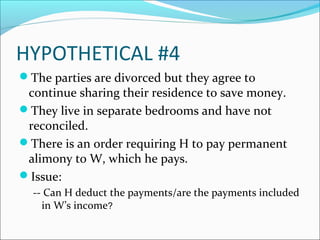

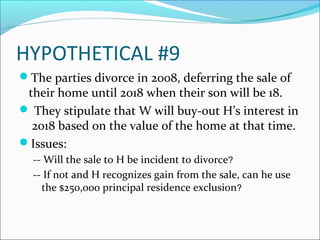

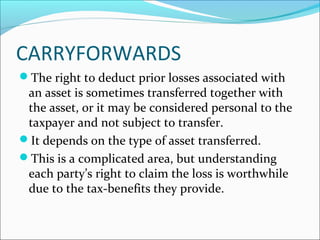

The document discusses the implications of alimony and property division in the context of divorce, focusing on tax planning strategies that can benefit clients. It presents a series of hypothetical scenarios to illustrate the complexities of alimony deductions and the handling of property transfers incident to divorce, such as tax basis and carryforwards. The conclusion invites readers to reach out for further questions on these topics.