Portugal’s Latest Amendments to the Income Tax Law – What you must know

•

1 like•400 views

Portugal is a great place to start a business. The economy here has grown vastly and the GDP is consistently above the European average

Report

Share

Report

Share

Download to read offline

Recommended

Recommended

Falcon stands out as a top-tier P2P Invoice Discounting platform in India, bridging esteemed blue-chip companies and eager investors. Our goal is to transform the investment landscape in India by establishing a comprehensive destination for borrowers and investors with diverse profiles and needs, all while minimizing risk. What sets Falcon apart is the elimination of intermediaries such as commercial banks and depository institutions, allowing investors to enjoy higher yields.Unveiling Falcon Invoice Discounting: Leading the Way as India's Premier Bill...

Unveiling Falcon Invoice Discounting: Leading the Way as India's Premier Bill...Falcon Invoice Discounting

More Related Content

More from Nair and Co.

More from Nair and Co. (20)

Belgium Introduces Changes to Employment Law Regulations

Belgium Introduces Changes to Employment Law Regulations

Germany Updates Minimum Salary Qualifications for EU Blue Card Holders

Germany Updates Minimum Salary Qualifications for EU Blue Card Holders

Australia Increases Super (Superannuation Guarantee), the Required Employer R...

Australia Increases Super (Superannuation Guarantee), the Required Employer R...

Sir Alan Collins to Honour “Magical Team” at The Churchill Club Awards Ceremony

Sir Alan Collins to Honour “Magical Team” at The Churchill Club Awards Ceremony

Australia Announces Changes to Unfair Dismissal Related Thresholds

Australia Announces Changes to Unfair Dismissal Related Thresholds

South Korea Enacts Tax Revision Bill: Update from International Tax Complianc...

South Korea Enacts Tax Revision Bill: Update from International Tax Complianc...

Australian Federal Court Clarifies that Reasonable Performance Management is ...

Australian Federal Court Clarifies that Reasonable Performance Management is ...

India Notifies Rules for ‘Voluntary Compliance Encouragement Scheme’: Update ...

India Notifies Rules for ‘Voluntary Compliance Encouragement Scheme’: Update ...

India passes finance bill for 2013 14- updates from international tax consult...

India passes finance bill for 2013 14- updates from international tax consult...

Argentina Introduces New Systems for Recording Overseas Payments: Update from...

Argentina Introduces New Systems for Recording Overseas Payments: Update from...

Argentina introduces new systems for recording overseas payments update from...

Argentina introduces new systems for recording overseas payments update from...

India Revises Tolerance Band for Transfer Pricing: Updates from International...

India Revises Tolerance Band for Transfer Pricing: Updates from International...

Australia Proposes Amendments to GAAR (Part IVA) to Counter Tax Dodging

Australia Proposes Amendments to GAAR (Part IVA) to Counter Tax Dodging

UK Relaxes Reporting Rules for Small Companies under RTI; Allows Extended Tim...

UK Relaxes Reporting Rules for Small Companies under RTI; Allows Extended Tim...

Introducing SDL BeGlobal - The industry's first cloud platform for real-time ...

Introducing SDL BeGlobal - The industry's first cloud platform for real-time ...

Russia Clarifies Conditions for Input VAT Deduction on Imports Made by Branch...

Russia Clarifies Conditions for Input VAT Deduction on Imports Made by Branch...

Recently uploaded

Falcon stands out as a top-tier P2P Invoice Discounting platform in India, bridging esteemed blue-chip companies and eager investors. Our goal is to transform the investment landscape in India by establishing a comprehensive destination for borrowers and investors with diverse profiles and needs, all while minimizing risk. What sets Falcon apart is the elimination of intermediaries such as commercial banks and depository institutions, allowing investors to enjoy higher yields.Unveiling Falcon Invoice Discounting: Leading the Way as India's Premier Bill...

Unveiling Falcon Invoice Discounting: Leading the Way as India's Premier Bill...Falcon Invoice Discounting

Recently uploaded (20)

Berhampur 70918*19311 CALL GIRLS IN ESCORT SERVICE WE ARE PROVIDING

Berhampur 70918*19311 CALL GIRLS IN ESCORT SERVICE WE ARE PROVIDING

Unveiling Falcon Invoice Discounting: Leading the Way as India's Premier Bill...

Unveiling Falcon Invoice Discounting: Leading the Way as India's Premier Bill...

Kalyan Call Girl 98350*37198 Call Girls in Escort service book now

Kalyan Call Girl 98350*37198 Call Girls in Escort service book now

Challenges and Opportunities: A Qualitative Study on Tax Compliance in Pakistan

Challenges and Opportunities: A Qualitative Study on Tax Compliance in Pakistan

Call 7737669865 Vadodara Call Girls Service at your Door Step Available All Time

Call 7737669865 Vadodara Call Girls Service at your Door Step Available All Time

Berhampur CALL GIRL❤7091819311❤CALL GIRLS IN ESCORT SERVICE WE ARE PROVIDING

Berhampur CALL GIRL❤7091819311❤CALL GIRLS IN ESCORT SERVICE WE ARE PROVIDING

Uneak White's Personal Brand Exploration Presentation

Uneak White's Personal Brand Exploration Presentation

The Abortion pills for sale in Qatar@Doha [+27737758557] []Deira Dubai Kuwait![The Abortion pills for sale in Qatar@Doha [+27737758557] []Deira Dubai Kuwait](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![The Abortion pills for sale in Qatar@Doha [+27737758557] []Deira Dubai Kuwait](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

The Abortion pills for sale in Qatar@Doha [+27737758557] []Deira Dubai Kuwait

Pre Engineered Building Manufacturers Hyderabad.pptx

Pre Engineered Building Manufacturers Hyderabad.pptx

UAE Bur Dubai Call Girls ☏ 0564401582 Call Girl in Bur Dubai

UAE Bur Dubai Call Girls ☏ 0564401582 Call Girl in Bur Dubai

JAJPUR CALL GIRL ❤ 82729*64427❤ CALL GIRLS IN JAJPUR ESCORTS

JAJPUR CALL GIRL ❤ 82729*64427❤ CALL GIRLS IN JAJPUR ESCORTS

Falcon Invoice Discounting: Unlock Your Business Potential

Falcon Invoice Discounting: Unlock Your Business Potential

Ooty Call Gril 80022//12248 Only For Sex And High Profile Best Gril Sex Avail...

Ooty Call Gril 80022//12248 Only For Sex And High Profile Best Gril Sex Avail...

Durg CALL GIRL ❤ 82729*64427❤ CALL GIRLS IN durg ESCORTS

Durg CALL GIRL ❤ 82729*64427❤ CALL GIRLS IN durg ESCORTS

Paradip CALL GIRL❤7091819311❤CALL GIRLS IN ESCORT SERVICE WE ARE PROVIDING

Paradip CALL GIRL❤7091819311❤CALL GIRLS IN ESCORT SERVICE WE ARE PROVIDING

Getting Real with AI - Columbus DAW - May 2024 - Nick Woo from AlignAI

Getting Real with AI - Columbus DAW - May 2024 - Nick Woo from AlignAI

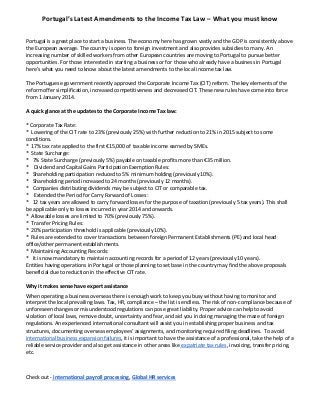

Portugal’s Latest Amendments to the Income Tax Law – What you must know

- 1. Portugal’s Latest Amendments to the Income Tax Law – What you must know Portugal is a great place to start a business. The economy here has grown vastly and the GDP is consistently above the European average. The country is open to foreign investment and also provides subsidies to many. An increasing number of skilled workers from other European countries are moving to Portugal to pursue better opportunities. For those interested in starting a business or for those who already have a business in Portugal here’s what you need to know about the latest amendments to the local income tax law. The Portuguese government recently approved the Corporate Income Tax (CIT) reform. The key elements of the reform offer simplification, increased competitiveness and decreased CIT. These new rules have come into force from 1 January 2014. A quick glance at the updates to the Corporate Income Tax law: * Corporate Tax Rate: * Lowering of the CIT rate to 23% (previously 25%) with further reduction to 21% in 2015 subject to some conditions. * 17% tax rate applied to the first €15,000 of taxable income earned by SMEs. * State Surcharge: * 7% State Surcharge (previously 5%) payable on taxable profits more than €35 million. * Dividend and Capital Gains Participation Exemption Rules: * Shareholding participation reduced to 5% minimum holding (previously 10%). * Shareholding period increased to 24 months (previously 12 months). * Companies distributing dividends may be subject to CIT or comparable tax. * Extended the Period for Carry Forward of Losses: * 12 tax years are allowed to carry forward losses for the purpose of taxation (previously 5 tax years). This shall be applicable only to losses incurred in year 2014 and onwards. * Allowable losses are limited to 70% (previously 75%). * Transfer Pricing Rules: * 20% participation threshold is applicable (previously 10%). * Rules are extended to cover transactions between foreign Permanent Establishments (PE) and local head office/other permanent establishments. * Maintaining Accounting Records: * It is now mandatory to maintain accounting records for a period of 12 years (previously 10 years). Entities having operations in Portugal or those planning to set base in the country may find the above proposals beneficial due to reduction in the effective CIT rate. Why it makes sense have expert assistance When operating a business overseas there is enough work to keep you busy without having to monitor and interpret the local prevailing laws. Tax, HR, compliance – the list is endless. The risk of non-compliance because of unforeseen changes or misunderstood regulations can pose great liability. Proper advice can help to avoid violation of local laws, remove doubt, uncertainty and fear, and aid you in doing managing the maze of foreign regulations. An experienced international consultant will assist you in establishing proper business and tax structures, documenting overseas employees’ assignments, and monitoring required filing deadlines. To avoid international business expansion failures, it is important to have the assistance of a professional, take the help of a reliable service provider and also get assistance in other areas like expatriate tax rules, invoicing, transfer pricing, etc. Check out - international payroll processing, Global HR services