QNBFS Daily Market Report October 4, 2018

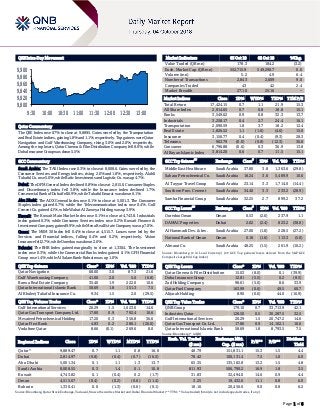

- 1. Page 1 of 6 QSE Intra-Day Movement Qatar Commentary The QSE Index rose 0.7% to close at 9,889.5. Gains were led by the Transportation and Real Estate indices, gaining 1.8% and 1.1%, respectively. Top gainers were Qatar Navigation and Gulf Warehousing Company, rising 3.0% and 2.0%, respectively. Among the top losers, Qatar Cinema & Film Distribution Company fell 8.0%, while Doha Insurance Group was down 5.5%. GCC Commentary Saudi Arabia: The TASI Index rose 0.3% to close at 8,008.6. Gains were led by the Consumer Services and Energy indices, rising 2.0% and 1.8%, respectively. Alahli Takaful Co. rose 5.0%, while Batic Investments and Logistic Co. was up 4.7%. Dubai: The DFM General Index declined 0.8% to close at 2,815.0. Consumer Staples and Discretionary index fell 3.8%, while the Insurance index declined 1.7%. Commercial Bank of Dubai fell 6.9%, while Takaful Emarat was down 6.1%. Abu Dhabi: The ADX General Index rose 0.1% to close at 5,001.3. The Consumer Staples index gained 0.7%, while the Telecommunication index rose 0.4%. Gulf Cement Co. gained 4.1%, while Wahat Al Zaweya Holding was up 3.9%. Kuwait: The Kuwait Main Market Index rose 0.1% to close at 4,743.8. Industrials index gained 0.3%, while Consumer Services index rose 0.2%. Kuwait Finance & Investment Company gained 9.9%, while Mena Real Estate Company was up 7.0%. Oman: The MSM 30 Index fell 0.4% to close at 4,515.7. Losses were led by the Services and Financial indices, falling 0.4% and 0.2%, respectively. Vision Insurance fell 2.7%, while Ooredoo was down 2.6%. Bahrain: The BHB Index gained marginally to close at 1,330.4. The Investment index rose 0.3%, while the Commercial Banks index gained 0.1%. GFH Financial Group rose 1.4%, while Al Salam Bank-Bahrain was up 1.0%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Qatar Navigation 68.00 3.0 87.3 21.6 Gulf Warehousing Company 41.00 2.0 5.6 (6.8) Barwa Real Estate Company 35.40 1.9 222.0 10.6 Qatar International Islamic Bank 58.69 1.8 151.3 7.5 Al Khaleej Takaful Insurance Co. 9.34 1.5 2.0 (29.5) QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Gulf International Services 20.29 1.5 1,023.0 14.6 Qatar Gas Transport Company Ltd. 17.80 0.9 792.4 10.6 Mesaieed Petrochemical Holding 17.20 0.3 356.8 36.6 Qatar First Bank 4.83 0.2 280.1 (26.0) Vodafone Qatar 8.66 (0.1) 269.6 8.0 Market Indicators 03 Oct 18 02 Oct 18 %Chg. Value Traded (QR mn) 178.3 184.2 (3.2) Exch. Market Cap. (QR mn) 552,715.9 549,290.7 0.6 Volume (mn) 5.2 4.9 6.4 Number of Transactions 2,843 2,609 9.0 Companies Traded 43 42 2.4 Market Breadth 27:10 25:16 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 17,424.15 0.7 1.1 21.9 15.3 All Share Index 2,914.65 0.7 0.8 18.8 15.1 Banks 3,549.62 0.9 0.8 32.3 13.7 Industrials 3,258.17 0.4 2.7 24.4 16.1 Transportation 2,090.59 1.8 3.7 18.2 12.4 Real Estate 1,826.52 1.1 (1.6) (4.6) 15.0 Insurance 3,156.77 0.4 (0.4) (9.3) 28.3 Telecoms 963.79 (0.0) (0.8) (12.3) 36.8 Consumer 6,796.88 (0.6) 0.3 36.9 13.8 Al Rayan Islamic Index 3,814.20 0.6 0.7 11.5 15.1 GCC Top Gainers ## Exchange Close # 1D% Vol. ‘000 YTD% Middle East Healthcare Saudi Arabia 37.80 3.8 1,363.6 (29.8) Sahara Petrochemical Co. Saudi Arabia 18.24 3.6 5,489.9 10.6 Al Tayyar Travel Group Saudi Arabia 23.14 3.3 1,714.0 (14.4) Southern Prov. Cement Saudi Arabia 34.40 3.3 233.2 (28.9) Samba Financial Group Saudi Arabia 32.25 2.7 899.2 37.2 GCC Top Losers ## Exchange Close # 1D% Vol. ‘000 YTD% Ooredoo Oman Oman 0.53 (2.6) 237.9 1.1 DAMAC Properties Dubai 2.02 (2.4) 823.2 (38.8) Al Hammadi Dev. & Inv. Saudi Arabia 27.00 (1.8) 228.5 (27.2) National Bank of Oman Oman 0.18 (1.6) 113.3 (5.0) Almarai Co. Saudi Arabia 48.25 (1.5) 261.9 (10.2) Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the S&P GCC Composite Large Mid Cap Index) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Qatar Cinema & Film Distribution 15.03 (8.0) 0.1 (39.9) Doha Insurance Group 12.81 (5.5) 0.2 (8.5) Zad Holding Company 98.61 (5.0) 8.6 33.9 Qatar Fuel Company 163.99 (0.6) 49.5 60.7 Alijarah Holding 8.90 (0.6) 44.0 (16.9) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% QNB Group 179.10 0.7 33,713.9 42.1 Industries Qatar 128.50 0.5 30,287.5 32.5 Gulf International Services 20.29 1.5 20,747.2 14.6 Qatar Gas Transport Co. Ltd. 17.80 0.9 14,102.1 10.6 Qatar International Islamic Bank 58.69 1.8 8,793.5 7.5 Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 9,889.47 0.7 1.1 0.8 16.0 48.79 151,831.1 15.3 1.5 4.4 Dubai 2,814.97 (0.8) (0.4) (0.7) (16.5) 78.42 100,131.4 7.5 1.0 6.0 Abu Dhabi 5,001.34 0.1 1.1 1.3 13.7 65.35 135,182.8 13.2 1.5 4.8 Saudi Arabia 8,008.55 0.3 1.4 0.1 10.8 811.93 506,790.2 16.9 1.8 3.5 Kuwait 4,743.82 0.1 (0.4) 0.2 (1.7) 31.83 32,494.0 14.6 0.9 4.4 Oman 4,515.67 (0.4) (0.2) (0.6) (11.4) 3.25 19,432.6 11.1 0.8 6.0 Bahrain 1,330.41 0.0 (1.3) (0.6) (0.1) 18.16 20,456.0 9.0 0.8 6.2 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Market and Dubai Financial Market (** TTM; * Value traded ($ mn) do not include special trades, if any) 9,800 9,820 9,840 9,860 9,880 9,900 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 6 Qatar Market Commentary The QSE Index rose 0.7% to close at 9,889.5. The Transportation and Real Estate indices led the gains. The index rose on the back of buying support from non-Qatari shareholders despite selling pressure from Qatari and GCC shareholders. Qatar Navigation and Gulf Warehousing Company were the top gainers, rising 3.0% and 2.0%, respectively. Among the top losers, Qatar Cinema & Film Distribution Company fell 8.0%, while Doha Insurance Group was down 5.5%. Volume of shares traded on Wednesday rose by 6.4% to 5.2mn from 4.9mn on Tuesday. However, as compared to the 30-day moving average of 6.2mn, volume for the day was 16.5% lower. Gulf International Services and Qatar Gas Transport Company Limited were the most active stocks, contributing 19.7% and 15.3% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Global Economic Data and Earnings Calendar Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 10/03 US Mortgage Bankers Association MBA Mortgage Applications 28-September 0.0% – 2.9% 10/03 US Automatic Data Processing, Inc ADP Employment Change September 230k 184k 168k 10/03 US Markit Markit US Services PMI September 53.5 53.0 52.9 10/03 US Markit Markit US Composite PMI September 53.9 – 53.4 10/03 UK Markit Markit/CIPS UK Services PMI September 53.9 54.0 54.3 10/03 UK Markit Markit/CIPS UK Composite PMI September 54.1 53.9 54.2 10/03 EU Markit Markit Eurozone Services PMI September 54.7 54.7 54.7 10/03 EU Markit Markit Eurozone Composite PMI September 54.1 54.2 54.2 10/03 Germany Markit Markit Germany Services PMI September 55.9 56.5 56.5 10/03 Germany Markit Markit/BME Germany Composite PMI September 55.0 55.3 55.3 10/03 France Markit Markit France Services PMI September 54.8 54.3 54.3 10/03 France Markit Markit France Composite PMI September 54.0 53.6 53.6 10/03 Japan Markit Nikkei Japan PMI Services September 50.2 – 51.5 10/03 Japan Markit Nikkei Japan PMI Composite September 50.7 – 52.0 Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Earnings Calendar Tickers Company Name Date of reporting 3Q2018 results No. of days remaining Status QNBK QNB Group 10-Oct-18 6 Due MARK Masraf Al Rayan 15-Oct-18 11 Due DBIS Dlala Brokerage & Investment Holding Company 15-Oct-18 11 Due MCGS Medicare Group 16-Oct-18 12 Due QNCD Qatar National Cement Company 17-Oct-18 13 Due QEWS Qatar Electricity & Water Company 17-Oct-18 13 Due QIBK Qatar Islamic Bank 17-Oct-18 13 Due DHBK Doha Bank 17-Oct-18 13 Due UDCD United Development Company 17-Oct-18 13 Due NLCS Alijarah Holding 18-Oct-18 14 Due QISI The Group Islamic Insurance Company 21-Oct-18 17 Due GWCS Gulf Warehousing Company 21-Oct-18 17 Due ABQK Ahli Bank 21-Oct-18 17 Due QIGD Qatari Investors Group 21-Oct-18 17 Due KCBK Al Khalij Commercial Bank 23-Oct-18 19 Due CBQK The Commercial Bank 23-Oct-18 19 Due AKHI Al Khaleej Takaful Insurance Company 28-Oct-18 24 Due DOHI Doha Insurance Group 29-Oct-18 25 Due ERES Ezdan Holding Group 29-Oct-18 25 Due Source: QSE Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 28.01% 34.51% (11,592,368.80) Qatari Institutions 16.24% 25.59% (16,677,289.00) Qatari 44.25% 60.10% (28,269,657.80) GCC Individuals 0.73% 0.85% (210,815.11) GCC Institutions 6.76% 12.15% (9,607,556.03) GCC 7.49% 13.00% (9,818,371.14) Non-Qatari Individuals 8.99% 10.82% (3,260,481.73) Non-Qatari Institutions 39.27% 16.08% 41,348,510.67 Non-Qatari 48.26% 26.90% 38,088,028.94

- 3. Page 3 of 6 News Qatar QISI to disclose 3Q2018 financial statements on October 21 – The Group Islamic Insurance Company (QISI) announced its intent to disclose 3Q2018 financial statements for the period ended September 30, 2018, on October 21, 2018. (QSE) DOHI to disclose 3Q2018 financial statements on October 29 – Doha Insurance Group (DOHI) announced its intent to disclose 3Q2018 financial statements for the period ended September 30, 2018, on October 29, 2018. (QSE) QP concludes two 5-year naphtha sale deals with Marubeni – Qatar Petroleum (QP) has concluded two 5-year sales agreements to supply Japan’s Marubeni Corporation an annual total of 1.2mn tons of naphtha starting from this month. The deals have been made “for and on behalf” of QP for the Sale of Petroleum Products Company (QPSPP), QP stated. The agreements are the largest and longest to be concluded with Marubeni Corporation since both parties started their naphtha business together over three decades ago. QP’s President and CEO, Saad Sherida Al-Kaabi said, “This contract will further enhance the strategic partnership and relationship between QP and Marubeni Corporation. Both our entities have been working together for decades and have enjoyed a fruitful partnership.” (Gulf-Times.com) CEO: QIIK yet to decide on nature of proposed Sukuk – Qatar International Islamic Bank (QIIK) has not yet decided on the nature of its proposed Sukuk, QIIK’s CEO, Abdulbasit Ahmad Al-Shaibei said. “We have two options now — either to go for private placement like a club deal, where you identify your investors and go to them directly or a public placement. We are still thinking, which way to go,” Al-Shaibei said on the sidelines of the opening of the bank’s newest branch at The Mall. Asked when the proposed Sukuk could be expected, he said, “We have not yet decided on that. Because we have finished the third quarter, it is mandatory that we update our figures before going in for the Sukuk. I believe it will take some time until we update all the figures and then go to our consultant and legal firms. Still, we have it (Sukuk) in our mind.” Al-Shaibei said there was “nothing like the best time” to issue the Sukuk. “Currently, the market is going up, and it seems to me it will go up in line with the US Federal Reserve raising rates (by 25 basis points or 0.25%). Indications are that they (the Fed) will raise rates at least two times in 2019 as well. So the rates are on the higher side,” Al-Shaibei noted. “If the cost of the funding is high, on the other side, the banks have to compensate themselves by finding the right rate, and the right tenor,” he said. Al-Shaibei said whenever a decision on Sukuk is taken, QIIK would seek investors in the Far East and Europe, among other places. (Gulf- Times.com) Indonesia to import oil from Qatar soon – Indonesia is set to import oil from Qatar very soon, said a top diplomat of the Southeast Asian nation, which is one of the leading gas exporting countries in the world. The founding OPEC member, who left the organization of oil exporting countries in 2009, is now importing large quantities of oil to meet the rising domestic demand. However, the country is still a net exporter of natural gas. “The negotiations to import oil from Qatar are almost at final. We are now expanding our storage capacity, and the shipments of Qatari oil are expected to reach our shores very soon,” Indonesian Ambassador to Qatar, Muhammad Basri Sidehabi said. Sidehabi added, “Our total oil consumption in 2017 was about 1.65mn barrels per day, which is growing fast. We rely on imports for about 50% of the total consumption, which we are sourcing from several countries.” (Peninsula Qatar) Alfardan Properties in deal to support Qatar start-ups, SMEs – The operational costs of start-ups and small and medium enterprises (SMEs) are set to ease significantly with Alfardan Properties joining hands with Turkey’s Workinton to cater to the growing needs for serviced office, co-working, virtual office and meeting rooms in Qatar. Alfardan Properties launched its partnership with Workinton, a Turkish international brand, as part of ongoing efforts to widen its spectrum of offerings to cover the needs of a new generation of entrepreneurs and workforce in the country. “This initiative is for supporting new and start-ups. It will reduce the operational costs for the start- ups and SMEs,” Alfardan Group’s President and CEO, Omar Hussain Alfardan said. Turkish Ambassador Fikret Ozer was present on the occasion. The Alfardan Center at the Bank Street will have 17 units catering up to 250 customers. It includes one conference room, two meeting rooms and co-working space for more than 50, scaleable up to 80. (Gulf-Times.com) Qatar Development Bank’s Tasdeer offers global paradigms to Qatari SME sector – Qatar Development Bank’s (QDB) Export Development and Promotion Department ‘Tasdeer’, hosted in recent months several trade missions as well as participated in a number of exhibitions in lucrative parts of the globe. This is in continuation to QDB’s vision of expanding scope of Qatari companies across the globe. Through its activities, Tasdeer aims to promote exports from Qatar and enhance the expanse of Qatari SMEs at global platforms. QDB took part in Columbia Plast, which was held from September 24 to 28, 2018 at Centro de convenciones, Bogota, Colombia. With around 705 exhibitors and 37,772 visitors, the event immensely offered one of the best platforms to companies operating in the plastics and allied industries. (Peninsula Qatar) Woqod opens new petrol station in Fereej Kulaib – Qatar Fuel Company (Woqod) opened the Fereej Kulaib petrol station, raising its network of petrol stations to 64 as part of the company’s ongoing expansion plans to serve every area in Qatar. (Gulf-Times.com) Qatar cements ties with Paraguay – The State of Qatar and the Republic of Paraguay held a session of official talks chaired by Amir HH Sheikh Tamim bin Hamad Al Thani and President Mario Abdo Benitez of the Republic of Paraguay, at the Presidential Palace in the capital city Asuncion. At the beginning of the meeting, the President of Paraguay welcomed HH the Amir and the accompanying delegation. He expressed his pleasure at HH the Amir’s acceptance of the invitation to visit Paraguay, especially as it coincides with the 17th anniversary of the establishment of relations between the two countries, looking forward to strengthening bilateral relations

- 4. Page 4 of 6 of friendship and cooperation in the coming years. (Peninsula Qatar) International US services sector activity hits 21-year high; hiring accelerates – US services sector activity raced to a 21-year high in September, and companies boosted hiring, signs of enduring strength in the economy at the end of the third quarter. The upbeat reports likely keep the Federal Reserve on track to raise interest rates again in December. The US central bank increased rates last week for the third time this year. Fed’s Chairman, Jerome Powell said on October 2 the economy’s outlook was “remarkably positive.” The Institute for Supply Management (ISM) stated its non-manufacturing activity index jumped 3.1 points to 61.6 last month, the highest reading since August 1997. The ISM’s new orders sub-index for the services sector increased 1.2 points to a reading of 61.6 last month. The survey’s factory employment measure jumped to 62.4 in September from 56.7 in August. This suggests September’s nonfarm payrolls could surprise on the upside when the government publishes its closely watched employment report. (Reuters) World Bank cuts sub-Saharan Africa's 2018 growth forecast to 2.7% – The World Bank has cut its economic growth forecast for sub-Saharan Africa this year to 2.7% from an earlier forecast of 3.1%, mainly because of slower-than-expected growth in the continent’s bigger economies, the bank said. The region, which had posted a fairly fast average growth rate in the years leading up to 2015, suffered a loss of momentum in economic output after commodity prices crashed in 2015-16. In April, the World Bank had predicted that the recovery would gather pace this year, with average growth expected at 3.1%, up from 2.3% last year. (Reuters) PMI: UK’s economy shows steady growth, Brexit concerns weigh on firms – Britain’s economy appears to have kept up most of its steady growth in the July-September period, but uncertainty among companies remained high six months ahead of Brexit, according to a business survey. The IHS Markit/CIPS UK Services Purchasing Managers’ Index (PMI) slipped to 53.9 in September from 54.3 in August, a shade weaker than the median forecast of 54.0 in a Reuters poll of economists. IHS Markit stated Britain’s economy was on course to grow at a quarterly rate of just under 0.4% in the three months to September, the same as its average growth rate since the Brexit referendum of June 2016. The world’s fifth-largest economy suffered a slow start to the year, when the country was hit by unusually cold weather, but grew solidly in the second quarter, albeit fuelled mostly by consumer spending rather than trade or manufacturing. (Reuters) PMI: Eurozone’s business growth eases in September to a four- month low – The expansion in Eurozone’s business activity eased in September to a four-month low, driven by the weakest factory growth in two years that was only partly offset by a pick-up among services providers, a survey showed. IHS Markit’s Eurozone Composite Final Purchasing Managers’ Index (PMI), seen as a good guide to economic health, eased to a four month-low in September of 54.1 from August’s 54.5. That was below an earlier flash estimate of 54.2, but held well above the 50 mark which separates growth from contraction. Optimism about the future brightened a bit at the end of the third quarter from a near two-year low. The composite future output PMI rose to 62.1 from 61.6. But manufacturing activity has dwindled across the Euro currency bloc this year, in line with evidence of moderation elsewhere around the globe. That suggests overall economic growth in the currency bloc is well past its peak and the pace of business activity is likely to ease further in coming months. (Reuters) Strong German services growth offsets weak manufacturing in September – Germany’s services growth hit an eight-month high in September, a survey showed, in a further sign that strong domestic demand is helping to cushion the effects of a slowdown in manufacturing. IHS Markit’s final composite Purchasing Managers’ Index (PMI), which tracks the manufacturing and services sectors that account for more than two-thirds of the economy, fell to 55.0 from 55.6 in August. The reading came in slightly below a preliminary estimate published last month, but was still well above the 50 line that separates growth from contraction. In the services sector, business activity increased to 55.9 in September, up from 55.0 the previous month, with the rate of job creation hitting its highest in nearly 11 years and service firms remaining very optimistic about future business. (Reuters) Regional GCC’s energy sector investments in MENA amount to $171bn – The GCC’s committed investments in the energy sector amounts to $171bn, representing about 50% of the total in the Middle East and North Africa (MENA) region, according to Arab Petroleum Investments Corporation (Apicorp). The committed investments in the MENA energy projects currently under execution are estimated at $345bn for the five-year period. The oil sector accounts for the largest share of investments at $131bn, with the majority in upstream projects. Total committed gas and power investments are approximately $106bn and $95bn respectively, followed by chemicals at $14bn. The planned MENA investments in the energy sector are estimated at $574bn for the next five years. The power sector accounts for the largest share of investments, at $187bn. The oil and gas sectors will represent $169bn and $150bn respectively, with the remaining investments in petrochemicals. Projects under study represent by far the largest portion of planned investments, at $251bn, Apicorp highlighted. (Gulf-Times.com) IIF: GCC economic growth seen gaining momentum in 2019 – The GCC countries are expected to see a pick-up in economic growth in 2018 and 2019, according to the latest forecasts by the Institute of International Finance (IIF). Higher oil prices and improved output, along with some easing in fiscal consolidation, are driving the growth. “We expect economic conditions to strengthen in the GCC, with overall growth of 2.3% in 2018 and 2.7% in 2019 after stagnating in 2017. Domestic demand should strengthen with the easing of fiscal consolidation,” IIF’s Chief Economist in the MENA region, Garbis Iradian said. A tighter monetary policy, in the context of the pegged exchange rates in the GCC, is expected to offset some of the gains from an expansionary fiscal stance. The IIF has a slightly more conservative GDP forecast for the UAE at 2.2% in 2018 and 2.6% in 2019. For the GCC as a whole, the IIF

- 5. Page 5 of 6 expects non hydrocarbon growth to accelerate to 3.2% by 2020. With higher oil prices and rising output, the fiscal positions of GCC states are expected to improve. (GulfBase.com) Middle East to account for 132 aircraft deliveries in 2018 – The Middle East will account for 132 aircraft deliveries this year, International Air Transport Association (IATA) stated, which is a clear sign of the region’s increasing passenger traffic in both the domestic and international segments. Out of the 132 aircraft deliveries, 77 will be wide body and 55 narrow body aircraft. The region registered aircraft deliveries totaling 122 last year and 123 in 2016. In August, Middle Eastern carriers posted 5.4% traffic increase even as passenger volumes trended upwards at 8% annualized rate since the start of the year. Capacity increased 6.3%, with load factor slipping 0.7% to 80.7%. (Gulf-Times.com) Chairman: Trade Bank of Iraq in talks to acquire Gulf lender – Trade Bank of Iraq (TBI) is in talks to buy a Gulf bank with branches in the UAE and Qatar as part of a strategy to boost revenues outside its home market, Trade Bank of Iraq’s Chairman, Faisal al-Haimus said. The talks are underway and the purchase is expected to be completed in six to eight months. Al-Haimus did not disclose the name of the bank. The move comes after TBI stated in August it had put on hold its plans to buy a commercial bank in Turkey due to the weak Lira. The bank, owned by the Iraqi government and with assets of around $20bn, helps fund around 80% of the trade finance business in Iraq. TBI will open its first overseas branch in Saudi Arabia in 1Q2019, having got the required approvals. The branch will focus on trade finance but will do some corporate business too, Al-Haimus said. (Reuters) KUNA: Saudi Arabia, UAE, Kuwait to sign agreement providing financial support to Jordan – The finance ministers of Saudi Arabia, Kuwait and the UAE will sign an agreement on October 4 to provide credit guarantees and grants to Jordan, state run Kuwait News Agency (KUNA) reported. The agreement, which also provides for deposits by the Gulf Arab nations in the Jordanian central bank, will be signed in Amman. The three Gulf nations in June pledged $2.5bn to help Jordan implement austerity measures. (Reuters) Saudi Arabia plans oil output hike in November, says Energy Minister – Saudi Arabia plans to raise oil production in November from an October output level of 10.7mn barrels per day (bpd) to meet rising crude demand, Saudi Arabia’s Energy Minister, Khalid al-Falih said. The Minister told a conference in Moscow attended by Russian President, Vladimir Putin that the Kingdom was in weekly communication with Russia to stabilize global oil markets, which touched a four-year high above $85 a barrel this week. Oil producers have added a total of about 1mn bpd output in recent weeks and months and the global market was well supplied, al-Falih said, adding that Saudi Arabia had raised its oil output to 10.7mn bpd in October. (Gulf-Times.com) Saudi Arabia, Russia agreed in September to lift oil output, informed US before meeting – Russia and Saudi Arabia struck a private deal in September to raise oil output to cool rising prices and informed the US before a meeting in Algiers with other producers, according to sources. “The Russians and the Saudis agreed to add barrels to the market quietly with a view to not look like they are acting on Trump’s order to pump more,” one source said. “The Saudi Arabian minister told (US Energy Secretary, Rick) Perry that Saudi Arabia will raise output if its customers asked for more oil,” another source said. Moreover, the world needs access to Russian gas, which is amongst the cheapest on the planet, Saudi Arabia’s Energy Minister, Khalid al-Falih said. He also said that Saudi Aramco was in active talks with Russia’s independent gas producer Novatek about participating in the next phase of the Russian Yamal LNG project. (Reuters) Saudi Arabia’s whole economy PMI falls to 53.4 in September – Emirates NBD and IHS Markit released the purchasing managers’ index (PMI) for Saudi Arabia’s whole economy fell to 53.4 in September 2018 from 55.1 in August 2018 and 55.5 in September 2017. This is the lowest reading since May 2018. (Bloomberg) Saudi Arabia spending injection cannot fix what ails the economy – Despite announcing bigger than forecast increase in government spending, Saudi Arabia’s economic growth is set to average 2.25% through 2021, half the pace seen in the decade prior to the oil crash, according to a budget draft, Bloomberg reported. Crude prices have not risen sufficiently to allow a larger stimulus, while consumers are scarred by subsidy cuts and new taxes, said Ziad Daoud, Chief Middle East economist at Bloomberg economics. He also said that concerns over the Kingdom’s domestic and foreign policies are deterring investment. (Gulf-Times.com) UAE’s whole economy PMI rises to 55.3 in September – Emirates NBD and IHS Markit’s purchasing managers’ index (PMI) for UAE’s whole economy rose to 55.3 in September 2018 from 55 in August 2018 and 55.1 in September 2017. (Bloomberg) Dubai's $36bn Al Maktoum airport expansion put on hold – The expansion of Dubai’s second airport, Al Maktoum International, to handle 120mn passengers a year by 2025, has been delayed, according to sources. The airport, which opened to passenger traffic in 2013, aims to be one of the world’s biggest, but now only handles a fraction of Dubai’s passenger traffic. (Reuters) Rise in Bahrain's foreign exchange reserves offers respite – The 47.3% advance in the Central Bank of Bahrain’s reserves in August versus July to $1.9bn offers much needed respite, according to MUFG Bank’s Head of MENA research and strategy, Ehsan Khoman. Higher oil prices are providing some support with public debt data suggesting no fresh external borrowing in August. Bahraini authorities expected to front- load delivery of fiscal consolidation, spending cuts and non-oil revenue expansion, pledges in line with financial aid they will receive. (Bloomberg)

- 6. Contacts Saugata Sarkar, CFA, CAIA Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa QNB Financial Services Co. W.L.L. Contact Center: (+974) 4476 6666 PO Box 24025 Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. W.L.L. (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (Q.P.S.C.). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange. Qatar National Bank (Q.P.S.C.) is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 6 of 6 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns; # Market was closed on October 3, 2018) 45.0 70.0 95.0 120.0 Aug-14 Aug-15 Aug-16 Aug-17 Aug-18 QSEIndex S&P Pan Arab S&P GCC 0.3% 0.7% 0.1% 0.0% (0.4%) 0.1% (0.8%) (1.0%) (0.5%) 0.0% 0.5% 1.0% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,197.35 (0.5) 0.4 (8.1) MSCI World Index 2,183.63 0.0 (0.0) 3.8 Silver/Ounce 14.64 (0.4) (0.4) (13.6) DJ Industrial 26,828.39 0.2 1.4 8.5 Crude Oil (Brent)/Barrel (FM Future) 86.29 1.8 4.3 29.0 S&P 500 2,925.51 0.1 0.4 9.4 Crude Oil (WTI)/Barrel (FM Future) 76.41 1.6 4.3 26.5 NASDAQ 100 8,025.09 0.3 (0.3) 16.2 Natural Gas (Henry Hub)/MMBtu 3.26 3.5 7.2 5.5 STOXX 600 383.84 0.2 (0.7) (5.5) LPG Propane (Arab Gulf)/Ton 106.00 (1.4) (2.0) 7.1 DAX# 12,287.58 0.0 (0.2) (8.6) LPG Butane (Arab Gulf)/Ton 125.25 (2.5) 0.8 15.4 FTSE 100 7,510.28 0.5 (0.4) (6.2) Euro 1.15 (0.6) (1.1) (4.4) CAC 40 5,491.40 0.1 (0.9) (1.0) Yen 114.53 0.8 0.7 1.6 Nikkei 24,110.96 (1.2) (0.8) 4.3 GBP 1.29 (0.3) (0.7) (4.2) MSCI EM 1,035.04 0.2 (1.2) (10.7) CHF 1.01 (0.8) (1.1) (1.8) SHANGHAI SE Composite# 2,821.35 0.0 0.0 (19.2) AUD 0.71 (1.2) (1.7) (9.0) HANG SENG 27,091.26 (0.2) (2.6) (9.7) USD Index 95.76 0.3 0.7 3.9 BSE SENSEX 35,975.63 (1.9) (1.9) (8.2) RUB 65.88 0.6 0.5 14.3 Bovespa 83,273.40 2.9 8.6 (7.3) BRL 0.26 1.0 3.8 (15.1) RTS 1,196.03 1.2 0.3 3.6 76.6 74.4 72.2