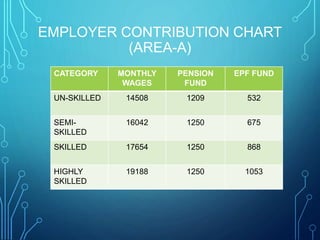

This document provides information about welfare facilities and social security measures for contract workers at NHPC Limited. It summarizes NHPC's operations and details the Employees' Provident Fund (EPF), Pension Scheme, and Employees' Deposit Linked Insurance (EDLI) that contract workers are entitled to. The EPF, Pension Scheme, and EDLI provide benefits like monthly contributions, pensions, insurance payouts, loans, and more. The document also discusses the Employees' Compensation Act and provides compensation amounts for injuries sustained on the job.