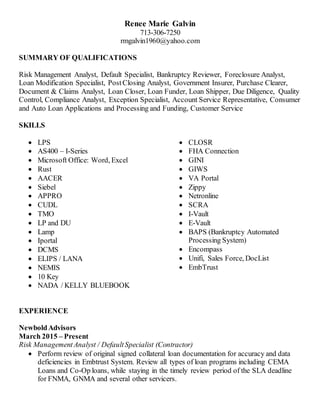

Renee Galvin's Resume for Risk Management and Compliance Roles

- 1. Renee Marie Galvin 713-306-7250 rmgalvin1960@yahoo.com SUMMARY OF QUALIFICATIONS Risk Management Analyst, Default Specialist, Bankruptcy Reviewer, Foreclosure Analyst, Loan Modification Specialist, PostClosing Analyst, Government Insurer, Purchase Clearer, Document & Claims Analyst, Loan Closer, Loan Funder, Loan Shipper, Due Diligence, Quality Control, Compliance Analyst, Exception Specialist, Account Service Representative, Consumer and Auto Loan Applications and Processing and Funding, Customer Service SKILLS LPS AS400 – I-Series Microsoft Office: Word, Excel Rust AACER Siebel APPRO CUDL TMO LP and DU Lamp Iportal DCMS ELIPS / LANA NEMIS 10 Key NADA / KELLY BLUEBOOK CLOSR FHA Connection GINI GIWS VA Portal Zippy Netronline SCRA I-Vault E-Vault BAPS (Bankruptcy Automated Processing System) Encompass Unifi, Sales Force, DocList EmbTrust EXPERIENCE NewboldAdvisors March 2015 – Present Risk ManagementAnalyst / DefaultSpecialist (Contractor) Perform review of original signed collateral loan documentation for accuracy and data deficiencies in Embtrust System. Review all types of loan programs including CEMA Loans and Co-Op loans, while staying in the timely review period of the SLA deadline for FNMA, GNMA and several other servicers.

- 2. Review of the accuracy of the legal documentation for proper execution of the documents and the correct data pertaining to correctproperty address, interest rates, loan amounts and monthly payments. Review of the final Title Policy for accuracy and verification of Schedule A and Schedule B have been obtained with correctinformation. Review of the Loan Modifications and Subordinations received for accuracy. Sited exceptions for Lender review. Entered exceptions in EmbTrust for followup of errors sited. Entered review date of documents received by several branches. Reviewed New Collateral files and Reinstatement Loans for requested corrected or missing documentation. Updated system for trailing documentation received by all branches and reviewed the documentation for correctness and accuracy. Assisted Management with training of new hires on Embtrust System and procedural operations. GreenKey Resourses December2014 – January 23, 2015 ComplianceAnalyst / HMDA Reviewer (Contractor) Analyzed and interpreted loan applications and related documentation gathered during the loan underwriting process to appropriately codefor HMDA reporting purposes. Reviewed loan application data and credit files on a daily basis for accuracy in reporting consistent with the requirements of the HMDA. Coordinated with various departments within the Bank to resolve any inconsistencies in loan data and recommends changes as warranted that will ensure the efficiency and accuracy in reporting of HMDA data. Maintained a good working knowledge of the requirements of the Home Mortgage Disclosure Act (HMDA) to assist in preparation and maintenance of the loan application register (LAR). Ensured the HMDA LAR is accurate within thirty calendar after the end of each calendar quarter Performed regulatory compliance reviews and restructuring with an in-depth focus in the areas of HMDA guidelines and regulations. The review involved in verifying specific data points on VA Purchase, Refinance IRRl and Home Equity Loans from the Loan Applications (LAR), TIL’s DU Findings, Loan Purpose, Loan Amount, Occupancy, Property Type, Lien Status, APR information, Data Action Taken, Government Monitoring Information (GMI). Worked alongside client to perform look-back reviews and controls and infrastructure reviews related to US Bank Secrecy Act requirements as required by multiple consent orders. Performed due diligence to ensure procedures were followed in accordanceto VA, FHA and Conventional loans meet HMDA, Fair Lending and Regulation C guidelines.

- 3. NewboldAdvisors February 2014 – September 2014 Post Closer Analyst /Bankruptcy& Foreclosure Reviewer /Government Insurer (Contractor) Responsible for Bankruptcy MFR validation, at the loan level, the proposedfinal draft of a Motion for Relief for accuracy before filing with the court. Reviewed and interpreted Chapter 7 and 13 plans for appropriate treatment and potential litigation Reviewed Court Dockets, (POC) Proofof Claim, (PNC) Payment Change notice and (MFR) Motion of Relief for filing approval Responsible for the protection of the Foreclosure review by adhering to Government Regulations and Investor requirements. Reviewed and researched problematic issue raise during the foreclosure process, analyze result of researched loans and writing summaries. Validated Security Instruments, Notes, Assignment of Mortgages, Pre-Foreclosure notice, Breach notice, and State statutory notice Audited closed loan files in preparation for delivery to investors or auditors, state or other regulatory agencies and/or for compliance requests Assembled loan documents and transmittals for final delivery to loan investors/agencies Identified trends and issues related to errors in the delivery of loans to investors and agencies Obtained missing documentation required to deliver files in compliance with investor/agency requirements from the company’s different brands, channels and clients Resolved investor post-closing findings by contacting title companies, brokers, lenders, borrowers, internal departments and other third parties as needed Assisted with data/documentation gathering for audits performed by internal/external auditors, quality control representatives or warehouse lenders Assisted in resolution of complex post-delivery issues Processed and cleared exception requests for both FHA and VA Loans and Conventional Loans. Clear exceptions in timely manner for purchase by 15 different Investors and Bond Agencies. I communicated with in house departments and management, appraisers, Title Companies, Investors and Bond Agencies, borrowers, sellers agents to retrieve missing conditions in preventing the purchase of our loans. Used multiple systems to find corrected documents and also communicate with various departments such as from underwriters, closers, title and escrow companies and borrowers by phone, email and Fed-X and UPS. Prepared a daily excel log spreadsheetlisting open exceptions to be cleared and also those already completed and closed and purchased. Inputted correctdata and make corrections thru FHA Connection and VA Portal to complete valid insurance applications Verified and reviewed Legal documents for accuracy, review corrected Hud-1 (settlement statements) for correct fees and charges to the borrower, contact Appraisers for required corrections to insure the loan or purchase the loan by investor. Reviewed documents to

- 4. insure GFE regulations, HMDA, SAFE Act, ECOA, Hazard and Flood Insurance coverage requirements, request for underwriter conditions, such as assets and income discrepancies in order to have loans purchased. Retrieve missing loan documentation from Title, Borrowers, Branches, Appraisers U.S. Small Business Administration February 2013 - July 2013 Loan Modification Specialist / Loan Officer Processed modification requests to increase or lower loan approvals due to insurance recoveries or disaster victims requests Verified insurance recoveries with insurance companies Re-verified repayment and credit Verified home ownership and occupancyto establish eligibility for Federal Disaster Relief Home Loan Reviewed and analyzed underwriting valid stipulations and approveall loans based on repayment and credit criteria Experience reviewing legal collateral documentation for residential loans including the Mortgage, Note, Modifications and Title Policies Quality Assurance experience consisted of data findings, HMDA, RESPA, reviewed Hud-1 (settlement statements), GFE regulations, ECOA Identified data deficiencies and exceptions between collateral documentation and mortgage servicing system data Collected client financial information and calculated / document all the income gathered Reviewed mortgage loan documentation for compliance with applicable laws, regulations and other guidelines and identified compliance errors Drafted loan authorization terms such as collateral and Hazard and Flood Insurance requirements Demonstrated excellent consultative, rapport-building and communication skills while delivering quality customer service for loan modification in a national call-center Other duties included: review of profit and loss statements, schedule of liabilities, utilities, rent, salaries, also review and analyze derogatory credit findings such as late payments, collections, charge offs and foreclosures Made final loan decision within 48 hours of receiving all required verification documents and communicating loan to borrower SolomonEdwards Group / Promontory FinancialGroup – November 2011 - January 2013

- 5. Documentand Claims Analyst – OCC PROJECT (Contractor) Reviewed foreclosure documents for compliance with all applicable State, Federal, HMDA and Local regulations and laws Determined if Claimant was financially harmed by bank practices in the foreclosure process, Bankruptcy, Loss Mitigation per the Office of Currency Comptroller per Foreclosure Consent Order Used multiple systems to find key documents and information pertaining to the foreclosure process Due to confidentiality agreement cannot elaborate in detail of specifics and responsibilities CO-OP Member Center Services November 2007 - November2011 Account Service Representative / Loan Representative Received high volume of incoming calls on a daily basis from over 400 different Credit Union members Assisted the member with all their financial needs this includes balance inquiries, transfer funds to and from specific accounts Provided correct updated Interest Rate information for all loan types and all investment options available Cross sold available loan products and investment products All information was found by navigating through each specific credit union’s template and the Credit Union’s website Obtained value of used vehicles by using Kelly Bluebook and NADA Book Received and completed new loan request by phone (signature loans, auto loans, credit card requests) Completed specific loan application for specific loan type thru Lending 360 and CUDL Systems and Appro Systems Reviewed credit findings and income information, decision loan and email or fax results to correct credit union to setup funding of loan request Received escalated calls from members with complaints and issues, able to diffuse the situation while handling situation in a professional manner Assisted management with training of new hires for job related duties Processed Mortgage Loan Applications for 1st and 2nd Mortgages, Home Equity Loans and HELOC’S requests accordancewith FNMA / FHLMC and lender guidelines, ECOA, GFE regulations, Hazard and Flood coverage requirements, HMDA Calculated closing costs fees, prepaid costs and reserves, PMI thru Loan Consultant applications Offered different loan programs and options for each applicant, discussed and answered any questions and concerns regarding estimated fees and current fixed and adjustable mortgage loan rates and all available loan programs.

- 6. Assisted in loan servicing issues regarding escrowdiscrepancies in regards to Tax and Hazard Insurance or shortages concerns for mortgage loans. Onboarded loans thru Lending 360. Entered all vital personal data information of the applicants. Calculated income, reviewed assets and liabilities Reviewed credit reports thru Appro System and CUDL Systems Imported all information received to correct Client for final decision and funding Clayton Group/ PCI June 2005 – July 2007 Due Diligence / Post PurchaseReviewer / ComplianceReviewer (Contractor) Clients included: Saxon Mortgage, Wilmington Mortgage, HSBC Mortgage Services, Aurora Loan Services Reviewed Conventional purchase property and refinances, FHA, VA, Purchase Money Seconds, HE Loans and HELOC’S, Loan Modifications and Loss Mitigations, HAMP, HARP Short Sales, Deed of Lieu for all states in accordancewith MERS, FNMA / FHLMC Guidelines, HMDA regulations Performed Due Diligence on closed mortgage loan files to assure document compliance with regulatory guidelines with MERS, FNMA / FHLMC, ECOA, Determined that all documentation required by underwriting was enclosed in each file reviewed while maintaining quality and quantity standards Reviewed all legal documents such as Note, Mortgage (Deed of Trust), ROR, HUD-1, Hazard and Flood Insurance coverage requirements, Title Commitments and RESPA Disclosures for completeness and accuracy Completed High CostScreen Test for Initial TIL and GFE regulations Applied credit exceptions, compensating factors, grading of loans, cleared stipulations Worked with TMO System to input all accurate data information, and standard desktop applications for daily reports and communication with in-house departments and investors Created spreadsheets thru Excel for activity daily on each file reviewed Multi tasked high volume of phone calls Compiled daily data report thru Excel Assisted management in training new contractors with Quality Control functions for accuracy and job related functions Interacted with Underwriting, Funding and other in house departments including Title / Escrow Companies, Brokers and Borrowers to obtain corrected or missing documentation for timely purchase Reviewed Final HUD's for accuracy of fees including PMI and other escrow fees Worked with DataTrac System to input and review all activity done on a daily basis with each loan file

- 7. Operated standard desktop applications for daily reports and communication with in- house departments and investors Loan Shipper / Government Insurer: Responsibility included training of new hires for the preparation and accuracy of delivery to each investor Organized and prepared FHA / VA, Texas Veteran and Conventional loan files to each investor on a timely manner and to meet all deadlines for individual investors and bulk sales Organized and prepared case binders to FHA / VA, Texas Veteran to insure government loans Requested missing documentation from all entities Wells Fargo Home Mortgage September 2002 - May 2004 Loan Closer / Loan Funder (Contractor) Loan Funder: Reviewed LP / DU findings, reviewed appraisal report, title commitment, 1003 / 1008, analyzed bank statements / VOD’s and paystubs and VOE’s for completeness and accuracy Sent out loan approvals to individual brokers, and cleared conditions received for loan closings and funding Reviewed and approved HUD-1’s (settlement statements) and Title Commitments. Followed up on collateral loan packages, Hazard and Flood coverage requirements Loan Funder / Closer: Maintained a daily reports thru Excel of loans reaching expiration and prioritizing the information efficiently Prepared loan closing documents for all states in accordancewith MERS, FNMA / FHLMC Guidelines, GFE regulations Knowledge of Conventional, FHA, VA, Texas Veteran Loans, Purchase Money Seconds and HE Loans, HELOC'S Maintained high volume of phone calls with escrow, title and brokers while providing excellence in customer service; communicating effectively with accountexecutives throughout the loan process Handled incoming calls, emails and outbound communication for outstanding conditions needed from all sources Audit responsibilities included: working with the underwriters to meet prior to funding conditions, accurate vesting of title, flood certification information, appraisal report completeness, adequate insurance coverage, verification of gift funds / receipt of proceeds from an existing property sale Funding loan via wire into escrow, boarding it through LPS and shipping it to the appropriate servicing center StewartMortgage Information April 2000 - September 2002

- 8. ComplianceAnalyst / Loan Shipper / Government Insurer Compliance Analyst: Performed quality controlaudit on special project loans given by our clients while following MERS, FNMA / FHLMC and lender guidelines, GFE regulations, ECOA, Hazard and Flood coverage requirements Ensured accuracy of all loan file documentation Knowledge of Conventional, FHA, VA, Texas Veteran Loans, Purchase Money Seconds and HE Loans, HELOC'S, Modifications Reviewed included all areas of closing, processing and underwriting. Revised daily reports for the clients of inconsistencies found on the audits performed Insuring Specialist: Prepared FHA / VA case binders from clients to insure their files in a timely manner Also communicated with HUD Agencies to clear deficiency items, to insure outstanding uninsurable loan products Loan Shipper: Organized and prepared FHA / VA and Conventional loan files to each investor on a timely basis for our clients Purchase Clearing Specialist: Resolved incoming suspenseitems from investors for timely purchase, while also meeting all deadlines Interacted with clients, brokers, title companies, and borrowers by incoming phone calls, emails and outbound communication to resolve exceptions Education WestminsterHigh School HighSchool Diploma ResidentialMortgageCoursework (completed atvariousinstitutions) Fair Lending Act, Fair Credit Report Act, Anti Money Laundering, GFE regulations and RESPA guidelines References - Upon request