: Abu Dhabi Investment Authority (ADIA), Abu Dhabi USA Canada USA USA USA Sweden India Portugal Brazil Canada China Germany UAE U.K. Norway Ireland USA/Saudi Arabia U.K. U.K. Japan USA Sultanate of Oman The Netherlands Brazil Saudi Arabia USA Norway China Canada USA USA USA USA USA Uruguay USA U.K. USA Finland USA USA USA Plus leading academics from: USA USA USA USA USA USA United Kingdom USA USA Sweden USA

- 2. 2 The InterContinental Hotel Boston, October 22nd to October 24th Founded in 2002, Global ARC Boston convenes a network of the world’s largest sovereign wealth funds, foundations and pension funds to discuss urgent macro- economic, finance, geopolitical, ethical and alternative investment issues. It is wholly owned by its founder David Stewart and is not affiliated with any media company or individual supplier of services to the investment industry. The InterContinental Boston hotel offers the city’s most captivating 4 Diamond AAA rated hotel experience and has been named one of the ‘Best Hotels in the World’ by Conde Nast Traveler magazine. Located in the heart of Boston - surrounded by the Fort Point Channel and Rose Kennedy Greenway - The InterContinental Boston hotel is just steps from Faneuil Hall/Quincy Market, Boston Convention and Exhibition Center, North End, Chinatown and a plethora of historical attractions such as the Boston Tea Party Museum and Freedom Trail. In addition to being flooded in natural light and overlooking the historic Fort Point Channel, at 10,300 Square Feet, The InterContinental Boston’s Rose Kennedy Ballroom is much more spacious than Global ARC’s previous meeting space, ensuring a more comfortable experience for our delegates. Tired of alternative investment gatherings where managers outnumber institutional investors, where criticisms of alternatives products are muted and where the same old hackneyed ideas are constantly recirculated? For 16 years, Global ARC has been providing institutional investors and alternatives managers with the antidote to such gatherings: 1. At Global ARC, creating a uniquely convivial atmosphere, which puts institutional investors at ease and, in so doing, dramatically improves the quality and number of manager investor interactions. 2. Global ARC draws a truly global range of institutional investors: with Global ARC exposes alternatives managers to new investor perspectives and client opportunities, outside their standard investor ‘gene-pool’. 3. Global ARC limiting it to full-time employees of major, not-for-profit, sovereign wealth funds, central banks, pension funds, endowments and foundations. 4. Global ARC provides access to the Global ARC consistently attracts the world’s foremost academics and researchers as speakers. 5. Global ARC provides an objective forum for the discussion of alternative investing, providing institutional investors with products and strategies. 6. Global ARC adheres to a over the last 16 years Global ARC has earned a hard-won reputation for ensuring that all of our delegates and sponsors are treated equally and that our pricing is transparent. 7. Global ARC from its gatherings; enabling our institutional investor and alternatives managers attendees to speak freely without fear of their frank exchange of views being subsequently misrepresented in the press.

- 3. The InterContinental Hotel Boston, October 22nd to October 24th 3 to be addressed at Global ARC 2018 will include: merely a transient market phenomenon or the beginning of a dramatic long-term market realignment? impact upon institutional investors strategic asset allocations? multi-faceted systems and how they can go about achieving this. strategies and products? what is the optimal asset allocation size for major institutional investors?’ what does it really mean to an ‘ethical’ institutional investor and how can institutional investors translate good intentions into meaningful actions? which strategies will thrive and which are likely to struggle under the new monetary and market regime? how are alternative investment credit strategies responding to recent financial market turmoil? and which type of alternative investment strategies can best exploit them? how can institutional investors differentiate best-practice direct lending firms from the ‘also-rans’? which sub-sectors of the infrastructure sector currently offer institutional investors the most attractive risk-return profile? What needs to be done to avert them? in the finance sector and in the wider economy: what are the causes, consequences and potential solutions to this crucial ongoing issue?

- 4. 4 The InterContinental Hotel Boston, October 22nd to October 24th Institutional Investor Speakers Additional Global ARC 2018 institutional investor speakers are being confirmed every month, so please visit our website www.garc2018.com for the updated institutional investor speaker list. * = Subject to finalised October calendar or formal board approval. Christof Rühl, Head of Research Abu Dhabi Investment Authority (ADIA) - United Arab Emirates Abu Dhabi Investment Authority is a sovereign wealth fund owned by the Emirate of Abu Dhabi and founded for the purpose of investing funds on behalf of the Government of the Emirate of Abu Dhabi. Prior to joining the Abu Dhabi Investment Authority in 2014, Christof served as Group Chief Economist of BP plc. Prior to BP, he was at the World Bank where he served as the Bank’s Chief Economist in Russia and in Brazil and a Professor of Economics at UCLA. Rob Roy, Chief Investment Officer - USA The Adventist Health System consists of forty six hospital campuses and hundreds of care sites located in nine states. Rob Roy is the Chief Investment Officer for Adventist Health System. Prior to joining Adventist Health System as its Chief Investment Officer, he held the position of Chief Investment Officer for Cain Brothers Asset Management. Rob earned a master’s degree in financial markets and trading from the Illinois Institute of Technology. John Patin, Chief Investment Officer - USA John is Chief Investment Officer with Allied World Assurance. He is responsible for the oversight of Allied World’s investment portfolio, including portfolio strategy, tactical asset allocation, performance and risk monitoring and day-to-day involvement with the company’s investment advisors. Prior to this, John was VP of Investments at Alterra, Bermuda. John graduated with a B.S. in Economics from the University of Wisconsin-Madison. Anurag Pandit, Chief Investment Officer - USA The mission of St. Jude Children’s Research Hospital is to advance cures, and means of prevention, for pediatric catastrophic diseases through research and treatment. Prior to joining St Jude Childrens Research Hospital as Chief Investment Officer, Anurag Pandit served as Director of Investments at Boston Childrens Hospital. Anurag Pandit holds a M.Sc. in Business and Finance from Massachusetts Institute of Technology. Ingrid Albinsson, Chief Investment Officer - Sweden AP7 (the Seventh National Pension Fund) acts within the DC system in Sweden which is part of the national government pension plan. Its default product “Såfa” has approximately SEK 430 billion (USD 54 billion) under management and is a global diversified life cycle product. Ingrid Albinsson is the Chief Investment Officer and Executive Vice President of AP7. Ingrid joined AP7 in 2011 as Head of Strategy. Prior to joining AP7 she spent 10 years with Swedbank Robur. Lan Kollengode, Chief Endowment Officer - India Lan Kollengode is the Chief Endowment Officer of the Azim Premji Endowment Fund, a multi-billion USD fund set up by businessman Azim Premji for philanthropy focused on improving India’s education system. The Azim Premji Endowment Fund is the first professional investment vehicle set up in India with a mandate to manage investments on behalf of a foundation. The Azim Premji Endowment Fund is one of the world’s largest foundations. Francisco Carneiro, Managing Director and Head of Alternative Investments - Portugal Founded in 1981, Banco Português de Investimento (Portuguese Investment Bank) is a major privately owned bank in Portugal. The bank’s shares are listed in the Euronext Lisbon’s PSI-20 stock index. It is the third largest private Portuguese financial group with assets of over €120 billion (USD 140 billion). The bank is headquartered in Porto. Francisco Carneiro serves as Managing Director and Head of Alternative Investments at Banco Português de Investimento. Ricardo da Costa Martinelli, Head of Investment Division - Brazil Banco Central do Brasil (The Central Bank of Brazil) operates as a federal agency that integrates the national financial system in Brazil. It performs various functions of the government bank, including controlling foreign trade operations; receiving deposits from commercial banks; executing foreign exchange trades; and acting on behalf of public enterprises and the National Treasury. It was founded in 1964 and is headquartered in Brasília. Eric Pedde, Director, External Fund Management – Canada Alberta Investment Management Corporation (AIMCo) manages an investment portfolio of approximately CAD 100 billion (USD 75 billion) on behalf of pension, endowment and government funds in the Province of Alberta. Eric Pedde leads the External Fund Management team at AIMCo, which manages CAD 7 billion of long-only equity mandates and CAD 10 billion of hedge funds and alternatives Eric holds a CFA designation and an MBA from McGill University. Scott Anderson - Managing Director of Asset and Risk Allocation - USA Founded 85-years ago, American Family Insurance is one of the United States’ largest insurance companies and offers a full range of property, casualty, auto life and health insurance as well as investment and retirement-planning products. Prior to joining American Family Insurance, Scott Anderson served as Managing Director of Asset and Risk Allocation at State of Wisconsin Investment Board. Scott holds an MBA from University of Wisconsin Madison and is a CFA. Paul Benjamin, Director of Pension Investments - USA Paul Benjamin is the Director of Pension Investments at Alcoa Corp. and is responsible for portfolio implementation, asset allocation, manager selection and risk management of Alcoa’s USD 7.5 billion global pension and foundation assets. Prior to joining Alcoa, Paul held positions at Brookfield Investment Management and General Motors Asset Management. Paul has an MBA from Cornell University. Paul is a CFA Charterholder.

- 5. 5The InterContinental Hotel Boston, October 22nd to October 24th Institutional Investor Speakers Gregoire Haenni Ph.D., Chief Investment Officer - Switzerland Grégoire Haenni has served as the CIO of the CHF. 13 billion (USD 13 billion) Caisse de Prévoyance de l’Etat de Genève, the pension fund of the State of Geneva, since 2014. Prior to that, he was the CIO of the pension fund of CERN, the European Organization for Nuclear Research. Grégoire Haenni holds a PhD in Mathematical Statistics of the Econometrics Department of the University of Geneva where he specialized in multi-dimensional statistics. John Callen, Chief Investment Officer - USA Established 150 years ago, Catholic Financial Life has grown to become the second largest Catholic not-for-profit financial services organization in the United States. As Chief Investment Officer, John Callen is responsible for Catholic Financial Life’s asset allocation, asset/liability management, investment policy and enterprise risk management. John holds an MBA if Finance from University of Michigan. Cristina Brizido, Head of Investments – Portugal * Cristina Brizido is responsible for the investments of Caixagest, the asset manager of Portugal’s state-owned investment bank Caixa Geral de Depositos, in which a USD 3.3 billion pension fund is included. Cristina Brizido also leads the fund selection team that serves the broadly diversified client base of Caixa Geral de Depositos. Cristina graduated with an Economics degree from Nova School of Business and Economics (Nova SBE) and is a Chartered Financial Analyst. Elena Manola-Bonthond, Chief Investment Officer - Switzerland Dr. Elena Manola-Bonthond is Chief Investment Officer, at the 4.75 billion CHF (USD 4.75 Billion) pension fund of CERN, the European Organization for Nuclear Research. Elena played an instrumental role in creating the investment governance framework optimized for dynamic risk management, now popularly known as the ‘CERN model’. Elena holds a PhD in particle physics from University of Savoie and CERN, and an MBA from University of Geneva. Christine Tessier, Vice-President, Investments and Treasury - Canada The Canadian Automobile Association, the CAA, is a non-profit Canadian federation. Founded in 1913, the CAA Club Group provides its over 6.2 million Canadian members with comprehensive insurance services, emergency roadside service and a full range of automotive and travel services via over 100 offices located across Canada. Prior to joining the CAA Club Group as its Vice-President, Investments and Treasury, Christine Tessier served as Principal, Manager Research at Mercer Investments. Yiqing Wan, Chief Executive Officer - China China Life is the largest insurer in Mainland China with over USD 382 billion in assets. Yiqing Wan is the Deputy CEO of China Life Investment Holding Company Limited and also the CEO of China Life Private Equity Investment Company, the alternative investment arms. Mr. Wan received his M.A. degree in International Economics from Nankai University in 1997 and an M.S. degree in Computer Science in 2000 from West Virginia University, USA. Roy Kuo, Head of Alternative Strategies - United Kingdom The Church Commissioners for England, which manages the Church of England’s endowment, possesses approximately GBP 8 billion (USD 11 billion) assets under management. Roy Kuo is responsible for managing and growing the endowment’s allocations in the alternatives sector. Prior to joining Church Commissioners for England, he was head of research at Dexion Capital. Roy holds an MBA from Said Business School, Oxford University. David Veal, Chief Investment Officer - USA City of Austin ERS is a multi-billion dollar pension fund for employees of the city of Austin. David Veal joined City of Austin ERS in 2016. Before which he served as CIO of EF Capital, a major single family office and as Director of Strategic Partnerships and Research at Teacher Retirement System of Texas where he oversaw USD 6 billion of private equity, real assets, distressed credit, and other illiquid strategies. David holds an MBA from University of Michigan. Dale Spencer, Chief Investment Officer - USA The Columbian Financial Group of companies, headquartered in Binghamton, New York, has been providing life insurance services to its members for over one hundred and thirty years. Dale Spencer has served as Columbian Financial Group’s Chief Investment Officer since 2016. Prior to joining Columbian Financial Group in 2008, Dale served as Portfolio Manager for Fixed Income at the hedge fund Aladdin Capital Management. Sajal Heda, Chief Investment Officer - United Arab Emirates Sajal Heda is Chief Investment Officer of DAMAC Investment Company, a United Arab Emirates based major single-family office. Before DAMAC Investment Company, Sajal served as Head of Investments at a major Saudi Arabian single family office. Sajal holds a Master’s in Business Administration from London Business school and is a Chartered Financial Analyst and Chartered Alternative Investment Analyst charterholder. Jonathan Glidden, Managing Director - Pensions – USA Jonathan Glidden has served as Delta Airlines Managing Director of Pensions since 2011. In this role he oversees approximately USD 40 billion of Delta Airlines defined contribution and defined benefits pension assets. Prior to joining Delta Airlines, Jonathan served as a Director of investment analysis at Emory University’s multi-billion dollar endowment. Jonathan holds an MS in Financial Mathematics from University of Chicago and an MBA from Duke University. Erin Archer, Treasurer - USA DePaul University is the largest Catholic university and one of the fifteen largest private universities in the US (by enrolment). Erin Archer was appointed Treasurer of DePaul in January 2018, with responsibility for the treasury operations and liquidity management functions of the university, its endowment and other investment holdings, capital finance strategy and debt portfolio. She holds an MBA from The University of Chicago and is a CFA charterholder.

- 6. Audrey Soh, Head of Fixed Income Research - Malaysia Audrey Soh is Head of Fixed Income Research for Etiqa and manages a USD 5 billion fixed income investment portfolio. Etiqa is one of the largest insurers in Malaysia and is the insurance subsidiary of Maybank, whch has over USD 150 bn AUM. Prior to Etiqa, she worked at OCBC Bank (Malaysia) Berhad, monitoring the bank’s fixed income investments. She holds a Masters of Business Administration degree from Victoria University, Australia. Institutional Investor Speakers The InterContinental Hotel Boston, October 22nd to October 24th Michael Dittrich, Chief Financial Officer - Germany Deutsche Bundesstiftung Umwelt (German Federal Environmental Foundation) was established in 1990 and is one of Europe’s largest foundations. Deutsche Bundesstiftung Umwelt’s promotional and philanthropic activities concentrate on funding and supporting innovative environmental technology, education and cultural assets. Since 1991, approximately nine thousand projects have received financial backing from Deutsche Bundesstiftung Umwelt. Valerie Sill, President and Chief Executive Officer - USA Valerie Sill is President and Chief Executive Officer of DuPont Capital Management and serves as its Chief Investment Officer. She is responsible for overseeing the investment of approximately USD 25 billion in assets held by DuPont Company plans and external clients. Prior to joining DuPont Valerie was Executive Vice President at The Boston Company Asset Management. Valerie holds a Master’s in Business Administration from Harvard Business School. Kris Kowal, Managing Director, Fixed Income Investments - USA DuPont Capital Management currently manages approximately USD 25 billion in pension assets across a wide spectrum of capitalization, geography, and asset classes on behalf of employees of DuPont. Kris Kowal joined DuPont Capital Management in 1996 and is responsible for all of DuPont Capital Management’s global fixed income portfolios. Kris holds a Ph.D. in Material Sciences and Engineering from the University of Pennsylvania. Biswajit Dasgupta, Chief Investment Officer, Treasury - U.A.E. Biswajit Dasgupta is Chief Investment Officer - Treasury, at Emirates Investment Bank, overseeing all of the Emirates Investment Bank’s proprietary investments. Prior to this, Biswajit Dasgupta was Executive Director at the Abu Dhabi Investment Council-owned Invest AD, where he led Invest AD’s treasury and capital market activities and before that served as a senior executive in the Treasury department at Al Khalij Commercial Bank in Doha, Qatar. Tom Tull, Chief Investment Officer - USA The Employees Retirement System of Texas is an agency of the Texas State government, which oversees retirement benefits on behalf of Texan state employees. Employees Retirement System currently manages over USD 26 billion in assets. Prior to joining Employees Retirement System of Texas, Tom Tull founded the investment adviser company, Gulfstream Global Investors, which he sold to West LB in 2001. Howard Hodel, Acting Chief Investment Officer - USA Employees’ Retirement System of the State of Hawaii is a public pension fund with approximately USD 17 billion in assets under management. Employees’ Retirement System of the State of Hawaii engages in a range of alternative investment strategies including buyouts, distressed debt, real estate, timber and venture capital. Howard Hodel currently serves as the Acting CIO of the Employees’ Retirement System of the State of Hawaii. 6 Anne Fossemalle, Director and Head of Private Equity - United Kingdom The European Bank for Reconstruction and Development is an international financial institution founded in 1991. As a multilateral developmental investment bank, the European Bank for Reconstruction and Development uses investment as a tool to build market economies. It currently has approximately USD 60 billion of AUM. Anne Fossemalle has worked at EBRD since 1999 and holds an MBA in Finance from Stanford University. Cheryl Alston, Executive Director and Chief Investment Officer - USA Cheryl D. Alston is the Executive Director of the Employees’ Retirement Fund of the City of Dallas, Texas, the pension plan for the City of Dallas’s civilian employees. Cheryl provides leadership for the Employees’ Retirement Fund of the City of Dallas’s staff in implementing the programs necessary to achieve the mission, goals and objectives established by the Board of Trustees. Cheryl has an M.B.A. in Finance from the Stern School at New York University. Catherine Ulozas, Chief Investment Officer - USA Founded in 1891, Drexel University is a private research university with three campuses in Philadelphia, Pennsylvania and one in Sacramento, California. Catherine Ulozas manages Drexel University’s USD 700 Million endowment. Prior to Drexel University Catherine worked for ING Direct and Arizona State Retirement System. Catherine holds an MBA in international business from The George Washington University School of Business. James O’Loughlin, Group Pensions Manager - Ireland James O’Loughlin has overall responsibility for managing all aspects of both the Electricity Supply Board’s Defined Benefit Pension Scheme and the Electricity Supply Board’s Defined Contribution Scheme (RetireSmart). Prior to taking up the role at the start of 2015, James held many senior roles in ESB including Property and Finance. James is a Fellow of the Chartered Certified Accountants (FCCA) Susan Ridlen, Chief Investment Officer - USA Susan M. Ridlen is the Chief Investment Officer for Lilly’s Eli Lilly and Company USD 18 billion U.S. retirement plan assets and also serves as Eli Lilly’s Assistant Treasurer. Susan also provides investment guidance to Lilly’s international benefit plans; manages affiliate contribution strategies; and provides evaluations of global benefit design projects/changes. She received an MBA in Corporate Finance and a B.S. in Accountancy from The University of Illinois and holds a CPA.

- 7. Institutional Investor Speakers The InterContinental Hotel Boston, October 22nd to October 24th Alexander Neszvecsko, Portfolio Manager - Germany The Reserve Funds of the European Patent Office (EPO) is the second-largest intergovernmental organisation in Europe. The European Patent Office currently employs approximately seven thousand staff from over thirty countries. The EPO Reserve Funds has approximately EUR 8 billion of asset under management (USD 9.5 billion) Alex Neszvecsko graduated in Business Administration from Friedrich-Alexander University and is a CFA charterholder. Omeir Jilani, Executive Director, Head of Alternatives - United Arab Emirates The merger of First Gulf Bank (FGB) and National Bank of Abu Dhabi (NBAD) into First Abu Dhabi Bank in December 2007 created the biggest bank in the United Arab Emirates with approximately USD 182 billion of assets. Managing the alternative investments portfolio of the bank, in his role as Executive Director, Omeir Jilani has been an integral part in establishing the Alternative Investments desk since 2008. Michael Winchester, Head of Investment Strategy - Australia First State Super manages a combined asset pool of over AUD 90 billion (USD 67 billion) on behalf of our 850,000 members. Michael Winchester serves as Head of Investment Strategy for First State Super. Before joining First State Super, Michael was Head of Strategy at StatePlus. Michael also served as Head of Research and Portfolio Manager at Select Asset Management Australia. He holds a Master’s degree in Funds Management from University of New South Wales. 7 Sanjay Chawla, Senior Vice President, Investments and Chief Investment Officer - USA Sanjay is SVP and CIO at FM Global, one of the world’s largest commercial and industrial property insurers. Assets managed include general account and pension assets, combined total in excess of US$20bn. He was previously VP and CIO at Raytheon Company (AUM USD $38bn). He received an MBA from Virginia Polytechnic Institute and State University and a bachelor’s degree in commerce (honors) from Shri Ram College of Commerce, Delhi University, India. Olivier Rousseau, Executive Director - France FRR is France’s largest pension fund, with assets totaling Euro 35 billion (USD 40 billion.) FRR was established in 1999 by the French government, to smooth-out the impact of demographic changes on the country’s pay-as-you-go pension system. Olivier Rousseau was appointed Executive Director of the FRR in November 2011. Prior to which Oliver worked for eleven years in senior positions at BNP Paribas in international banking and finance. Srikanya Yathip, Deputy Secretary General - Thailand Dr. Srikanya Yathip joined the USD 22 billion Government Pension Fund of Thailand in 2010. Prior to joining the Government Pension Fund of Thailand, she spent more than ten years studying and working first in Japan and later in the United Kingdom. Her responsibilities at the Government Pension Fund of Thailand include assessing investment choices, pension research and making pension policy reform recommendations. Erik Ranberg, Chief Investment Officer – Norway * Gjensidige Forsikring is a leading Nordic insurance group and can trace its roots over 200 years, providing insurance products in Norway, Denmark, Sweden and the Baltic states. In Norway, Gjensidige Forsikring also offer banking, pension and savings services. Gjensidige Forsikring has total assets of NOK 149 billion (USD 19 billion,) three thousand eight hundred employees, one hundred and seventy-six branches and approximately one and a half million customers. Luke Webster, Chief Investment Officer - United Kingdom Luke Webster is the Chief Investment Officer of the Greater London Authority Group Treasury which helps manage the GLA pension funds for London’s Fire Commissioner and the Metropolitan Police, together with other Local Authorities. Luke read mathematics at Cambridge and Applied Statistics and Stochastic Modelling at Birkbeck, London. He is a member of the Bank of England’s Money Markets Committee. Jake Xia PhD, Managing Director and Chief Risk Officer - USA Harvard University’s USD 37 billion endowment is the largest academic endowment in the world and is managed by Harvard Management Company. Prior to joining Harvard Management Company as its Chief Risk Officer, Jake Xia held several senior roles at Morgan Stanley around the world, including head of global structured rates trading, and head of global fixed incoming trading risk. Jake Xia earned a PhD degree from MIT. Marinos Gialeli, Chief Executive Officer - Cyprus With thirteen thousand members, the Hotel Employees Provident Fund is the largest pension fund in Cyprus. As Chief Executive Officer, Marinos Gialeli is responsible for the general management of the Hotel Employees Provident Fund and for overseeing Hotel Employees Provident Fund’s investment portfolio. Marinos Gialeli holds a B.A. in Management and an MBA from the Fairleigh Dickinson University. Jean-François Pépin, General Manager, Pension Fund - Canada Hydro-Québec manages the generation, transmission and distribution of electricity in the Province of Quebec. Hydro-Québec Pension Fund manages the multi-billion dollar retirement assets of Hydro-Québec’s nineteen thousand employees. Jean-François Pépin is General Manager of the pension fund and holds a bachelor’s and master’s degree in business administration – finance from the Université de Sherbrooke. A.K. Sridhar, Chief Investment Officer - India IndiaFirst Life Insurance has over six thousand partner bank branches across India and provides life insurance to nearly three million clients. Prior to joining India First Life Insurance, A.K. Sridhar was the Chief Executive Officer of UTI International, a Singapore based investment management company and before that was the Executive Director and Chief Investment Officer of UTI AMC, managing USD 10 billion of equity and debt funds.

- 8. 8 Andrien Meyers, Head of Treasury and Pensions - United Kingdom The London Borough of Lambeth Pension Fund is a defined benefit scheme, administered in accordance with the Local Government Pension Scheme Regulations. Andrien Meyers is responsible for directing and overseeing the administration and investments of London Borough of Lambeth Pension Fund. Andrien Meyers holds a first class double honours degree in accounting and is a qualified member of the Association of Chartered Certified Accountants. Institutional Investor Speakers The InterContinental Hotel Boston, October 22nd to October 24th Bridget Uku, Group Investment Manager - United Kingdom Bridget Uku is Group Investments Manager at the United Kingdom Local Government Pension Scheme. She holds a law degree and is a Chartered PF Accountant with seventeen years of experience managing Treasury and Pension Fund investments within the United Kingdom’s Local Government sector. Bridget Uku also currently serves as a member of the FTSE Europe, Middle East and Africa advisory committee. Trevor Castledine, Investment Director - United Kingdom Trevor Castledine is Investment Director and Head of Credit at Local Pensions Partnership, which manages approximately GBP 13 billion (USD 17 billion) of pension fund assets for the Lancashire and London Local Authorities. Prior to joining LPP, Trevor was Deputy Chief Investment Officer at the GBP 6 billion (USD 8 billion) Lancashire County Pension Fund. He is a qualified Chartered Accountant and holds a Masters degree from the University of Cambridge. Gregory Doyle, Vice President, Pension Fund Investments - Canada Greg Doyle is the Vice President of Pension Fund Investments at Kruger Inc. in charge of all pension investment related activity. Prior to Kruger, Greg was at Caisse de Dépôt et Placement du Québec. He began his career in the UK where he worked at various investment banks. He is a graduate of City University, London and holds a Diplome International de Management from the Institut commercial de Nancy, France. Gaurav Singh, Head of International Investments - Kuwait Kuwait International Bank (KIB) is an islamic bank located in Kuwait City, founded in 1973. It offers various banking and finance services for individuals and corporate customers. Gaurav Singh is head of KIB’s international investment unit. Prior to joining KIB Gaurav spent a number of years in corporate finance across Asia and the Middle East. He has a degree from the University of Allahabad and an MBA from NIILM, India. He also holds the CFA and CAIA designations. Raivo Vanags, Head of Market Operations Dept, Member of the Board - Latvia Raivo Vanags is a Member of the Board and the Head of Market Operations Department at Latvijas Banka, the central bank of Latvia. In this role Raivo Vanags is responsible for the management of Latvijas Banka’s foreign reserves. He also serves as Latvijas Banka’s representative on the European Central Bank’s Market Operations Committee. Raivo Vanags holds a B.Sc. from the Stockholm School of Economics and an M.Sc. from the University of Latvia. Joshua Rabuck, Chief Investment Officer - USA Josh Rabuck was appointed Executive Director at Indiana University Health (IU Health) in mid-2011. IU Health has USD 3.5 billion in assets in the long-term pool; USD 1.6 billion in defined benefit and defined contribution retirement plans; and a USD 100 million captive insurance pool. Before this, Josh served as Director of Absolute Return and Deputy Chief Investment Officer at the USD 30 billion Indiana Public Retirement System for six years. Jerry Moriarty, Chief Executive Officer and Director of Policy - Ireland The Irish Association of Pension Funds is the peak Irish body for Irish pension funds. Its members provide retirement security to over quarter of a million people and are responsible for over EUR 108 billion (USD 122 billion) in pension assets. Before joining the Irish Association of Pension Funds as its Chief Executive Officer, Jerry Moriarty was Head of Compliance with the Pensions Board, the government regulator of the Irish pension fund industry. Glenn Hubert, Managing Director, Private Debt – Canada In July 2016, the Province of Ontario created IMCO through the Investment Management Corporation of Ontario Act. IMCO currently manages approximately CAD 60 billion (USD 50 billion) of assets on behalf of clients such as the Ontario Pension Board and the Workplace Safety and Insurance Board. Glenn Hubert serves Managing Director responsible for private debt at IMCO. Prior to this, he headed private debt investments at Ontario Pension Board. Rafael Andreata, Associate Director of Absolute Return – USA/Saudi Arabia KAUST (King Abdullah University of Science and Technology) is an international graduate research university dedicated to advancing science and technology through interdisciplinary research, education and innovation. Rafael Andreata joined KAUST in 2014 and his responsibilities include sourcing, underwriting and monitoring the Endowment’s hedge fund portfolio. He holds an M.B.A. in Finance from Duke University’s Fuqua School of Business. Stuart Odell, Assistant Treasurer, Retirement Investments - USA Stuart Odell, Assistant Treasurer, Retirement Investments at Intel Corporation. In this role he oversee all investment related aspects of Intel’s USD 20 billion in ERISA qualified retirement plan assets, USD 2 billion in non-qualified plan assets, and serve as adviser on approximately USD 2.5 billion of Intel pension assets and liabilities outside the US. Stuart holds an MBA from NYU Stern School of Business. James Clarke, Treasurer and Senior Vice President, Investments - USA James Clarke serves as the Treasurer and Senior Vice President of Investments for the USD 2 billion KU Endowment. In this role, he oversees investments on behalf of the oldest foundation for a public university in the US. Before this, he was a partner and head of private equity with Fiduciary Research and Consulting, and director of private investments for the USD 2 billion Kauffman Foundation. James holds an MBA from the University of Kansas and is a CFA.

- 9. 9 Andrew Sawyer, Chief Investment Officer - USA Andrew Sawyer is the Chief Investment Officer of the Maine Public Employees Retirement System a USD 14 billion state-wide pension fund. Prior to working at Maine Public Employees Retirement System, Andrew worked for TD Bank, Raytheon Company, Prime Buchholz & Associates, and Fuji Bank. He earned a BA from the University of Maine and a MBA from Pace University. Andrew is a CFA and a CAIA charterholder. Simon Lee, Chief Investment Officer - United Kingdom Marks & Spencer (‘M&S’) is one of the UK’s leading retailers. The M&S Pension Trust manages GBP 11 billion (USD 14 billion) in retirement assets for the 115,000 members of the Scheme, which was closed to future accrual from April 2017. Simon Lee joined M&S in July 2015. Previously he was Head of Investments at Lloyds Banking Group’s pension schemes. Simon is a Fellow of the Institute of Chartered Accountants. Omar Bassal, Head of Asset Management - Saudi Arabia Omar Bassal, is the head of asset management at MASIC, a major single-family office based in Saudi Arabia, where he oversees investments in traditional and alternative assets that are consistent with Shariah principles. Prior to MASIC, he worked as head of Asset Management at NBK Capital, the investment arm of the largest and highest rated bank in the Middle East. He holds an holds an MBA with honors from the Wharton School of Business. Peter Martin, Head of Investments - United Kingdom The MDU is the largest medical defence organisation in the UK. Before joining the MDU Peter Martin was Head of Manager Research at the pension consultancy JLT Employee Benefits. Peter has been a member of the Society of Pension Professionals Investment Committee He has also been the SPP representative to Debt Management Office quarterly consultation with regard to gilt issuance and End Year consultation with the Commercial Secretary to the Treasury. Elizabeth Jourdan, Deputy Chief Investment Officer - USA Elizabeth Jourdan has served as Deputy Chief Investment Officer of Mercy Health (St. Louis) since September 2015. Prior to joining Mercy Health (St. Louis), Elizabeth Jourdan helped manage the investment portfolio of Allied World Insurance, a property and casualty insurance company based in New York. Elizabeth holds a degree in finance from Babson College and is a Chartered Financial Analyst charter-holder. Clark Cheng, Chief Investment Officer - USA Merrimac is a large single family office with investments in hedge funds, private equity, real estate and mutual funds. Prior to Merrimac, Clark was responsible for managing the hedge fund due diligence process in the Americas for HSBC’s Alternative Investment Group which had USD 39 billion in hedge fund investments He holds an MBA from Duke University and a Bachelors of Arts Degree from UCLA. Clark holds the CFA, FRM and CAIA designations. Institutional Investor Speakers The InterContinental Hotel Boston, October 22nd to October 24th Larissa Benbow, Head of Fixed Income - United Kingdom London CIV is the first fully authorised and regulated investment management company set up by local government, for local government the UK. Its founding members are London boroughs and the City of London Corporation and London CIV has been established as a collective investment vehicle for their Local Government Pension Scheme funds. London CIV aims to grow its current aum of GBP 3 billion (USD 4 billion) to GBP 25 billion (USD 31 billion) by 2020. Mark Laidlaw, Chief Capital Officer and Chief Investment Officer - United Kingdom LV= (formerly known as Liverpool Victoria Insurance) is one of the United Kingdom’s largest insurance companies, employing five thousand seven hundred people and servicing a client base of over five million customers. Prior to joining LV= Mark Laidlaw served as Chief Financial Officer of AEGON UK, the British subsidiary of Aegon N.V. the multi-national Dutch life insurance, asset management and pension company. Eric Nierenberg Ph.D., Chief Strategy Officer - USA Eric Nierenberg has worked at the USD 60 billion Massachusetts Pension Reserves Investment Management (‘MassPRIM’) since 2013. In addition to his work at MassPRIM, Eric also teaches graduate courses in investments and international portfolio management at Brandeis University. Prior to joining MassPRIM in 2013, he was a Vice President at Independence Investments. Eric Nierenberg holds a Ph.D. in Business Economics from Harvard University. Grant Harslett, General Manager Investment and Finance – Australia Grant has been General Manager Investment and Finance of Maritime Super since 2004. Maritime Super AUM is AUD 6 billion (USD 5 billion). Grant has over 40 years’ experience in the Australian superannuation industry, having worked in a range of management and consulting roles covering actuarial, investments and finance areas. He is a member of the AIST working group on operational due diligence of investment managers and the ISA working group on retirement incomes. Sean Anthonisz Ph.D., Head of Asset Allocation - Australia Mine Super is a superannuation fund dedicated to serving the retirement needs of members working in the Australian mining and related industries. Mine Super has approximately AUD 10 billion (USD 7.5 billion) assets under management and over sixty-six thousand members. Sean Anthonisz is head of asset allocation at Mine Super. Sean holds a Ph.D. in Applied Finance from Macquarie University. Yuji Hirokoshi, Chief Investment Officer - Japan Yuji Horikoshi has worked for Mitsubishi’s Finance Department and Capital and Money Markets Group for 30 years. He was CIO of Mitsubishi Corporation Capital in Tokyo from 2004 to 2006, Co-CEO of Minerva Alternative Strategies in New York from 2006 to 2009 and Managing Director of Minerva Capital in London from 2009 to 2010. He is now responsible for managing the Corporation’s pension fund’s assets.

- 10. Institutional Investor Speakers The InterContinental Hotel Boston, October 22nd to October 24th10 Hisae Sato, Chief Investment Officer - Japan Nissan Motor Company’s current pension fund assets under management amount to approximately USD 7 billion. Hisae Sato serves as Nissan Motor Company Pension Plan’s Chief Investment Officer. Prior to working at Nissan Motor Company, Hisae Sato was Deputy General Manager at AIG Global Investment Group and worked for Watson Wyatt consulting, where she advised a number of Japanese pension funds on a range of investment related issues. Luiz Claudio Levy Cardoso, Chief Investment Officer - Brazil Luiz Claudio Levy Cardoso is the Chief Investment Officer of Nucleos Instituto de Seguridade Social. Nucleos Instituto de Seguridade Social is the multi-billion USD pension fund for employees of the Brazilian nuclear industry. Before joining Nucleos Instituto de Seguridade Social he served as commercial manager of INB, the Brazilian nuclear fuel cycle company and before that as head of equities and fixed income of Aerus pension fund. Fabio Scacciavillani Ph.D., Chief Strategy Officer - Oman Oman Investment Fund is a USD 8 billion sovereign wealth fund that seeks to diversify Oman’s asset base. Fabio Scacciavillani, holds a Ph.D. in Economics from the University of Chicago and is member of the Oman Investment Fund Investment Committee. Prior to the Oman Investment Fund, Fabio was an Executive Director at Goldman Sachs. He is the author of the book ‘The New Economics of Sovereign Wealth Funds’. Monte Tarbox, Executive Director, Investments - USA NEBF has approximately USD 14 billion in asset and is the third largest Taft-Hartley Pension Plan in the United States. It serves over half a million participating individuals, with over one hundred and thirty thousand of those individuals receiving either a retirement or surviving spouse benefit. Monte Tarbox has served as Executive Director, Investments at NEBF since 2013. He holds an MBA from University of Chicago’s Booth School of Business. Ken Stemme, Director, Investments - USA In the thirty-two years since being chartered by Congress, the National Fish and Wildlife Foundation has grown to become the country’s largest conservation grant-maker. The National Fish and Wildlife Foundation-funded projects have generated a cumulative conservation impact of more than USD 3.5 billion. Ken Stemme currently serves as Director of Investments at the National Fish and Wildlife Foundation. John St. Hill, Deputy Chief Investment Officer - United Kingdom National Employment Savings Trust (NEST) is a defined contribution workplace pension scheme set up by the British government to facilitate automatic enrollment as part of the government’s workplace pension reforms. John is Deputy Chief Investment Officer of the NEST . He previously worked at the PPF and SEI Investments. John has an MBA from the University of Chicago and holds the CFA and FRM designations. Gilles Horrobin, Chief Investment Officer - Canada Gilles Horrobin joined the multi-billion dollar Societe de Transport de Montreal – Regime de Retraite (Montreal Transit Society Pension Funds) in 2000 as portfolio manager U.S. equities. From 2007 to 2012, he also supervised the management of all other equities portfolios. In 2012, he took over the role of Chief Investment Officer. Gilles graduated from the University of Montreal Business School (HEC) in Finance and also holds the CFA designation. John Adler, Director and Chief Pension Investment Advisor – USA The Mayor’s Office of Pensions and Investments (MOPI) is the administration’s full-time, central advisor to the Mayor’s trustees on the five New York City retirement system boards and on the New York City DC Plan Board which hold combined assets valued at over USD 150 billion, covering over 350,000 active employees and 275,000 retirees and beneficiaries. John Adler was most recently the Director of the Retirement Security Campaign at SEIU. Leo Svoboda, Managing Director – USA Nationwide is one of the largest insurance companies in the world, with more than USD 158 billion in statutory assets. As Managing Director for Liquid Alternative Investments at Nationwide, Leo Svoboda’s remit includes Nationwide’s hedge fund strategies, equities, and emerging market debt investments. Prior to this, Leo worked at Penso Advisors and at UPS Group Trust, a USD 30 billion Trust for employees of UPS. Leo holds an MBA from the Wharton School. Craig Grenier, Director of Investments - USA Craig Grenier is the Director of Investments for Northeastern University, where he provides strategic direction for the management of over USD 1.5 billion in endowment and operating assets across both public and private markets. Prior to NE , Craig worked at Blue Cross Blue Shield of Massachusetts and GMO. Craig holds an MBA and a BS in Management from Northeastern University, and has both the CFA and CAIA designations. Enrique Cuyegkeng, Director of Public Markets - Canada Ontario Power Generation oversees the USD 13 billion Ontario Power Generation Pension Fund and the USD 18 billion Ontario Nuclear Funds. Prior to joining Ontario Power, Enrique Cuyegkeng was Managing Director, Public Market Investments at OP Trust, where he oversaw the Trust’s USD 11 Billion plus investments in externally-managed publicly-traded assets. Enrique holds an MBA in Finance from Columbia Business School. Kenichi Ota, Chief Investment Officer - Japan Ken Ota was appointed CIO for Mitsui & Co. Pension Fund in 2014. He joined Mitsui & Co. in 1987. He was the head of Trading Dept. with nearly 20 years’ experience of currency, fixed income, equity, and derivatives trading at Mitsui’s Tokyo HQ and London office. After that, he assumed the position of CFO for Mitsui & Co. Australia as well as Auditor for the several subsidiaries of Mitsui. Prior to this, he was the portfolio manager at the investment company affiliated with Mitsui.

- 11. Ricardo Nogueira, Chief Investment Officer - Brazil Real Grandeza Pension Fund is one of the largest pension funds in Brazil with AUM of over USD 4 Billion. It runs the pension fund for employees of Eletrobras Furnas, the state-owned electrical power industry company. Ricardo has been the CIO of Real Grandeza since May 2018. He spent the previous 32 years in various senior management positions in the finance industry. Ricardo has an academic background in business administration (MBA), finance and marketing. Institutional Investor Speakers The InterContinental Hotel Boston, October 22nd to October 24th 11 Satya Prasad, Executive Director - India Established by the Government of India in 2003, the PFRDA is mandated to promote old age income security and to act as the regulator of India’s pension sector. Satya Ranjan Prasad was appointed Executive Director of PFRDA in 2015. Prior to this he served as Chief General Manager in the Securities and Exchange Board of India. He has more than 30 years of experience in the Financial Sector and holds a degree in law and an MBA in Finance. Arjen Pasma,Chief Risk Officer Investments - The Netherlands PGGM Investments manages approximately EUR 190 billion (USD 210 billion) in assets from five Dutch Pension Funds in a worldwide diversified portfolio of both public and private investments. Arjen Pasma is the Chief Risk Officer at PGGM Investments and a board member of the investment committee, allocation committee, ALM committee and investment policy committees of PGGM Investments. Mauricio Guzman, Chief Investment Officer - Colombia Mauricio Guzmán is Chief Investment Officer at Pontificia Universidad Javeriana, one Colombia’s largest private universities, primarily responsible for the investment and risk management process, across local and global equity and fixed income assets, as well as alternative investments in hedge funds, private equity and real state. He holds an MBA from Universidad de Los Andes and is a Chartered Financial Analyst charter holder. Molly Murphy, Chief Investment Officer - USA Molly Murphy currently oversees the investments of the USD 15 billion Orange County Employees Retirement System. She joined OCERS in 2017 after many years as CIO of a non-profit US health system. Previous to that role, with a background in trading and portfolio management, she was the co-founder and CIO of a boutique investment firm serving the bespoke needs of institutional fixed income investors. Michael Nicks, Director of Investments – USA Pepperdine University is an independent, medium-sized university enrolling approximately seven thousand, three hundred students in five colleges and schools. The University is located on 830-acre campus overlooking the Pacific Ocean in Malibu. Michael Nicks has served as Director of Investments at Pepperdine University since 2008. Michael holds an MBA from Pepperdine University’s Graziadio School of Business and Management. Brandon Gill New, Portfolio Manager, Office of the CIO - Canada With net assets of over CAD 20 billion (USD 16 billion), OPTrust invests and manages one of Canada’s largest pension funds and administers the OPSEU Pension Plan, a defined benefit plan with over 92,000 members and retirees. Before joining OPTrust, Brandon Gill New was a Director at BMO Capital and a Portfolio Manager for equities and alternatives at Ontario Teachers’ Pension Plan. Brandon holds an MBA from London Business School. Chad Myhre, Portfolio Manager - USA Chad Myhre is a Portfolio Manager covering hedge fund and public equity investments at the USD 44 billion Public School Retirement System of Missouri. Prior to joining Public School Retirement System of Missouri, he oversaw the USD 2 billion active hedge fund portfolio for the Missouri State Employees’ Retirement System. Chad holds the Chartered Financial Analyst and Chartered Alternative Investment Analyst designations. Timour Zilberchteine, Director, External Manager Search and Monitoring - Canada Timour Zilberchteine is Director, External Manager Search and Monitoring at PSP Investments, one of Canada’s largest pension investment managers with USD 116 billion in assets. PSP Investments manages a diversified global portfolio composed of investments in public financial markets, private equity, real estate, infrastructure, natural resources and private debt. Timour holds an MBA from Wilfried Laurier University in Waterloo and the CFA designation. Tomasz Mrowczyk, Head of Structured Investments - Poland PZU Insurance Group is Poland’s largest insurance group. Tomasz Mrowczyk works as PZU Insurance Group’s Head of Structured Investments. Tomasz Mrowczyk specializes in investments in illiquid structured private debt, occasionally with some equity components. He started his career in Ernst & Young Corporate Finance. Tomasz Mrowczyk is both a Chartered Financial Analyst and CAIA charter holder. Steve Davis, Chief Investment Officer - USA The Sacramento County Employees’ Retirement System (SCERS) is a USD 9 billion public pension plan. Steve Davis has been with SCERS since 2010, and as Chief Investment Officer is responsible for the oversight and implementation of SCERS’ investment program. Steve holds a BA from the University of Arizona and an MBA from the University of Southern California, and is a CFA and CAIA charterholder. Ignacio Noguez, Senior Investment Strategist - Uruguay Republica AFAP is a Uruguayan state-owned pension fund company, based in Montevideo. Ignacio is the senior investment strategist at Republica AFAP and responsible for managing the pension investments. Ignacio is concurrently a lecturer in economics and capital markets at the ORT University Uruguay, Uruguay’s largest private university. He holds degrees in both statistics and economics from Universidad de la República, and is a CFA charterholder.

- 12. Institutional Investor Speakers The InterContinental Hotel Boston, October 22nd to October 24th12 David Lawson, Head of Investments - Canada Telus Corporation is a Canadian, national telecommunication company that provides a wide range of telecommunications products and services to Canadian businesses and consumers. Telus Corporations pension fund manages approximately CAD 11 Billion (approximately USD 9 billion) on behalf of Telus’s 47,000 employees. Prior to Telus, David Lawson spent eleven years as the Chief Investment Officer at the Workers Compensation Board of Alberta. Dominic Blais, Senior Risk Manager - Canada Since 2004, Dominic has been with the CMPA, a not-for-profit, mutual defence association that provides medical-legal assistance for Canadian physicians and contributes to safe medical care. He currently leads the performance measurement and risk management functions, and has oversight of the internal trading activities and the internal systems development and support efforts. Dominic holds a bachelor of business administration from Bishop’s University and is a CFA and CAIA charterholder. Christopher Brockmeyer, Director of Employee Benefit Funds - USA Christopher Brockmeyer has been the Director of Employee Benefit Funds for the Broadway League, the national trade association for the Broadway theatre industry, since 2007. This includes 11 multi-employer pension funds, 7 health funds and 4 annuity/401(k) funds with nearly USD 6 Billion in assets, covering 120,000 current or future retirees and providing health care coverage for 24,000 employees (plus their dependents) in the entertainment industry. Ellen Hung, Deputy Chief Investment Officer - USA Ellen Hung is the Deputy Chief Investment Officer for the State Universities Retirement System. She has over 25 years of experience managing pension funds, trust funds and government assets. Her career achievements include Assistant Chief Executive Officer for Santa Barbara County Employees’ Retirement System and Treasurer and Investment Officer for City of Spokane. Ellen is a CFA Charterholder and holds MBA and BS degrees from Rensselaer Polytechnic Institute. Dr. Olin Liu, Managing Director and Chief Economist - China Dr. Olin Liu is Managing Director of the asset management arm of the Sunshine Insurance Group, responsible for Sunshine Insurance Group’s strategic investment asset allocation overseas and macro thematic research. Previously Olin Liu was a director of CICC, China’s first joint venture investment bank, and Mission Chief for the International Monetary Fund’s Asia Pacific Department. Olin Liu holds a PhD in Economics from Boston College. Hasan AlJabri, Chief Executive Officer - Saudi Arabia Hasan is the CEO of SEDCO Holding Group. He joined the Group in 2010 as the CEO of SEDCO Capital and has over 33 years of banking experience in the GCC region. He is also currently serving as a member of boards and executive committees of several companies in the Kingdom of Saudi Arabia. He holds a B.Sc. in Engineering from the American University of Beirut and is a graduate of the Executive Management Program at Columbia University. Clemens Quast, Head of Treasury - Germany The Sparda banks are a group of twelve regional German cooperative banks serving a total of almost 3.4 million members in Germany. Between them the Sparda banks have roughly six thousand employees spread across more than four hundred branches throughout Germany. Founded in 1930 and headquartered in Munich, Sparda-Bank München eG is the largest cooperative bank in Bavaria, with over quarter of a million members. Michael Malewicz, Chief Investment Officer - USA SSM Healthcare is a Catholic, not-for-profit US health care system with more than one thousand six hundred employed physicians and thirty three thousand other employees spread across four states. Michael Malewicz oversees SSM Healthcare’s USD 4 billion investment portfolio, over USD 600 million of which are allocated to alternative assets. He holds an MBA in Finance from University of San Francisco. Mamraj Chahar, Chief Investment Officer - Saudi Arabia Headquartered in Riyadh, the Saudi Reinsurance Company is the first reinsurance company established in Saudi Arabia. It is listed on the Saudi Exchange Market. The Saudi Reinsurance Company has strong underwriting expertise in engineering, property, marine, casualty, commercial, automobile, and retro reinsurance products. Mamraj Chahar has served as Saudi Reinsurance Company’s CIO since 2014 and is a Chartered Financial Analyst charterholder. Farouki Majeed, Chief Investment Officer - USA Founded in 1937, the Ohio School Employees Retirement System currently manages USD 14 billion in assets on behalf of 121,000 active, contributing members and 72,000 benefit recipients. Farouki Majeed has served as Chief Investment Officer of the Ohio School Employees Retirement System since 2012. Prior to this he worked as Senior Investment Officer at CalPERS. Farouki holds an MBA from Rutgers University and is a Chartered Financial Analyst. Georg Lund Skare, Head of External Manager Selection - Norway The Storebrand Group is a leading player in the Nordic market for long-term savings and insurance, managing more than NOK 700 billion (USD 85 billion.) Georg Lund Skare is responsible for manager selection in listed equity and fixed income strategies on behalf of the Storebrand Group. He holds an M.Sc. in International Management (CEMS) from HEC, Paris and Norges Handelshøyskole (NHH), Bergen. He earned a CEFA in 2005 and a MBA in Finance from NHH in 2008. Richard Stensrud, Executive Director - USA The USD 14 Billion School Employees Retirement System of Ohio is a public pension fund for non-teaching school employees of the State of Ohio. As Executive Director, Richard Stensrud heads SERS and is tasked with the accountability for SERS’ overall affairs, as well as investment, operational and financial performance. Before taking over SERS, Richard served as CEO of the USD 8 Billion Sacramento County Employees’ Retirement System.

- 13. Institutional Investor Speakers The InterContinental Hotel Boston, October 22nd to October 24th 13 Mateo Fernández, Head of Investments - Uruguay Mateo Fernandez is Head of Investments at UnionCapital AFAP. UnionCapital AFAP is one of the four pension funds in Uruguay, UnionCapital AFAP has over two hundred thousand members. Mateo Fernandez has more than 10 years of experience in financial markets. He graduated with a degree in economics from Universidad de Montevideo, Uruguay and has been a CFA charterholder since 2015. Richard Chau, Managing Director - USA Richard Chau is Managing Director of Tulane University’s USD 1.2 Billion endowment. He joined the Tulane University Investment Management Office in 2013. From 2011 to August 2013, Richard was a Vice President in Bessemer Trust’s Private Equity Funds Group in New York, where he helped manage a multi-billion dollar global private equity portfolio. Richard holds an MBA from Columbia Business School. Elmer Huh, Chief Investment Officer - USA The M.J. Murdock Charitable Trust is a private, non-profit foundation based in Vancouver, Washington. The trust funds projects that serve four primary areas: scientific research, arts and culture, education and health and human services. Elmer Huh has more than 20 years’ experience in public/private equity and alternative investing , most recently at Ernst & Young Capital Advisors, as senior vice president of investment banking and alternative asset managers. David Hughes, Managing Director - USA The J. Paul Getty Trust is the world’s wealthiest art institution with an endowment of approximately USD 7 billion. Based in Los Angeles, it operates the J. Paul Getty Museum. David Hughes is responsible for managing the trust’s fixed income and public equities investments. Prior to this, David Hughes was Investment Officer for Public Equity at University of California endowment and pension fund. David holds an MBA in Finance from UC Berkeley. Ian Prideaux, Chief Investment Officer - United Kingdom The Grosvenor Estate is a multi-billion dollar single-family office. Ian Prideaux manages the Grosvenor Estate’s non-property investment portfolio. This includes long equity and bond portfolios, commodity, hedge fund and private equity investments. He is responsible for asset allocation and manager selection, investments being managed externally. Ian has been with The Grosvenor Estate since 2006, and was previously at HSBC, SG Warburg and Price Waterhouse. Meena Lakshman, Director of Investments – USA Meena Lakshman is involved in the overall investment management, macro research and asset allocation for the USD 6 Billion Trust portfolio. Prior to joining the Trust, Meena was a portfolio specialist at Morgan Stanley Investment Management. She conducted Macroeconomic research as a member of the investment committee, pitched relative value trade ideas, managed Investor relations and evaluated managers for addition to the portfolio. Susan Chen, Managing Director - USA University of Texas Investment Management Co (UTIMCO) oversees USD 40 billion in assets on behalf of the University of Texas. Susan Chen leads UTIMCO’s investments in public equities in developed and emerging markets and technology-related venture capital. Prior to which she was a Managing Director at Highbridge Capital., focused on distressed debt, private loans and event-driven equity. Susan holds a JD and MBA from Harvard. Mirko Cardinale Ph.D., Head of Multi-Asset Allocation – United Kingdom The Universities Superannuation Scheme (USS) manages over GBP 80 billion (USD 90 billion) on behalf of its 390,000 members, who are drawn from the academic and academic- related staff of 350 UK universities. Prior to joining USS in 2015, Mirko Cardinale was Head of Investment Allocation at Russell Investments and Head of Strategic Asset Allocations at Aviva. He holds a Ph.D. in Finance, focused on pension funding and long-term investing, from Imperial College, London. Jason Josephiac, Senior Manager, Pension Investments – USA JasonJosephiacisaSeniorManagerfortheUnitedTechnologies’PensionPlan,andisprimarily responsibleforglobalpublicequities,portablealpha/hedgefundsandriskparity.Priortojoining United Technologies, he was a Senior Associate at The Boston Company Asset Management, LLC.JasongraduatedmagnacumlaudefromBentleyUniversitywithadegreeinFinanceaswellasminors in Economics and International Studies. Jason is a CFA charterholder and a CAIA charterholder. Travis Shore, Managing Director, Public Markets - USA Totaling over USD 4 billion, Vanderbilt University has one of the 25 largest endowments in the United States. Travis Shore serves as a managing director for the public investments team at Vanderbilt University. Travis joined Vanderbilt University in 2014 after serving as an investment director at the Alfred Sloan Foundation. Prior to that, Travis served as a director of investments at New York University’s endowment. Sami Lahtinen, Head of Position Management and Diversified Investments – Finland Valtion Eläkerahasto is a Euro 20 billion (USD 23 billion) pension fund that manages the pension investments of Finnish State employees. Sami Lahtinen heads the Position Management department at Valtion Eläkerahasto, which focuses on limiting the market risks affecting the entire portfolio via the use of derivatives and hedge funds – amongst other methods - to improve the diversification of investments and risk management. Steve Blundin, Director - Liquid Alternatives and Strategic Partnerships - USA Stephen Blundin, CFA, is the Director of Global Equity and Alternatives for Verizon Investment Management Corporation. In this role, Stephen is responsible for managing the global equity, hedge fund, risk parity, active currency, commodities and strategic partnership portfolios across the Defined Benefit, Defined Contribution and affiliated plans. In total, he oversees approximately USD 25 billion of the US 54 billion managed by VIMCO.

- 14. Institutional Investor Speakers 14 The InterContinental Hotel Boston, October 22nd to October 24th Matthew Mordus, Head of Hedge Fund Portfolio Management – USA Matthew Mordus serves as Chairman of the Hedge Fund Investment Committee within the Investment Group at XL Catlin. XL Catlin is a global P&C insurance and reinsurance company. The firm manages a USD 35 billion investment portfolio, of which approximately USD 1.5 billion is invested in hedge funds. Matthew is primarily responsible for the firm’s Hedge Fund Portfolio, though he also serves on the firm’s House View Committee as well as the firm’s Private Credit Team.

- 15. Tony Gannon, Chief Executive Officer and Chief Investment Officer - Ireland TonyGannonfoundedAbbeyCapitalin2000withavisiontocreateanalternativeinvestment business providing multi-manager funds in the managed futures, Foreign Exchange and global macro sectors of the hedge fund industry. Tony has more than 25 years’ investment experience in the managed futures industry and prior to founding Abbey Capital he was co-founder of Allied Irish Capital Management which grew to became one of the largest European CTAs. Chris Hentemann, Managing Partner and Chief Investment Officer - USA 400 Capital Management (‘400CM’) is a structured credit asset management firm offering qualified investors access to a broad range of investment opportunities and innovative solutions across global structured credit markets. Chris Hentemann organized and launched 400CM in 2008 and is its CIO and Chairs the Firm’s Operating and Investment Committees. Prior to 400CM, Chris was the Head of Global Structured Products at Banc of America Securities. Thomas Dobler, Ph.D., Vice President, Multi-Asset Class Strategies - USA Thomas Dobler joined Acadian’s Multi-Asset Class Strategies Investment team in 2017. Prior to Acadian, he held portfolio management, trading and research roles at BlackRock and Goldman Sachs and a quantitative research role at Saloman Brothers Asset Management. Thomas holds a Ph.D. in mathematics from Columbia University, an M.S. in mathematics from the University of Illinois, and a B.S. from the University of Vienna, Austria. Martin Lueck, Co-Founder and Research Director - United Kingdom Martin Lueck co-founded Aspect in 1997 and oversees the Research team responsible for generating and analysing fundamental research hypotheses for development of all Aspect’s investment programmes. He chairs the Investment Management Committee and is a member of the Risk Management Committee. Previously, he co-founded Adam, Harding and Lueck Ltd in 1987. He currently serves on the Board of the National Futures Association. Clayton DeGiacinto, Founder and Managing Partner - USA Mr. DeGiacinto is the Founder and Managing Partner of Axonic Capital LLC. He serves as Chief Investment Officer for the firm’s investment funds and commercial lending business. Prior to founding Axonic, Mr. DeGiacinto ran the adjustable rate mortgage credit business at Goldman Sachs. He earned an MBA from Wharton, and BS from West Point. He served as an Army Ranger in the 25th Infantry Division from 1995 until 2000. Jonathan Rotolo, Head of Private Equity and Real Assets – USA Jonathan Rotolo is a member of Barings Alternative Investments team. He is Head of Private Equity / Real Assets and serves as chairman of the group’s investment committee. Prior to joining the firm in 2005, Jon worked at State Street Corporation in their Strategic Alliances business. Jon holds a Master of Science in Investment Management from Boston University and has an M.B.A. from the Tuck School of Business at Dartmouth. 15The InterContinental Hotel Boston, October 22nd to October 24th Gordon Bajnai, Chairman, Global Advisory Board - USA Gordon Bajnai is Chairman of the Global Advisory Board at Campbell Lutyens. He served as Prime Minister of the Republic of Hungary from April 2009 until May 2010. Prior to this, he was Minister of Economy and National Development and Minister of Regional Development. In the private sector, he served as Group COO of Meridiam Infrastructure between 2014 and 2017 and Chief Executive Officer of the Wallis Group from 2000 to 2006. Michael Rosen, Chief Investment Officer - USA Angeles Investment Advisors advises on USD 47 billion across customized portfolios for many highly respected educational institutions, charitable foundations, non-profit organizations, governments and corporations. Michael Rosen has more than 30 years’ experience as an institutional portfolio manager, investment strategist, and investment consultant and served as Adjunct Professor of Finance at Pepperdine University. Russ Ivinjack, Senior Partner - USA Russ Ivinjack is a Senior Partner at Aon Hewitt Investment Consulting and chairs the firm’s U.S. Investment Committee. Russ previously led the development of Aon’s alternatives investment capabilities and global equity manager research teams. He has written research papers on defined contribution pension plan issues and what fiduciaries need to know when selecting asset allocation and fund selection models for participant-directed plans. Richard (Jerry) Haworth, Chief Executive Officer and Chief Investment Officer – United Kingdom 36 South was established in 2001 and specialises in finding cheap convexity, principally in longdated options, across all asset classes. Its global volatility strategies are designed to perform well in various market environments, but substantially outperform in periods of extreme market movement and volatility. Jerry Haworth has over 28 years of investment experience and co-founded 36 South. He is the CIO, CEO and chairs the Investment Management Committee. Bill Kelly, Chief Executive Officer – USA William (Bill) J. Kelly is the Chief Executive Officer of the CAIA Association and a frequent writer, and commentator on alternative investment topics globally since taking the leadership role in 2014. Previously, Bill was CEO of Boston Partners and one of seven founding partners of the predecessor firm, Boston Partners Asset Management. His career in the institutional asset management space spans over 30 years in successive CFO, COO and CEO roles. Additional Global ARC 2018 speakers are being confirmed every month. Please visit our website www.garc2018.com for the latest speaker list.

- 16. William Murray, Co-Head of Asset Backed Securities and Portfolio Manager - USA William is Co-Head of ABS and jointly manages CQS’ global asset backed securities strategies across dedicated hedge funds, long-only funds and bespoke mandates. William is a member of the Firm’s Executive Committee, Asset Advisory Committee, and together with his fellow Co-Head, he leads the eight-strong team of dedicated ABS portfolio managers and analysts. Prior to joining CQS in 2008, William worked for UBS Investment Bank and Ernst & Young. Theodore Koenig, President & Chief Executive Officer - USA Theodore Koenig is President, CEO & Founder of Monroe Capital, a private credit asset management firm specializing in direct lending and opportunistic private credit investing, established in 2004. Prior to Monroe, Koenig was President and CEO of Hilco Capital LP, a junior secured/mezzanine debt fund. Koenig is a graduate of the Kelley School of Business at Indiana University (B.S.) in accounting with high honors and Chicago-Kent College of Law (J.D.) with honors. Alina Osorio, President – Canada Alina Osorio is a seasoned investment professional with over twenty-four years of experience. Prior to Fiera she was the Chief Executive Officer of one of North America’s first unlisted infrastructure funds, Macquarie Essential Assets Partnership, where she lead OPTrust’s CAD 2.5 Billion infrastructure program; and founder and CEO of Aquila Infrastructure. Alina holds a BEng from McGill University and an MBA from the Schulich School of Business. Michael Levitt, Chief Executive Officer – USA Michael Levitt is the CEO of Kayne Anderson Capital Advisors. Prior to joining Kayne, Michael served as a vice chairman with Apollo Global Management. At Apollo, he was a partner in the private equity and credit businesses. In 2001, Michael founded Stone Tower Capital where he served as chairman, CEO and CIO and grew Stone Tower to USD 17 billion in credit- focused alternative investments until it was eventually acquired by Apollo in 2012. Paul Hilal, Founder and Chief Executive Officer - USA Paul Hilal is Founder and CEO of Mantle Ridge LP and Vice Chairman of the board of directors of CSX Corporation. He has built a strong record both as an engaged investor, and as a passive value investor. Prior to forming Mantle Ridge, Paul was a Senior Partner at Pershing Square Capital, where he focused on both passive and activist investing projects. Among these successes were Canadian Pacific Railway Limited, Air Products and Chemicals, and Ceridian. 16 The InterContinental Hotel Boston, October 22nd to October 24th Tim McCusker, Chief Investment Officer and Partner - USA NEPC is one of the industry’s largest independent, full-service investment consulting firms, serving over three hundred retainer clients with total assets of over USD 850 billion. Tim McCusker is responsible for overseeing Investment Research at NEPC, a group of forty-five professionals including dedicated teams focusing on alternative investments, traditional strategies, and asset allocation. Tim McCusker is Fellow of the Society of Actuaries. Erik S. Weisman PhD., Chief Economist and Portfolio Manager – USA Erik is the chief economist and a portfolio manager at MFS Investment Management. He manages the firm’s US/global inflation-adjusted, global total return and global government portfolios. Erik chairs the Fixed Income and Global Rates/Currency Strategy Groups. Erik joined MFS in 2002. Previously, he held positions at the IMF and US Treasury Department. Erik earned a bachelor’s degree from the University of Michigan and master’s and Ph.D degrees from Duke University. Pete Keliuotis, Senior Managing Director – USA Cliffwater provides investment advisory services to institutions, such as endowments, foundations and retirement systems. Prior to joining Cliffwater in 2014, Pete Keliuotis was a Managing Director and CEO of Strategic Investment Solutions where he led the consulting teams and consulted to large institutional investors. Pete holds an MBA in Analytic Finance from the University of Chicago Booth School of Business, and holds the CFA designation. David Stewart, Founder - Australia Founded by David Stewart in 2002, Global ARC convenes a network of the world’s foremost academics, pension funds, endowments, sovereign wealth funds and asset managers to analyze macro-economic, capital market, and alternative investment developments and their implications for the institutional investor community. Global ARC is an independent organization wholly owned by its founder and is not affiliated with any media company or investment industry supplier. Christopher Holt, Senior Advisor - Canada Chris Holt serves as senior advisor to Global ARC. Prior to working with Global ARC, Chris Holt served as senior advisor to the Chartered Alternative Investment Analyst Association (‘CAIA’), and as the managing editor of AllAboutAlpha.com, CAIA’s research, analysis and opinion portal. Chris holds an MBA from Duke University’s Fuqua School of Business and is currently a PhD candidate at University of Toronto. Jason M. Ruggiero, Co-Chief Investment Officer and Senior Portfolio Manager - USA Jason Ruggiero joined EJF at its founding in 2005 and is a member of the Executive Committee and serves as the primary Portfolio Manager for the EJF Financial Services Fund. Prior to joining EJF, he was an equity trader in FBR’s Alternative Asset Investment Group. In 2004, Jason assumed co-portfolio manager responsibilities for FBR Ashton, L.P. He holds a BBA in accounting from James Madison University and an MBA in finance from the University of Maryland. John Liguori, Co-Founding Member and Chief Investment Officer, Direct Lending - USA John Liguori is a co-founding member of Jefferies Finance and the Chief Investment Officer of the firm’s direct lending business. John has been with Jefferies Finance for 14 years and currently manages a team responsible for investment sourcing, execution and portfolio management. He has also worked in similar direct lending roles at GE Capital, Heller Financial, AIG Investments and Prudential Capital Group. He holds an MBA from Duke University’s Fuqua School of Business