QNBFS Daily Market Report March 28, 2019

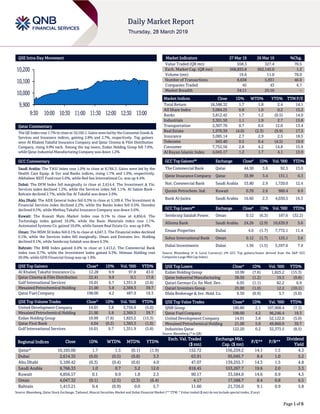

- 1. Page 1 of 6 QSE Intra-Day Movement Qatar Commentary The QE Index rose 1.7% to close at 10,105.1. Gains were led by the Consumer Goods & Services and Insurance indices, gaining 2.8% and 2.7%, respectively. Top gainers were Al Khaleej Takaful Insurance Company and Qatar Cinema & Film Distribution Company, rising 9.9% each. Among the top losers, Ezdan Holding Group fell 7.6%, while Qatar Industrial Manufacturing Company was down 1.2%. GCC Commentary Saudi Arabia: The TASI Index rose 1.0% to close at 8,766.3. Gains were led by the Health Care Equip. & Svc and Banks indices, rising 1.7% and 1.6%, respectively. Alkhabeer REIT Fund rose 5.0%, while Red Sea International Co. was up 4.4%. Dubai: The DFM Index fell marginally to close at 2,614.4. The Investment & Fin. Services index declined 1.2%, while the Services index fell 1.1%. Al Salam Bank - Bahrain declined 2.7%, while Dar Al Takaful was down 2.0%. Abu Dhabi: The ADX General Index fell 0.3% to close at 5,109.4. The Investment & Financial Services index declined 2.2%, while the Banks index fell 0.5%. Ooredoo declined 9.5%, while Methaq Takaful Insurance Company was down 5.6%. Kuwait: The Kuwait Main Market Index rose 0.1% to close at 4,856.6. The Technology index gained 10.0%, while the Basic Materials index rose 1.1%. Automated Systems Co. gained 10.0%, while Sanam Real Estate Co. was up 9.8%. Oman: The MSM 30 Index fell 0.1% to close at 4,047.3. The Financial index declined 0.1%, while the Services index fell marginally. Oman and Emirates Inv. Holding declined 9.1%, while Sembcorp Salalah was down 6.3%. Bahrain: The BHB Index gained 0.4% to close at 1,413.2. The Commercial Bank index rose 0.7%, while the Investment index gained 0.3%. Ithmaar Holding rose 20.0%, while GFH Financial Group was up 1.9%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Al Khaleej Takaful Insurance Co. 12.28 9.9 97.8 43.0 Qatar Cinema & Film Distribution 22.41 9.9 0.1 17.8 Gulf International Services 16.01 6.7 1,351.9 (5.8) Mesaieed Petrochemical Holding 21.00 5.8 2,369.3 39.7 Qatar Fuel Company 198.00 4.2 487.9 19.3 QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% United Development Company 14.01 3.8 3,756.9 (5.0) Mesaieed Petrochemical Holding 21.00 5.8 2,369.3 39.7 Ezdan Holding Group 10.99 (7.6) 1,825.2 (15.3) Qatar First Bank 4.04 (0.2) 1,363.3 (1.0) Gulf International Services 16.01 6.7 1,351.9 (5.8) Market Indicators 27 Mar 19 26 Mar 19 %Chg. Value Traded (QR mn) 558.3 327.4 70.5 Exch. Market Cap. (QR mn) 568,835.8 562,145.0 1.2 Volume (mn) 19.6 11.0 78.0 Number of Transactions 8,658 5,931 46.0 Companies Traded 45 43 4.7 Market Breadth 34:11 25:16 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 18,588.32 1.7 1.8 2.4 14.1 All Share Index 3,084.25 0.8 1.0 0.2 15.2 Banks 3,812.42 1.7 1.2 (0.5) 14.0 Industrials 3,301.50 1.1 1.9 2.7 15.8 Transportation 2,307.70 0.7 0.6 12.0 13.4 Real Estate 1,970.39 (4.0) (2.3) (9.9) 17.5 Insurance 3,085.14 2.7 2.9 2.5 18.5 Telecoms 943.40 0.5 0.4 (4.5) 19.9 Consumer 7,752.56 2.8 4.2 14.8 15.9 Al Rayan Islamic Index 4,045.17 1.2 1.7 4.1 13.9 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% The Commercial Bank Qatar 44.50 3.6 92.5 13.0 Qatar Insurance Company Qatar 35.99 3.4 131.1 0.3 Nat. Commercial Bank Saudi Arabia 53.80 2.9 1,720.0 12.4 Qurain Petrochem. Ind. Kuwait 0.39 2.6 980.4 8.9 Bank Al-Jazira Saudi Arabia 16.60 2.3 4,030.5 16.3 GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Sembcorp Salalah Power. Oman 0.12 (6.3) 187.6 (32.2) Alinma Bank Saudi Arabia 24.26 (2.9) 10,639.9 5.6 Emaar Properties Dubai 4.6 (1.7) 7,772.1 11.4 Sohar International Bank Oman 0.12 (1.7) 125.1 3.6 Dubai Investments Dubai 1.36 (1.5) 5,597.6 7.9 Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the S&P GCC Composite Large Mid Cap Index) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Ezdan Holding Group 10.99 (7.6) 1,825.2 (15.3) Qatar Industrial Manufacturing 38.50 (1.2) 19.5 (9.8) Qatari German Co. for Med. Dev. 6.05 (1.1) 82.2 6.9 Qatari Investors Group 25.00 (1.0) 12.2 (10.1) Dlala Brokerage & Inv. Hold. Co. 9.50 (0.9) 5.7 (5.0) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% QNB Group 180.80 2.1 107,908.4 (7.3) Qatar Fuel Company 198.00 4.2 96,246.4 19.3 United Development Company 14.01 3.8 52,122.0 (5.0) Mesaieed Petrochemical Holding 21.00 5.8 49,860.0 39.7 Industries Qatar 122.20 0.2 32,373.5 (8.5) Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 10,105.06 1.7 1.5 (0.1) (1.9) 152.72 156,259.2 14.1 1.5 4.3 Dubai 2,614.35 (0.0) (0.5) (0.8) 3.3 63.91 95,045.7 8.4 1.0 5.2 Abu Dhabi 5,109.42 (0.3) (0.4) (0.6) 4.0 47.07 139,255.7 14.3 1.5 4.8 Saudi Arabia 8,766.33 1.0 0.7 3.2 12.0 818.45 553,267.7 19.6 2.0 3.3 Kuwait 4,856.57 0.1 0.9 1.8 2.5 90.17 33,584.0 14.6 0.9 4.3 Oman 4,047.32 (0.1) (2.5) (2.3) (6.4) 4.17 17,588.7 8.4 0.8 6.5 Bahrain 1,413.21 0.4 (0.9) 0.0 5.7 11.60 21,726.0 9.1 0.9 5.8 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Market and Dubai Financial Market (** TTM; * Value traded ($ mn) do not include special trades, if any) 9,900 10,000 10,100 10,200 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 6 Qatar Market Commentary The QE Index rose 1.7% to close at 10,105.1. The Consumer Goods & Services and Insurance indices led the gains. The index rose on the back of buying support from Qatari shareholders despite selling pressure from GCC and non-Qatari shareholders. Al Khaleej Takaful Insurance Company and Qatar Cinema & Film Distribution Company were the top gainers, rising 9.9% each. Among the top losers, Ezdan Holding Group fell 7.6%, while Qatar Industrial Manufacturing Company was down 1.2%. Volume of shares traded on Wednesday rose by 78.0% to 19.6mn from 11.0mn on Tuesday. Further, as compared to the 30-day moving average of 10.6mn, volume for the day was 84.6% higher. United Development Company and Mesaieed Petrochemical Holding Company were the most active stocks, contributing 19.1% and 12.1% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Earnings Releases, Global Economic Data and Earnings Calendar Earnings Releases Company Market Currency Revenue (mn) 4Q2018 % Change YoY Operating Profit (mn) 4Q2018 % Change YoY Net Profit (mn) 4Q2018 % Change YoY Saudi Ceramic Co.* Saudi Arabia SR 1,028.0 -9.8% -160.4 – -220.6 – Wafrah for Industry and Development Co.* Saudi Arabia SR 80.1 31.7% -13.5 – -26.5 – The Mediterranean and Gulf Insurance and Reinsurance Co.* Saudi Arabia SR 2,069.5 -22.4% – – 15.0 88.3% MetLife AIG ANB Cooperative Insurance Company* Saudi Arabia SR 168.8 -52.4% – – 4.3 -22.1% Al-Sagr National Insurance Company* Dubai AED 355.7 -10.2% – – 21.7 6.6% Source: Company data, DFM, ADX, MSM, TASI, BHB. (*Financials for FY2018) Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 03/27 US Mortgage Bankers Association MBA Mortgage Applications 22-March 8.9% – 1.6% 03/27 France INSEE National Statistics Office Consumer Confidence March 96 96 95 03/27 France INSEE National Statistics Office PPI MoM February 0.4% – 0.3% 03/27 France INSEE National Statistics Office PPI YoY February 2.1% – 1.7% Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Earnings Calendar Tickers Company Name Date of reporting 4Q2018 results No. of days remaining Status ZHCD Zad Holding Company 30-Mar-19 2 Due Source: QSE Earnings Calendar Tickers Company Name Date of reporting 1Q2019 results No. of days remaining Status QNBK QNB Group 9-Apr-19 12 Due ERES Ezdan Holding Group 11-Apr-19 14 Due CBQK The Commercial Bank 17-Apr-19 20 Due QIGD Qatari Investors Group 23-Apr-19 26 Due UDCD United Development Company 29-Apr-19 32 Due DHBK Doha Bank 30-Apr-19 33 Due Source: QSE Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 27.57% 44.77% (95,996,586.71) Qatari Institutions 32.56% 15.07% 97,668,760.94 Qatari 60.13% 59.84% 1,672,174.23 GCC Individuals 0.54% 0.72% (1,003,054.20) GCC Institutions 1.90% 1.80% 571,148.40 GCC 2.44% 2.52% (431,905.80) Non-Qatari Individuals 10.68% 10.06% 3,468,219.35 Non-Qatari Institutions 26.74% 27.58% (4,708,487.78) Non-Qatari 37.42% 37.64% (1,240,268.43)

- 3. Page 3 of 6 News Qatar QGMD reports net loss of QR7.3mn in 4Q2018 – Qatari German Company for Medical Devices (QGMD) reported net loss of QR7.3mn in 4Q2018 compared to net loss of QR15.4mn in 4Q2017 and QR1.1mn in 3Q2018. In FY2018, QGMD reported net loss of QR12.8mn compared to QR21.7mn in FY2017. Loss per share amounted to QR1.11 in FY2018 compared to loss per share of QR1.88 in FY2017. (QSE) MRDS reports net loss of QR5.5mn in 4Q2018 – Mazaya Qatar Real Estate Development (MRDS) reported net loss of QR5.5mn in 4Q2018 compared to net profit of QR10.5mn in 4Q2017 and net profit of QR5.9mn in 3Q2018. In FY2018, MRDS reported net profit of QR16.6mn compared to QR28.1mn in FY2017. EPS amounted to QR0.143 in FY2018 compared to QR0.243 in FY2017. The board of directors has proposed to the AGM to distribute 5% dividend equivalent to QR0.5 per share. (QSE) UDCD to disclose 1Q2019 financial statements on April 29 – United Development Company (UDCD) announced its intent to disclose 1Q2019 financial statements for the period ending March 31, 2019, on April 29, 2019. (QSE) QIGD to disclose 1Q2019 financial statements on April 23 – Qatari Investors Group (QIGD) announced its intent to disclose 1Q2019 financial statements for the period ending March 31, 2019, on April 23, 2019. (QSE) AKHI to hold its AGM on April 17 – Al Khaleej Takaful Insurance Company (AKHI) announced that it will hold its Annual Ordinary Assembly Meeting (AGM) on April 17, 2019. In case the quorum is not met, an alternate meeting will be held on April 24, 2019. (QSE) Nakilat inks JV with Maran Ventures, expands fleet – Qatar Gas Transport Company Limited (Nakilat) established a new joint venture (JV), ‘Global Shipping Co Ltd’, with shipping company Maran Ventures Inc. (Maran Ventures). Under the agreement, Nakilat will have 60% stake in the JV, while Maran Ventures will hold the remaining 40%. With four LNG vessels under the new JV, the number of Nakilat vessels will effectively increase to 74, which is approximately 11.5% of the global LNG fleet in carrying capacity. Nakilat’s CEO, Abdullah Al Sulaiti said, “This agreement is a step forward for the company as we expand our fleet with additional capacity to meet the growing international demand for clean energy. This has subsequently led to a significant increase in demand for LNG shipping, which we hope will have a positive effect on charter rates. With the four new vessels being managed and marketed by Nakilat, this not only affirms our global leadership in energy transportation, but also bears testament to our vessel management and marketing capabilities with the world’s largest LNG fleet.” (Qatar Tribune) Mannai Corporation to open new innovation centers in Lisbon and Lyon; proposed cash dividend of QR2 per share approved – Mannai Corporation, which has a growing footprint across Europe and North Africa, is all set to open two innovation centers 'Fablabs' in Lisbon and Lyon. With this, the Qatari company will have a total of six Fablabs, including one in the new headquarters of Mannai at the Industrial Area. The other Fablabs are in Paris and Nantes in France as well as Gent in Belgium. Mannai Corporation’s Chairman, Sheikh Hamad bin Abdulla bin Khalifa Al-Thani said, “Internationally, we will continue to innovate and integrate our ICT (information, communication and technology) services throughout Europe.” Mannai Corporation also stated that looking ahead, the retail sector is likely to remain challenged in 2019, particularly for its GCC-wide jewelry business in Damas. Mannai Corporation held its Ordinary & Extraordinary General Assembly meetings and approved all the agenda of the meeting, including the board of directors’ proposal to distribute cash dividend of 20% (QR2 per share), to its shareholders. (Gulf-Times.com, Peninsula Qatar) BRES’ EGM endorses all items on its agenda – Barwa Real Estate Company (BRES) held its Extraordinary General Assembly Meeting (EGM) and approved all the agenda of the meeting including the draft amendment of the Articles of Association in accordance with the decision of Qatar Financial Markets Authority. At its AGM, which was held on March 20, 2019, shareholders approved the distribution of cash dividend of 25% of the share value. (Peninsula Qatar) Qatar’s foreign trade surplus stood at QR13.77bn at February- end – Qatar’s foreign trade surplus stood at QR13.77bn at the end of February this year, according to official statistics. The country’s trade surplus had seen 1.9% decline YoY and more than 13% plunge on a monthly basis, data released by the Planning and Statistics Authority stated. In February 2019, the total exports of goods (including exports of goods of domestic origin and re-exports) amounted to QR22.3bn, showing a decrease of 0.5% compared to February 2018, and 9.7% against January 2019. Meanwhile, imports in February 2019 amounted to QR8.5bn, showing a yearly increase of 1.9%, even as there was a MoM decrease of 3.8%. Exports of petroleum gases and other gaseous hydrocarbons (liquefied natural gas, condensates, propane and butane) reached QR14.5bn, petroleum oils and oils from bituminous minerals (crude) reached QR3.4bn, and petroleum oils and oils from bituminous minerals (non-crude) of QR1.6bn. (Gulf-Times.com) Qatar’s Energy Bank is credit ‘positive’ for GCC, says Moody’s – Qatar’s proposed Shari’ah-principled Energy Bank is credit ‘positive’ for Islamic finance in the GCC, according to Moody’s, a global credit rating agency. “The establishment of Energy Bank as an Islamic lender (rather than a conventional bank) is one of several GCC sovereign initiatives over these years to grow the Islamic finance sector regionally and globally,” the rating agency stated, expecting the lender to support the GCC’s energy sectors regionally and internationally. Qatar is all set to launch Energy Bank with a targeted capital of $10bn to fund hydrocarbon-centric projects across the world, a move that will make Doha a leading player across verticals in the global oil and gas industry. (Gulf-Times.com) MoCI’s new department to protect national products – The economy ministry has established a new department to protect national products, according to Minister of Commerce and Industry (MoCI), HE Ali bin Ahmed Al Kuwari. Al Kuwari said the department named ‘Protecting National Product Department’ (PNPD), will enhance the competitiveness of national products at local and global levels. Qatar’s industrial sector has become one of the most important economic sectors contributing to the country’s economic diversification. He said achieving self-sufficiency will be one of the country’s key

- 4. Page 4 of 6 strategies in the period ahead. Al Kuwari underscored MoCI’s role in facilitating business community and enhancing the private sector’s role as well as solving obstacles that might hinder the sustainable economic development. (Qatar Tribune) Japan's LNG imports from Qatar jump 58.7% YoY in February – Japan’s LNG imports from Qatar jumped 58.7% YoY to 1.05mn tons in February 2019, Ministry of Finance data showed. This is the highest number for Japan’s LNG imports since March 2018. (Bloomberg) HIA ranked fourth best airport in the world – Hamad International Airport (HIA) has been ranked the fourth best airport in the world at the Skytrax World Airport Awards 2019. HIA has also once again been ranked as a five-star Airport and was honored with the title of ‘Best Airport in the Middle East’ for the fifth year in a row and ‘Best Staff Service in the Middle East’ for the fourth year in a row. The awards recognize HIA’s innovative facilities, five-star customer service and state-of- the-art terminal which accommodates more than 30mn passengers annually. (Gulf-Time.com) International US trade deficit shrinks on strong soybean, auto exports – The US trade deficit narrowed by the most in 10 months in January as automotive exports rose and China likely boosted purchases of soybeans, driving the first increase in exports in four months and offering a respite to a flood of dour data on the economy. The Commerce Department stated the trade deficit declined 14.6%, the largest drop since March 2018 to $51.1bn also as increased domestic oil production and lower crude prices curbed the import bill. Economists polled by Reuters had forecasted the trade gap narrowing to $57.0bn in January. The trade deficit with China fell 6.4% in January. US imports from China had increased in prior months as American businesses front-loaded shipments of goods like household furniture and appliances in anticipation of more duties. (Reuters) US current account deficit hits 10-year high; firms bring back more foreign profits – The US current account deficit increased more than expected in the fourth quarter amid declining exports, pushing the overall shortfall in 2018 to its highest level in 10 years, and US companies repatriated a record amount of foreign earnings last year following the Republican tax overhaul. The Commerce Department stated the current account deficit, which measures the flow of goods, services and investments into and out of the country, rose 6.1% to $134.4bn. The quarterly current account gap was the largest since the fourth quarter of 2008. Data for the third quarter was revised to show the deficit rising to $126.6bn from the previously reported $124.8bn. Economists polled by Reuters had forecasted the current account deficit rising to $130.0bn in the fourth quarter. The current account gap represented 2.6% of GDP in the fourth quarter, the largest share since the second quarter of 2012. It was up from 2.5% in the July-September period. (Reuters) MBA: Surprise spike in US refinancing lifts dreary mortgage outlook – A flurry of US refinancing applications sparked by a one-year low for mortgage rates could provide a much-needed boost for mortgage providers, according to the Mortgage Bankers Association (MBA). The trade group stated mortgage applications jumped 9% this week, as unexpected growth in refinancing applications outpaced growth in new loans. Since late December the group’s Refinance Index has increased 76%, reaching its highest level in more than a year. “For the industry in general the pickup in (refinancing) has been a nice surprise,” MBA’s Associate Vice President of economic and industry forecasting, Joel Kan said. The uptick in refinance applications has led the MBA to increase its originations outlook twice this year. The group originally forecast the metric to be slightly lower in 2019 after a 4% drop in 2018. However it reversed its outlook in March to predict 1% growth for the year. (Reuters) UK’s retail sales fall most in 17 months as Brexit nears – British retail sales fell most in 17 months in March, reflecting concern among shoppers about Britain’s unresolved Brexit impasse, a leading employers group stated. Confederation of British Industry (CBI) stated some of the decline might have been caused by Easter’s coming later this year than last year. However the poor run in the data - the balance has not been positive for four months - suggested an underlying caution among British shoppers, whose spending helps drive the economy. Shoppers have generally shown less doubt about Brexit than the country’s employers, who have scaled back their investment before the country’s departure from the European Union, which remains up in the air. The CBI stated its monthly sales balance fell to -18, meaning more retailers reported falling than rising sales. A Reuters poll of economists had forecasted a reading of +5. (Reuters) Japan vows to raise sales tax as record budget passes parliament – Japanese policymakers vowed to raise the sales tax to 10% as planned in October, following the passage in parliament of the budget bill for the next fiscal year beginning next month. Speculation lingers among market players that Prime Minister Shinzo Abe may again put off the twice-delayed tax increase as Japan’s export-led economy sputters in the face of slowing global growth and the Sino-US trade war. Proceeding with the politically unpopular hike could be risky as Abe’s ruling party faces national elections for the upper house in the summer, some analysts said. (Reuters) Regional Saudi Aramco to buy SABIC in $69bn chemicals megadeal – The world’s largest oil producer Saudi Aramco has agreed to buy 70% stake in Saudi Basic Industries Corp (SABIC) from the Kingdom’s wealth fund, Public Investment Fund (PIF) for $69.1bn in one of the biggest deals in the global chemical industry. The agreement will help boost Saudi Aramco’s downstream growth plans comes after months of talks between Saudi Aramco and the PIF, which contributed to the delay of Saudi Aramco’s planned multi-billion Dollar Initial Public Offering (IPO). “This is a win-win-win transaction and a transformational deal for three of Saudi Arabia’s most important economic entities,” PIF’s Managing Director, Yasir Al-Rumayyan said. The deal could inject billions of Dollars into the PIF, giving it the firepower to proceed with its plans to create jobs and diversify the largest Arab economy beyond oil exports, including a mega business zone in the northwest of the country. Saudi Aramco has been increasing its investments in refining and petrochemicals to secure new markets for its crude, as it sees growth in chemicals as central to its downstream expansion strategy. SABIC and Saudi Aramco stated that the agreed purchase price was SR123.39 per share, a slight discount

- 5. Page 5 of 6 from SABIC’s closing price on Wednesday. “Share price at SR123.4 is fair given it is a strategic, long-term investment and given that SABIC is one of the most defensive, uncyclical segments as its growth is mainly related to population growth,” Alrajhi Capital’s Head of Research, Mazen Al-Sudairi said. (Reuters) Zain Saudi signs SR2.52bn tower sale and lease-back pact – Zain Saudi, also known as Mobile Telecommunications Company Saudi Arabia has signed an agreement with IHS Holding for the sale and lease back of its passive towers infrastructure, according to a statement. The transaction value is raised to SR2.52bn from SR2.43bn. The company has stated that it will focus on core operations, optimize use of funds and resources and reduce indebtedness. (Bloomberg) Uniper plans capacity-boosting revamp at Fujairah plant in August – Germany-based energy trader Uniper is planning a ‘debottlenecking’ revamp of its Fujairah low-sulfur fuel oil (LSFO) plant in the UAE in August, a company executive said. “The reason for the debottlenecking is to try and grow capacity and to give us flexibility,” Dubai-based Uniper Energy DMCC’s Managing Director, Chris Wood said on the sidelines of the Fujairah Bunkering and Fuel Oil Forum. The planned revamp is expected to take four to six weeks, he added. Uniper’s Fujairah plant currently has an annual production capacity of about 3mn tons of LSFO with a sulfur content between 0.1% and 0.5%, he said. Demand for low-sulphur marine fuels is expected to soar as new global shipping rules set by the International Maritime Organization (IMO) will come into effect at the start of 2020, which will limit the sulfur content in marine fuels at 0.5% compared with 3.5% currently. (Reuters) UAE’s regulator in final stages of issuing license for nuclear plant – The UAE’s regulator is in the final stages of issuing a license to the operator of the Barakah nuclear power plant now being built, but cannot yet give a date for when it will be granted, a senior official said. Operator Nawah Energy Company in May stated that Barakah should start up between the end of 2019 and early 2020. It will be the UAE’s first nuclear plant and the world’s largest when complete with four reactors and 5,600 megawatts (MW) capacity. “We are not yet ready to issue the operating license, we are in the final stages,” Federal Authority for Nuclear Regulation’s (FANR) Director-General, Christer Viktorrson told reporters, adding that it is “very hard” to say when it will be issued. Barakah, which will be operated by Nawah and owned by Emirates Nuclear Energy Company, is being built by Korea Electric Power Corporation (KEPCO). Delays in training enough local staff have pushed back the startup of the first reactor several times. Viktorrson stated that the UAE is working with government entities on a strategy to provide education and training in radiation protection to those involved in the project. He also said that a concrete void detected by the contractor in the construction of two units of the plant has been repaired and added that this issue “is not part of the delay.” (Reuters) Dubai economic growth at its slowest since 2009 debt crisis – Dubai’s economy grew 1.94% in 2018, the government stated, slowing down from a 2.8% growth rate in 2017 and hitting its slowest pace since a contraction in 2009, when the economy was hobbled by a debt crisis. Dubai, which has a diversified economy that focuses on tourism and international business services, has been hurt by a rough patch amid a downturn in its real estate market. “A weakening external backdrop, a strong US Dollar and the ongoing correction in the property market are headwinds for a number of vital sectors,” Abu Dhabi Commercial Bank’s (ADCB) Chief Economist, Monica Malik said. Property prices in Dubai have fallen by more than a quarter from their peak in 2014. S&P stated last month that it expects prices to fall another 5%-10% this year due to a continued gap between supply and demand, before steadying in 2020. Dubai needed a $20bn bailout from oil-rich Abu Dhabi to escape a debt crisis in 2009 caused by collapsing property prices, which had threatened to force some state-linked companies to default on billions of Dollars of debt. Analysts expect some economic recovery for Dubai ahead of 2020 when the city hosts the World Expo event. The government stated that GDP growth was largely driven by the performance of trade related activities, which grew by 1.3% in 2018 from a year earlier, representing 18.1% of the total growth achieved last year. (Reuters) Denizbank sale to Emirates NBD may be completed in April – Sberbank’s sale of its Turkish unit, Denizbank to Emirates NBD may be completed in early April, Denizbank’s CEO, Hakan Ates said. The sale may be completed in the first few days of April,” he said. Further approvals will then be required for the transaction to close, he added. Sberbank expects the sale to close by the end of the year, CEO, Herman Grefsaid said in February, adding that he was not 100% sure if it will go through at all. Emirates NBD, the biggest bank in Dubai, in May last year had agreed to buy Denizbank for $3.2bn and take on subordinated debt. (Bloomberg) Dubai Aerospace repurchases $250mn of common shares – Dubai Aerospace Enterprise Ltd., the Middle East’s biggest plane-leasing company, has repurchased outstanding common shares worth $250mn. The company has also received $250mn on the early partial repayment of a note receivable from certain shareholders, it stated. “We are committed to maintaining a strong balance sheet and generating best-in-class margins, returns and leverage," CEO, Firoz Tarapore said. "Repurchasing our shares at this time allows us to optimize the capital we need to run our business efficiently,” he added. (Bloomberg)

- 6. Contacts Saugata Sarkar, CFA, CAIA Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa Mehmet Aksoy, PhD QNB Financial Services Co. W.L.L. Senior Research Analyst Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6589 PO Box 24025 mehmet.aksoy@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. W.L.L. (“QNB FS”) a wholly-owned subsidiary of Qatar National Bank (Q.P.S.C.). QNB FS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange. Qatar National Bank (Q.P.S.C.) is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNB FS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNB FS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNB FS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNB FS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNB FS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNB FS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNB FS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNB FS. Page 6 of 6 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 45.0 70.0 95.0 120.0 Feb-15 Feb-16 Feb-17 Feb-18 Feb-19 QSE Index S&P Pan Arab S&P GCC 1.0% 1.7% 0.1% 0.4% (0.1%) (0.3%) (0.0%) (1.0%) 0.0% 1.0% 2.0% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,309.58 (0.5) (0.3) 2.1 MSCI World Index 2,094.02 (0.4) (0.0) 11.2 Silver/Ounce 15.29 (0.9) (0.9) (1.3) DJ Industrial 25,625.59 (0.1) 0.5 9.9 Crude Oil (Brent)/Barrel (FM Future) 67.83 (0.2) 1.2 26.1 S&P 500 2,805.37 (0.5) 0.2 11.9 Crude Oil (WTI)/Barrel (FM Future) 59.41 (0.9) 0.6 30.8 NASDAQ 100 7,643.38 (0.6) 0.0 15.2 Natural Gas (Henry Hub)/MMBtu 2.69 (2.2) (2.9) (15.6) STOXX 600 377.28 (0.2) (0.0) 9.8 LPG Propane (Arab Gulf)/Ton 63.63 (1.0) (0.4) (0.6) DAX 11,419.04 (0.3) 0.1 6.4 LPG Butane (Arab Gulf)/Ton 62.38 0.0 (3.3) (10.3) FTSE 100 7,194.19 (0.1) (0.0) 10.9 Euro 1.12 (0.2) (0.5) (1.9) CAC 40 5,301.24 (0.4) 0.2 10.1 Yen 110.51 (0.1) 0.5 0.7 Nikkei 21,378.73 (0.3) (1.6) 6.7 GBP 1.32 (0.2) (0.2) 3.4 MSCI EM 1,044.10 (0.6) (1.5) 8.1 CHF 1.01 (0.0) (0.1) (1.3) SHANGHAI SE Composite 3,022.72 0.7 (2.8) 23.9 AUD 0.71 (0.7) 0.0 0.5 HANG SENG 28,728.25 0.6 (1.3) 10.9 USD Index 96.77 0.0 0.1 0.6 BSE SENSEX 38,132.88 (0.4) 0.1 6.7 RUB 64.85 0.7 0.3 (6.5) Bovespa 91,903.40 (5.1) (3.1) 3.0 BRL 0.25 (3.1) (2.3) (2.9) RTS 1,207.23 (1.8) (0.5) 13.0 100.5 94.1 83.8