4 things maybe you don't know about nasdaq-100 (posted 23th June 2017)

•

0 likes•115 views

This is a presentation of a work abount the American Index that I made at the end of June. I hope it's useful for someone, even there are questions, criticism or advises don't hesitate to contact me, thank you. Check it out and have a good read!

Report

Share

Report

Share

Download to read offline

Recommended

Recommended

Data Mining refers to the analysis of large amounts of data stored in computers. The Big Data

era is already present, with current sources indicating that more data have been created over the last two years

than they have been generated throughout the entire human history. Big Data involves data sets so large that

traditional data analysis methods are no longer usable due to the huge amount of data. Lacking or ignoring

the data structure is an extremely important aspect,Using Data Mining methods to solve classification problems. The connection be...

Using Data Mining methods to solve classification problems. The connection be...International Journal of Business Marketing and Management (IJBMM)

More Related Content

Similar to 4 things maybe you don't know about nasdaq-100 (posted 23th June 2017)

Data Mining refers to the analysis of large amounts of data stored in computers. The Big Data

era is already present, with current sources indicating that more data have been created over the last two years

than they have been generated throughout the entire human history. Big Data involves data sets so large that

traditional data analysis methods are no longer usable due to the huge amount of data. Lacking or ignoring

the data structure is an extremely important aspect,Using Data Mining methods to solve classification problems. The connection be...

Using Data Mining methods to solve classification problems. The connection be...International Journal of Business Marketing and Management (IJBMM)

Similar to 4 things maybe you don't know about nasdaq-100 (posted 23th June 2017) (20)

Running Head UNITED STATES STOCK EXCHANGE MARKET 1UNITED STA.docx

Running Head UNITED STATES STOCK EXCHANGE MARKET 1UNITED STA.docx

BUSINESS FINANCE BBUS350Stock Portfolio ProjectObjectiveTh.docx

BUSINESS FINANCE BBUS350Stock Portfolio ProjectObjectiveTh.docx

BUSINESS FINANCE BBUS350Stock Portfolio ProjectObjectiveTh.docx

BUSINESS FINANCE BBUS350Stock Portfolio ProjectObjectiveTh.docx

Using Data Mining methods to solve classification problems. The connection be...

Using Data Mining methods to solve classification problems. The connection be...

IRJET- Stock Market Prediction using Candlestick Chart

IRJET- Stock Market Prediction using Candlestick Chart

ASSESSMENT CASE PAPER ANALYSIS / TUTORIALOUTLET DOT COM

ASSESSMENT CASE PAPER ANALYSIS / TUTORIALOUTLET DOT COM

HOQUE’S IIM AND INDIVIDUAL & GROUP PRESENTATION FOR HED.docx

HOQUE’S IIM AND INDIVIDUAL & GROUP PRESENTATION FOR HED.docx

Recently uploaded

Recently uploaded (20)

No 1 Top Love marriage specialist baba ji amil baba kala ilam powerful vashik...

No 1 Top Love marriage specialist baba ji amil baba kala ilam powerful vashik...

Black magic specialist in pakistan usa dubai oman karachi multan canada londo...

Black magic specialist in pakistan usa dubai oman karachi multan canada londo...

Collecting banker, Capacity of collecting Banker, conditions under section 13...

Collecting banker, Capacity of collecting Banker, conditions under section 13...

Certified Kala Jadu, Black magic specialist in Rawalpindi and Bangali Amil ba...

Certified Kala Jadu, Black magic specialist in Rawalpindi and Bangali Amil ba...

cost-volume-profit analysis.ppt(managerial accounting).pptx

cost-volume-profit analysis.ppt(managerial accounting).pptx

20240514-Calibre-Q1-2024-Conference-Call-Presentation.pdf

20240514-Calibre-Q1-2024-Conference-Call-Presentation.pdf

asli amil baba bengali black magic kala jadu expert in uk usa canada france c...

asli amil baba bengali black magic kala jadu expert in uk usa canada france c...

Amil baba powerful kala jadu in islamabad rawalpindi - Amil baba in lahore Am...

Amil baba powerful kala jadu in islamabad rawalpindi - Amil baba in lahore Am...

20240419-SMC-submission-Annual-Superannuation-Performance-Test-–-design-optio...

20240419-SMC-submission-Annual-Superannuation-Performance-Test-–-design-optio...

Test bank for advanced assessment interpreting findings and formulating diffe...

Test bank for advanced assessment interpreting findings and formulating diffe...

amil baba in australia amil baba in canada amil baba in london amil baba in g...

amil baba in australia amil baba in canada amil baba in london amil baba in g...

GIFT City Overview India's Gateway to Global Finance

GIFT City Overview India's Gateway to Global Finance

4 things maybe you don't know about nasdaq-100 (posted 23th June 2017)

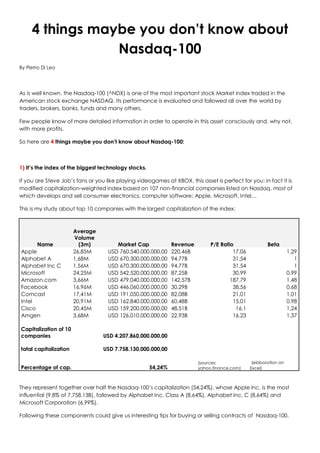

- 1. 4 things maybe you don’t know about Nasdaq-100 By Pietro Di Leo As is well known, the Nasdaq-100 (^NDX) is one of the most important stock Market index traded in the American stock exchange NASDAQ. Its performance is evaluated and followed all over the world by traders, brokers, banks, funds and many others. Few people know of more detailed information in order to operate in this asset consciously and, why not, with more profits. So here are 4 things maybe you don’t know about Nasdaq-100: 1) It’s the index of the biggest technology stocks. If you are Steve Job’s fans or you like playing videogames at XBOX, this asset is perfect for you: in fact it is modified capitalization-weighted index based on 107 non-financial companies listed on Nasdaq, most of which develops and sell consumer electronics, computer software: Apple, Microsoft, Intel… This is my study about top 10 companies with the largest capitalization of the index: Name Average Volume (3m) Market Cap Revenue P/E Ratio Beta Apple 26,85M USD 760.540.000.000,00 220,46B 17,06 1,29 Alphabet A 1,68M USD 670.300.000.000,00 94,77B 31,54 1 Alphabet Inc C 1,56M USD 670.300.000.000,00 94,77B 31,54 1 Microsoft 24,25M USD 542.520.000.000,00 87,25B 30,99 0,99 Amazon.com 3,66M USD 479.040.000.000,00 142,57B 187,79 1,48 Facebook 16,96M USD 446.060.000.000,00 30,29B 38,56 0,68 Comcast 17,41M USD 191.050.000.000,00 82,08B 21,01 1,01 Intel 20,91M USD 162.840.000.000,00 60,48B 15,01 0,98 Cisco 20,45M USD 159.200.000.000,00 48,51B 16,1 1,24 Amgen 3,68M USD 126.010.000.000,00 22,93B 16,23 1,37 Capitalization of 10 companies USD 4.207.860.000.000,00 tatal capitalization USD 7.758.130.000.000,00 Percentage of cap. 54,24% (sources: yahoo.finance.com) (elaboration on Excel) They represent together over half the Nasdaq-100’s capitalization (54,24%), whose Apple inc. is the most influential (9,8% of 7.758.13B), followed by Alphabet Inc. Class A (8,64%), Alphabet Inc. C (8,64%) and Microsoft Corporation (6,99%). Following these components could give us interesting tips for buying or selling contracts of Nasdaq-100.

- 2. 2) Follow others assets, above all Russell 200 and Nasdaq Composite Statistical models for data analysis help us build a strategy in any kind of market order (Intraday, multiday…) and in hedging bets, we can use: a) Endogenous models like the Exponential Smoothing you need to smooth time series otherwise to give more weight to recent data than that older. Yt* = ( 1- λ ) Yt + λ Yt-1 * where λ is the smoothing factor, and 0 < λ < 1 - λ 0 for smoothing - λ 1 to make short-term predictions B) Exogenous models (with more variables) like multiple linear regression: it’s based on discovering possible connections between our target and external factors. I have done this analysis with a monthly dataset (from January 2004 to May 2017) that contains 161 observations about 10 assets: Nasdaq-100(^NDX), S&P 500 (^GSPC), Dow Jones (^DJI), Nasdaq Composite (^IXIC), Russell 2000 (^RUT), EUR/USD (forex), Crude oil (CL), Gold Aug 17 (GC) FUTURES, Apple (AAPL) and Microsoft Corporation (MSFT). The method follows 2 steps, scilicet correlation analysis with F-test and then regression with p-value. First of all I did multivariable correlation on Excel, then I used the F test to verify hipotheses F= (r²/(1-r²)) * (n- 2) with Fx,1,n-2 where r= correlation coefficient and n= number of observations I compared coefficient with F value and I realized that all values are significant ( COEFFICIENTS > f= 0.3317). There are different relationships between elements and Nasdaq, so I need to understand which of external variables is the best, and Regression gives the answer. 0.00 1000.00 2000.00 3000.00 4000.00 5000.00 6000.00 Nasdaq-100 Monthly (closing prices) From january 2004 to may 2017 --- λ = 0,2 --- λ = 0,8 --- NSX

- 3. (Dataset is available on yahoo.finance.com, investing.com, processing on Excel) Nasdaq 100 (NDX) S&P 500 (^GSP C) Dow Jones (^DJI) Nasdaq Composit e (^IXIC) Russell 2000 (^RUT) EUR/US D Crude oil (CL) Gold Aug 17 (GC) FUTURES Apple (AAPL) Microsoft Corporati on (MSFT) Nasdaq 100 (NDX) 1 S&P 500 (^GSPC) 0,9601 4 1 Dow Jones (^DJI) 0,9652 6 0,99328 1 Nasdaq Composit e (^IXIC) 0,9964 8 0,97794 0,9787 1 1 Red=High correlatio n Yellow= Medium correlatio n Green=low correlation Russell 2000 (^RUT) 0,9613 3 0,98252 0,9855 2 0,97689 1 EUR/USD - 0,5756 2 - 0,54582 - 0,5058 8 -0,5774 - 0,5018 5 1 Crude oil (CL) - 0,1285 8 - 0,12441 -0,0619 -0,13616 - 0,0253 3 0,71969 1 Gold Aug 17 (GC) FUTURES 0,5027 4 0,33972 0,4164 4 0,45249 0,4396 9 0,0385 0,4833 8 1 Apple (AAPL) 0,9554 0,86481 0,8884 3 0,93503 0,8908 1 -0,5095 - 0,0114 3 0,68092 1 Microsoft Corporati on (MSFT) 0,9408 6 0,93584 0,9269 8 0,94638 0,8944 6 - 0,61432 - 0,2807 2 0,27827 0,83189 1 In regression, after the control of indices of determination (both are 99,95%, so we have only 0.05% error percentage) the significance level must be lower than p-value (0.05). Here we must exclude 3 variables, and in comparison between standard error (distance of observation from estimation) and correlation coefficient, the better choices are Nasdaq Composite and Russell 2000. Coefficients Standard Error Stat t Significance level Inferior 95% Superior 95% Inferior 95,0% Superior 95,0% Nasdaq-100 -114,7275 44,09043 - 2,602096 0,010188 - 201,8413 -27,61369 - 201,8413 -27,61369 S&P 500 (^GSPC) -0,139898 0,082167 - 1,702608 0,090699 - 0,302244 0,022447 - 0,302244 0,022447 Dow Jones (^DJI) 0,003357 0,008778 0,382366 0,702727 - 0,013988 0,020701 - 0,013988 0,020701 Nasdaq Composite (^IXIC) 1,205397 0,028565 42,19798 1,79E-85 1,148958 1,261837 1,148958 1,261837 Russell 2000 (^RUT) -1,132576 0,086474 - 13,09733 1,15E-26 - 1,303431 -0,961722 - 1,303431 -0,961722 EUR/USD -104,6402 36,89552 - 2,836121 0,005193 - 177,5383 -31,74202 - 177,5383 -31,74202 Crude oil (CL) 0,565837 0,211634 2,673653 0,008329 0,14769 0,983984 0,14769 0,983984 Gold Aug 17 (GC) FUTURES 0,144623 0,015262 9,476289 5,24E-17 0,114469 0,174776 0,114469 0,174776 Apple (AAPL) 0,769284 0,321365 2,393799 0,017902 0,134331 1,404237 0,134331 1,404237 Microsoft Corporation 0,818693 0,926204 0,883923 0,378143 -1,0113 2,648685 -1,0113 2,648685

- 4. 3) Wait!! Here’s the answers to the classical question “What should I invest?” a) Graphical analysis: you can study the psychological behaviour between “Bulls” and “Bears” : in this case I used daily candlesticks (in order to have 4 elements: open and closed prizes, maximum and minimum of the day) , I marked the uptrend began from 04/11/2016 with a gap-up and the most interesting patterns, 2 Bear bozu (17 may and 09 june), and the Hanging Man before the last bozu, they are signals for a potential trend reversal. We need to control that there’s no breakline of trend.

- 5. b) Seasonality and trend-cycle estimation: we need to know when it’s more advantageous buying or selling, in other words when the price of the assets is lower (for long) or higher (for short). I have found the coefficients of seasonality by calculating the average between errors and seasonal average (SMA 12). We can see in the graphic how the index loses value during summer months and goes up in the autumn. The thing is visible also in the other graphic for the trend-cycle estimation. 0.00 50.00 100.00 150.00 200.00 250.00 300.00 350.00 400.00 450.00 Seasonality 0.00 1000.00 2000.00 3000.00 4000.00 5000.00 6000.00 trend-cycle estimation (Ch - St)…

- 6. 4) Watch macroeconomic data. Balance of Payments (B.O.P), interest rate, inflation rate and money supply are a few of the most important indicators can can be divided into 4 categories: a) Confidence indicators such as Zew o Ifo. In USA there is Consumer Confidence Index (CCI) is published every month, specifically in the last Tuesday of every month at 4:00 p. m. (Italian time). It shows the degree of confidence of Americans consumers about purchase power for the next semester in comparison with the real purchase power. b) Economic activities Indexes, specific to each sector: - Monthly data for American manufacturing, the first published is Philadelphia Fed Index, that could anticipate the Chicago’s Purchasing Managers’ Index (PMI) and the Institute for supply Management’s (ISM). While Pmi is a market survey carried on opinions of 200 companies of the area, Ism is a progress report of 300 companies of the whole state. - Gross Domestic Product (GDP) , report with annual and quarterly values about investments, private consumption, public spending and difference between export and import (Also important for the Balance of Payments). - Real estate market, to follow in particular monthly building permits and the real estate sells, perhabs the most powerful influencer to consumption. - Labour market , whose 3 things are very followed: weekly jobless claims, monthly non farm payrolls and the monthly unemployment rate; these is made by Bureau of Labour Statistics. c) Inflation indicators, that analyze both consumption and supply: - The Consumer Price Index (CPI) studies the cost of living trend based on a basket of goods normally is “cleaned” of goods with high volatility like food and energy because represents real price changes. It’s also important for forex traders, but their expectations are in opposition to stock traders: they want an inflation increasing ( so a stock markets decrease) in order to buy national currency because they estimate an increasing cost of this; - The Producer Price Index (PPI) measures the cost of a basket of production factors (raw products, finished and semifinished) net of energy and food and you can see how prices change. Traders find this index very useful for analyzing the commodities trend (Gold, Crude Oil, Corn…) , and since it is the first indicator of inflation published every month, operators could anticipate price pressures. d) Central Banks, if the currency changes stock prices might fluctuate, for this reason who invests controls what are the monetary policy choices they realize through 2 different strategies: - direct interventions, that is to say buying / selling own currency in order to revalue / devalue it; - Report about American economy health state, that is named “The Beige Book” ; Federal Reserve publishes it 8 times a year, 2 weeks before the known meeting Federal Open Market Committee (FOMC). N.B. This is my point of view on this market and presentation of my work on Excel, I don’t want influence anyone for investment choices, on the contrary I wanted to show you my finance skills (I need to improve them certainly). If there are any ask, critique or recommendation don’t hesitate to contact me.