QNBFS Daily Market Report January 3, 2019

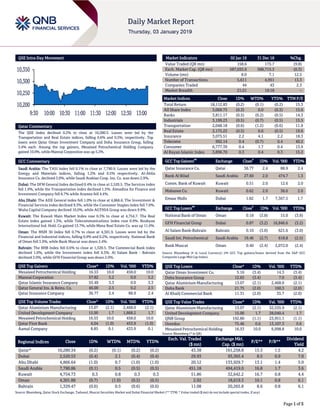

- 1. Page 1 of 5 QSE Intra-Day Movement Qatar Commentary The QSE Index declined 0.2% to close at 10,280.3. Losses were led by the Transportation and Real Estate indices, falling 0.6% and 0.5%, respectively. Top losers were Qatar Oman Investment Company and Doha Insurance Group, falling 3.4% each. Among the top gainers, Mesaieed Petrochemical Holding Company gained 10.0%, while Mannai Corporation was up 5.2%. GCC Commentary Saudi Arabia: The TASI Index fell 0.1% to close at 7,790.9. Losses were led by the Energy and Materials indices, falling 1.2% and 0.5% respectively. Al-Ahlia Insurance Co. declined 3.0%, while Saudi Arabian Coop. Ins. Co. was down 2.9%. Dubai: The DFM General Index declined 0.4% to close at 2,520.5. The Services index fell 1.9%, while the Transportation index declined 1.5%. Almadina for Finance and Investment Company fell 6.7% while Aramex fell 4.4%. Abu Dhabi: The ADX General index fell 1.0% to close at 4,866.6. The Investment & Financial Services index declined 9.3%, while the Consumer Staples index fell 7.0%. Waha Capital Company declined 10.0%, while AGTHIA Group was down 9.9%. Kuwait: The Kuwait Main Market Index rose 0.3% to close at 4,754.7. The Real Estate index gained 1.3%, while Telecommunications index rose 0.9%. Boubyan International Ind. Hold. Co gained 13.7%, while Mena Real Estate Co. was up 11.0%. Oman: The MSM 30 Index fell 0.7% to close at 4,301.9. Losses were led by the Financial and Industrial indices, falling 0.9% and 0.2%, respectively. National Bank of Oman fell 3.9%, while Bank Muscat was down 2.4%. Bahrain: The BHB Index fell 0.6% to close at 1,329.5. The Commercial Bank index declined 1.0%, while the Investment index fell 0.3%. Al Salam Bank - Bahrain declined 3.0%, while GFH Financial Group was down 2.0%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Mesaieed Petrochemical Holding 16.53 10.0 458.0 10.0 Mannai Corporation 57.82 5.2 0.0 5.2 Qatar Islamic Insurance Company 55.49 3.3 0.0 3.3 Qatar General Ins. & Reins. Co. 46.00 2.5 0.2 2.5 Qatar Insurance Company 36.77 2.4 88.9 2.4 QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Qatar Aluminium Manufacturing 13.07 (2.1) 2,468.0 (2.1) United Development Company 15.00 1.7 1,868.2 1.7 Mesaieed Petrochemical Holding 16.53 10.0 458.0 10.0 Qatar First Bank 4.04 (1.0) 453.9 (1.0) Aamal Company 8.85 0.1 433.9 0.1 Market Indicators 02 Jan 19 31 Dec 18 %Chg. Value Traded (QR mn) 158.6 175.7 (9.8) Exch. Market Cap. (QR mn) 587,035.9 588,715.3 (0.3) Volume (mn) 8.0 7.1 12.5 Number of Transactions 5,611 4,951 13.3 Companies Traded 44 43 2.3 Market Breadth 21:21 19:18 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 18,112.83 (0.2) (0.1) (0.2) 15.3 All Share Index 3,069.75 (0.3) 0.0 (0.3) 15.6 Banks 3,811.17 (0.5) (0.2) (0.5) 14.3 Industrials 3,199.23 (0.5) (0.7) (0.5) 15.5 Transportation 2,048.18 (0.6) (1.2) (0.6) 11.9 Real Estate 2,175.22 (0.5) 0.6 (0.5) 19.6 Insurance 3,075.51 2.2 4.1 2.2 18.3 Telecoms 992.14 0.4 (0.7) 0.4 40.2 Consumer 6,777.39 0.4 1.7 0.4 13.9 Al Rayan Islamic Index 3,896.70 0.3 0.4 0.3 15.2 GCC Top Gainers ## Exchange Close # 1D% Vol. ‘000 YTD% Qatar Insurance Co. Qatar 36.77 2.4 88.9 2.4 Bank Al Bilad Saudi Arabia 27.60 2.0 474.7 1.3 Comm. Bank of Kuwait Kuwait 0.51 2.0 12.6 2.0 Mabanee Co. Kuwait 0.62 2.0 38.6 2.0 Emaar Malls Dubai 1.82 1.7 7,367.5 1.7 GCC Top Losers ## Exchange Close # 1D% Vol. ‘000 YTD% National Bank of Oman Oman 0.18 (3.8) 15.0 (3.8) GFH Financial Group Dubai 0.87 (3.2) 16,846.6 (3.2) Al Salam Bank-Bahrain Bahrain 0.10 (3.0) 621.6 (3.0) Saudi Int. Petrochemical Saudi Arabia 19.46 (2.7) 618.8 (2.5) Bank Muscat Oman 0.40 (2.4) 2,072.0 (2.4) Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the S&P GCC Composite Large Mid Cap Index) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Qatar Oman Investment Co. 5.16 (3.4) 14.3 (3.4) Doha Insurance Group 12.65 (3.4) 7.0 (3.4) Qatar Aluminium Manufacturing 13.07 (2.1) 2,468.0 (2.1) Doha Bank 21.75 (2.0) 160.3 (2.0) Al Khalij Commercial Bank 11.31 (2.0) 35.7 (2.0) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Qatar Aluminium Manufacturing 13.07 (2.1) 32,535.9 (2.1) United Development Company 15.00 1.7 28,040.4 1.7 QNB Group 192.80 (1.1) 23,951.1 (1.1) Ooredoo 75.46 0.6 13,107.3 0.6 Mesaieed Petrochemical Holding 16.53 10.0 6,998.8 10.0 Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 10,280.34 (0.2) (0.1) (0.2) (0.2) 43.38 161,258.8 15.3 1.5 4.2 Dubai 2,520.53 (0.4) 2.1 (0.4) (0.4) 29.93 93,365.4 8.5 0.9 7.0 Abu Dhabi 4,866.64 (1.0) 0.7 (1.0) (1.0) 20.12 133,929.7 13.1 1.4 5.0 Saudi Arabia 7,790.86 (0.1) 0.5 (0.5) (0.5) 451.18 494,419.0 16.8 1.7 3.6 Kuwait 4,754.73 0.3 0.8 0.3 0.3 51.86 32,642.2 16.7 0.8 4.4 Oman 4,301.88 (0.7) (1.0) (0.5) (0.5) 2.92 18,619.3 10.1 0.8 6.1 Bahrain 1,329.47 (0.6) 0.5 (0.6) (0.6) 11.08 20,265.8 8.6 0.8 6.1 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Market and Dubai Financial Market (** TTM; * Value traded ($ mn) do not include special trades, if any) 10,200 10,250 10,300 10,350 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 5 Qatar Market Commentary The QSE Index declined 0.2% to close at 10,280.3. The Transportation and Real Estate indices led the losses. The index fell on the back of selling pressure from GCC and non-Qatari shareholders despite buying support from Qatari shareholders. Qatar Oman Investment Company and Doha Insurance Group were the top losers, falling 3.4% each. Among the top gainers, Mesaieed Petrochemical Holding Company gained 10.0%, while Mannai Corporation was up 5.2%. Volume of shares traded on Wednesday rose by 12.5% to 8mn from 7.1mn on Tuesday. Further, as compared to the 30-day moving average of 7.3mn, volume for the day was 9.7% higher. Qatar Aluminium Manufacturing Company and United Development Company were the most active stocks, contributing 30.9% and 23.4% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Ratings, Global Economic Data and Earnings Calendar Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 01/02 US Markit Markit US Manufacturing PMI December F 53.8 53.9 53.9 01/02 UK Markit Markit UK PMI Manufacturing SA December 54.2 52.5 53.6 01/02 EC Markit Markit Eurozone Manufacturing PMI December F 51.4 51.4 51.4 01/02 Germany Markit Markit/BME Germany Manufacturing PMI December F 51.5 51.5 51.5 01/02 France Markit Markit France Manufacturing PMI December F 49.7 49.7 49.7 01/02 China Markit Caixin China PMI Mfg December 49.7 50.2 50.2 01/02 India Markit Nikkei India PMI Mfg December 53.2 -- 54 Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Earnings Calendar Tickers Company Name Date of reporting 4Q2018 results No. of days remaining Status QNBK QNB Group 15-Jan-19 12 Due GWCS Gulf Warehousing Company 16-Jan-19 13 Due QIBK Qatar Islamic Bank 16-Jan-19 13 Due DHBK Doha Bank 16-Jan-19 13 Due ABQK Ahli Bank 16-Jan-19 13 Due MARK Masraf Al Rayan 21-Jan-19 18 Due QNCD Qatar National Cement Company 23-Jan-19 20 Due CBQK The Commercial Bank 4-Feb-19 32 Due Source: QSE News Qatar Doha Insurance Group sells a property in Doha for QR38mn – Doha Insurance Group has sold a property in Doha, for an amount of QR38mn. The book value of the property was QR4,121,700. Profit from the sale was QR33,878,300. (QSE) GWCS’ board meets to discuss the financial statements ended December 31, 2018 on January 16, 2019 – Gulf Warehousing Company (GWCS) announced that its board of directors will meet on January 16, 2019 to discuss the bank’s 2018 financial results and the profit distribution. (QSE) QDB extends QR8bn support to companies in 2018 – Qatar Development Bank (QDB) extended a financial support of about QR8bn in 2018 to Qatari companies, including small and medium-sized enterprises (SMEs). QDB, the state-backed entity, noted that it is committed to promoting economic diversification by establishing a cluster of vibrant private sector industries as part of the country’s long term objective to achieve sustainable development. (Peninsula Qatar) Qatar Airways acquires nearly 5% of China Southern Airlines – Qatar Airways Group (Qatar Airways) announced that as part of its strategy to invest in the strongest airlines around the world and continue enhancing operations and network connectivity, on December 28, it completed an on-market purchase of certain A shares and H shares of China Southern Airlines Company Limited (China Southern Airlines), resulting in Qatar Airways' aggregate holding of approximately 5% of the total issued share capital of China Southern Airlines. (Peninsula Qatar) Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 44.79% 44.26% 842,540.64 Qatari Institutions 21.61% 18.59% 4,794,308.24 Qatari 66.40% 62.85% 5,636,848.88 GCC Individuals 1.67% 0.55% 1,765,817.73 GCC Institutions 3.60% 5.45% (2,932,130.66) GCC 5.27% 6.00% (1,166,312.93) Non-Qatari Individuals 11.99% 10.08% 3,030,403.73 Non-Qatari Institutions 16.34% 21.07% (7,500,939.68) Non-Qatari 28.33% 31.15% (4,470,535.95)

- 3. Page 3 of 5 Network and coverage obligations of Ooredoo, Vodafone Qatar approved – The Minister of Transport and Communications HE Jassim Saif Ahmed Al Sulaiti has approved the amendment of the network rollout and coverage obligations of Ooredoo and Vodafone Qatar licenses, for the provision of public mobile telecommunications networks and services. The amendments adopted unified obligations for both companies related to the Second Generation (2G), Third Generation (3G) and Fourth Generation (4G) networks, that is in accordance with the amendments of the Annexure (G), of the network rollout and coverage obligations of both companies licenses related to public mobile telecommunications networks and services. (Peninsula Qatar) Microsoft gets green light from Qatar for global data center – Qatar's cabinet approved the establishment of a Microsoft global data center in the country, state news agency QNA reported. Azure, Microsoft's cloud platform, announced plans to expand into the Middle East for the first time last year by setting up data centers in the neighboring UAE. (Zawya) Remittances from expatriate workers in Qatar touch QR31bn in the first nine months of 2018 – Remittances from expatriate workers in Qatar amounted to QR31.29bn in the first nine months of 2018, according to data released by Qatar Central Bank (QCB) recently. According to the data released as part of Qatar’s balance of payments (BoP) in the third quarter of 2018, total remittances from Qatar in the third quarter of 2018 was worth QR10.316bn. Remittances from Qatar amounted to QR10.31bn and QR10.86bn in the first quarter and second quarter of 2018 respectively. Remittances in the first nine months of 2018 witnessed a decline compared with remittances of QR36.09bn in the first nine months of 2017, the data showed. The current transfers deficit increased to QR15.28bn in the third quarter of 2018 from QR14.8bn in the same quarter of the previous year. (Qatar Tribune) Cabinet issues draft law on establishing Media City in Qatar – The Prime Minister and Minister of Interior HE Sheikh Abdullah bin Nasser bin Khalifa Al Thani chaired the Cabinet regular meeting at the Amiri Diwan. The Cabinet took the necessary measures to issue a draft law establishing the Media City, after it reviewed the recommendation of the Shura Council. Under the draft law, a city called "Media City" will be established, and shall have a moral personality and an independent budget. Its borders and coordinates will be determined by a Cabinet's decision. (Qatar Tribune) Anadolu: Alternatifbank’s brokerage arm to act as an intermediary for capital flows between Qatar and Turkey – Brokerage Alternatif Yatirim ve Menkul will act as an intermediary for capital flows between Qatar and Turkey, Anadolu Agency cited AlternatifBank’s CEO, Kaan Gur as saying in Istanbul. AlternatifBank is owned by The Commercial Bank. Gur sees about 1% economic growth, 18% inflation and expects average ~12% loan growth for the Turkish banking industry in 2019. AlternatifBank targets to become the bank of exporters and work to increase number of exporters to Qatar. The Turkish lender will also increase capital by $50mn in January, and also plans a $200mn capital increase by the end of 2020. (Bloomberg) International UK’s factories build up stockpiles before Brexit, boosting PMI – British factories ramped up their stockpiling in December as they prepared for possible border delays when Britain leaves the European Union in less than three months’ time, a survey showed. The IHS Markit/CIPS Manufacturing Purchasing Managers’ Index (PMI) rose to 54.2 from an upwardly revised 53.6 in November, the highest reading in six months and stronger than all forecasts in a Reuters poll of economists. Markit stated the improvement did not herald a big change in the outlook for Britain’s stuttering economy and was caused in large part by manufacturers stockpiling inputs and finished goods, both of which were near record highs. Many manufacturers are building up inventories to protect themselves against the risks of customs delays at the border after March 29, when Britain is due to leave the EU. Prime Minister Theresa May is struggling to overcome deep opposition to her Brexit plan in her own Conservative Party, raising the risk that no transition period will be provided to ease Britain out of its four decade-long membership of the EU. (Reuters) UK’s services growth drops to two-year low in fourth-quarter in Brexit 'stasis' – Businesses in Britain’s dominant services sector reported the slowest sales growth in two years during the final three months of 2018, another sign of a slowing economy ahead of Brexit, the British Chambers of Commerce stated. Many retailers had reported difficulties in the run-up to Christmas, but Thursday’s findings - from Britain’s largest private-sector economic survey - point to a broader slowdown among businesses that rely on consumer spending. Manufacturers also reported weaker sales growth, and orders slowed across the board before Britain’s planned departure from the European Union on March 29. The Bank of England estimates overall economic growth slowed to 0.2% in the final quarter of 2018 from 0.6% in the three months before. Prime Minister Theresa May is struggling to overcome deep opposition to her Brexit plan in her own Conservative Party, raising the risk that no transition period will be provided to ease Britain out of its four- decade-long membership of the EU. (Reuters) Eurozone’s factories end 2018 on a low note – Eurozone’s manufacturing activity barely expanded at the end of 2018 in a broad-based slowdown, according to a survey which showed scant signs for optimism as the new-year begins. The disappointing survey comes just after the European Central Bank ended its EUR2.6tn asset purchasing scheme and is likely to make uncomfortable reading for policymakers. IHS Markit’s December final manufacturing Purchasing Managers’ Index fell for a fifth month, coming in at 51.4 from November’s 51.8, matching a flash reading but barely above the 50 level separating growth from contraction. That was its lowest reading since February 2016 but an index measuring output, which feeds into a composite PMI that is seen as a good gauge of economic health, nudged up to 51.0 from 50.7. (Reuters) German manufacturing growth slows again in December – Growth in Germany’s manufacturing sector slowed again in December as new orders fell at the fastest rate in four years, a survey showed. Markit’s Purchasing Managers’ Index (PMI) for manufacturing, which accounts for about a fifth of the

- 4. Page 4 of 5 economy, fell to a 33-month low of 51.5 from 51.8 in November, edging closer to the 50.0 mark that separates growth from contraction. It was the 11th time in 2018 that the manufacturing index fell, reflecting a sustained cooling of growth in Europe’s largest economy, which shrank in the third quarter partly on one-off effects such as fewer car registrations as makers adapt to new pollution standards. Germany is also facing headwinds from trade frictions between the United States and China and weaker demand from the Eurozone. (Reuters) China’s fourth-quarter economic growth may fall below 6.5% – China’s economic growth could fall below 6.5% in the fourth quarter as companies face increased difficulties, a central bank magazine noted. The government should step up tax cuts to help ease the burden on companies, especially small firms, the magazine stated. Chinese leaders have pledged to ratchet up support for the economy in 2019 by cutting taxes and keeping ample liquidity amid a trade dispute with the US. China’s economic growth slowed to 6.5% in the third quarter, the weakest pace since the global financial crisis. Indications are that momentum is likely to come off further in the fourth quarter and next year. Chinese officials have said the economy would still hit the official growth target of around 6.5% in 2018. (Reuters) Regional OPEC+ caps prove no barrier to the record Russia oil output in 2018 – Russia’s oil production reached a post-Soviet high last year even as it coordinated supply with the Organization of Petroleum Exporting Countries (OPEC). Output averaged 11.16mn bpd, up 1.6% from 2017, according to preliminary data from the Energy Ministry’s CDU-TEK unit. That compares with an all-time high of 11.416mn bpd in 1987, BP Plc figures show. During the first half of last year, Russian volumes were capped as part of an agreement with OPEC to support prices. But after the market rebounded, the producers rolled back their cuts, with Russia rapidly raising output to reach 11.45mn bpd in December. (Gulf-Times.com) OPEC output falls most in almost two years as Saudi Arabia begins cuts – Before its agreement to cut oil supplies even started, OPEC’s production plunged by the most in almost two years last month. In a sign of the urgency felt by the cartel amid tumbling crude prices, leading member Saudi Arabia throttled back production, according to a Bloomberg survey of officials, analysts and ship-tracking data. The group’s pact to curb output only formally started this week. The Kingdom’s deliberate cutbacks were compounded by unplanned losses in Iran, which is being targeted by US sanctions, and in Libya, where protests halted the biggest oil field. As a result, oil output from the Organization of Petroleum Exporting Countries (OPEC) fell 530,000 barrels a day to 32.6mn a day last month. It’s the sharpest pullback since January 2017, when the group first embarked on its strategy to clear the glut created by rising supplies of US shale oil. (Bloomberg) Banks seek advisors for biggest bank merger in Saudi Arabia since 2016 – National Commercial Bank (NCB) and Riyad Bank are seeking advisors for a potential merger that would create the Gulf region’s third-biggest lender with $182bn in assets, according to sources. The banks have sent out so-called request for proposals to firms including Citigroup Inc., Credit Suisse Group AG, Goldman Sachs Group Inc., HSBC Holdings Plc, JPMorgan Chase & Co. and UBS Group AG, the sources added. Formal advisors for the deal, which could be the biggest bank merger in almost three years, could be appointed this month, the sources said. The proposed combination has the backing of the Public Investment Fund (PIF), the sovereign wealth fund that owns about 44% of National Commercial Bank (NCB) and 22% of Riyad Bank, the sources added. No final decisions have been made and the banks may choose other advisors, sources said. (Bloomberg) Tasnee obtains $533mn facility to refinance Islamic bond – National Industrialization Co. (Tasnee) has obtained a $533mn Islamic debt facility to refinance its Sukuk maturing this year. The company got the seven-year Murabaha funding from Banque Saudi Fransi, it stated. Tasnee’s Sukuk matures in May 2019. (Bloomberg) Omani aviation is set to soar in 2019 – International Air Transport Association (IATA) forecasts that by the end of 2019, Omani aviation will have grown 40% over a three-year period - a very promising statistic, that itself is helping drive aviation growth in the region. In Oman’s capital, a new $1.8bn terminal at Muscat’s International airport has already opened its doors to passengers flying to, from or through Oman. The new terminal raised the capacity up to 20mn passengers per year, and is equipped with the latest technology to accommodate aircraft including the superjumbo Airbus A380. (Gulf-Times.com) Bahrain Petroleum raises $4.1bn financing – State-run Bahrain Petroleum Co. has raised $4.1bn from a nine-part financing package for capital expenditure, according to data on Bloomberg. The loan is split between tranches of $1.04bn, $650mn, $650mn, $530mn, $400mn, $367mn, $257mn, $110mn and $100mn. They all mature in 2035. (Bloomberg)

- 5. Contacts Saugata Sarkar, CFA, CAIA Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa QNB Financial Services Co. W.L.L. Contact Center: (+974) 4476 6666 PO Box 24025 Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. W.L.L. (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (Q.P.S.C.). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange. Qatar National Bank (Q.P.S.C.) is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 5 of 5 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns, #Market was closed on January 2, 2019) 45.0 70.0 95.0 120.0 Dec-14 Dec-15 Dec-16 Dec-17 Dec-18 QSEIndex S&PPanArab S&PGCC (0.1%) (0.2%) 0.3% (0.6%) (0.7%) (1.0%) (0.4%) (1.5%) (1.0%) (0.5%) 0.0% 0.5% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,284.60 0.6 0.3 0.2 MSCI World Index 1,881.15 (0.1) 0.6 (0.1) Silver/Ounce 15.52 0.2 0.9 0.2 DJ Industrial 23,346.24 0.1 1.2 0.1 Crude Oil (Brent)/Barrel (FM Future) 54.91 2.1 5.2 2.1 S&P 500 2,510.03 0.1 1.0 0.1 Crude Oil (WTI)/Barrel (FM Future) 46.54 2.5 2.7 2.5 NASDAQ 100 6,665.94 0.5 1.2 0.5 Natural Gas (Henry Hub)/MMBtu 2.82 (13.2) (13.2) (13.2) STOXX 600 337.21 (1.2) (0.6) (1.2) LPG Propane (Arab Gulf)/Ton 64.25 0.4 (0.8) 0.4 DAX 10,580.19 (0.7) (0.7) (0.7) LPG Butane (Arab Gulf)/Ton 69.63 0.2 3.5 0.2 FTSE 100 6,734.23 (1.2) (0.9) (1.2) Euro 1.13 (1.1) (0.9) (1.1) CAC 40 4,689.39 (1.9) (0.7) (1.9) Yen 108.88 (0.8) (1.3) (0.7) Nikkei# 20,014.77 0.0 0.0 0.0 GBP 1.26 (1.0) (0.7) (1.2) MSCI EM 955.66 (1.1) (0.7) (1.0) CHF 1.01 (0.8) (0.6) (0.9) SHANGHAI SE Composite 2,465.29 (0.9) (0.9) (0.9) AUD 0.70 (1.0) (0.9) (0.9) HANG SENG 25,130.35 (2.8) (1.5) (2.8) USD Index 96.82 0.8 0.4 0.7 BSE SENSEX 35,891.52 (1.2) (0.7) (1.0) RUB 69.72 0.0 0.3 0.0 Bovespa 91,012.31 5.1 5.1 5.1 BRL 0.26 2.4 2.4 2.4 RTS 1,066.13 0.0 0.0 0.0 82.2 78.8 76.2