Invest In India Consumer Fund - UTI Mutual Funds

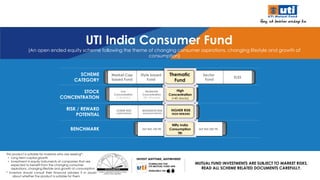

- 1. Information Classification: UTI AMC - Confidential Information Classification: UTI AMC - Confidential This product is suitable for investors who are seeking*: • Long term capital growth • Investment in equity instruments of companies that are expected to benefit from the changing consumer aspirations, changing lifestyle and growth of consumption * Investors should consult their financial advisers if in doubt about whether the product is suitable for them SCHEME CATEGORY STOCK CONCENTRATION RISK / REWARD POTENTIAL BENCHMARK LOWER RISK LOWER REWARD MODERATE RISK MODERATE REWARD HIGHER RISK HIGH REWARD Low Concentration (> 60 stocks) Moderate Concentration (40 - 60 stocks) High Concentration (<40 stocks) Market Cap based Fund Style based Fund Thematic Fund Sector Fund ELSS UTI India Consumer Fund (An open ended equity scheme following the theme of changing consumer aspirations, changing lifestyle and growth of consumption) S&P BSE 100 TRI Nifty India Consumption TRI S&P BSE 200 TRI MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

- 2. Information Classification: UTI AMC - Confidential Information Classification: UTI AMC - Confidential Consumption: A real-life scenario 2 The above is only to illustrate the concept of identifying stocks that could possibly form part of a house hold. The performance of stocks would ultimately depend on various factors such as prevailing market conditions, global political scenario, exchange rate etc. Investors are requested to note that there are various factors (both local and international) that can have impact on the future performance and expectations of any company. There is no assurance or guarantee of any company’s performance and also there is no assurance or guarantee that the scheme would invest in these stock.

- 3. Information Classification: UTI AMC - Confidential Information Classification: UTI AMC - Confidential Long-term drivers of Consumption in India 3 Favourable demographics, rising income levels, urbanization will lead to growth in consumption Household consumption to increase with the support of retail finance Driven by Penetration, Per Capita Consumption, Premiumization & Formalization Faces and Facets of India’s Consumption: set to become the 3rd largest consumer economy by 2025 India is set to become the third largest consumer economy by 2025, trailing only the US and China, fuelled by an increase in consumption levels, changes in consumer behaviour and spending patterns, according to a report released by consulting firm The Boston Consulting Group on March 20, 2017 Favorable Demographics Credit Availability Market Scalability

- 4. Information Classification: UTI AMC - Confidential Information Classification: UTI AMC - Confidential Reaping the Demographic Dividend Demographics Dependency Ratio GDP / Income Growth Consumption 4

- 5. Information Classification: UTI AMC - Confidential Information Classification: UTI AMC - Confidential Reaping the Demographic Dividend Ratio of working age population / dependency ratio has a direct link with income growth and there by growth in consumption India's working age population will overtake China's in 20 years Source: US Census Bureau, CIA India China United States 2014 2030 2014 2030 2014 2030 812 988 Working age population (million) 993 941 211 219 India's ratio will improve for the next 20 years whilst that for China and United States is deteriorating 5 Working age population ratio India China United States 2014 2030 2014 2030 2014 2030 67.4% 65.7% 65.0% 73.3% 60.7% 66.1% Demographics

- 6. Information Classification: UTI AMC - Confidential Information Classification: UTI AMC - Confidential In India, Income distribution is evolving as Affluence Rises Sources: BCG CCI proprietary income database; BCG analysis. 6 2010 INDIAN HOUSEHOLDS, BY INCOME (IN CRORES) Annual gross Household income Elite (> Rs. 20 lakhs) Affluent (Rs. 10 to Rs. 20 lakhs) Aspirers (Rs. 5 to Rs. 10 lakhs) Next Billion (Rs. 1.5 to Rs. 5 lakhs) Strugglers (< Rs. 1.5 lakhs) 69 (25%) 76 (28%) 102 (37%) 20 (7%) 8 (3%) 62 (20%) 55 (18%) 139 (46%) 33 (11%) 16 (6%) 2018 2025 102 (42%) 91 (38%) 1 (0.5%) 3 (1.5%) 43 (18%) From 2018 through 2025, the share of Aspirers and Next Billion households will increase from 65% to 72% of the total while the share of strugglers will drop from 25% to 20%. Demographics

- 7. Information Classification: UTI AMC - Confidential Information Classification: UTI AMC - Confidential Shampoos 0% 20% 40% 60% 80% 100% 120% 0% 20% 40% Laundry Detergents 0% 20% 40% 60% 80% 100% 120% 0% 20% 40% Toothpaste 0% 20% 40% 60% 80% 100% 120% 0% 20% 40% Chocolates 0% 20% 40% 60% 80% 100% 120% 0% 20% 40% Noodles 0% 20% 40% 60% 80% 100% 120% 0% 20% 40% Skin Care 0% 20% 40% 60% 80% 100% 120% 0% 20% 40% Rapid growth in Penetration to kick-in 7 Per capita consumption of India as % of EM average Penetration (%) FMCG Market Scalability Data as of CY 2016, Source: Kotak Research Durables & Automobile Data as of FY 2017, Source: Investec Research 33 6 13 5 5 - 5 10 15 20 25 30 35 Refrigerator AC Washing Mac Mircowave 4W HH Penetration (%) 8.6 3.5 4.0 1.0 2.3 0 2 4 6 8 10 Refrigerator AC Washing Mac Mircowave 4W Units/ 1000 people FMCG – Fast Moving Consumer Goods, EM Average – Emerging Markets Average, HH – House Hold

- 8. Information Classification: UTI AMC - Confidential Information Classification: UTI AMC - Confidential Premiumization trend to pick pace further Source: Citi Research, Euromonitor – Data as of FY 2017, Market Growth 2003-17 (CAGR %): Actuals , Market Growth 2017-21 (CAGR %): Estimate Size of bubble = market size, CAGR: Compounded Annualised Growth Rate Rising income levels and improving lifestyle created potential for nascent categories in consumption products 8 Packaged Foods Beauty and Personal Care Bar Soap Body Wash/Shower Gel Colour Cosmetics Fragrances Shampoos Men's Shaving Toothpaste Skin Care 0% 2% 4% 6% 8% 10% 12% 14% 16% 0% 5% 10% 15% 20% 25% Market Growth 2017-21 (CAGR %) Market Growth 2003-17 (CAGR %) Cheese Yoghurt and Sour Milk Products Olive Oil Ice Cream and Frozen Desserts Noodles Salty Snacks Sweet Biscuits Butter and Margarine Breakfast Cereals 0% 5% 10% 15% 20% 25% 30% 35% 0% 10% 20% 30% Market Growth 2017-21 (CAGR %) Market Growth 2003-17 (CAGR %) Market Scalability

- 9. Information Classification: UTI AMC - Confidential Information Classification: UTI AMC - Confidential Shift to Organized : Ready for the paradigm shift Increase in disposable income Higher tax compliance post GST 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Share of market (%) Share of Unorganised in sector 9 Deepening media penetration in rural Increasing choice with entry of new brands Key factors steering the shift of unorganised to organized market: Data as of CY 2016, Source: Kotak Research Market Scalability GST : Goods and Services Tax

- 10. Information Classification: UTI AMC - Confidential Information Classification: UTI AMC - Confidential Rural consumption mimicking urban driven by income growth, aspirations & deepening distribution 10 Source: Dabur India Investor Presentation, IBEF Rural to Rurban Source: World Bank Data (Estimate) Rural Contribution to Sectors Rural Population as % of Total Population 50% 45% 36% 30% 70.1 69.8 69.4 69.1 68.7 68.4 68.0 67.6 67.3 66.9 66.5 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Rural Landscape – Set to witness a sea change

- 11. Information Classification: UTI AMC - Confidential Information Classification: UTI AMC - Confidential Rural – Urban Split of FMCG Market FY 2017-18 Rural vs. Urban Sales Source: Citi Research, IBEF Accelerated sales from rural India expected to increase, primarily on account of increase in rural income and focus of FMCG companies to improve rural distribution Changing Face of Rural India 11 Source: IBEF Rural to Rurban

- 12. Information Classification: UTI AMC - Confidential Information Classification: UTI AMC - Confidential Road to increased consumption and shift in spending 12 India has low mortgage to GDP ratio Revival in Personal Loan growth has kicked off 10 18 20 31 34 38 40 45 52 56 67 88 Mortgage to GDP ratio (%) March fiscal year-end, 2017 Personal Loan % of GDP Source: Company, Kotak Institutional Equities Source: HDFC, European mortgage federation, Hofinet, Kotak Institutional Equities 4.2 4.4 4.4 4.5 4.7 5.0 5.6 Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Credit Availability

- 13. Information Classification: UTI AMC - Confidential Information Classification: UTI AMC - Confidential Summary: Drivers of Consumption Growth 13 Credit Availability Increase in proportion of working age population to drive GDP / Income growth which would drive consumption Consumption economy would expand driven by penetration, per capita consumption, premiumization & formalization Rural consumption would mimic urban trends driven by income growth, aspirations & deepening distribution Household consumption could increase with the support of retail finance

- 14. Information Classification: UTI AMC - Confidential Information Classification: UTI AMC - Confidential Product Spectrum on Risk v/s Return Grid (Active Funds) 14 UTI LTEF (Tax Saving) – UTI Long Term Equity Fund (Tax Saving); UTI B&FS Fund – UTI Banking & Financial Services Fund; UTI T&L Fund – UTI Transportation & Logistics Fund The above representation is only for understanding purpose, one should not constitute portfolio only based on the above and advised to approach their financial advisors based on the investors respective risk profile before making investment decisions. UTI Value Opportunities Fund UTI Mastershare Unit Scheme UTI LTEF (Tax Saving) UTI Flexi Cap Fund UTI Mid Cap Fund UTI Dividend Yield Fund UTI MNC Fund UTI Small Cap Fund UTI India Consumer Fund UTI T&L Fund UTI Healthcare Fund UTI B&FS Fund UTI Infrastructure Fund CORE ALLOCATION CORE SATELLITE ALLOCATION TACTICAL ALLOCATION RISK / STANDARD DEVIATION RETURN POTENTIAL UTI Core Equity Fund UTI Focused Equity Fund

- 15. Information Classification: UTI AMC - Confidential Information Classification: UTI AMC - Confidential UTI India Consumer Fund: A wide sphere of investment opportunity SECTORS INFLUENCED BY LIFESTYLE CHOICE Retail Financial Services Automobiles Consumer Goods Healthcare & Pharma Media & Entertainment Telecom 2W and Cars, Tyres, Batteries Mortgage, Insurance, Credit Cards, MFs FMCG, Consumer Durables, Retail, Apparel, Paints Hospital, Diagnostics, Equipment, Medical Insurance, Medicines & Drugs Multiplexes, Amusement Parks Telecom Services, Mobile App, 15

- 16. Information Classification: UTI AMC - Confidential Information Classification: UTI AMC - Confidential Overweight Sectors Underweight Sectors India Consumption Index offers a Unique Sector Composition Data as of March 31, 2022, Source: IISL Nifty India Consumption index has a differentiated sector allocation versus other diversified equity indices % Sectoral allocation INDICES SECTORAL WEIGHTAGE 16 Absent Nifty India Consumption Nifty 50 Nifty 500 58 16 8 10 6 10 5 2 2 3 3 13 19 36 11 5 2 2 3 4 4 9 15 29 0 10 20 30 40 50 60 70 CONSUMER GOODS AUTOMOBILE CONSUMER SERVICES TELECOM POWER PHARMA METALS OIL & GAS IT FINANCIAL SERVICES

- 17. Information Classification: UTI AMC - Confidential Information Classification: UTI AMC - Confidential Consumption Index has outperformed diversified portfolio 3 Years Rolling Returns Indices / Period Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 Mar-20 Mar-21 Mar-22 Nifty India Consumption TRI 24.18% 12.51% 16.54% 22.81% 17.24% 15.85% 12.86% 13.83% 1.89% 9.21% 13.40% Nifty 50 TRI 21.83% 3.91% 6.04% 18.50% 12.13% 12.38% 7.38% 16.10% -0.81% 14.58% 15.82% Data as of March 31, 2022, Source: IISL. CAGR – Compound Annual Growth Rate 17 ` 10,000/- invested on Jan-06 ` 74,920 ` 83,138 Nifty India Consumption TRI Index has given a CAGR of 13.92% where as Nifty 50 Index TRI has given a CAGR of 13.19% Jan-2006 Aug-2006 Mar-2007 Oct-2007 May-2008 Dec-2008 Jul-2009 Feb-2010 Sep-2010 Apr-2011 Nov-2011 Jun-2012 Jan-2013 Aug-2013 Mar-2014 Oct-2014 May-2015 Dec-2015 Jul-2016 Feb-2017 Sep-2017 Apr-2018 Nov-2018 Jun-2019 Jan-2020 Aug-2020 Mar-2021 Oct-2021 Nifty 50 TRI Nifty India Consumption TRI

- 18. Information Classification: UTI AMC - Confidential Information Classification: UTI AMC - Confidential Investment Strategy Emphasis on companies with longevity of growth while generating sustainable cash flows 1 2 3 4 5 Companies likely to benefit from the growth of consumption through bottom-up stock-picking High active weights with a market cap agnostic approach Universe of companies with B2C focus across sectors 18

- 19. Information Classification: UTI AMC - Confidential Information Classification: UTI AMC - Confidential UTI India Consumer Fund – Fund Facts An open ended equity scheme following the theme of changing consumer aspirations, changing lifestyle and growth of consumption Type of scheme Fund Inception Fund Manager Benchmark ` 5,000/- and in multiples of ` 1/- Subsequent min. investment, ` 1,000/- and in multiples of ` 1/- Minimum Investment Investment Objective The objective of the scheme is to generate long term capital appreciation by investing predominantly in companies that are expected to benefit from the growth of consumption, changing demographics, consumer aspirations and lifestyle. However, there can be no assurance or guarantee that the investment objective of the scheme would be achieved. #The fund may invest up to 50% of its debt portfolio in securitized debt. Asset Allocation Instruments Indicative Allocation (% of total assets) Risk Profile Minimum Allocation (%) Maximum Allocation (%) Equity and equity related instruments (minimum 80% of the total assets would be in equity and equity related instruments of companies related to the theme of Indian Lifestyle & are part of benchmark sectors) 80 100 Medium to High Debt and Money Market instruments including securitized debt# 0 20 Low to Medium Units issued by REITs & InvITs 0 10 Medium to High 19 Mr. Vishal Chopda, CFA, BE, PGDM (Managing since Feb 2018) Nifty India Consumption TRI 30th July, 2007

- 20. Information Classification: UTI AMC - Confidential Information Classification: UTI AMC - Confidential Fund Size: Monthly Avg. AuM : ` 366 Crores Last Day AuM : ` 379 Crores No. of Unit Folios : 48,292 Fund Snapshot Fund Facts (contd.) 37 No. of Stocks 30.40% / 48.14% Top 5 / Top10 Stocks 91.79% Top 5 Sectors 38.33% Outside Benchmark Fund BM Beta : 0.92 1.00 SD (3 Years) : 18.68% 19.54% PTR (Annual) : 27% - Sharpe Ratio : 0.52 - OCF C1 : 95% C2 : 4% C3 : 1% ROCE R1 : 75% R2 : 9% R3 : 16% Portfolio Composition# Market Capitalisation (%) Fund BM Large : 70 91 Mid : 14 9 Small : 16 0 Quantitative Indicators Active Share : 48.24% Nifty India Consumption TRI UTI India Consumer Fund 20 Price to Earnings Price to Book Return on Equity Avg. AuM – Average Asset under Management, SD – Standard Deviation, PTR – Portfolio Turnover Ratio, Market cap – Market Capitalisation, ROCE – Return on Capital Employed. #Operating Cash Flow Tiers (C)- 3 Tiers based on the number of years in which they have generated positive operating cash flows in the previous 5 years (for manufacturing companies). RoCE/ Implied RoE Tiers (R) - 3 Tiers based on the previous 5 year average return on capital (for manufacturing companies & non-lending non banking finance companies (NBFCs)) & based on the previous 5 year average return on asset for banks & NBFCs (including housing finance companies). All data are as of March 31, 2022 15.98 16.23 52.66 52.55 21.20 20.55

- 21. Information Classification: UTI AMC - Confidential Information Classification: UTI AMC - Confidential Portfolio Equity Top 20 Holdings STOCK NAME SECTOR % to NAV Act. Wt % BHARTI AIRTEL LTD. TELECOM 7.13 -2.95 MARUTI SUZUKI INDIA LTD. AUTOMOBILE 6.73 1.05 ASIAN PAINTS (INDIA) LTD. CONSUMER GOODS 6.57 -1.28 ITC LTD. CONSUMER GOODS 5.82 -3.79 HINDUSTAN UNILEVER LTD CONSUMER GOODS 4.15 -6.08 NESTLE INDIA LTD. CONSUMER GOODS 3.89 0.39 AVENUE SUPERMARTS LTD. CONSUMER SERVICES 3.89 0.52 GODREJ CONSUMER PRODUCTS CONSUMER GOODS 3.38 1.78 METRO BRANDS LTD CONSUMER GOODS 3.30 3.30 TITAN COMPANY LTD. CONSUMER GOODS 3.28 -2.70 DABUR INDIA LTD. CONSUMER GOODS 2.89 1.12 EICHER MOTORS LTD AUTOMOBILE 2.78 0.84 MARICO LTD CONSUMER GOODS 2.72 1.25 A B FASHION & RETAIL CONSUMER SERVICES 2.53 2.53 ICICI BANK LTD FINANCIAL SERVICES 2.52 2.52 JUBILANT FOODWORKS LTD. CONSUMER SERVICES 2.50 1.36 C. G. CONSUMER ELECTRICALS CONSUMER GOODS 2.47 1.21 HDFC BANK LIMITED FINANCIAL SERVICES 2.46 2.46 UNITED BREWERIES LTD. CONSUMER GOODS 2.41 2.41 FSN E-COMM VENT (NYKAA) CONSUMER SERVICES 2.21 2.21 Top 10 Unique Stocks (As compared to Benchmark) STOCK NAME SECTOR % to NAV METRO BRANDS LTD CONSUMER GOODS 3.30 A B FASHION & RETAIL CONSUMER SERVICES 2.53 ICICI BANK LTD FINANCIAL SERVICES 2.52 HDFC BANK LIMITED FINANCIAL SERVICES 2.46 UNITED BREWERIES LTD. CONSUMER GOODS 2.41 FSN E-COMM VENT (NYKAA) CONSUMER SERVICES 2.21 SHEELA FOAM LTD. CONSUMER GOODS 2.21 PHOENIX MILLS LTD CONSTRUCTION 2.08 BAJAJ FINANCE LTD. FINANCIAL SERVICES 1.96 V-MART RETAIL LTD CONSUMER SERVICES 1.61 OTHERS 15.04 TOTAL 38.33 Portfolio above shows Top 20 equity holdings under the scheme, for detailed portfolio visit www.utimf.com Act. Wt % - Active Weight % (as compared to the Benchmark Index – Nifty India Consumption TRI) Data as of March 31, 2022 21

- 22. Information Classification: UTI AMC - Confidential Information Classification: UTI AMC - Confidential Portfolio Snapshot Active Stock Position (As compared to Benchmark) Sectoral Breakdown (%) (As compared to Benchmark) Overweight (Top 5) Underweight (Top 5) Data as of March 31, 2022 22 STOCK NAME SECTOR % to NAV Act. Wt % METRO BRANDS LTD CONSUMER GOODS 3.30 3.30 AB FASHION & RETAIL CONSUMER SERVICES 2.53 2.53 ICICI BANK LTD FINANCIAL SERVICES 2.52 2.52 HDFC BANK LIMITED FINANCIAL SERVICES 2.46 2.46 UNITED BREWERIES LTD. CONSUMER GOODS 2.41 2.41 STOCK NAME SECTOR % to NAV Act. Wt % HINDUSTAN UNILEVER LTD CONSUMER GOODS 4.15 6.08 MAHINDRA & MAHINDRA AUTOMOBILE - 4.36 ITC LTD. CONSUMER GOODS 5.82 3.79 ADANI TRANSMISSION LTD. POWER - 3.68 BHARTI AIRTEL LTD. TELECOM 7.13 2.95 Active Weight 0.0 0.0 0.9 1.3 1.7 2.0 7.9 8.1 10.7 16.1 49.0 -1.5 -6.0 0.9 -1.3 0.3 2.0 7.9 -2.0 -5.6 8.0 -4.9 0 20 40 60 80 100 120 MEDIA,ENTERTAINMENT&PUBLI CATION POWER INDUSTRIAL MANUFACTURING HEALTHCARE SERVICES TEXTILES CONSTRUCTION FINANCIAL SERVICES TELECOM AUTOMOBILE CONSUMER SERVICES CONSUMER GOODS UTI - India Consumer Fund

- 23. Information Classification: UTI AMC - Confidential Information Classification: UTI AMC - Confidential Portfolio Commentary BPC – Beauty and Personal Care, QSR – Quick Service Restaurant, FMCG – Fast Moving Consumer Goods, IPO – Initial Public Offering Consumer Goods/Services: The Fund is overweight in Consumer Discretionary and underweight in Consumer Staples. The Fund expects discretionary to outperform staples over the medium to long term given low penetration levels in most discretionary categories. The Fund added weight in a recently listed largest BPC ecommerce platform, a leading QSR player and a leading grocery retailer after correction. The Fund exited a small cap alcobev company due to capital allocation concerns and added weight in a leading FMCG company with presence across multiple emerging markets available at favorable valuations. Telecom: The Fund remains positive on Telecom as the sector has seen consolidation and it is expected to see improvement in return ratios and cash flows with tariff hikes. 23 Automobile: The Automobile sector has started seeing recovery in demand post Covid last year, but has again seen an impact due to semi conductor shortages and commodity inflation. The Fund expects the sector demand to recover but profitability recovery might get delayed by a few quarters due to input cost pressures. The Fund has added weight to two passenger vehicle companies in the sector which saw sharp corrections due to geopolitical issues and commodity inflation. The Fund will look to further add weight in the sector as we expect a cyclical recovery in the sector. The Fund has been selective in participating in IPOs which have significantly increased over the past 12 months. The Fund participated in new age businesses with strong consumer value proposition and unit economics which could lead to good profitability in the medium term. In traditional businesses, the focus remains on the growth outlook and return ratios.

- 24. Information Classification: UTI AMC - Confidential Information Classification: UTI AMC - Confidential Rolling Return Analysis 24 Rolling Returns with daily frequency of UTI India Consumer Fund at difference time frame as mentioned above. CAGR – Compounded Annual Growth Rate. Data period: July 30, 2007 to March 31, 2022. Different plans have a different expense structure. The performance details provided herein are of regular plan. Past performance may or may not be sustained in future. Rolling Returns of UTI India Consumer Fund Median Rolling Returns (CAGR) Instances of -ve Returns Over 8% 24.0% 1.2% 0.1% 59.9% 74.3% 79.0% 0% 96.0% -50% -3% 0% 7% 93% 32% 24% 17% -70% -50% -30% -10% 10% 30% 50% 70% 90% 110% 1 Year 3 Years 5 Years 10 Years Lowest Highest Median 12% 11% 12% 11%

- 25. Information Classification: UTI AMC - Confidential Information Classification: UTI AMC - Confidential B - Benchmark, AB - Additional Benchmark, TRI - Total Return Index Past performance may or may not be sustained in future. Different plans shall have a different expense structure. The performance details provided herein are of regular plan (growth option). Returns greater than 1 year period are Compound Annual Growth Rate (CAGR). Inception of UTI India Consumer Fund : July 30th, 2007. Date of allotment in the scheme/plan has been considered for inception date. The Scheme is currently managed by Mr. Vishal Chopda since Feb-2018. Period for which scheme’s performance has been provided is computed basis last day of the month-end preceding the date of advertisement. Performance Track Record UTI India Consumer Fund Performance Vs Benchmark as of 31/03/2022 Period Fund Performance Vs Benchmark Growth of ` 10,000/- Scheme Returns (%) B: Nifty India Consumption TRI (%) AB: Nifty 50 TRI (%) Scheme Returns (`) B: Nifty India Consumption TRI (`) AB: Nifty 50 TRI (`) 1 Year 17.33 16.04 20.26 11,733 11,604 12,026 3 Years 13.61 13.42 15.86 14,669 14,595 15,559 5 Years 10.66 12.64 15.14 16,599 18,139 20,244 Since Inception 9.39 12.64 11.07 37,340 57,388 46,702 25 Fund – UTI India Consumer Fund Benchmark – Nifty India Consumption TRI This product is suitable for investors who are seeking*: • Long term capital growth • Investment in equity instruments of companies that are expected to benefit from the changing consumer aspirations, changing lifestyle and growth of consumption * Investors should consult their financial advisers if in doubt about whether the product is suitable for them #Risk-o-meter for the fund is based on the portfolio ending March 31, 2022. The Risk-o-meter of the fund/s is/are evaluated on monthly basis and any changes to Risk-o-meter are disclosed vide addendum on monthly basis, to view the latest addendum on Risk-o-meter, please visit addenda section on https://utimf.com/forms-and-downloads/

- 26. Information Classification: UTI AMC - Confidential Information Classification: UTI AMC - Confidential Performance Track Record (contd.) Performance of other open-ended schemes managed by the Fund Manager Mr. Vishal Chopda Scheme Inception Date Managing the Fund Since Benchmark 1 Year (%) 3 Years (%) 5 Years (%) Fund Benchmark Fund Benchmark Fund Benchmark UTI LTEF (Tax Saving) 15-Dec-99 Aug-19 Nifty 500 TRI 18.92 22.29 17.03 16.78 13.16 14.55 UTI CCF – Savings Plan 12-July-93 Aug-19 CRISIL Short Term Debt Hybrid 60+40 12.71 11.54 9.33 11.98 7.53 10.86 UTI CCF – Investment Plan 30-Jan-08 Aug-19 Nifty 500 TRI 18.56 22.29 15.75 16.78 13.02 14.55 26 Mr. Vishal Chopda manages 4 open-ended schemes of UTI Mutual Fund. a. Period for which scheme’s performance has been provided is computed basis last day of the month-end preceding the date of advertisement. b. Different plans shall have a different expense structure. The performance details provided herein are of Growth Option (Regular Plan). c. Date of allotment in the scheme/plan has been considered for inception date.

- 27. Information Classification: UTI AMC - Confidential Information Classification: UTI AMC - Confidential Why Invest in UTI India Consumer Fund? An equity fund that primarily focus on India’s rising aspirations ― Sweet spot of dependency ratio & expected income acceleration played via consumption theme ― Endeavors to capture the potential growth from the resultant demand uptick ― Market cap agnostic with high active weights makes it a focused play Suitable for: Suitable for those Investor with a higher risk appetite willing to benefit from the growth of consumption, changing demographics, consumer aspirations and lifestyle Regular investors willing to have a tactical allocation to their overall equity portfolio. 27

- 28. Information Classification: UTI AMC - Confidential Information Classification: UTI AMC - Confidential Name of the Scheme This product is suitable for investors who are seeking* Riskometer UTI Mastershare Unit Scheme (Large Cap Fund- An open ended equity scheme predominantly investing in large cap stocks) • Long term capital appreciation • Investment predominantly in equity instruments of large cap companies UTI Core Equity Fund (Large & Mid Cap Fund- An open ended equity scheme investing in both large cap and mid cap stocks) • Long term capital appreciation • Investment predominantly in equity instruments of both large cap and mid cap companies UTI Mid Cap Fund (Mid Cap Fund- An open ended equity scheme predominantly investing in mid cap stocks) • Long term capital appreciation • Investment predominantly in mid cap companies UTI Value Opportunities Fund (An open ended equity scheme following a value investment strategy) • Long term capital appreciation • Investment in equity instruments following a value investment strategy across the market capitalization spectrum UTI Flexi Cap Fund (Flexi Cap Fund- An open ended dynamic equity scheme investing across large cap, mid cap, small cap stocks) • Long term capital appreciation • Investment in equity instruments of companies with good growth prospects across the market capitalization spectrum UTI Small Cap Fund Small Cap Fund - An open ended equity scheme predominantly investing in small cap stocks • Long term capital appreciation • Investment predominantly in equity and equity related securities of small cap companies UTI Dividend Yield Fund (An open ended equity scheme predominantly investing in dividend yielding stocks) • Long term capital appreciation • Investment predominantly in dividend yielding equity and equity related securities UTI Focused Equity Fund (Focused Fund- An open ended equity scheme investing in maximum 30 stocks across market caps) • Long term capital growth • Investment in equity and equity related securities across market capitalisation in maximum 30 stocks *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. Product Label #Risk-o-meter for the fund is based on the portfolio ending March 31, 2022. The Risk-o-meter of the fund/s is/are evaluated on monthly basis and any changes to Risk-o-meter are disclosed vide addendum on monthly basis, to view the latest addendum on Risk-o-meter, please visit addenda section on https://utimf.com/forms-and-downloads/

- 29. Information Classification: UTI AMC - Confidential Information Classification: UTI AMC - Confidential Name of the Scheme This product is suitable for investors who are seeking* Riskometer UTI Infrastructure Fund (An open ended equity scheme following the Infrastructure theme) • Long term capital appreciation • Investment predominantly in equity and equity related securities of companies forming part of the infrastructure sector UTI MNC Fund (An open ended equity following the theme of investing predominantly in equity and equity related securities of Multi-National Companies) • Long term capital appreciation • Investment predominantly in equity and equity related securities of Multi-National companies UTI India Consumer Fund (An open ended equity scheme following the theme of changing consumer aspirations, changing lifestyle and growth of consumption) • Long term capital growth • Investment in equity instruments of companies that are expected to benefit from of the changing consumer aspirations, changing lifestyle and growth of consumption UTI Banking and Financial Services Fund (An open ended equity scheme investing in Banking and Financial Services Sector) • Long term capital appreciation • Investment predominantly in equity and equity related securities of companies engaged in banking and financial services activities. UTI Healthcare Fund (An open ended equity scheme investing in the Healthcare Services Sector) • Long term capital appreciation • Investment predominantly in equity and equity related securities in the Healthcare Services sector. UTI Transportation and Logistics Fund (An open ended equity scheme investing in transportation and logistics sector) • Long term capital appreciation • Investment predominantly in equity and equity related securities of the companies engaged in the transportation and logistics sector UTI Long Term Equity Fund (Tax Saving) (An open ended equity linked saving scheme with a statutory lock in of 3 years and tax benefit) • Long term capital growth • Investment in equity instruments of companies that are believed to have growth potential Product Label *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. #Risk-o-meter for the fund is based on the portfolio ending March 31, 2022. The Risk-o-meter of the fund/s is/are evaluated on monthly basis and any changes to Risk-o-meter are disclosed vide addendum on monthly basis, to view the latest addendum on Risk-o-meter, please visit addenda section on https://utimf.com/forms-and-downloads/

- 30. Information Classification: UTI AMC - Confidential Information Classification: UTI AMC - Confidential Thank You The information contained in this document is for general purposes only and is not an offer to sell or a solicitation to buy/ sell any mutual fund units / securities. The information / data here in alone are not sufficient and should not be used for the development or implementation of an investment strategy. The same should not be construed as investment advice to any party. REGISTERED OFFICE: UTI Tower, ‘Gn’ Block, Bandra Kurla Complex, Bandra (E), Mumbai - 400051. Phone: 022 – 66786666. UTI Asset Management Company Ltd (Investment Manager for UTI Mutual Fund) Email: invest@uti.co.in . (CIN-L65991MH2002PLC137867). For more information, please contact the nearest UTI Financial Centre or your AMFI/NISM certified Mutual Fund Distributor (MFD) for a copy of the Statement of Additional Information, Scheme Information Document and Key Information Memorandum cum Application Form. Disclaimers: The information on this document is provided for information purposes only. It does not constitute any offer, recommendation or solicitation to any person to enter into any transaction or adopt any hedging, trading or investment strategy, nor does it constitute any prediction of likely future movements in rates or prices or any representation that any such future movements will not exceed those shown in any illustration. Users of this document should seek advice regarding the appropriateness of investing in any securities, financial instruments or investment strategies referred to on this document and should understand that statements regarding future prospects may not be realized. The recipient of this material is solely responsible for any action taken based on this material. Opinions, projections and estimates are subject to change without notice. UTI AMC Ltd is not an investment adviser, and is not purporting to provide you with investment, legal or tax advice. UTI AMC Ltd or UTI Mutual Fund (acting through UTI Trustee Company Pvt. Ltd) accepts no liability and will not be liable for any loss or damage arising directly or indirectly (including special, incidental or consequential loss or damage) from your use of this document, howsoever arising, and including any loss, damage or expense arising from, but not limited to, any defect, error, imperfection, fault, mistake or inaccuracy with this document, its contents or associated services, or due to any unavailability of the document or any part thereof or any contents or associated services. Mutual Fund Investments are subject to market risks, read all scheme related documents carefully.