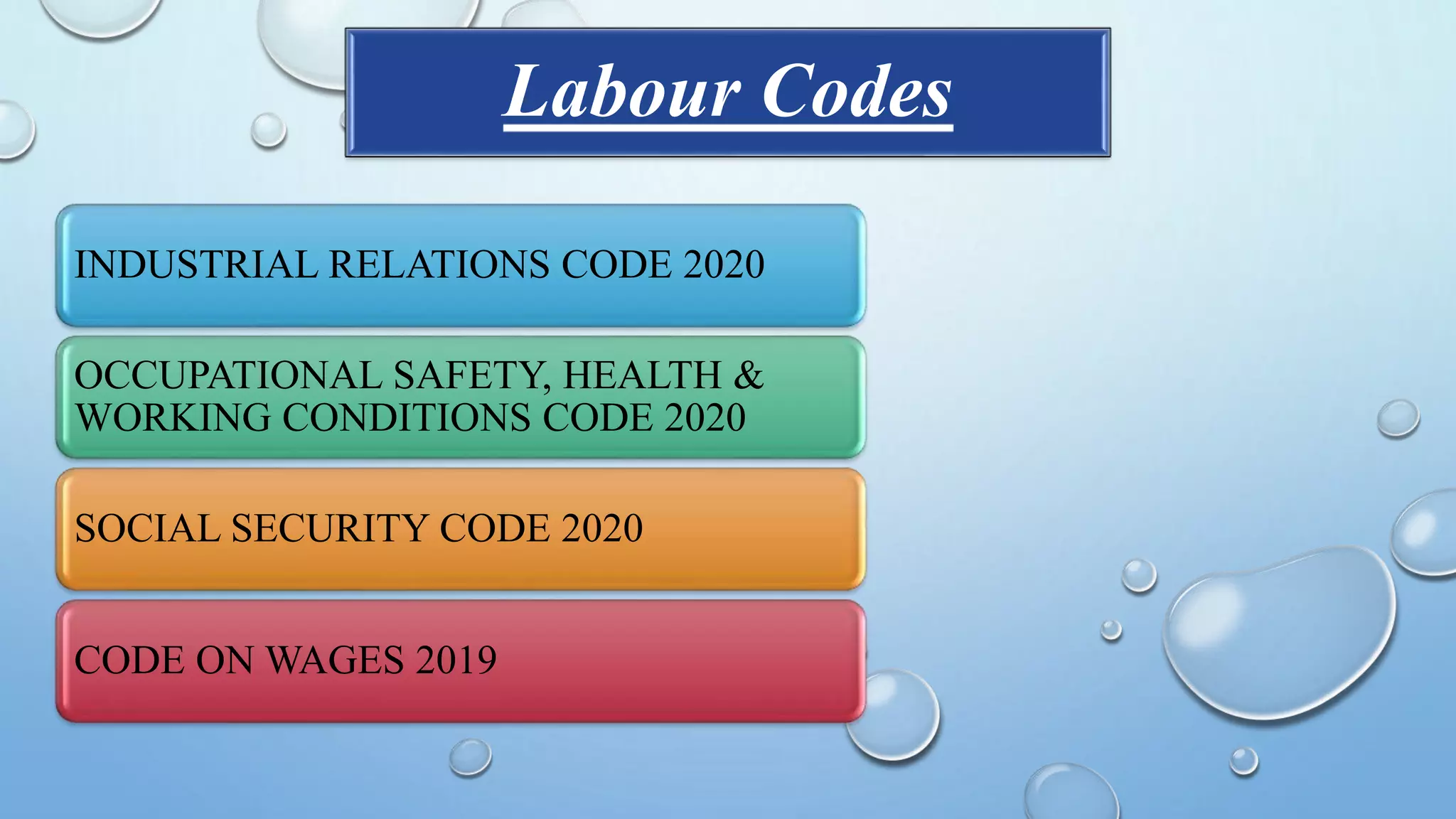

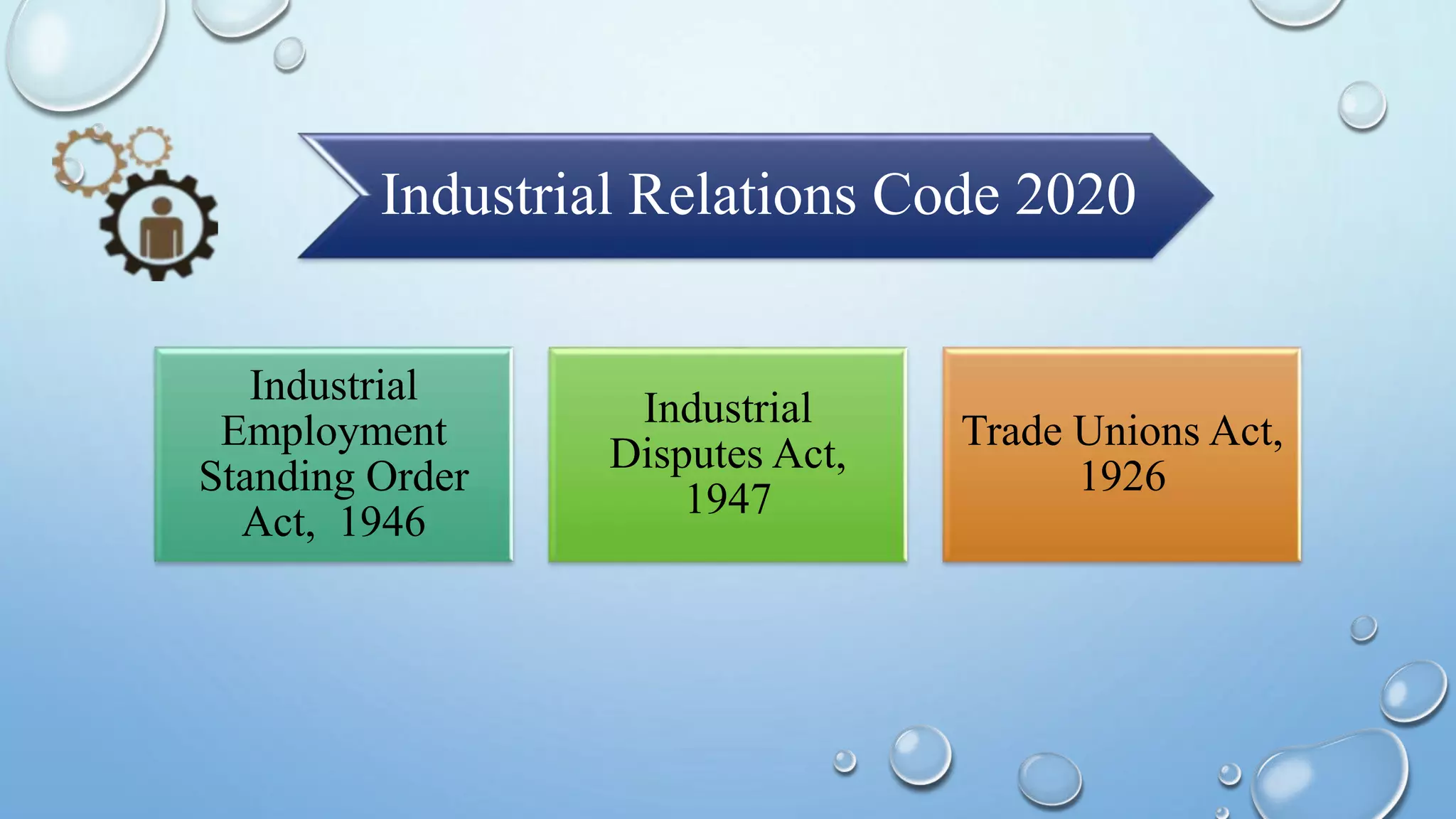

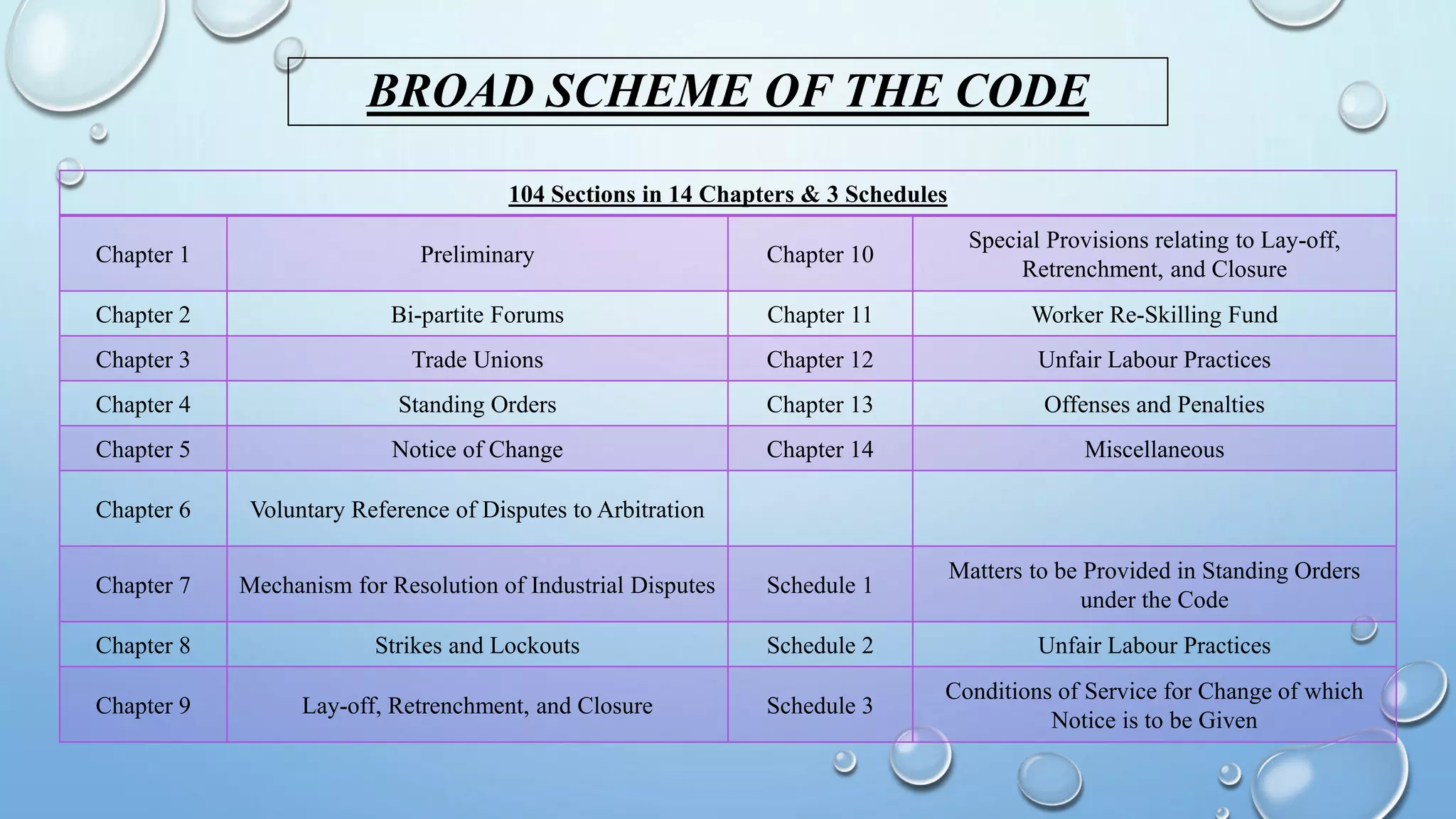

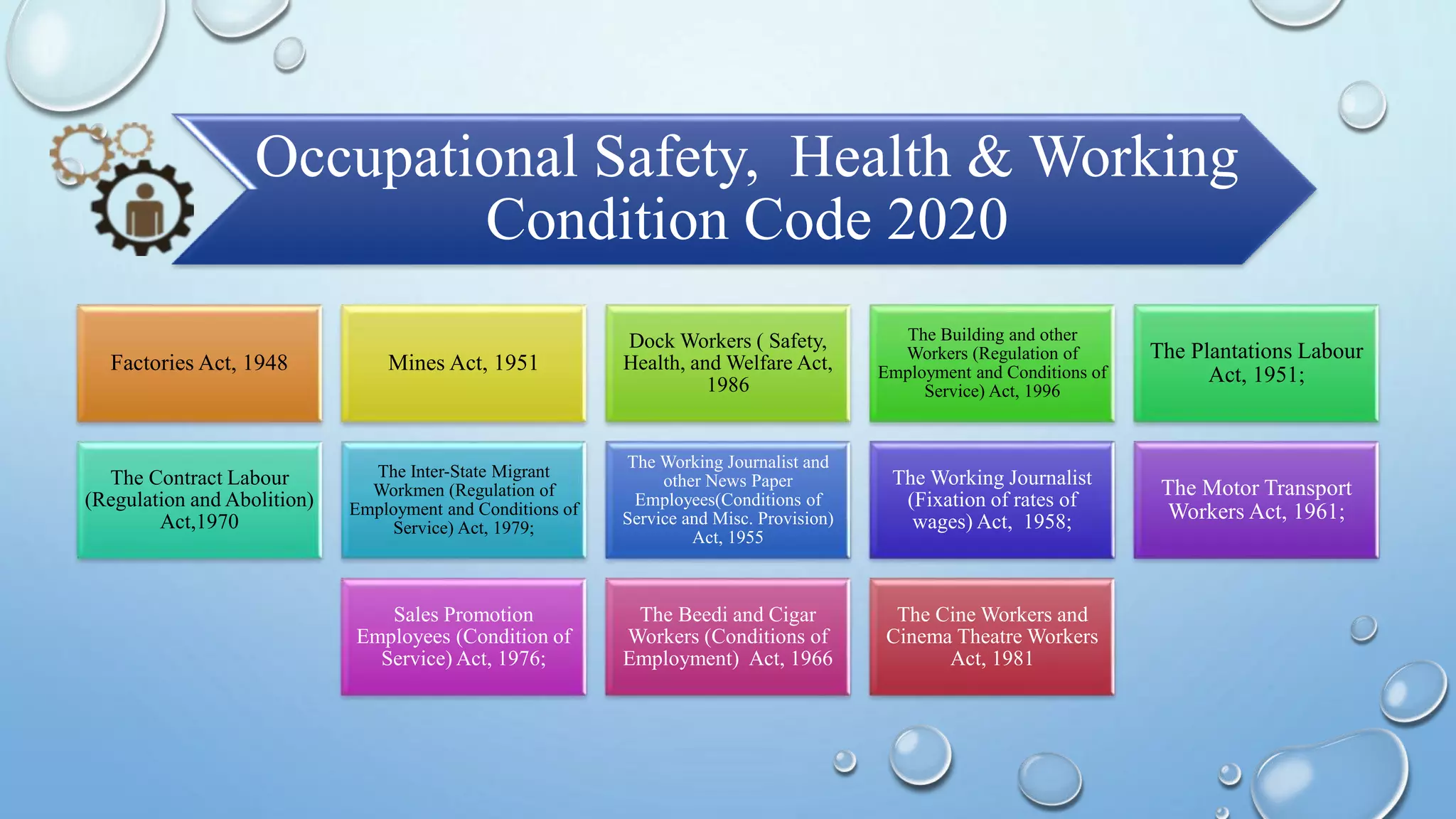

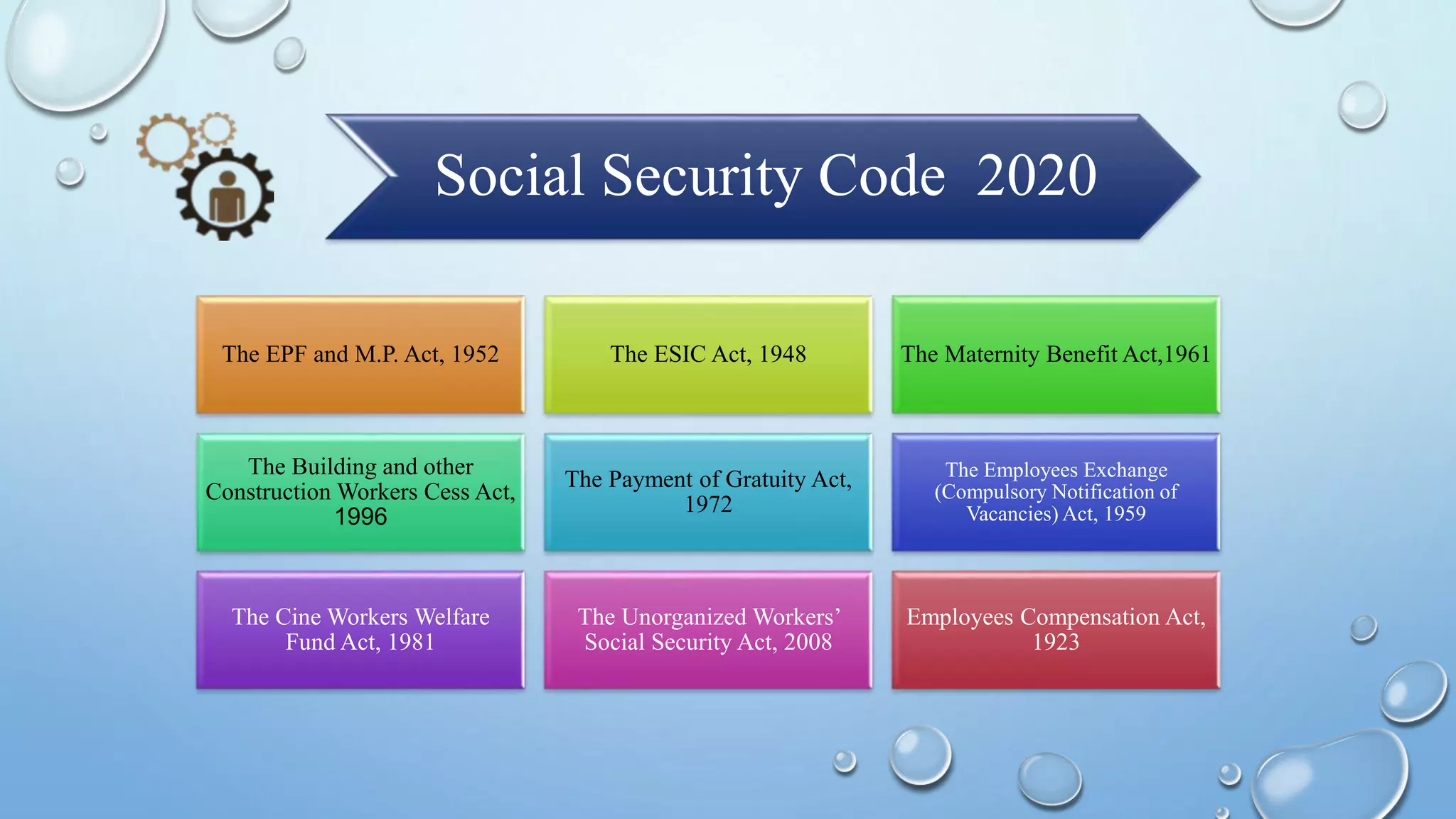

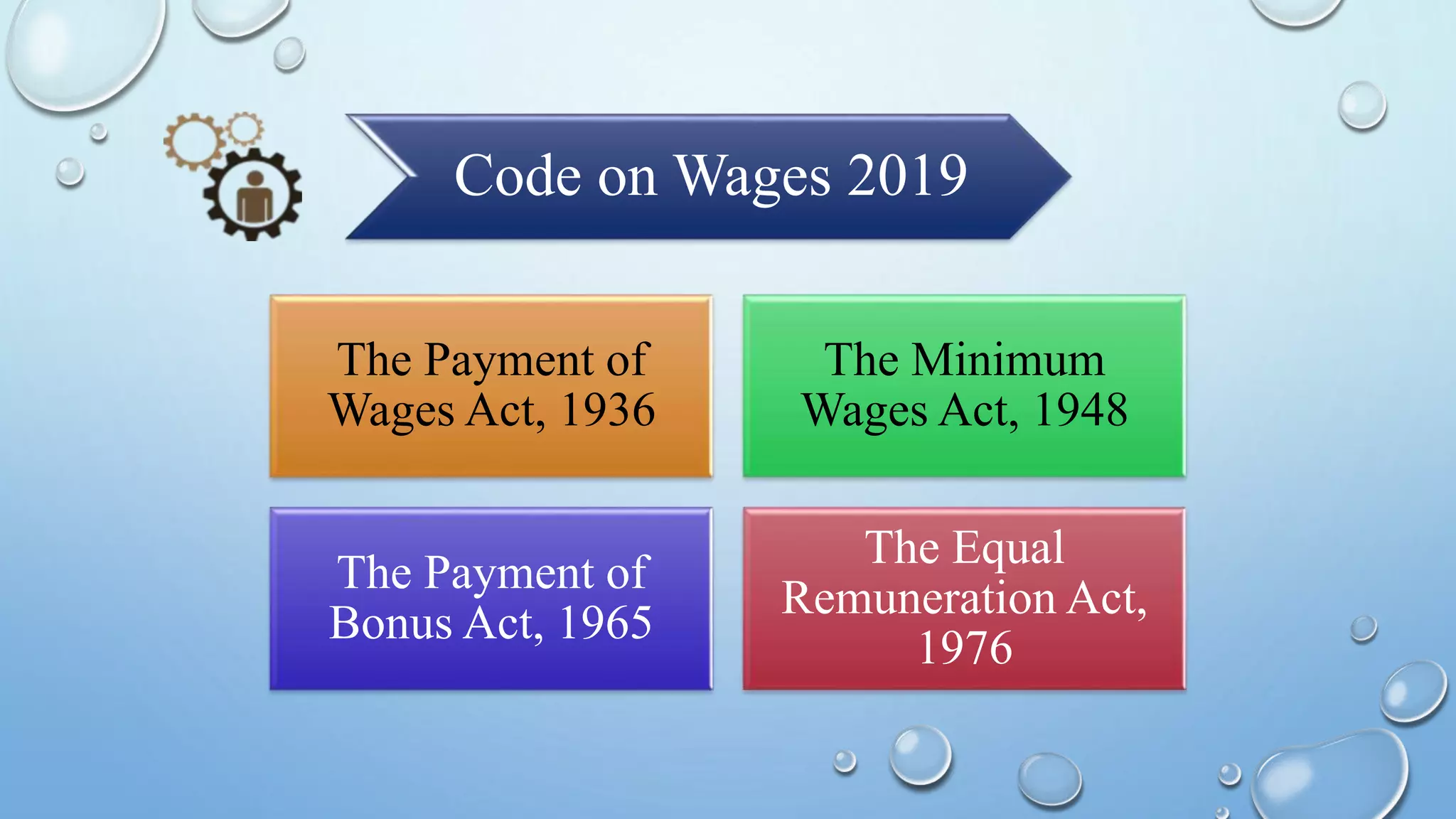

The document summarizes key changes brought about by four labour codes in India - the Industrial Relations Code, Occupational Safety, Health and Working Conditions Code, Social Security Code, and Code on Wages.

Some important changes include expanding the definition of a worker, allowing fixed-term contracts without retrenchment benefits, increasing the threshold for government approval of layoffs, and modifying the definition of wages. The codes consolidate various existing labour laws and introduce provisions for gig and platform workers. They aim to simplify labour law compliance and improve safety, social security and working conditions for workers.