QNBFS Daily Market Report July 20, 2017

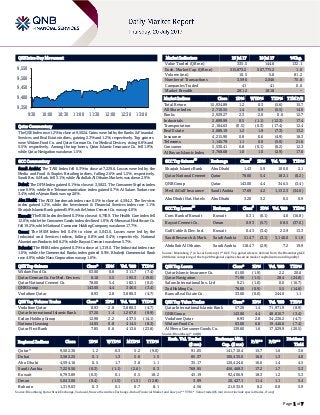

- 1. Page 1 of 7 QSE Intra-Day Movement Qatar Commentary The QSE Index rose 1.2% to close at 9,502.4. Gains were led by the Banks & Financial Services and Real Estate indices, gaining 2.3% and 1.2%, respectively. Top gainers were Widam Food Co. and Qatar German Co. for Medical Devices, rising 6.8% and 5.5%, respectively. Among the top losers, Qatar Islamic Insurance Co. fell 1.9%, while Qatar Navigation was down 1.5%. GCC Commentary Saudi Arabia: The TASI Index fell 0.3% to close at 7,229.6. Losses were led by the Media and Food & Staples Retailing indices, falling 2.6% and 1.5%, respectively. Saudi Res. & Mark. fell 3.1%, while Abdullah Al Othaim Markets was down 2.9%. Dubai: The DFM Index gained 0.1% to close at 3,582.3. The Consumer Staples index rose 0.9%, while the Telecommunication index gained 0.7%. Al Salam Sudan rose 3.4%, while Ajman Bank was up 2.6%. Abu Dhabi: The ADX benchmark index rose 0.5% to close at 4,594.2. The Services index gained 1.2%, while the Investment & Financial Services index rose 1.1%. Sharjah Islamic Bank gained 5.9%, while Union Cement Co. was up 4.0%. Kuwait: The KSE Index declined 0.3% to close at 6,793.9. The Health Care index fell 12.0%, while the Consumer Goods index declined 1.0%. Al-Mowasat Healthcare Co. fell 19.2%, while National Consumer Holding Company was down 17.7%. Oman: The MSM Index fell 0.4% to close at 5,043.0. Losses were led by the Industrial and Services indices, falling 0.8% and 0.4%, respectively. National Aluminium Products fell 6.2%, while Raysut Cement was down 5.7%. Bahrain: The BHB Index gained 0.3% to close at 1,319.0. The Industrial index rose 1.0%, while the Commercial Banks index gained 0.5%. Khaleeji Commercial Bank rose 4.9%, while Nass Corporation was up 1.6%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Widam Food Co. 63.00 6.8 311.7 (7.4) Qatar German Co. for Med. Devices 8.18 5.5 195.3 (19.0) Qatar National Cement Co. 78.00 5.4 182.1 (0.2) QNB Group 143.00 4.4 346.5 (3.4) Vodafone Qatar 8.93 2.8 3,880.3 (4.7) QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Vodafone Qatar 8.93 2.8 3,880.3 (4.7) Qatar International Islamic Bank 57.20 1.4 1,267.0 (8.9) Ezdan Holding Group 12.98 2.2 437.5 (14.1) National Leasing 14.05 0.8 414.5 (8.3) Qatar First Bank 7.85 0.6 413.6 (23.8) Market Indicators 19 Jul 17 18 Jul 17 %Chg. Value Traded (QR mn) 335.5 144.6 132.1 Exch. Market Cap. (QR mn) 515,873.2 507,775.2 1.6 Volume (mn) 10.5 5.8 81.2 Number of Transactions 3,596 2,046 75.8 Companies Traded 41 41 0.0 Market Breadth 28:12 18:18 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 15,934.89 1.2 0.3 (5.6) 15.7 All Share Index 2,710.55 1.4 0.9 (5.5) 14.0 Banks 2,929.27 2.3 2.0 0.6 12.7 Industrials 2,899.99 0.5 (1.1) (12.3) 17.4 Transportation 2,104.63 (0.5) (0.3) (17.4) 12.4 Real Estate 2,080.19 1.2 1.9 (7.3) 13.2 Insurance 4,215.90 0.8 0.6 (4.9) 18.3 Telecoms 1,145.79 1.1 0.0 (5.0) 21.6 Consumer 5,530.41 0.8 (0.1) (6.2) 12.3 Al Rayan Islamic Index 3,768.68 1.0 1.0 (2.9) 17.0 GCC Top Gainers ## Exchange Close # 1D% Vol. ‘000 YTD% Sharjah Islamic Bank Abu Dhabi 1.43 5.9 100.0 2.1 Qatar National Cement Qatar 78.00 5.4 182.1 (0.2) QNB Group Qatar 143.00 4.4 346.5 (3.4) Med. & Gulf Insurance Saudi Arabia 17.69 4.2 1,132.3 (34.6) Abu Dhabi Nat. Hotels Abu Dhabi 3.20 3.2 0.5 0.9 GCC Top Losers ## Exchange Close # 1D% Vol. ‘000 YTD% Com. Bank of Kuwait Kuwait 0.31 (6.1) 4.0 (16.8) Raysut Cement Co. Oman 0.93 (5.7) 68.5 (37.0) Gulf Cable & Elec. Ind. Kuwait 0.43 (3.4) 22.9 13.3 Saudi Research & Mark. Saudi Arabia 51.47 (3.1) 3,140.0 51.9 Abdullah Al Othaim. Saudi Arabia 118.47 (2.9) 7.2 19.9 Source: Bloomberg ( # in Local Currency) ( ## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Qatar Islamic Insurance Co. 61.00 (1.9) 2.2 20.6 Qatar Navigation 71.90 (1.5) 28.4 (24.8) Salam International Inv. Ltd 9.21 (1.0) 0.0 (16.7) Zad Holding Co. 76.00 (0.9) 5.5 (14.8) Barwa Real Estate Co. 33.60 (0.6) 244.0 1.1 QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Qatar International Islamic Bank 57.20 1.4 71,971.9 (8.9) QNB Group 143.00 4.4 48,810.7 (3.4) Vodafone Qatar 8.93 2.8 34,230.2 (4.7) Widam Food Co. 63.00 6.8 19,446.6 (7.4) Al Meera Consumer Goods Co. 139.60 1.6 17,029.9 (20.5) Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 9,502.36 1.2 0.3 5.2 (9.0) 91.05 141,710.4 15.7 1.6 3.6 Dubai 3,582.25 0.1 1.3 5.6 1.5 85.37 100,435.0 16.6 1.3 4.0 Abu Dhabi 4,594.16 0.5 1.7 3.8 1.1 35.17 120,424.6 16.6 1.4 4.5 Saudi Arabia 7,229.56 (0.3) (1.1) (2.6) 0.3 769.95 456,468.3 17.2 1.7 3.3 Kuwait 6,793.89 (0.3) 0.1 0.5 18.2 45.19 92,406.9 18.3 1.2 5.3 Oman 5,043.00 (0.4) (1.5) (1.5) (12.8) 3.99 20,427.1 11.4 1.1 5.4 Bahrain 1,319.03 0.3 0.1 0.7 8.1 4.56 21,035.9 8.2 0.8 5.9 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 9,350 9,400 9,450 9,500 9,550 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 7 Qatar Market Commentary The QSE Index rose 1.2% to close at 9,502.4. The Banks & Financial Services and Real Estate indices led the gains. The index rose on the back of buying support from Qatari and non-Qatari shareholders despite selling pressure from GCC shareholders. Widam Food Co. and Qatar German Co. for Medical Devices were the top gainers, rising 6.8% and 5.5%, respectively. Among the top losers, Qatar Islamic Insurance Co. fell 1.9%, while Qatar Navigation was down 1.5%. Volume of shares traded on Wednesday rose by 81.2% to 10.5mn from 5.8mn on Tuesday. However, as compared to the 30-day moving average of 12.7mn, volume for the day was 17.1% lower. Vodafone Qatar and Qatar International Islamic Bank were the most active stocks, contributing 36.9% and 12.0% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Earnings Releases, Global Economic Data and Earnings Calendar Earnings Releases Company Market Currency Revenue (mn) 2Q2017 % Change YoY Operating Profit (mn) 2Q2017 % Change YoY Net Profit (mn) 2Q2017 % Change YoY Saudi Electricity Co. Saudi Arabia SR – – 2,925.0 3.9% 2,232.0 -0.4% Aldrees Petroleum & Transport Services Co. Saudi Arabia SR – – 21.9 -31.6% 18.3 -35.8% Sharjah Group Company Abu Dhabi AED – – – – 1.4 -53.0% Dhofar Int. Dev. and Inv. Hold.* Oman OMR 2.6 -15.5% – – 3.2 -54.6% Source: Company data, DFM, ADX, MSM, TASI, BHB. (*1H2016) Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 07/19 US Mortgage Bankers Association MBA Mortgage Applications 14-July 6.30% – -7.40% 07/19 EU Eurostat Construction Output MoM May -0.70% – 0.30% 07/19 EU Eurostat Construction Output YoY May 2.60% – 3.30% Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Earnings Calendar Tickers Company Name Date of reporting 2Q2017 results No. of days remaining Status GWCS Gulf Warehousing Company 20-Jul-17 0 Due QNCD Qatar National Cement Company 23-Jul-17 3 Due QIIK Qatar International Islamic Bank 23-Jul-17 3 Due QGTS Qatar Gas Transport Company (Nakilat) 24-Jul-17 4 Due QIGD Qatari Investors Group 25-Jul-17 5 Due BRES Barwa Real Estate Company 25-Jul-17 5 Due QATI Qatar Insurance Company 25-Jul-17 5 Due QIMD Qatar Industrial Manufacturing Company 25-Jul-17 5 Due QEWS Qatar Electricity & Water Company 26-Jul-17 6 Due DBIS Dlala Brokerage & Investment Holding Company 26-Jul-17 6 Due QFBQ Qatar First Bank 26-Jul-17 6 Due ERES Ezdan Real Estate Company 26-Jul-17 6 Due ORDS Ooredoo 26-Jul-17 6 Due VFQS Vodafone Qatar* 27-Jul-17 7 Due NLCS National Leasing (Alijarah) 27-Jul-17 7 Due QOIS Qatar & Oman Investment 30-Jul-17 10 Due AHCS Aamal Company 30-Jul-17 10 Due GISS Gulf International Services 31-Jul-17 11 Due QNNS Qatar Navigation (Milaha) 1-Aug-17 12 Due QISI Qatar Islamic Insurance 2-Aug-17 13 Due AKHI Al Khaleej Takaful Insurance 3-Aug-17 14 Due Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 40.23% 41.53% (4,341,481.14) Qatari Institutions 29.46% 25.56% 13,111,032.42 Qatari 69.69% 67.09% 8,769,551.28 GCC Individuals 0.37% 3.11% (9,166,350.21) GCC Institutions 3.25% 9.24% (20,097,476.10) GCC 3.62% 12.35% (29,263,826.31) Non-Qatari Individuals 9.46% 9.75% (965,630.51) Non-Qatari Institutions 17.22% 10.82% 21,459,905.54 Non-Qatari 26.68% 20.57% 20,494,275.03

- 3. Page 3 of 7 DOHI Doha Insurance 6-Aug-17 17 Due SIIS Salam International Investment 6-Aug-17 17 Due MERS Al Meera Consumer Goods Company 10-Aug-17 21 Due QFLS Qatar Fuel Company 10-Aug-17 21 Due Source: QSE (* Results for 1Q2017-18) News Qatar DHBK’s net profit declines 3.6% QoQ in 2Q2017, in line with our estimate – Doha Bank’s (DHBK) net profit declined 3.6% QoQ (- 0.9% YoY) to QR351.12mn in 2Q2017, in line with our estimate of QR339.76mn (+3.3% variation). Net interest income came in at QR571.89mn in 2Q2017, increasing by 9.8% QoQ (+9.2% YoY). DHBK’s total assets stood at QR91.80bn at the end of June 30, 2017, up 1.2% QoQ (+5.1% YoY). Loans & advances to customers fell 0.5% QoQ to QR59.19bn at the end of June 30, 2017. However, on YoY basis Loans & advances to customers increased 6.8%. Customer deposits rose 3.7% QoQ (+6.8% YoY) to QR56.0bn, an evidence of the strong liquidity position of the bank. Earnings per share declined to QR1.25 in 2Q2017 from QR1.41 in 1Q2017 and QR1.32 in 2Q2016. In 1H2017, the bank’s net operating income grew 4.8% to QR1.47bn. DHBK’s Managing Director Sheikh Abdul Rehman bin Mohamad bin Jabor al-Thani said, “Through the strategic utilization of the shareholders’ funds by way of increasing our performance levels, the return on average shareholders’ equity is 14.7%, one of the best in the industry.” The bank, given the scale of operations, has achieved a very high return on average assets of 1.57%, which is a clear demonstration of the effective utilization of shareholders’ funds and optimum asset allocation strategies, he said. Highlighting its key achievements and innovations, he said the bank, as a founder, is in the final stage of launching the QE Index exchange traded fund (QETF), which would invest and replicate the Qatar Index’s largest 20 companies in term of market capitalization and liquid listings. (QNBFS Research, Company financials, Gulf-Times.com) QGRI posts net loss of ~QR3.3mn in 2Q2017 – Qatar General Insurance & Reinsurance Company (QGRI) reported net loss of ~QR3.3mn in 2Q2017 as compared to net profit of QR43.1mn in 1Q2017. Earnings per share amounted to QR0.45 in 1HQ2017 as compared to QR0.98 in 1H2016. (QSE) IBQ’s net profit jumps 20% YoY to QR278mn in 1H2017 – Aided by its robust corporate banking, International Bank of Qatar (IBQ), which is in the midst of a three-way merger with Masraf Al Rayan and Barwa Bank has reported 20% YoY jump in net profit to QR278mn in 1H2017. The bank, whose total operating income grew 17%, has continued to derisk its balance sheet and reduce its reliance on wholesale interbank funding, its spokesman said. These factors coupled with the current situation has seen some contraction in total assets, even though loans and advances remained stable, while the bank continues to rely on client deposits and deepening relationships to fund its asset book, said IBQ, which enjoys an ‘A+’ rating from Fitch and an ‘A2’ from Moody’s. “This strong set of results is the outcome of IBQ’s focus on deepening its exceptional client franchise, maintaining conservative risk management, and delivering consistently high standards of service quality to its customers,” IBQ’s Managing Director, Omar Bouhadiba said. The bank’s asset quality has remained stable with the non- performing loan ratio at 1.19%. Its net interest margin, return on average assets and most operating metrics continued to improve and the bank’s return on average equity now stands at a healthy 12.3% compared to 10.8% last year. “All business segments contributed positively to the total operating income result with corporate banking delivering a stellar set of first half results,” the spokesman said. Expenses continued to be tightly managed with the cost-to-income ratio showing a 13% reduction from last year, as the lender successfully controlled the day-to-day operating model while retaining oversight on good corporate governance. (Gulf-Times.com) Siege will not stop Qatar from pursuing sustainable growth – The unilateral illegal land, sea and air siege imposed on Qatar by the Saudi-led bloc will not deviate it from achieving sustainable development, prosperity and growth, HE the Minister of Development Planning and Statistics, Dr. Saleh Mohamed Salem al-Nabit, said. Speaking at a meeting of the 2017 high-level political forum on sustainable development at the United Nations headquarters in New York, the Minister said that after the contrived crisis, Qatar is addressing the siege with the power of truth, logic and transparency, along with the support of its friends in the region and the world. Dr Al-Nabit stressed Qatar's commitment to the UN charter and relevant international conventions in every step it takes, reiterating that nothing would deviate it from the path it chose and set for itself in Qatar National Vision 2030, represented in achieving sustainable development. The Minister referred to the international indicators and comparisons that reflect Qatar's continuous and steady progress in all the different economic development indicators as well as the social, human, safety indicators and peace in the world. (Gulf-Times.com) Hamad Port breaks siege with new lines – Hamad Port has succeeded in breaking the siege imposed on Qatar since June 5 with the opening of five new shipping lines under the direction of the Ministry of Transport and Communications and in cooperation with partners such as Mediterranean Shipping Company (MSC), Maersk Company and Qatar Navigation Company (Milaha), said Captain Abdul Aziz al-Yafei, Director of Hamad Port. Captain Al-Yafei said that Hamad Port’s new lines connect directly to several ports in the region and beyond such as Sohar and Salalah in Oman, Mundra and Nhava Sheva in India, Izmir in Turkey and other ports served by these international companies from all over the world. (Gulf- Times.com) Qatari banks confident in future growth – A vast majority of banks in Qatar believe that systemic risk in the country’s banking sector will decrease or remain the same in the current year. A ‘risk perception survey-2017’, conducted by Qatar Central Bank (QCB), found almost all the banks expressing confidence in the financial stability of the country’s banking

- 4. Page 4 of 7 sector. “Around 70% of the respondent banks opined the systemic risk in the banking sector will decrease or remain the same in the current year and the year ahead”, the QCB said in its survey conducted as part of its eighth Financial Stability Review. The perception of the respondent banks on credit and market risk also indicate a higher majority expect the risk levels will either decrease or remain at the same level during 2017 and 2018. On then liquidity risk, the opinion is equally distributed on positive and negative perception. (Peninsula Qatar) Envoy: UK-Qatar ties strong – A luncheon event held by the Qatar-British Business Forum (QBBF) in Doha recently “was an opportunity to reassure businesses that the UK-Qatar relationship remains as strong as ever,” British Ambassador to Qatar, Ajay Sharma said. At the event, Ambassador Sharma addressed more than 140 QBBF members. The QBBF luncheon events encourage businesses to meet, collaborate and share ideas on supporting trade between Qatar and the UK. (Gulf- Times.com) Qatar Chamber to identify losses of firms from siege – Qatar Chamber (QC) has launched an initiative aimed at identifying losses sustained by Qatari companies from the economic blockade imposed by Saudi Arabia and its allies. QC said it recently published an online questionnaire on its website to monitor and identify the extent of the damage caused by the economic blockade to Qatari companies. The questionnaire will aid the Compensation Claims Committee in addressing the claims made not only by Qatari companies but also government bodies, authorities, ministries, private companies, public institutions and individuals. (Peninsula Qatar) Qatar Airways increases frequency to Moscow with additional daily flight – Qatar Airways announced that it has added additional flights to its Moscow route, bringing the total frequency to 21 flights per week between Doha and the Russian capital. Commencing August 2, the airline will introduce an extra daily flight on the Doha-Moscow route to meet growing demand to Moscow, a destination popular with both business and leisure travelers. The additional frequency will be served by an Airbus A320 aircraft. (Peninsula Qatar) International US homebuilding hits four-month high – US homebuilding increased to a four-month high in June, but construction activity remains constrained by rising lumber prices and labor and land shortages. June's better-than-expected increase in housing starts ended three straight months of declines, offering hope that investment in homebuilding was only a modest drag on economic growth in the second quarter. Housing starts jumped 8.3% to a seasonally adjusted annual rate of 1.22mn units, the highest level since February, as both single-family and multi-family construction rebounded after a recent slump, the Commerce Department said. May’s sales pace was revised up to 1.12mn units from the previously reported 1.09mn units. Economists had forecasted groundbreaking activity rising to a 1.16mn-unit rate last month. Building permits shot up 7.4% to a 1.25mn-unit rate in June, with approvals for the single-family housing segment snapping a three-month losing streak. Permits for multi-family homes construction rose to a five-month high. (Reuters) Finance Ministry: German economy to grow by around 0.6% in second quarter – The German economy is humming and set for solid growth despite external risks such as the unknown outcome of Brexit negotiations and US President Donald Trump's future trade policies, the German Finance Ministry said. “The current picture of economic indicators suggests that the economic upswing continued vigorously in the second quarter,” the ministry said in its monthly report, pointing to rising industrial output and buoyant business morale. German gross domestic product (GDP) likely expanded in the second quarter by a similar rate as in the previous three months when the economy grew by 0.6% on the quarter, it said. “However, risks arising from the Brexit negotiations and from the future US trade policy remain,” the ministry added. The Federal Statistics Office will publish preliminary second quarter GDP growth figures in mid-August. The International Monetary Fund (IMF) has raised its growth forecast for the German economy. It now expects it to expand by 1.8% in 2017 and by 1.6% in 2018 in real terms. The German government remains more cautious and so far has stuck to its estimates of 1.5% for 2017 and 1.6% for 2018, non-adjusted for workdays. This would be below the 1.9% in 2016, which was the strongest rate in five years. (Reuters) Japan's June export growth points to sustained economy recovery – Japan's exports rose for a seventh straight month in June led by shipments of cars and electronics, an indication external demand continues to support a gradual economic recovery and backing the central bank's upbeat economic view. Ministry of Finance (MoF) data showed that exports grew 9.7% YoY in June, versus a 9.5% annual gain expected by economists in a Reuters poll. It followed a 14.9% YoY rise in the previous month. The data comes hours before the Bank of Japan ends a two-day rate review, at which it is expected to raise its growth forecasts as robust exports and private consumption heighten prospects of a moderate economic recovery. However, the central bank is also likely to cut its price forecasts and hold off from expanding stimulus, highlighting a gap between strong growth and weak inflation. (Reuters) BoJ to cut inflation forecasts but stand pat on policy as economy picks up – The Bank of Japan (BoJ) is set to paint a brighter picture of the economy on July 20, but cut its inflation forecasts again, reinforcing expectations that it will lag well behind major global central banks in scaling back its massive stimulus program. With robust exports and private consumption pointing to a steady though modest economic recovery, the Japanese central bank is expected to hold off from expanding stimulus at its two-day rate review that ends on July 20. However, stubbornly weak price growth will likely force the BoJ to cut its inflation forecasts, sources said, underscoring the challenges the central bank faces as it tries to reflate the economy and coax consumers into spending more. Depending on how deep the cuts are, the BoJ may push back the timing for hitting its 2% inflation target, the sources said, in a flesh blow to Governor Haruhiko Kuroda's radical monetary experiment aimed at sustainably ending deflation. (Reuters) Regional GCC refining sector faces uncertain outlook – Plans for Greenfield projects and refinery expansions across the GCC

- 5. Page 5 of 7 countries are entering a critical phase, the latest Energy Research of Arab Petroleum Investments Corporation (Apicorp) revealed. The region is leading the drive in the Middle East with 1.5mn barrels per day of new refining capacity expected online by 2021. Substantial investments in the refining sector were made to tackle increasing domestic demand and diversify away from crude to more specialized product exports. At the same time, these refinery additions are changing global trade flows, with the region exporting more refined products, particularly to Europe. As global capacity rises and fuel standards improve, competition will become more intense meaning a more uncertain outlook awaits the region’s refineries. (GulfBase.com) IoT solutions market in the GCC to hit $11bn by 2025 – The Internet of Things (IoT) solutions market in the GCC region is poised for solid growth and is likely to be worth $11bn over the next eight years, said an industry expert. The IoT has the potential to unlock up to 11% in incremental GDP driving economic growth in the GCC region, according to AT Kearney’s latest report, named ‘IoT in the GCC: Building a Brighter, More Sustainable Future’. By 2025, the IoT solutions market will be generating a potential value for the economy of nearly $160bn; implying that every dollar spent on IoT solutions could produce nearly $14.50 in economic value, stated the report. (GulfBase.com) RIBL’s net profit falls 26.0% YoY to SR848mn in 2Q2017 – Riyad Bank (RIBL) recorded net profit of SR848mn in 2Q2017, registering decrease of 26.0% YoY due to 28.2% rise in operating expenses, attributable to increase in impairment charge for credit losses partially offset by drop in impairment charge for investments. Total operating income fell 2.1% YoY to SR1,984mn in 2Q2017, as decrease in fee and commission income, net exchange income and gains on non-trading investments were partially offset by increase in net special commission income. Total assets stood at SR218.99bn at the end of June 30, 2017 as compared to SR227.78bn at the end of June 30, 2016. Loans and advances stood at SR141.18bn (-8.7% YoY), while customer deposits stood at SR156.98bn (-4.3% YoY) at the end of June 30, 2017. EPS decreased to SR0.63 in 1H2017, as compared to SR0.77 in 1H2016. (Tadawul) Saudi Aramco reportedly considers Zuluf oilfield’s expansion – Saudi Aramco is considering building new facilities to add production of Arabian Heavy crude from the Zuluf offshore oilfield, industry sources said. The central processing plant is expected to have two units, known as trains, with a total capacity of 600,000 barrels per day (bpd) to process Arabian Heavy crude supplied by electrical submersible pumps (ESP). (Zawya) IMF suggests UAE ease reins on spending to nudge growth – The UAE should slow down its efforts to rein in spending this year in order to nudge growth and invest in preparation for Expo 2020, according to the International Monetary Fund (IMF) mission country head Natalia Tamirisa. “There is some slowdown in the pace of fiscal consolidation that the Government is planning to implement and we believe that their plans are appropriate. Growth is just starting to recover this year”, Tamirisa said. (GulfBase.com) DIB’s net profit rises to AED1,057.4mn in 2Q2017 – Dubai Islamic Bank (DIB) recorded net profit of AED1,057.4mn in 2Q2017 as compared to net profit of AED928.9mn in 2Q2016. Income from Islamic financing and investing transactions came in at AED1,907.7mn in 2Q2017 as compared to AED1,615.7mn in 2Q2016. Total assets stood at AED193.08bn at the end of June 30, 2017 as compared to AED174.97bn at the end of December 31, 2016. Islamic financing and investing assets (net) stood at AED125.44bn, while customers’ deposits stood at AED141.38bn at the end of June 30, 2017. Earnings per share came in at AED0.21 in 2Q2017, as compared to AED0.22 in 2Q2016. (DFM) EMIRATES NBD’s net profit rises to AED2,020.6mn in 2Q2017 – Emirates NBD Bank recorded net profit of AED2,020.6mn in 2Q2017 as compared to AED1,910.2mn in 2Q2016. Net interest income came in at AED2,195.1mn in 2Q2017 as compared to AED2,123.5mn in 2Q2016. Total operating income came in at AED3,835.8mn as compared to AED3,765.7mn in 2Q2016. Total assets stood at AED456.22bn at the end of June 30, 2017 as compared to AED448.0bn at the end of December 31, 2016. Loans and receivables stood at AED256.73bn, while customers’ deposits stood at AED264.95bn at the end of June 30, 2017. EPS came in at AED0.34 in 2Q2017, as compared to AED0.32 in 2Q2016. (DFM) EIB’s net profit rises sharply to AED165.7mn in 2Q2017 – Emirates Islamic Bank (EIB) recorded net profit of AED165.7mn in 2Q2017 as compared to net profit of AED92.1mn in 2Q2016. Net operating profit came in at AED288.3mn in 2Q2017 as compared to AED212.9mn in 2Q2016. Total assets stood at AED60.50bn at the end of June 30, 2017 as compared to AED59.23bn at the end of December 31, 2016. Financing and investing receivables stood at AED35.36bn, while customers’ deposits stood at AED41.81bn at the end of June 30, 2017. EPS increased to AED0.031 in 2Q2017, as compared to AED0.024 in 2Q2016. (DFM) CBI’s net profit narrows to AED31.8mn in 2Q2017 – Commercial Bank International (CBI) recorded a net profit of AED31.8mn in 2Q2017 as compared to AED32.2mn in 2Q2016. Total interest income and income from Islamic financing & investing assets came in at AED211.8mn in 2Q2017 as compared to AED180.5mn in 2Q2016. Net operating income came in at AED202.4mn in 2Q2017 as compared to AED210.7mn in 2Q2016. Total assets stood at AED20.17bn at the end of June 30, 2017 as compared to AED20.32bn at the end of December 31, 2016. Loans and advances to customers stood at AED13.28bn, while customers’ deposits stood at AED13.31bn at the end of June 30, 2017. EPS came in flat YoY at AED0.01 in 2Q2017. (ADX) Oil Minister: Kuwait plans to increase natural gas production capacity – Kuwait’s Oil Minister, Issam Almarzooq said that the country plans to increase natural gas production capacity by 510mcf by December. Kuwait currently produces 210mcf of gas, and 80k bpd of light oil from northern fields. Kuwait plans to develop Dorra gas field with Saudi Arabia in their shared Neutral Zone and will also tender for development of Jurassic gas project with capacity of 500kcf. (Bloomberg) Central Bank of Oman raises OMR41mn from treasury bills – Oman raised OMR41mn by way of treasury bills this week. The treasury bills are with a maturity period of 28 days, from July 19 to August 16, 2017. The average accepted price reached 99.924 for every OMR100, and the minimum accepted price arrived at

- 6. Page 6 of 7 99.920 per OMR100. Whereas the average discount rate and the average yield reached 0.98881% and 0.98956%, respectively. The interest rate on the Repo operations with Central Bank of Oman is 1.728% for the period from July 18, 2017 to July 24, 2017, while the discount rate on the Treasury Bills Discounting Facility with Central Bank of Oman is 2.478%, for the same period. (GulfBase.com) Oman Oil Company to close $1bn PXF loan imminently – According to sources, Oman Oil Company expects to close imminently, within two months at the latest, a pre-export financing (PXF) loan of around $1bn. The petroleum firm has hired Natixis and Societe Generale to lead the debt transaction, which is being marketed to other lenders. The loan is in the region of $1bn, but the final size could be larger, the source added. (Reuters) NBB’s net profit rises to BHD17.0mn in 2Q2017 – National Bank of Bahrain (NBB) recorded net profit of BHD17.0mn in 2Q2017 as compared to BHD14.0mn in 2Q2016. Net interest income came in at BHD17.8mn in 2Q2017 as compared to BHD16.0mn in 2Q2016. Total operating income came in at BHD26.9mn as compared to BHD25.3mn in 2Q2016. Total assets stood at BHD2.99bn at the end of June 30, 2017 as compared to BHD2.97bn at the end of June 30, 2016. Loans and advances stood at BHD1.05bn, while customers’ deposits stood at BHD2.14bn at the end of June 30, 2017. EPS came in at BHD0.0135in 2Q2017, as compared to BHD0.0111 in 2Q2016. (Bahrain Bourse)

- 7. Contacts Saugata Sarkar Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa Mohamed Abo Daff QNB Financial Services Co. W.L.L. Senior Research Analyst Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6589 PO Box 24025 mohd.abodaff@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. W.L.L. (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (Q.P.S.C.). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange. Qatar National Bank (Q.P.S.C.) is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 7 of 7 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg ( # Market closed on July 19, 2017) Source: Bloomberg (*$ adjusted returns) 70.0 90.0 110.0 130.0 150.0 170.0 Jun-13 Jun-14 Jun-15 Jun-16 Jun-17 QSEIndex S&PPanArab S&PGCC (0.3%) 1.2% (0.3%) 0.3% (0.4%) 0.5% 0.1% (0.5%) 0.0% 0.5% 1.0% 1.5% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,241.21 (0.2) 1.0 7.7 MSCI World Index 1,958.56 0.5 0.5 11.8 Silver/Ounce# 16.29 0.0 1.8 2.3 DJ Industrial 21,640.75 0.3 0.0 9.5 Crude Oil (Brent)/Barrel (FM Future) 49.70 1.8 1.6 (12.5) S&P 500 2,473.83 0.5 0.6 10.5 Crude Oil (WTI)/Barrel (FM Future) 47.12 1.6 1.2 (12.3) NASDAQ 100 6,385.04 0.6 1.1 18.6 Natural Gas (Henry Hub)/MMBtu 3.10 0.5 5.9 (15.8) STOXX 600 385.54 0.4 0.2 16.5 LPG Propane (Arab Gulf)/Ton 66.88 3.1 4.3 (6.8) DAX 12,452.05 (0.2) (0.9) 18.5 LPG Butane (Arab Gulf)/Ton 74.25 2.8 2.8 (23.5) FTSE 100 7,430.91 0.5 0.4 9.8 Euro 1.15 (0.3) 0.4 9.5 CAC 40 5,216.07 0.5 0.2 17.2 Yen 111.97 (0.1) (0.5) (4.3) Nikkei 20,020.86 0.4 0.3 9.4 GBP 1.30 (0.1) (0.6) 5.5 MSCI EM 1,060.12 0.7 1.2 22.9 CHF 1.05 (0.1) 0.8 6.6 SHANGHAI SE Composite 3,230.98 1.3 0.5 7.1 AUD 0.80 0.5 1.5 10.3 HANG SENG 26,672.16 0.5 1.1 20.4 USD Index 94.78 0.2 (0.4) (7.3) BSE SENSEX 31,955.35 0.8 (0.2) 26.9 RUB 58.98 (0.8) (0.0) (4.1) Bovespa 65,179.92 (0.1) 0.6 11.6 BRL 0.32 0.2 1.0 3.3 RTS 1,043.13 0.5 (0.1) (9.5) 102.9 97.8 96.4