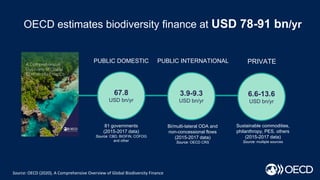

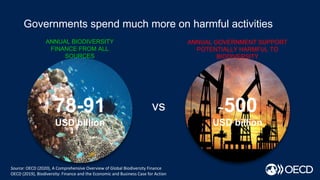

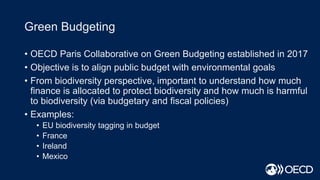

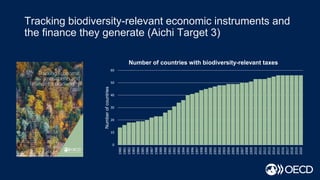

The document provides an overview of global biodiversity finance, estimating it at USD 78-91 billion annually while highlighting that governments allocate significantly more towards harmful activities. It discusses innovative approaches for scaling up biodiversity finance such as green budgeting, biodiversity tagging in budgets, and the establishment of frameworks like the Task Force on Nature-related Financial Disclosures (TNFD) to enhance tracking and reporting. Key recommendations include improving assessment of public and private finance flows and promoting responsible business conduct aligned with environmental goals.