QSE rises 0.2% as Insurance index gains 0.5

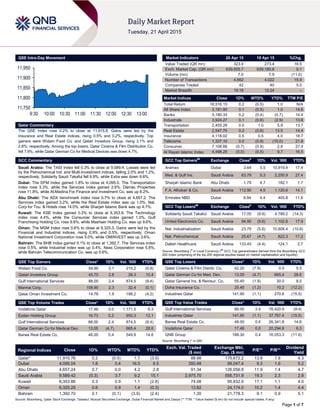

- 1. Page 1 of 7 QSE Intra-Day Movement Qatar Commentary The QSE Index rose 0.2% to close at 11,915.8. Gains were led by the Insurance and Real Estate indices, rising 0.5% and 0.2%, respectively. Top gainers were Widam Food Co. and Qatari Investors Group, rising 3.1% and 2.8%, respectively. Among the top losers, Qatar Cinema & Film Distribution Co. fell 7.9%, while Qatar German Co for Medical Devices was down 4.7%. GCC Commentary Saudi Arabia: The TASI Index fell 0.3% to close at 9,589.4. Losses were led by the Petrochemical Ind. and Multi-Investment indices, falling 2.0% and 1.2%, respectively. Solidarity Saudi Takaful fell 9.9%, while Extra was down 9.6%. Dubai: The DFM Index gained 1.8% to close at 4,095.0. The Transportation index rose 3.3%, while the Services index gained 2.6%. Damac Properties rose 11.8%, while Al-Madina For Finance and Investment Co. was up 8.2%. Abu Dhabi: The ADX benchmark index rose 0.7% to close at 4,657.2. The Services index gained 3.2%, while the Real Estate index was up 1.0%. Nat. Corp for Tou. & Hotels rose 14.0%, while Sharjah Islamic Bank was up 4.7%. Kuwait: The KSE Index gained 0.3% to close at 6,353.9. The Technology index rose 4.4%, while the Consumer Services index gained 1.0%. Gulf Franchising Holding Co. rose 9.8%, while Mashaer Holding Co. was up 9.6%. Oman: The MSM Index rose 0.6% to close at 6,325.3. Gains were led by the Financial and Industrial indices, rising 0.9% and 0.5%, respectively. Oman National Investment Corporation rose 5.0%, while OMINVEST was up 3.6%. Bahrain: The BHB Index gained 0.1% to close at 1,392.7. The Services index rose 0.5%, while Industrial index was up 0.4%. Nass Corporation rose 5.8%, while Bahrain Telecommunication Co. was up 0.6%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Widam Food Co. 59.90 3.1 215.2 (0.8) Qatari Investors Group 45.70 2.8 28.3 10.4 Gulf International Services 88.00 2.4 874.5 (9.4) Mannai Corp. 108.90 2.3 32.4 (0.1) Qatar Oman Investment Co. 14.76 1.9 198.2 (4.2) QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Vodafone Qatar 17.48 0.0 1,171.5 6.3 Ezdan Holding Group 16.73 0.2 950.3 12.1 Gulf International Services 88.00 2.4 874.5 (9.4) Qatar German Co for Medical Dev. 13.05 (4.7) 665.4 28.6 Barwa Real Estate Co. 48.00 0.4 549.9 14.6 Market Indicators 20 Apr 15 19 Apr 15 %Chg. Value Traded (QR mn) 323.9 273.4 18.5 Exch. Market Cap. (QR mn) 639,505.7 639,180.8 0.1 Volume (mn) 7.0 7.9 (11.0) Number of Transactions 4,662 4,022 15.9 Companies Traded 42 40 5.0 Market Breadth 19:18 12:24 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 18,516.15 0.2 (0.5) 1.0 N/A All Share Index 3,181.80 0.1 (0.5) 1.0 14.6 Banks 3,180.33 0.2 (0.4) (0.7) 14.4 Industrials 3,924.27 0.1 (0.8) (2.9) 13.8 Transportation 2,455.28 0.0 1.0 5.9 13.7 Real Estate 2,547.75 0.2 (0.6) 13.5 14.4 Insurance 4,118.02 0.5 0.5 4.0 18.7 Telecoms 1,337.10 0.0 (0.9) (10.0) 21.8 Consumer 7,108.66 (0.7) (0.9) 2.9 27.4 Al Rayan Islamic Index 4,498.25 (0.0) (0.5) 9.7 16.5 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Aramex Dubai 3.64 5.5 10,919.4 17.4 Med. & Gulf Ins. Saudi Arabia 63.79 5.3 2,250.9 27.4 Sharjah Islamic Bank Abu Dhabi 1.79 4.7 182.1 1.7 F.A. Alhokair & Co. Saudi Arabia 112.90 4.5 1,120.6 14.1 Emirates NBD Dubai 9.94 4.4 405.8 11.8 GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Solidarity Saudi Takaful Saudi Arabia 17.05 (9.9) 4,789.2 (14.3) United Electronics Co. Saudi Arabia 94.90 (9.6) 1,102.6 17.9 Nat. Industrialization Saudi Arabia 23.79 (5.6) 10,608.4 (10.6) Nat. Petrochemical Saudi Arabia 25.67 (4.7) 822.3 17.2 Dallah Healthcare Saudi Arabia 133.45 (4.4) 124.1 2.7 Source: Bloomberg ( # in Local Currency) ( ## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Qatar Cinema & Film Distrib. Co. 42.20 (7.9) 0.5 5.5 Qatar German Co for Med. Dev. 13.05 (4.7) 665.4 28.6 Qatar General Ins. & Reinsur. Co. 55.40 (1.9) 30.0 8.0 Doha Insurance Co. 25.45 (1.2) 10.2 (12.2) Industries Qatar 141.90 (1.1) 270.6 (15.5) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Gulf International Services 88.00 2.4 76,420.9 (9.4) Industries Qatar 141.90 (1.1) 37,767.4 (15.5) Barwa Real Estate Co. 48.00 0.4 26,341.8 14.6 Vodafone Qatar 17.48 0.0 20,294.8 6.3 QNB Group 188.30 0.4 16,053.3 (11.6) Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 11,915.76 0.2 (0.5) 1.7 (3.0) 88.98 175,672.2 13.8 1.9 4.3 Dubai 4,095.04 1.8 0.4 16.5 8.5 350.48 99,047.4 9.3 1.6 5.2 Abu Dhabi 4,657.24 0.7 0.0 4.2 2.8 91.34 126,056.8 11.9 1.4 4.7 Saudi Arabia 9,589.42 (0.3) 3.7 9.2 15.1 2,975.70 556,731.9 19.3 2.3 2.8 Kuwait 6,353.86 0.3 0.9 1.1 (2.8) 74.08 95,832.9 17.1 1.1 4.0 Oman 6,325.25 0.6 0.9 1.4 (0.3) 13.82 24,174.0 10.2 1.4 4.4 Bahrain 1,392.70 0.1 (0.1) (3.9) (2.4) 1.30 21,778.3 9.1 0.9 5.1 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 11,750 11,800 11,850 11,900 11,950 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 7 Qatar Market Commentary The QSE Index rose 0.2% to close at 11,915.8. The Insurance and Real Estate indices led the gains. The index rose on the back of buying support from Qatari and non-Qatari shareholders despite selling pressure from GCC shareholders. Widam Food Co. and Qatari Investors Group were the top gainers, rising 3.1% and 2.8%, respectively. Among the top losers, Qatar Cinema & Film Distribution Co. fell 7.9%, while Qatar German Co for Medical Devices was down 4.7%. Volume of shares traded on Monday fell by 11.0% to 7.0mn from 7.9mn on Sunday. Further, as compared to the 30-day moving average of 8.2mn, volume for the day was 14.2% lower. Vodafone Qatar and Ezdan Holding Group were the most active stocks, contributing 16.6% and 13.5% to the total volume, respectively. Source: Qatar Stock Exchange (*as a % of traded value) Earnings and Global Economic Data Earnings Releases Company Market Currency Revenue (mn) 1Q2015 % Change YoY Operating Profit (mn) 1Q2015 % Change YoY Net Profit (mn) 1Q2015 % Change YoY Bishah Agriculture Development Co. (BISHACO) Saudi Arabia SR – – -0.4 NA -0.4 NA Arabia Insurance Cooperative Co. (AICC) Saudi Arabia SR 136.4 -7.7% – – 2.2 NA Al Sagr Co-operative Insurance Co. (Sagr Insurance) Saudi Arabia SR 112.8 194.8% – – 0.8 -89.2% MetLife AIG ANB Cooperative Insurance Co. (ANB Insurance) Saudi Arabia SR 6.7 NA – – -7.9 NA Zamil Industrial Investment Co. (Zamil Indust) Saudi Arabia SR – – 97.5 2.7% 73.7 11.7% Bupa Arabia for Cooperative Insurance (Bupa Arabia) Saudi Arabia SR 2,073.3 46.0% – – 36.8 NA Sanad Insurance and Reinsurance Cooperative Co. (SANAD) Saudi Arabia SR -0.5 NA – – 4.7 NA Fitaihi Holding Group (FHG) Saudi Arabia SR – – 11.1 -43.2% 18.5 -23.3% Wataniya Insurance Co. (Wataniya) Saudi Arabia SR 80.0 46.3% – – 3.2 -45.5% Al Sorayai Trading And Industrial Group Co. (ATIG) Saudi Arabia SR – – -0.9 NA -2.9 NA Aljazira Takaful Taawuni Co. (Jazira Takaful) Saudi Arabia SR 2.2 763.6% – – 3.0 43.3% Ace Arabia Cooperative Insurance Co. (ACE) Saudi Arabia SR 54.2 26.6% – – -1.0 NA Salama Cooperative Insurance Co. (SALAMA) Saudi Arabia SR 106.9 30.6% – – 2.6 221.0% Buruj Cooperative Insurance Co. (Buruj) Saudi Arabia SR 85.3 15.9% – – 5.8 63.2% Methanol Chemicals Co. (CHEMANOL) Saudi Arabia SR – – -6.3 NA -15.0 NA Alujain Corporation (Alujain) Saudi Arabia SR – – -3.3 NA -16.8 NA SABB Takaful Saudi Arabia SR 43.4 12.3% – – 3.1 13.5% Al-Tayyar Travel Group Holding Co. (ALTAYYAR) Saudi Arabia SR – – 300.0 12.8% 286.0 2.1% Dur Hospitality Co. Saudi Arabia SR – – 43.7 1.4% 45.0 -1.8% Tabuk Cement Co. (TCC) Saudi Arabia SR – – 33.1 -27.7% 32.6 -25.8% Knowledge Economic City (KEC) Saudi Arabia SR – – -6.1 NA -4.8 NA Saudi Real Estate Co. (SRECO) Saudi Arabia SR – – 39.5 6.1% 43.1 15.1% Saudi International Petrochemical Co. (SIPCHEM) Saudi Arabia SR – – 176.6 5.3% 80.6 17.3% Aseer Trading, Tourism & Manufacturing Co. (Aseer) Saudi Arabia SR – – 101.5 16.1% 60.5 14.8% Saudi Vitrified Clay Pipes Co. (SVCP) Saudi Arabia SR – – 30.1 28.1% 21.9 -3.5% Allianz Saudi Fransi Coop Insurance Co. (Allianz SF) Saudi Arabia SR 99.1 -10.0% – – 5.5 NA Overall Activity Buy %* Sell %* Net (QR) Qatari 60.54% 58.43% 6,826,866.64 GCC 3.08% 5.40% (7,528,416.37) Non-Qatari 36.39% 36.17% 701,549.73

- 3. Page 3 of 7 Filing and Packing Materials Manufacturing Co. (FIPCO) Saudi Arabia SR – – 2.8 -64.0% 2.5 -63.9% National Medical Care Co. (Care) Saudi Arabia SR – – 28.4 -8.6% 27.7 -14.4% Arabian Cement Co. (ACC) Saudi Arabia SR – – 215.1 29.6% 195.3 16.9% Saudi Arabia Refineries Co. (SARCO) Saudi Arabia SR – – -0.6 NA -0.7 NA Basic Chemical Industries Co. (BCI) Saudi Arabia SR – – 10.7 -41.2% 2.8 -67.8% Fawaz Abdulaziz Alhokair Co. (AlHokair) Saudi Arabia SR – – – – 201.7 5.7% Saudi Telecom Co. (STC) Saudi Arabia SR – – – – 2,500.0 4.6% National Industrialization Company (Tasnee) Saudi Arabia SR – – – – -332.5 NA National Aluminium Products Co. (NAPCO) Oman OMR 6.2 51.9% – – 0.2 3.8% Takaful Oman Insurance (TAOI) Oman OMR 2.4 NA – – 0.7 NA Source: Company data, DFM, ADX, MSM Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 04/20 US Chicago Fed Chicago Fed Nat Activity Index March -0.4 0.1 -0.2 04/20 EU Eurostat Construction Output MoM February -1.80% – 1.60% 04/20 EU Eurostat Construction Output YoY February -3.70% – 0.60% 04/20 Germany Destatis PPI MoM March 0.10% 0.20% 0.10% 04/20 Germany Destatis PPI YoY March -1.70% -1.60% -2.10% 04/20 UK Rightmove Rightmove House Prices MoM April 1.60% – 1.00% 04/20 UK Rightmove Rightmove House Prices YoY April 4.70% – 5.40% 04/20 Spain Ministerio de Ind., Energ Trade Balance February -2,037.2M – -2,596.2M Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) News Qatar DHBK’s 1Q2015 QoQ profitability driven by a drop in provisions and opex – Doha Bank (DHBK) reported a net income of QR420.2mn in 1Q2015 slightly ahead of our estimate of QR401.8mn (4.6% variation). DHBK’s Net operating income (QR461.3mn) was in-line with our estimate of QR457.8mn (0.8% variation). Thus, the beat was mainly due to lower provisions vs. our estimate. Net income surged by 92.2% QoQ (+5.2% YoY). QoQ growth is primarily attributed to an 80.8% plunge in net provisions (QR38.5mn in 1Q2015 vs. QR200.4mn in 4Q2014 and QR72.5mn in 1Q2014) followed by a 7.1% decline in opex. As such the cost-to-income ratio improved QoQ to 35.4% vs. 39.1% in 4Q2014. The bank’s net interest income rose 6.2% QoQ (+4.4% YoY) to QR506.7mn. Hence, annualized NIM improved to ~2.94% in 1Q2015 vs. ~2.88% in 4Q2014. Fees and commissions dropped by 22.2% QOQ to QR118.7mn while it grew by 24.9% YoY. Overall, non-interest income declined by 5.1% and 2.4% QoQ and YoY, respectively mainly due to a sharp decline investment (-31.8% QoQ and 78.3% YoY). Net loans grew by 4.7% YTD to QR50.8bn while deposits receded by 1.6% YTD to QR45.2bn. As a result, the LDR was lifted to 112% vs. 106% at the end of 2014. We rate DHBK an Accumulate with Price Target of QR62.00. The stock trades at a P/B and P/E of 1.4x and 11.1x on our 2015 estimates, respectively. (QNBFS Research, Company Financials) MARK net profit jumps 18.1% YoY in 1Q2015 – Masraf Al Rayan’s (MARK) bottom-line in 1Q2015 jumped 18.1% YoY to QR511mn as compared to QR432mn in 1Q2014. Earnings beat our estimate by 9% and BBG consensus by 11%. The beat was on the back of better net interest income & investing income and lower operating expenses. Total assets of the bank reached QR83.2bn as compared to QR69.4bn as of March 31, 2014, reflecting a growth of 19.9%. Financing assets grew 37.6% YoY to QR62.8bn whereas customers’ deposits reached QR60.8bn, registering a growth of 16.2% YoY. EPS for the period amounted QR0.68 as compared to QR0.58 in 1Q2014. Further, the bank reported that its capital adequacy ratio reached 17.41% as per Basel-III standards versus 18.65% on March 31, 2014 based on Basel-II standards. Non-performing loans (NPL) ratio continued to be one of the lowest in the banking industry at 0.09%. (Peninsula Qatar) QNCD reports in-line 1Q2015 results – Qatar National Cement Company’s (QNCD) net income fell slightly by 3.2% YoY to QR125.8mn in 1Q2015 despite reporting a 4.4% YoY rise in revenue to QR292.1mn. Reported results were in line with our estimate of QR288.2mn revenue (1% divergence) and QR121.1mn in net income (4% divergence). The decline in profitability primarily resulted from a higher cost of sales (+9.6% to QR164.6mn in 1Q2015) and a plunge in other income (- 45.8% YoY to QR8.1mn), which overshadowed a decline (- 22.5% YoY to QR9.7mn) in its general & administrative expenses. EPS totaled QR2.33 in 1Q2015 as compared to QR2.41 in 1Q2014. We continue to rate QNCD a Market Perform with a price target of QR126.00. (QNBFS Research, Company Financials) KCBK delivers strong 1Q2015 numbers with a 32% YoY earnings growth – Al Khalij Commercial Bank (KCBK) reported a net profit of QR144.4mn in 1Q2015, reflecting an increase of 32% YoY. The EPS amounted to QR0.40 in 1Q2015 as compared to QR0.30 in 1Q2014. The profitability growth was primarily driven by increased net interest income and net fee and commission income. The bank’s net interest income rose 33% YoY to QR221mn in 1Q2015 while its net fee & commission income grew 20% YoY to QR45.2mn in 1Q2015. As a result, the bank’s net operating income moved up to QR276.6mn in 1Q2015 from QR213.8mn in 1Q2014. Loans & advances expanded 31% YoY to QR30bn while deposit portfolio

- 4. Page 4 of 7 swelled by 32% YoY to QR29bn in 1Q2015. Total assets rose 21% YoY to reach QR53bn. (Company Press Release) QFLS reports QR237mn net profit in 1Q2015 – Woqod (QFLS) reported a net profit of QR237mn in 1Q2015, reflecting an increase of 3.5% YoY. The company’s total assets reached QR9.4bn, down 10% YoY. Woqod’s EPS amounted to QR2.81 in 1Q2015 as compared to QR2.71 in 1Q2014. Woqod said its LPG sales grew 8% in 1Q2015 and the number of cylinders (refilled and sold) reached 1.3mn (metal) and 472,000 (Shafaf- 12kg/6kg) units. The company also said the total sale of petroleum products (diesel, gasoline and jet fuel) reached 1,870mn litres, showing an increase of 14.7% YoY. Sales are expected to increase significantly during the coming period following the commissioning of the Hamad International Airport. Also, the company is currently involved in the implementation of some 44 projects, 19 of them under construction, while 19 projects are in the design and approval stages. Six of these projects are in the tendering stages. In addition, some 24 new locations are currently under consideration. (Gulf-Times.com) DOHI’s net profit rises 8.8% YoY to QR25.4mn in 1Q2015 – Doha Insurance Company’s (DOHI) net profit increased by 8.8% YoY to QR25.4mn in 1Q2015. On the other hand, the company’s net underwriting profit fell by 27.1% YoY to QR13.4mn in 1Q2015. However, DOHI’s investment & other income jumped 28.8% YoY to QR24.9mn in 1Q2015. EPS amounted to QR0.51 in 1Q2015 as compared to QR0.47 in 1Q2014. (QSE) AMMC to open new branch in Oman – Al Meera Markets Company (AMMC), a subsidiary of Al Meera Holding Company, has accepted and signed the offer letter from Muzan Oman Commercial, to open a new branch in Al Muzn mall in Oman. The new branch is expected to be opened in March 2016. (QSE) Qatar to invest around $350bn in 15 years – George Ayache, General Manager of IFP Qatar, the organizer of the upcoming ‘Project Qatar 2015’ said Qatar as part of its sustainable development strategy in the run-up to the 2022 FIFA World Cup and in line with the National Vision 2030 (QNV 2030) document, will invest around $350bn over the next 15 years to achieve the goals. Ayache stated that the construction sector will remain vital in contributing to the development goals, considering that Qatar’s economy is expected to record a 7.7% real GDP growth in 2015, with the non-hydrocarbon sector accounting for 50% of its GDP. (Peninsula Qatar) International US, Japan fail to seal trade agreement before Abe’s US trip – US and Japanese officials have failed to reach an agreement in marathon bilateral trade talks in Tokyo, a setback for Prime Minister Shinzo Abe’s hopes of arriving for a summit in Washington next week with a pact in hand. US trade representative Michael Froman left Tokyo after negotiations concluded early on April 21, 2015, with differences remaining over auto and rice imports. The delay in two partners’ bid to advance the Trans-Pacific Partnership (TPP) and remain a center of economic gravity in the region comes after China’s success in enhancing its own muscle in Asia by luring 57 countries to join its new regional development bank. (Bloomberg) Bundesbank: Consumption to fuel German economic upswing – Germany's Bundesbank said strong private consumption backed by low unemployment and rising wages will sustain Germany's economic upswing for some time to come, despite the recent slower industrial performance. However, the bank said that the underlying pace of growth is likely lower now than the headline 4Q2014 growth figure of 0.7%. The central bank added that private consumption would continue to provide the mainstay for strong growth ahead. The Bundesbank said that low unemployment, if it continues, would mean that it could be financially manageable for the country to further reduce its 3% charge on workers for unemployment benefit. (Reuters) IMF: Greece talks gain momentum but still long way from target – The International Monetary Fund's (IMF) European Head, Poul Thomsen said global lenders' negotiations with Greece, which have been moving at a crawl recently, have gained some momentum but remained a long way from the finish line. Athens has been stuck in negotiations with its Eurozone partners and the IMF over economic reforms required by its lenders to unlock the remaining bailout funds. Thomsen said the Greek government's finances would perhaps last until June 2015. He warned against underestimating the risks that would be associated with Greece leaving the Eurozone. Meanwhile, data released from Greece’s central bank showed that its current account deficit widened to €929mn in February 2015 versus a deficit of €729mn in February 2014, due to a smaller surplus in the services balance and a deficit in the income account after higher interest and dividend payments. (Reuters) Japan leaves economic assessment unchanged in April – Japan's government kept its overall assessment of the economy unchanged in its monthly economic report on April 21, noting a moderate recovery trend as the factory output is picking up on the back of improving corporate activity. The government also kept unchanged its assessment of consumer spending, capital expenditure and exports, as the economy stabilizes after a recession was unexpectedly caused by a sales tax hike in April 2014. The report said that consumer spending in April was holding firm, capital expenditure stood flat while industrial output and exports are showing signs of recovery. However, certain areas of concern still remain as real wages continue to fall which, some economists say, could hold back consumer spending. (Reuters) China, Pakistan launch economic corridor plan worth $46bn – China and Pakistan have launched a plan for energy and infrastructure projects in Pakistan worth $46bn, linking their economies and underscoring China's economic ambitions in Asia and beyond. The plan, which would eclipse US spending in Pakistan over the last decade or so, is part of China's aim to forge "Silk Road" land and sea ties to markets in the Middle East and Europe. Pakistan said China will provide up to $37bn in investment for energy projects to generate 16,400 megawatt of power. Concessional loans will cover nearly $10bn of infrastructure projects. The corridor, a network of roads, railways and pipelines, will pass through Pakistan's poor Baluchistan province, where a long-running separatist insurgency that the army has vowed to crush, will raise questions about the feasibility of the plan. (Reuters) Regional JMC signs rental deal with Imtiyaz Arabia – Jarir Marketing Company (JMC) has signed a rental agreement with Imtiyaz Arabia Ltd to lease an apartment in its own building in Jazan for one year. The agreement is automatically renewed for an amount of SR35,000 annually, and the financial impact will be considered in 2Q2015. Imtiyaz is owned by Jarir’s board members. This agreement is subject to the general assembly meeting’s approval. (Tadawul) STC BoD approves SR2bn dividend for 1Q2015 – Saudi Telecom Company’s (STC) board of directors has approved the distribution of 10% dividend (SR1 per share), amounting to

- 5. Page 5 of 7 SR2bn for 1Q2015. Shareholders, who are registered with the Securities Depository Center (Tadawul) on April 26, 2015, will be eligible to receive the dividend. The dividend will be distributed on May 14, 2015 through Saudi Fransi Bank. (Tadawul) SABIC, Saudi Aramco & PIF JV may go public – Saudi Basic Industries Corporation’s (SABIC) CEO, Yousef Abdullah Al Benyan said that a joint venture (JV) between SABIC, Saudi Arabian Oil Company (Saudi Aramco) and Public Investment Fund (PIF) may eventually go public. Early in 2014, the government had approved the creation of the Saudi Arabian Company for Industrial Investment with a capital of SR2bn, which would help to diversify the economy by focusing on manufacturing industries. (GulfBase.com) Acwa, Air Products JV wins Aramco gas plant project – Acwa Holding and US-based Air Products have won a major contract from Saudi Aramco to build, own and operate the world's largest industrial gas complex in the Kingdom. The complex will supply 75,000 metric tons (MT) per day of oxygen and nitrogen to Saudi Aramco's refinery being built in Jazan area for 20 years. The complex will be designed and built by Air Products using its proprietary technology. Acwa will hold a 75% stake in the facility, while the remainder 25% will be held by Air Products. (GulfBase.com) ISC to launch new SR100mn fund to develop tourism in EP – The Investor for Securities Company (ISC) is launching its first tourism fund with a capital of SR100mn at Dana Bay Resort in Half Moon Bay of the Eastern Province (EP). Dana Bay Tourism Company’s Chairman, Abdul Mohsen Al-Rashid said that the company has sold a 42,000-square meter area to ISC for building and developing 20 chalets as well as setting up a special tourism fund. He said that this project is aimed at increasing the flow of tourists to the province, adding that Dana Bay Resort includes a number of hotels, resorts, entertainment projects, chalets and markets. He stated that the project requires an investment up to SR4bn. The company would cooperate with other national and Gulf companies to float similar tourism funds. (GulfBase.com) SAIC EGM approves capital rise via bonus shares – Saudi Advanced Industries Company’s (SAIC) extra ordinary general meeting (EGM) has approved a capital increase via bonus shares. Meanwhile, the Saudi Stock Exchange (Tadawul) announced that the addition of bonus shares and the fluctuation limits for SAIC will be based on a share price of SR20.46. (Tadawul) Aramex AGM approves 14% cash dividend – Aramex’s ordinary general assembly meeting (AGM) has approved the distribution of 14% cash dividend from the paid-up capital for the year ended December 31, 2014. (DFM) GRM wins DIB’s records storage contract – Ireland-based Glenbeigh Records Management (GRM) has secured a records storage contract with Dubai Islamic Bank (DIB). GRM is a leading records management company. (GulfBase.com) DWTC unveils 15,500 sq.m expansion plan – Dubai World Trade Centre (DWTC) has announced plans to build a 15,500 square meter (sq.m) extension to its current indoor complex space, taking the available multipurpose indoor event and exhibition capacity to over 122,000 sq.m. (GulfBase.com) UNB reports AED610.8mn net profit in 1Q2015 – Union National Bank (UNB) has reported a net profit of AED610.84mn in 1Q2015 as compared to AED509.1mn in 1Q2014. The bank’s operating profit increased 22% YoY to AED683.72mn. UNB’s total assets stood at AED97.8bn at the end of March 31, 2015 as compared to AED93.46bn at the end of March 31, 2014. Loan & advances reached to AED66.94bn, where as customer deposits stood at AED69.68bn. EPS amounted to AED0.21 in 1Q2015 versus AED0.16 in 1Q2014. (ADX) Aldar launches three residential projects in Abu Dhabi – Aldar Properties has launched three major new residential developments in prime areas of Abu Dhabi, including in investment zones where property can be purchased by non- UAE nationals. Aldar Properties’ CEO, Mohammad Al Mubarak, said that the three new developments, West Yas, Mayan and Meera, will enrich Yas Island and Shams Abu Dhabi with high quality homes to meet demand across all segments of the market. The developer is planning to build 2,000 more homes in Abu Dhabi to meet the growing demand across all market segments. (ADX) Mubadala to launch unit sales at Rosewood, Four Seasons – Mubadala announced that it will launch residential sales at Rosewood Abu Dhabi and Four Seasons in 2H2015. Mubadala said that more than 140 apartments at Rosewood Hotel and Four Seasons Hotel, which are due to open in 2016, will be available for sale. The Rosewood Residences will offer 73 apartments ranging from one to three-bedrooms, along with three penthouses, while the 69 units at the Four Seasons will offer one to four-bedroom apartments and two penthouses. (GulfBase.com) NBK: Kuwait’s trade surplus down 18% over cheap oil – According to the latest research released by the National Bank of Kuwait (NBK), Kuwait’s trade surplus slipped in 2014 for the first time in six years. The surplus fell by 18% to KD19.8bn, mainly due to lower oil export receipts. A decline in non-oil export earnings also dragged the surplus lower. With oil prices forecasted to continue to fall or remain low in 2015, downward pressures on the country’s surplus are expected to persist. Still, Kuwait continued to enjoy a relatively large surplus estimated at 41% of GDP in 2014, which was also it’s fourth highest on record. Kuwait’s oil export earnings fell by 12% in 2014 to KD26.8bn, while non-oil exports declined by 6.3% in 2014 and stood at KD1.4bn. (GulfBase.com) Ominvest, ONICH BoD approve proposed merger – Oman International Development & Investment Company (Ominvest) and Oman National Investment Corporation Holding (ONICH) signed a Memorandum of Understanding (MoU) to explore the viability of a merger between the two companies. In light of the satisfactory completion of due diligence, the board of directors of both the companies have approved the proposed merger as agreed in the MoU. The decision was disclosed to MSM on December 31, 2014, regarding the execution of a MoU between Ominvest and ONICH. The merger will be subject to approvals from the respective shareholders; and all necessary legal and regulatory approvals from relevant authorities. (MSM) NCSI: Oman’s GDP rises 4.6% in 2014 – According to the National Centre for Statistics & Information (NCSI), Oman’s GDP rose by 4.6% in 2014 to reach OMR31.45bn as compared to OMR30.06bn in 2013. The country’s petroleum production fell by 2.4% to OMR14.84bn in 2014 against OMR15.2bn in 2013. Crude oil contributed OMR13.78bn, showing a decrease of a 1.9% as compared to OMR14.04bn in 2013. On the other hand, natural gas posted a decline of 8.5% in 2014 to OMR1.06bn against OMR1.15bn in 2013. Meanwhile, the total value of non- petroleum activities registered a 10.1% growth to reach OMR18.92bn as compared to OMR17.19bn in 2013. The services sector witnessed a rise of 13.1% to stand at OMR12.81bn during 2014 as compared to OMR11.33bn in 2013. (GulfBase.com)

- 6. Page 6 of 7 OIF acquires 40% stake in Sigit – Oman Investment Fund (OIF) has acquired a 40% stake in Italian auto parts maker, Sigit SpA. This acquisition is expected to open the way for investments in an array of auto parts manufacturing facilities to be set up in Oman. With this acquisition, OIF now boasts a well- diversified portfolio of investments across a number of production and service sectors. (GulfBase.com) CBO: Oman's bank lending grows 11.4% YoY in February – According to the Central Bank of Oman (CBO), bank lending growth in Oman accelerated to 11.4% YoY in February 2015, the fastest rate since January 2013, from 11.1% in January 2015. The CBO said M2 money supply growth slowed to 10.9% in February 2015, the slowest since December 2013, from 13.1% in January 2015. (Reuters) GFH to delist from LSE, keep other listings – Gulf Finance House (GFH) has decided to delist its global depositary receipts (GDR) from the London Stock Exchange (LSE). The board of directors has decided that terminating the program is in the best interests of the bank. GFH will maintain its other stock listings in Bahrain, Kuwait, and Dubai. (Bahrain Bourse) Zain deploys Ericsson’s Radio Dot System in Bahrain – Ericsson and Zain have partnered to deploy Ericsson’s state of the art Radio Dot System in Bahrain. The solution is implemented in Zain’s new Network Operation Center. This is one of the first implementations in the region and demonstrates the solution’s ability to cater for the fast-growing demand for data traffic among consumers. (Bahrain Bourse) NBB reports of BHD17mn net profit in 1Q2015 – The National Bank of Bahrain (NBB) reported net profit of BHD17.02mn in 1Q2015, reflecting an increase of 2.4% YoY. NBB’s net interest income stood at BHD14.17mn in 1Q2015 as compared to BHD15.57mn in 1Q2014. The decrease is mainly due to lack of quality lending opportunities and lower yield on surplus funds as a result of strong domestic liquidity. Other income for 1Q2015 stood at BHD12.09mn, an increase of 27.1% YoY. Customer deposits amounted to BHD2.24bn in 1Q2015. EPS stood at 16.4 fils in 1Q2015 versus 16.1 fils in 1Q2014. The bank continues to focus on efficiency management resulting in its cost-to-income ratio improving from 29.07% in 1Q2014 to 29.02% in 1Q2015. (GulfBase.com) BBK reports BHD14.9mn net profit in 1Q2015 – BBK reported net profit of BHD14.9mn in 1Q2015, up 6% YoY. The increase in the bank’s net profit was mainly attributable to the robust growth in fees & commission income as well as the healthy rise in net interest income. Fees & commission income grew by 8.4% to BHD7.3mn in 1Q2015, while the net interest income stood at BHD17.9mn, showing an increase of 4.7% YoY. Net loans & advances grew by 9.2% YoY to stand at BHD1.89bn, and non- trading investment portfolio grew by 9.5% YoY to BHD797mn. Customer deposits rose by 13.7% to BHD2.59bn. EPS amounted to 14 fils in 1Q2015 versus 13 fils in 1Q2014. (GulfBase.com)

- 7. Contacts Saugata Sarkar Ahmed Al-Khoudary Sahbi Kasraoui Head of Research Head of Sales Trading – Institutional Manager – Head of HNI Tel: (+974) 4476 6534 Tel: (+974) 4476 6548 Tel: (+974) 4476 6544 saugata.sarkar@qnbfs.com.qa ahmed.alkhoudary@qnbfs.com.qa sahbi.alkasraoui@qnbfs.com.qa QNB Financial Services SPC Contact Center: (+974) 4476 6666 PO Box 24025 Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of QNB SAQ (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange QNB SAQ is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 7 of 7 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg ( # Market closed on 20 April 2015) Source: Bloomberg (*$ adjusted returns) 80.0 100.0 120.0 140.0 160.0 180.0 200.0 220.0 Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 QSE Index S&P Pan Arab S&P GCC (0.3%) 0.2% 0.3% 0.1% 0.6% 0.7% 1.8% (0.6%) 0.0% 0.6% 1.2% 1.8% 2.4% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,195.88 (0.7) (0.7) 0.9 MSCI World Index 1,779.12 0.6 0.6 4.1 Silver/Ounce 15.97 (1.9) (1.9) 1.7 DJ Industrial 18,034.93 1.2 1.2 1.2 Crude Oil (Brent)/Barrel (FM Future)# 63.45 0.0 0.0 10.7 S&P 500 2,100.40 0.9 0.9 2.0 Crude Oil (WTI)/Barrel (FM Future) 56.38 1.1 1.1 5.8 NASDAQ 100 4,994.60 1.3 1.3 5.5 Natural Gas (Henry Hub)/MMBtu 2.55 (3.4) (3.4) (15.0) STOXX 600 406.87 0.5 0.5 5.5 LPG Propane (Arab Gulf)/Ton 56.25 (1.7) (1.7) 14.8 DAX 11,891.91 1.5 1.5 7.2 LPG Butane (Arab Gulf)/Ton 62.00 (1.2) (1.2) (1.2) FTSE 100 7,052.13 0.6 0.6 2.8 Euro 1.07 (0.6) (0.6) (11.2) CAC 40 5,187.59 0.6 0.6 7.9 Yen 119.18 0.2 0.2 (0.5) Nikkei 19,634.49 (0.5) (0.5) 12.6 GBP 1.49 (0.4) (0.4) (4.3) MSCI EM 1,033.77 (0.9) (0.9) 8.1 CHF 1.05 (0.4) (0.4) 4.0 SHANGHAI SE Composite 4,217.08 (1.6) (1.6) 30.6 AUD 0.77 (0.7) (0.7) (5.5) HANG SENG 27,094.93 (2.0) (2.0) 14.8 USD Index 97.94 0.4 0.4 8.5 BSE SENSEX 27,886.21 (2.8) (2.8) 1.7 RUB 53.39 2.7 2.7 (12.1) Bovespa 53,761.27 0.5 0.5 (6.5) BRL 0.33 0.3 0.3 (12.6) RTS 995.70 (0.3) (0.3) 25.9 171.2 141.9 128.2