QNBFS Daily Market Report November 18, 2018

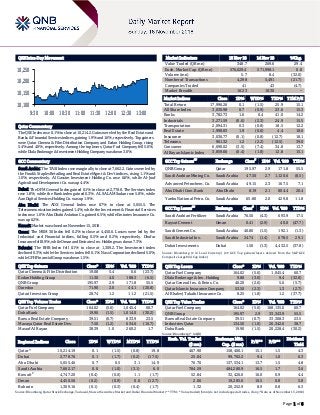

- 1. Page 1 of 6 QSE Intra-Day Movement Qatar Commentary The QSE Index rose 0.1% to close at 10,214.2. Gains were led by the Real Estate and Banks & Financial Services indices, gaining 1.9% and 1.6%, respectively. Top gainers were Qatar Cinema & Film Distribution Company and Ezdan Holding Group, rising 5.4% and 4.0%, respectively. Among the top losers, Qatar Fuel Company fell 5.6%, while Dlala Brokerage & Investment Holding Company was down 3.0%. GCC Commentary Saudi Arabia: The TASI Index rose marginally to close at 7,662.2. Gains were led by the Food & Staples Retailing and Real Estate Mgmt & Dev't indices, rising 1.1% and 1.0%, respectively. Al Gassim Investment Holding Co. rose 6.6%, while Al-Jouf Agricultural Development Co. was up 4.4%. Dubai: The DFM General Index gained 0.1% to close at 2,778.8. The Services index rose 1.8%, while the Bank index gained 0.3%. AL SALAM Sudan rose 5.8%, while Aan Digital Services Holding Co. was up 1.9%. Abu Dhabi: The ADX General Index rose 0.7% to close at 5,055.5. The Telecommunication index gained 1.4%, while the Investment & Financial Services index rose 1.0%. Abu Dhabi Aviation Co. gained 6.5%, while Emirates Insurance Co. was up 6.2%. Kuwait: Market was closed on November 15, 2018. Oman: The MSM 30 Index fell 0.2% to close at 4,450.6. Losses were led by the Industrial and Financial indices, falling 0.5% and 0.2%, respectively. Dhofar Insurance fell 8.9%, while Oman and Emirates Inv. Holding was down 7.3%. Bahrain: The BHB Index fell 0.1% to close at 1,309.2. The Investment index declined 0.3%, while the Services index fell 0.1%. Nass Corporation declined 5.0%, while GFH Financial Group was down 1.5%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Qatar Cinema & Film Distribution 19.08 5.4 0.6 (23.7) Ezdan Holding Group 11.30 4.0 188.3 (6.5) QNB Group 195.97 2.9 171.8 55.5 Ooredoo 71.90 2.0 44.1 (20.8) Qatari Investors Group 28.74 1.2 11.2 (21.5) QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Qatar Fuel Company 164.02 (5.6) 1,045.4 60.7 Doha Bank 19.90 (1.5) 1,014.0 (30.2) Barwa Real Estate Company 39.51 (0.7) 833.9 23.5 Mazaya Qatar Real Estate Dev. 7.50 (1.2) 634.6 (16.7) Masraf Al Rayan 38.39 1.0 260.2 1.7 Market Indicators 15 Nov 18 14 Nov 18 %Chg. Value Traded (QR mn) 348.7 269.6 29.4 Exch. Market Cap. (QR mn) 576,629.4 571,998.1 0.8 Volume (mn) 5.7 8.4 (32.0) Number of Transactions 4,298 5,491 (21.7) Companies Traded 41 43 (4.7) Market Breadth 16:23 10:30 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 17,996.26 0.1 (1.5) 25.9 15.1 All Share Index 3,030.98 0.7 (0.9) 23.6 15.3 Banks 3,782.73 1.6 0.4 41.0 14.2 Industrials 3,271.59 (0.6) (2.3) 24.9 15.5 Transportation 2,094.31 0.3 (0.8) 18.5 12.2 Real Estate 1,998.83 1.9 (0.0) 4.4 18.0 Insurance 3,036.77 (0.1) (0.8) (12.7) 18.1 Telecoms 961.32 1.2 (2.2) (12.5) 39.0 Consumer 6,690.02 (3.5) (7.4) 34.8 13.7 Al Rayan Islamic Index 3,859.66 (0.4) (1.8) 12.8 15.1 GCC Top Gainers ## Exchange Close # 1D% Vol. ‘000 YTD% QNB Group Qatar 195.97 2.9 171.8 55.5 Saudi Arabian Mining Co. Saudi Arabia 47.50 2.7 1,120.6 (8.5) Advanced Petrochem. Co. Saudi Arabia 49.15 2.3 167.5 7.1 Abu Dhabi Com. Bank Abu Dhabi 8.19 2.1 804.4 20.4 Yanbu National Petro. Co. Saudi Arabia 65.80 2.0 429.8 11.8 GCC Top Losers ## Exchange Close # 1D% Vol. ‘000 YTD% Saudi Arabian Fertilizer Saudi Arabia 76.50 (4.3) 693.9 17.5 Raysut Cement Oman 0.41 (2.9) 40.0 (47.7) Saudi Cement Co. Saudi Arabia 46.80 (1.5) 192.1 (1.3) Saudi Industrial Inv. Saudi Arabia 24.74 (1.4) 678.5 29.1 Dubai Investments Dubai 1.50 (1.3) 4,432.5 (37.8) Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the S&P GCC Composite Large Mid Cap Index) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Qatar Fuel Company 164.02 (5.6) 1,045.4 60.7 Dlala Brokerage & Inv. Holding 9.88 (3.0) 9.4 (32.8) Qatar General Ins. & Reins. Co. 46.20 (2.6) 5.6 (5.7) Qatar Islamic Insurance Company 53.50 (2.3) 1.3 (2.7) Al Khaleej Takaful Insurance Co. 8.25 (1.8) 1.2 (37.7) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Qatar Fuel Company 164.02 (5.6) 168,135.0 60.7 QNB Group 195.97 2.9 33,343.9 55.5 Barwa Real Estate Company 39.51 (0.7) 33,308.3 23.5 Industries Qatar 134.50 (1.0) 26,342.6 38.7 Doha Bank 19.90 (1.5) 20,228.4 (30.2) Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 10,214.19 0.1 (1.5) (0.8) 19.8 467.90 158,400.1 15.1 1.5 4.3 Dubai 2,778.76 0.1 (1.7) (0.2) (17.5) 25.04 99,702.2 9.4 1.0 6.3 Abu Dhabi 5,055.46 0.7 0.5 3.1 14.9 76.70 137,534.1 13.7 1.5 4.8 Saudi Arabia 7,662.17 0.0 (1.0) (3.1) 6.0 784.59 484,280.9 16.5 1.7 3.6 Kuwait# 4,747.20 (0.4) (0.0) 1.1 (1.7) 52.84 32,426.0 16.0 0.9 4.4 Oman 4,450.56 (0.2) (0.9) 0.6 (12.7) 2.06 19,285.6 10.5 0.8 5.8 Bahrain 1,309.16 (0.1) (0.3) (0.4) (1.7) 1.32 20,252.9 8.9 0.8 6.3 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Market and Dubai Financial Market (** TTM; * Value traded ($ mn) do not include special trades, if any; # Data as of November 13, 2018) 10,100 10,150 10,200 10,250 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 6 Qatar Market Commentary The QSE Index rose 0.1% to close at 10,214.2. The Real Estate and Banks & Financial Services indices led the gains. The index rose on the back of buying support from Qatari and non-Qatari shareholders despite selling pressure from GCC shareholders. Qatar Cinema & Film Distribution Company and Ezdan Holding Group were the top gainers, rising 5.4% and 4.0%, respectively. Among the top losers, Qatar Fuel Company fell 5.6%, while Dlala Brokerage & Investment Holding Company was down 3.0%. Volume of shares traded on Thursday fell by 32.0% to 5.7mn from 8.4mn on Wednesday. However, as compared to the 30-day moving average of 5.5mn, volume for the day was 2.8% higher. Qatar Fuel Company and Doha Bank were the most active stocks, contributing 18.3% and 17.8% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Earnings Releases and Global Economic Data Earnings Releases Company Market Currency Revenue (mn) 3Q2018 % Change YoY Operating Profit (mn) 3Q2018 % Change YoY Net Profit (mn) 3Q2018 % Change YoY Baazeem Trading Co. Saudi Arabia SR 65.9 -0.6% 5.3 10.4% 3.7 -7.3% United Paper Industries*# Bahrain BHD 3,508.3 11.9% – – -54.0 N/A Source: Company data, DFM, ADX, MSM, TASI, BHB. (*Financials for 2Q2018-19, # Values in ‘000) Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 11/15 US Department of Labor Initial Jobless Claims 10-November 216k 213k 214k 11/15 US Department of Labor Continuing Claims 3-November 1,676k 1,625k 1,630k 11/16 US Federal Reserve Industrial Production MoM October 0.1% 0.2% 0.2% 11/15 EU Eurostat Trade Balance SA September 13.4bn 16.3bn 16.8bn 11/16 EU Eurostat CPI Core YoY October 1.1% 1.1% 1.1% 11/16 EU Eurostat CPI YoY October 2.2% 2.2% 2.2% 11/16 EU Eurostat CPI MoM October 0.2% 0.2% 0.5% 11/15 India Directorate General of Commerce Imports YoY October 17.6% – 10.5% 11/15 India Directorate General of Commerce Exports YoY October 17.9% – -2.2% Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) News Qatar Executive regulation on PRP to be issued within months – The decisions and executive regulations for the implementation of the Permanent Residency Permit (PRP) Law have been prepared and currently under study and expected to be issued within a few months. According to the law on permanent residency, the Law No. 10 of 2018, issued by Amir HH Sheikh Tamim bin Hamad Al Thani in September this year, the expatriates in Qatar are able to obtain permanent residency permit of Qatar under certain rules and conditions. (Peninsula Qatar) Qatar, Ukraine bilateral trade scaling up, says Al-Kuwari – Agreements and memorandum of understanding in trade and investment played a key role in bolstering bilateral trade between Qatar and Ukraine, which reached QR257.6mn in 2017, according to HE the Minister of Commerce and Industry, Ali bin Ahmed Al-Kuwari. He was speaking after co-chairing the two- day first session of the joint Qatari-Ukrainian Committee for Economic, Commercial and Technical Cooperation. Al-Kuwari praised the role that private sector companies from both countries were playing in terms of supporting Qatar’s economy. Some 39 companies, jointly owned by Qatari and Ukrainian citizens are currently operating in Qatar. The minister said he looked forward to cooperating with his Ukrainian counterparts to strengthen partnerships on all levels in line with the aspirations of both countries in a bid contribute to the development of innovative areas of cooperation. (Gulf- Times.com) CEO: Alternatif Bank to open three more branches in Turkey in 2019 – Turkey’s Alternatif Bank, 100% owned by The Commercial Bank, will maintain its customer-centric focus, invest further on IT and open three more branches in Izmir, Ankara and Istanbul in 2019, according to Alternatif Bank’s CEO, Kaan Gür. Gür said, “We will continue to provide our customers in the corporate, commercial and retail banking segments with high value products, services and solutions. We Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 38.40% 32.87% 19,277,113.75 Qatari Institutions 15.07% 17.90% (9,865,980.65) Qatari 53.47% 50.77% 9,411,133.10 GCC Individuals 1.48% 0.64% 2,916,760.06 GCC Institutions 0.19% 4.81% (16,139,083.15) GCC 1.67% 5.45% (13,222,323.09) Non-Qatari Individuals 10.72% 9.19% 5,335,671.53 Non-Qatari Institutions 34.15% 34.58% (1,524,481.54) Non-Qatari 44.87% 43.77% 3,811,189.99

- 3. Page 3 of 6 desire to deepen our relationship with customers and further penetrate the market.” Currently, Alternatif Bank has a network of some 50 branches widely distributed across Turkey. This will go up to 53 by 2019-end with the opening of new branches in ‘industrial zones’ near Izmir, Ankara and Istanbul. (Gulf-Times.com) Hassad Food, Rwanda sign MoU for cooperation – Hassad Food, Qatar’s premier investor in the food sector, has signed a memorandum of understanding (MoU) with the government of Rwanda, represented by the Rwanda Development Board. The MoU aims to start cooperation between the two sides, and explore possible investment opportunities in the agricultural and food sectors. Hassad Food’s CEO, Al-Sadah said, “We’ve signed the memorandum of understanding with the Rwandan side in line with Hassad Food’s new vision and strategy to become a successful strategic investor in the global food and agriculture value chains. We are currently working on identifying suitable business opportunities in several countries, as well as signing agreements that are in line with Hassad Food’s new strategy.” (Gulf-Times.com) International Federal Reserve nods to concerns but still sees US rate hikes – Federal Reserve policymakers signaled further interest rate increases ahead, even as they raised relatively muted concerns over a potential global slowdown that has markets betting heavily that the rate-hike cycle will soon peter out. The widening chasm between market expectations and the interest- rate path the Fed laid out just two months ago underscores the biggest question facing US central bankers: How much weight to give a growing number of potential red flags, even as robust US economic growth continues to push down unemployment and create jobs?. “We are at a point now where we really need to be especially data dependent,” Richard Clarida, the Fed’s newly appointed Vice Chair, said in a CNBC interview. “I think certainly, where the economy is today, and the Fed’s projection of where it’s going, that being at neutral would make sense,” he added, defining “neutral” as the policy rate somewhere between 2.5% and 3.5%. Such a range implies anywhere from two to six more rate hikes, and Clarida declined to say how many he would prefer. He did say he is optimistic that US productivity is rising, a view that suggests he would not see faster economic or wage growth as necessarily feeding into higher inflation or, necessarily, requiring tighter policy. But he also sounded a mild warning. (Reuters) US retail sales rebound, but consumers spending slowing – US retail sales rebounded sharply in October as purchases of motor vehicles and building materials rose, but data for the prior two months was revised lower and the underlying trend suggested that consumer spending was probably slowing down. Still, the report on November 15 from the Commerce Department showed broad gains in sales ahead of the holiday shopping season, which bodes well for consumer spending and the overall economy as the fourth quarter gets under way. Retail sales increased 0.8% last month. Retail sales in September slipped 0.1% instead of rising 0.1% and sales in August were also weaker than previously thought. Economists polled by Reuters had forecasted retail sales increasing 0.5% in October. Sales rose 4.6% from a year ago. Excluding automobiles, gasoline, building materials and food services, retail sales increased 0.3% last month. These so-called core retail sales correspond most closely with the consumer spending component of gross domestic product. Data for September was revised lower to show core retail sales rising 0.3% instead of gaining 0.5% as previously reported. Core retail sales fell 0.2% in August rather than being unchanged. (Reuters) US manufacturing production increases; headwinds growing – US manufacturing output rose for a fifth straight month in October, shrugging off a sharp drop in motor vehicle production and suggesting underlying strength in factory activity, despite growing headwinds that are expected to slow the sector in 2019. The Federal Reserve said manufacturing production rose 0.3% last month. Data for September was revised up to show output at factories increasing 0.3% instead of advancing 0.2% as previously reported. Economists polled by Reuters had forecasted manufacturing output rising 0.2% in October. Manufacturing, which accounts for more than 12% of the economy, is expected to slow down next year in part as the stimulus from the Trump’s administration’s $1.5tn tax cut package fades. Manufacturing surveys have suggested a moderation in factory activity amid labor shortages as well as more expensive raw materials caused by the White House’s protectionist trade policy. (Reuters) UK’s retail sales slow to six-month low, shoppers delay buying winter clothing – British retail sales growth unexpectedly slowed to a six-month low last month, as shoppers held off winter clothing purchases due to mild weather and cut back on other goods after a heavy-spending summer. Retail sales volumes in October alone dropped by 0.5% from September, in contrast to average forecasts in a Reuters poll of economists for them to rise by 0.2%. Growth slowed to 2.2% YoY from an upwardly revised 3.3% in September, the slowest since April and weaker than economists’ forecasts for it to hold at September’s original 3.0% reading. Looking at the three months to October as a whole, which smooth out some monthly volatility, sales growth slowed to 0.4% from 1.2%, also the weakest growth since the April. Britain’s economy has slowed since June 2016’s Brexit vote, but enjoyed a solid summer, with household spending growing by 0.5% in the three months to September. Less than five months before Britain is due to leave the European Union, there have been signs this week of some respite for households, with underlying pay growth picking up to its fastest since 2008 at 3.2% and inflation holding at an 18- month low of 2.4%. (Reuters) Eurozone’s inflation confirmed at nearly six-year high in October – Eurozone’s inflation rose in October at its fastest pace in nearly six years, driven by energy prices, the European Union statistics agency-Eurostat stated, confirming its earlier estimate. The core inflation measure which excludes energy and food was revised down. Eurostat stated that consumer prices in the 19 countries sharing the Euro rose 2.2% YoY in October after a 2.1% increase in September and a 2.0% gain in August. It was the biggest increase since December 2012. The headline figure supports the European Central Bank’s (ECB) decision to end its price-boosting bond-buying program at year- end, as inflation is now overshooting the ECB target of price growth below, but close to, 2% over the medium term. In less

- 4. Page 4 of 6 positive news for the ECB, inflation excluding the volatile components of energy and unprocessed food, the core indicator that the central bank watches in its policy decisions, was revised down by Eurostat to 1.2% on the year, from a previous estimate of 1.3%. However, it was still growing faster than the 1.1% increase posted in September. On the month, headline inflation went up by 0.2% in October, in line with market expectations, but slowing from 0.5% in September. (Reuters) Germany’s minister looks to tax cuts as economy contracts – Germany needs a package of tax cuts and other measures to shore up economic growth in the long term, Economy Minister Peter Altmaier said in an interview, days after the country posted its first economic contraction since 2015. Altmaier, a member of Chancellor Angela Merkel’s governing conservatives, said he was focused on cutting high German corporate taxes following tax cuts in the US, Britain and soon France. He proposed using half of the increase in tax revenues to fund the tax cuts and said it was imperative to ensure that contributions for social benefits did not grow beyond 40% of a person’s gross salary. GDP in Europe’s biggest economy fell 0.2% in the third quarter from the previous three months, according to data released on November 14 by the Federal Statistics Office. At the time, Altmaier said the contraction was not “a catastrophe” and his ministry called the slowdown a temporary phenomenon that occurred as car companies struggled to adjust to new pollution standards known as WLTP. Welt am Sonntag said Altmaier, a close Merkel ally, hoped to parlay concern over the downturn in the third quarter to gain support for tax cuts from Finance Minister Olaf Scholz and his left-leaning Social Democratic party (SPD). (Reuters) France and Germany to present Eurozone’s budget plans on November 19 – France and Germany will lay out plans on November 19 for a limited Eurozone budget focused for now, solely on financing investment, French Finance Ministry sources said. They will steer clear of more controversial plans for using the proposed budget to help Eurozone countries in economic downturns as they seek to overcome opposition to their ideas from other members of the single currency bloc. Paris and Berlin agreed in June to flesh out plans for a joint budget by the end of the year as part of broader package on closer Eurozone integration, proposals that have long been championed by President Emmanuel Macron. However, the idea quickly ran into resistance from some other countries, led by the Netherlands, who are concerned about how much money it will require and how it will be used. The French and German finance ministers will present their Eurozone counterparts with the new proposal at a meeting on November 19 in Brussels, while also clarifying the legal framework and governance for it. (Reuters) Reuters poll: Japan's exports to rebound in October, core CPI steady – Japan’s exports likely rebounded in October after falls led by a series of natural disasters, a Reuters poll found, but worries over global demand and the US-China trade war linger. Exports were forecasted to rise 9.0% in October from a year earlier, the fastest pace of gain since January, the poll of 16 economists showed. In September, they declined a revised 1.3%. Imports likely jumped 14.5% in October from a year earlier, giving a trade deficit of ¥70bn ($617.5mn). The finance ministry will publish the trade data on November 19. The poll also found the nationwide core consumer price index (CPI), which excludes fresh food prices, but includes fuel costs, rose 1.0% in October from a year earlier, and steady from September. The government will release the CPI data on November 22. Japan’s economy shrank more than expected in the third quarter, hit by natural disasters and a decline in exports, a worrying sign that trade protectionism is starting to take its toll on overseas demand. (Reuters) Regional Saudi Arabia plans to spend $400bn on IKTVA program – Saudi Arabia plans to spend more than $400bn on its ‘In Kingdom Total Value Add’ (IKTVA) program in the next 10 years which includes plans to prepare 360,000 trainees for the labor market by 2030. IKTVA was designed and launched in December 2015 with the aim of leveraging the relationship between Saudi Aramco and its suppliers to support the company’s goals to increase local content to 70% by the end of 2021. IKTVA also seeks to develop a diversified and sustainable ecosystem that is capable of competing in the energy sector in the Kingdom, which will provide the labor market with 360,000 graduates from 30 Saudi Aramco training centers and institutes by 2030. (GulfBase.com) Saudi Aramco taps banks for $5bn petrochemical project finance – Saudi Aramco has approached banks to finance its $5bn Amiral petrochemical project that the state-owned oil producer plans to develop with France’s Total, sources said. Saudi Aramco, the world’s largest crude producer, plans to boost investment in refining and petrochemicals in a bid to cut reliance on crude as demand for oil slows. It will be located next to the Satorp refinery, which is also jointly owned and operated by Saudi Aramco and Total. Saudi Aramco has asked banks to pitch for a financial advisory role and to provide indicative commitments for the financing, sources added. (Reuters) Saudi Arabia says Libya agrees to join decision on oil cuts – Saudi Arabian and Libyan energy officials “affirmed the importance of Libya’s participation in the decisions to rebalance the market through reducing production” when OPEC meets next month, the state Saudi Press Agency (SPA) reported. (Bloomberg) ACWA Power gets to financial close on 300MW Saudi Arabian solar project – ACWA Power led a consortium to achieve financial close on the first utility-scale solar project in Saudi Arabia under its National Renewable Energy Program. The Sakaka plant will cover six square kilometers in the Al Jouf area of the Kingdom and will begin operating commercially by the end of 2019, ACWA stated. The 300-megawatt installation has a 25-year purchase power agreement with the Saudi Power Procurement Co. It will be run by newly founded Sakaka Solar Energy Co., with ACWA Power being the majority stakeholder. The plant is expected to cost $302mn and will supply electricity to more than 75,000 homes. (Bloomberg) NMC Health seeks to extend $100mn financing – NMC Health has requested for extension of a $100mn portion of $250mn 1 year term loan signed in June 2018. The margin is at L+215, from existing L+200. The amendment fee is 25bps; around 15 banks were in the deal including arranger Societe Generale, according to sources. (Bloomberg)

- 5. Page 5 of 6 Emirates NBD postpones bond issue due to market conditions – Emirates NBD (ENBD) has postponed a planned issue of US Dollar denominated bonds due to challenging market conditions, sources said. The bank announced earlier last week that it intended to issue a Regulation S senior unsecured benchmark bond with a five-year maturity. Benchmark bonds generally total more than $500mn. The deal has been postponed due to a risk-off tone across emerging markets, the sources added. (Reuters) VP enacts changes to DIFC’s legal framework – HH Sheikh Mohammed Bin Rashid Al Maktoum, Vice President and Prime Minister of the UAE, has enacted changes to the Dubai International Financial Centre (DIFC) Authority’s legal and regulatory framework. The newly enacted laws, which update the DIFC’s companies and property regimes, as well as the overall operating environment for entities based in the Centre, aim to ensure that the DIFC remains the most sophisticated and business-friendly Common Law jurisdiction in the region. The new DIFC Companies Law will now follow a public and private company regime after substantial research, consultation and global benchmarking to allow maximum flexibility, especially for small private companies. In addition, it will provide appropriate levels of oversight for complex corporate arrangements, such as those associated with listed entities, mergers, schemes of arrangement and debt restructurings. (GulfBase.com) Dubai Aerospace signs $720mn revolving credit facility – Dubai Aerospace Enterprise (DAE) stated that it has signed a new unsecured $720mn revolving credit facility with a group of nine international banks based in the US, Europe, and Asia. It stated that the credit facility has a maturity of five years. (Reuters) Middle East Glass sells 74% stake in PET subsidiary – Gulf Capital, one of the largest and most active alternative asset managers in the Middle East, stated that its portfolio company, Middle East Glass (MEG), successfully sold a 74% stake in its PET subsidiary, Medco Plast for Packing and Wrapping Systems (Medco Plast). The sale was made to Indorama Ventures Public Company Limited (IVL), one of the world’s leading producers in the intermediate petrochemicals industry, it stated. Established in 1996, Medco Plast is a leading manufacturer of PET preforms, injection molded products and closures for local and multinational clients, primarily in the carbonated soft drinks, bottled water and dairy segments. The company has a production capacity of 60,000 metric tons per annum of PET preforms. (GulfBase.com) ADNOC Distribution looks abroad as Saudi Arabian gas station set to open – Abu Dhabi National Oil Co. (ADNOC) for Distribution has its sights set on growth abroad as it prepares to open its first foreign filling station in Saudi Arabia later this year. “We have a number of conversations not just within Saudi Arabia, there’s a lot of opportunities going,” Deputy CEO John Carey said. The planned expansion comes as the UAE, OPEC’s fourth-largest oil producer, works to diversify revenue beyond crude sales. ADNOC Distribution will open at least one service station in Saudi Arabia this year, Carey said. ADNOC, the Emirate’s state-owned oil producer, sold shares in ADNOC Distribution last year as it sought to diversify sources of income. “Lower oil prices mean lower pump prices, mean more fuel, that’s the benefit for us,” Carey said. (Bloomberg) Gulf Air, Etihad sign MoU to explore alliance opportunities – Gulf Air, the national carrier of Bahrain, and UAE's Etihad Airways are set to explore deeper cooperation following the signing of a Memorandum of Understanding (MoU) at the Bahrain International Airshow. The wide-ranging MoU covers scope to introduce joint codeshare operations between Abu Dhabi and Manama, as well as on the global flight networks beyond the two carriers’ GCC hubs. The MoU also contains plans for greater commercial cooperation in the fields of cargo, engineering, guest experience and the optimization of pilot training facilities. (GulfBase.com) CFM wins Gulf Air maintenance contract worth $1bn at list price – CFM has signed a 10-year contract worth $1bn for maintenance of 65 LEAP-1A engines that Gulf Air ordered in 2017, CFM stated. (Bloomberg)

- 6. Contacts Saugata Sarkar, CFA, CAIA Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa QNB Financial Services Co. W.L.L. Contact Center: (+974) 4476 6666 PO Box 24025 Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. W.L.L. (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (Q.P.S.C.). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange. Qatar National Bank (Q.P.S.C.) is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 6 of 6 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg ( # Data as of November 13, 2018) Source: Bloomberg ( # Market closed on November 16, 2018) Source: Bloomberg (*$ adjusted returns) 45.0 70.0 95.0 120.0 Oct-14 Oct-15 Oct-16 Oct-17 Oct-18 QSE Index S&P Pan Arab S&P GCC 0.0% 0.1% (0.4%) (0.1%) (0.2%) 0.7% 0.1% (0.5%) 0.0% 0.5% 1.0% SaudiArabia Qatar Kuwait# Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,221.50 0.7 1.0 (6.3) MSCI World Index 2,031.76 0.3 (1.5) (3.4) Silver/Ounce 14.41 0.8 1.8 (14.9) DJ Industrial 25,413.22 0.5 (2.2) 2.8 Crude Oil (Brent)/Barrel (FM Future) 66.76 0.2 (4.9) (0.2) S&P 500 2,736.27 0.2 (1.6) 2.3 Crude Oil (WTI)/Barrel (FM Future)# 56.46 0.0 (6.2) (6.6) NASDAQ 100 7,247.87 (0.2) (2.1) 5.0 Natural Gas (Henry Hub)/MMBtu 4.30 (8.3) 12.3 21.5 STOXX 600 357.71 0.7 (1.5) (12.7) LPG Propane (Arab Gulf)/Ton 80.00 3.6 9.6 (18.2) DAX 11,341.00 0.7 (0.9) (16.7) LPG Butane (Arab Gulf)/Ton 81.50 6.5 6.2 (22.8) FTSE 100 7,013.88 0.2 (2.5) (13.5) Euro 1.14 0.8 0.7 (4.9) CAC 40 5,025.20 0.7 (0.9) (10.2) Yen 112.83 (0.7) (0.9) 0.1 Nikkei 21,680.34 (0.1) (1.7) (5.0) GBP 1.28 0.5 (1.1) (5.0) MSCI EM 986.30 0.6 1.0 (14.9) CHF 1.00 0.7 0.6 (2.5) SHANGHAI SE Composite 2,679.11 0.4 3.4 (24.0) AUD 0.73 0.8 1.5 (6.1) HANG SENG 26,183.53 0.3 2.3 (12.7) USD Index 96.47 (0.5) (0.5) 4.7 BSE SENSEX 35,457.16 0.6 2.0 (7.4) RUB 65.98 0.1 (3.1) 14.5 Bovespa 88,515.27 4.3 3.3 2.3 BRL 0.27 1.1 (0.3) (11.5) RTS 1,134.93 0.3 1.2 (1.7) 76.4 74.2 73.9