Pi financial - Bluestone Resources Report

- 1. C B ( RA (unc Se CORPOR BLUESTO (V-BSR) $ ATING: BU changed) eeing th EVENT: Blues a Feasibility S DISCUSSION to our model supports aver Overall the FS $196M boast produce annu >900,000oz a 8.5g/t Au und initial up-fron achievable. As Bluestone potential conv believe ample on the operat of known vein Overall, result model. Impro compared to $117.8/t mille stoping to cut slightly higher TAKE-AWAY undeveloped cash flow pro secure a proje already secure gold producer RECOMMEN rating and $ incorporating FS, our valua currently tradin in-line when c average of 0.6 conservative $17.50/oz Ag SPECULATIV ATE UPD ONE RES $1.42 UY he Finish stone announc tudy for its flag N: The FS retur and included age annual FC S returned an ing an after-tax ual gold produ cross its mine der a 1,250tpd nt capital req e managemen version of inf e opportunities ions potential ns outside of th ts of the FS ta oved metallurg our 91% whic d versus our e t-and-fill mining r anticipated op : Cerro Blanco project worthy ofile confirms ect financing p ed and we see r in the coming DATION & VA $2.40/sh targ updates to our ation metrics ng at 0.6x our N compared to ot 6x and $46/oz, 8% discount r g prices. Sha VE and more su DATE Jan OURCES TARG (unchang h Line at ced positive an gship Cerro Bla ned favorable c cash and AISC F of $91M in it after-tax NPV x IRR of 34%. uction of 146,0 life (113,000oz conventional uirement of t pursues var erred resource exist to add re mine life. Ups he current reso abled today co gical work led h is slightly off estimate of $10 g compared to perating costs. o has always y of advancem our thesis and package later in e Bluestone em years. ALUATION: We et price for r model to refl remain relativ NAVPS and ~$4 ther junior deve respectively. O rate using our ares of Blue itable for risk to nuary 29, 2019 S INC. GET: $2.4 ged) Cerro B nd attractive ec anco project in costs and cash C of $424/oz a ts first 3yrs of o of $241M with The envisione 000oz over its z/yr) at average milling scenari $196M as m rious optimizat es (~360,000o ecoverable oun ide exists to ta ource envelope ompare relative d to gold reco fset by unit op 00/t. A higher s o the project P been an attra ment. The attr d we expect n 2019. Advan merging as an e continue to m Bluestone R ect parameters vely unchange 49/oz on an EV elopers who ha Our target is ge long term $1 estone should olerable investo 40 Blanco conomics with Guatemala. h flow compare and $579/oz an operations. h initial capex ed operation w s first 3yrs an e head grades io. We view th manageable an tion efforts an oz) to M&I, w nces and expan arget extension . ely in-line to o overies of 96 perating costs split of long-ho EA is a result ctive high-grad ractive cost an management nced permits a attractive juni maintain our BU esources. Aft s outlined in th d. Bluestone V/oz metric and ave a peer grou enerated using 1,300/oz Au an d be rated a ors. Philip pker@p Neeh nupady Comp Risk: 52-wee Shares Market 3-Mon Workin Long T Enterp CEO: Finan US$ Value Au Prod Revenu Cash Co Net Inco Thousands Corp Bluesto compan Blanco Guatem returne produci estimat estimat trades u the OTC A Disc this re hin ed nd of will nd of he nd nd we nd ns our % of ole of de nd to re or UY ter he is is up g a nd as p Ker, P.Geo, M @pifinancial.com 6 hal Upadhyay yhaya@pifinancia pany Statist ek High/ Low: s Outstanding: t Capitalization (C th Avg. Daily Vo ng Capital (US$): Term Debt (US$) prise Value (US$) ncial Summa es duction (Koz) e ($M) osts ($/Au oz) ome ($M) porate Inform one Resources is a ny that is focused Gold and Mita mala. A FS comp d robust economic ng 902,000oz of ted in the FS to fun ted at US$196M under the symbol “ CQB. closure fact she eport. MBA 647.789.2407 ya, BAFM, MAc al.com 416.775. ics S $ 6 6 C$): $ lume: 9 $ : $ : $ D ary 2018 ( mation mineral exploratio on advancing its 1 a Geothermal pr pleted for the Ce cs with an expect f gold. Initial ca nd construction an with AISC of US$ “BSR” on the TSX- et is available o cc 5107 SPECULATIVE $1.60/$1.05 64M (basic) 67M (fd) $91M 9.6K $11M $0M $59M Darren Klinck 8E 2019E 202 - - - - - - (4) (5) ( on and developmen 100% owned Cerr rojects located i erro Blanco projec ted 8-year mine lif apital expenditure d commissioning i $579/oz. Blueston -V and “BBSRF” o on Pages 6-7 of 20E - - - 11) nt o n ct e s s e n

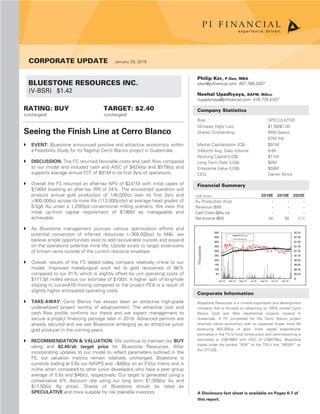

- 2. Bluestone Resources Inc. (V-BSR) – January 29, 2019 2 | CORPORATE UPDATE Philip Ker, P.Geo, MBA | Neehal Upadhyaya, BAFM, MAcc Company Snapshot BLUESTONE RESOURCES INC. (TSXV-BSR) BSR.V $1.42 Operation Metric Units 2018E 2019E 2020E 2021E 2022E Rating BUY Cerro Blanco Gold Sold oz - - - 113,584 145,838 Risk SPECULATIVE Silver Sold oz - - - 0.27 0.38 Target Price $2.40 Tonnes Mined Mt - - - 0.32 0.45 Projected Total Return 69% Ore Processed tpd - - - 1,000 1,250 Au Grade g/t - - - 11.50 10.50 Market Data Au Recovery % - - 96.0% 96.0% 96.0% Shares O/S (M) 64 Ag Grade g/t - - - 31.25 31.25 Shares O/S F.D. (M) 67 Ag Recovery % - - 85.0% 85.0% 85.0% 52-Week High ($) $1.60 Capex US$M - 40.0 160.0 41.0 22.0 52-Week Low ($) $1.05 Cash Costs ($/oz) - - - 289 321 Market Cap (C$ M) $91 AISC ($/oz) - - - 440 417 Working Capital ($M) $11 Long Term Debt ($M) $0 Enterprise Value ($M) $59 Fiscal Year End Dec. 31 Forecast Units Gold Price - Assumption US$/oz 1,269 1,300 1,300 1,300 1,269 Valuation $/sh Silver Price - Assumption US$/oz 15.71 17.50 17.50 17.50 15.71 Cerro Blanco Underground $1.52 Foreign Exchange Rate US$/C$ 0.78 0.78 0.78 0.78 0.78 Working Capital $0.08 Revenue US$M - - - 152 196 Corp Adjustments ($M) $(0.20) Net Income US$M (4) (5) (11) 49 62 NAV ($US/sh) $1.86 Cash Flow from Operations US$M (4) (5) (9) 77 100 NAV ($C/sh) $2.38 EPS US$M (0.04) (0.04) (0.09) 0.39 0.48 P/NAV 0.6X CFPS US$M (0.04) (0.04) (0.07) 0.61 0.78 Target Multiple 1.0X Resources Management Tonnage Au Grade Ag Grade Gold Silver Darren Klinck - CEO Cerro Blanco UG (Kt) (g/t) (g/t) (Moz) (oz) John Robins - Executive Chairman Measured & Indicated 3,712 10.05 37.89 1.20 4.53 Peter Hemstead - CFO Inferred 1,373 8.09 23.58 0.36 1.04 Price Market Cap. EV AuEQ EV/oz AuEq Key Shareholders (C$/sh) (C$M) (C$M) M+I+I (Moz) (US$/oz) Lundin Family Trust - 36.2% Pure Gold Mining Inc PGM.V Ontario 0.73 193.21 175.53 2.04 66.26 CD Capital - 16.7% ATAC Resources Ltd ATC.V Yukon 0.28 42.71 29.55 2.36 9.65 Goldcorp Inc. - 4.9% Rubicon Minerals Corp RMX.TO Ontario 1.29 84.95 84.84 1.03 63.42 Ruffer LLP - 2.87% Gold Standard Ventures Corp. GSV.TO Nevada 1.67 433.88 402.65 2.69 115.15 Franklin Advisors - 2.71% Barkerville Gold Mines Ltd BGM.V British Columbia 0.44 192.38 166.54 3.75 34.15 AGF International - 2.08% Treasury Metals Inc TML.TO Ontario 0.30 43.53 43.47 1.41 23.81 Marathon Gold Corp MOZ.TO Nfld 0.92 146.81 140.91 3.24 33.47 Sabina Gold & Silver Corp SBB.TO Nunavut 1.36 391.86 352.67 7.18 37.80 Probe Metals Inc PRB.V Quebec 1.05 116.11 81.02 1.40 44.42 Nighthawk Gold Corp NHK.TO NWT 0.41 79.38 59.70 2.61 17.59 Osisko Mining Inc OSK.TO Quebec 2.68 689.30 587.72 7.01 64.56 Bluestone Resources Inc. BSR.V Guatemala 1.5 95.8 80.6 1.64 49.3 UG only Bluestone Resources Inc BSR.V Guatemala 1.5 95.8 80.6 3.80 21.2 incl. open pit Average= 46.4 Median= 37.8 Sources: PI Finacial Corp., Thomson Eikon, Company Documents Comparable Companies Ticker Region

- 3. Philipp Ker, P.Geo, MBAA | Neehal Upadhhyaya, BAFM, MA FEASIB Overview: T as a low-co approved EIA height are re Next Steps resources from an updated re A long section Exhibit 1. Oth backfill/paste Exhibit 1: Source: Compa Initial Cape $196M. This dewater zone Dewatering w drilled surroun via re-injection shown below. Acc BILITY S The FS present ost undergroun A where only a equired but wo : Bluestone aim m inferred and in esource and upda n demonstrating er initiatives by plant and lastly, : Cerro Blan any Documents x & Dewateri is a result of i es of the depos will be a key com nding the ore bo n wells safely aw . STUDY ted for Cerro B nd operation in amendments re uld not impede s to complete a ncorporate the ad ated FS in H2/19 blocks of inferre management inc securing project nco Long Se ng: In comparis ncreased infrast sit as mining d mponent to the s ody with a maxim way from the m Blues – CERR Blanco provides n the coming elating to the p e on a construc an infill drill prog dditional ounces 9 with a goal of i ed resources wit clude optimizatio financing in H2/ ection & D son to the projec tructure related evelopment sur success of the o mum pumping ca mine site. A sche stone Resources RO BLAN s an attractive years. The p planned higher ction decision. gram targeting lo s into a revised m increasing >300 thin the existing on efforts and ev /19. rill Targets ct PEA, initial ca to dewatering rpasses the exi operation as it m apacity of 6,000 ematic demonst s Inc. (V-BSR) – J CORPORA NCO high-grade dep project already r throughput an ow hanging fruit mine plan. This is ,000oz to the pro block model is valuation of a po s apex rose slightly wells and pump sting depth of matures. A series gpm. Water will rating the plann January 29, 201 ATE UPDATE | posit to emerg possesses a nd tailings stac to increase M& s expected withi ojected mine life outlined below i tential ore sorte y from $171M t ps to adequatel the water table s of wells will b be re-distribute ed well drilling i 9 3 e n k &I n e. n r, o y e. e d s

- 4. 4 | CCORPORATE UPDDATE Exhibit 2: Source: Compan Mining & O factor with a b and-fill and 8% the deposit as designed cut- unit operating increase, impr PEA. A com outlined below : Dewaterin ny Documents Operations: Un blend of mining m % waste develo s designed in th and-fill mining, i costs increased roved metallurgi parison of the p w in Exhibit 3. ng Wells nder the envision methods used. O pment. Mining w he improved geo n addition to req d to $117.8/t com cal study work e parameters outlin Blues Philip K ned 1,250tpd op Ore will be extru will target the m ologic interpretat quired refrigerat mpared to the P enhanced projec ned and econom stone Resources Ker, P.Geo, MBA | perating scenario ded on a mix of modelled 1.9m a tion of Cerro Bla tion and cooling EA estimate of $ ct gold recoverie mics from the P s Inc. (V-BSR) – J | Neehal Upadhy o, the FS calls fo 54% long-hole s verage wide vei anco. With the costs and high- $93/t. Despite th s to 96% from 9 PEA and FS for January 29, 201 yaya, BAFM, MAc or a 20% dilutio stoping, 37% cut in swarms withi slight increase i -temp explosives he slight unit cos 91.3% within th Cerro Blanco ar 9 cc n t- n n s, st e e

- 5. Bluestone Resources Inc. (V-BSR) – January 29, 2019 Philip Ker, P.Geo, MBA | Neehal Upadhyaya, BAFM, MAcc CORPORATE UPDATE | 5 Exhibit 3: PEA & FS Comparison Source: PI Financial Valuation/Recommendation: After updating our model to reflect new inputs and results tabled within the FS, our BUY recommendation and $2.40/sh target price remains unchanged. Our target is generated using a conservative 8% discount rate using our long term $1,300/oz Au and $17.50/oz Ag prices and a 1.0x NAVPS multiple. Considering the current valuation of Bluestone being in-line to its peers on both P/NAV and EV/oz basis, we foresee key valuation growth to come from: 1) exploration success/mine life extension 2) securing construction financing 3) improved regional geopolitical risk – all of which will result in a lower discount rate in our NAV calculation leading to a higher valuation and price target. Exhibit 4: Updated NAVPS Breakdown Source: PI Financial Cerro Blanco Cerro Blanco Stage of Study PEA Feasibility Year of study 2017 2019 Reserves Modeled Units Mineable Tonnes of Ore Mt 4.0 Dominant Mining Method - Long-hole & Cut/fill Long-hole & Cut/fill Mining Operations Mine Life Yrs 9 8 Gold Grade g/t 8.10 8.50 Avg Annual Gold Production oz 105,000 113,000 Processing Throughput Rate tpd 1,250 1,250 Gold Recovery % 91.3% 96.0% Silver Recovery % 87.8% 85.0% Operating & Capital Costs Total Mining & Processing Costs US$/t 93 118 Avg LOM Cash Costs $US/oz 372 424 Avg LOM AISC $US/oz 490 579 Capex (Initial & Sustaining) $US (M) 276.0 336.0 Economics NPV after tax $US (M) 317 241 IRR after tax % 44 34 Interest Discount Multiple NAV (US$) NAVPS (US$) Cerro Blanco Underground 100% 8% 1.0x $199.2 $1.52 Cerro Blanco Open Pit @ 100% - $15/oz $30.0 $0.23 Mita Geothermal 100% - - $30.0 $0.23 Project Asset Value $259.2 $1.98 Working Capital $10.2 $0.08 ITM Proceeds $1.0 $0.01 G&A ($4.0) ($0.03) 2019 Exploration Budget ($10.0) ($0.08) Long Term Debt $0.0 $0.00 Assumed Interest Expenses ($13.2) ($0.10) NAV (US$) $243.2 $1.86 NAV (C$) $311.8 $2.38

- 6. Bluestone Resources Inc. (V-BSR) – January 29, 2019 6 | CORPORATE UPDATE Philip Ker, P.Geo, MBA | Neehal Upadhyaya, BAFM, MAcc Disclosure Fact Sheet Ratings Price Volatility / Risk BUY : recommendation: stock is expected to appreciate from its current price level at least 10-20% in the next 12 months. NEUTRAL : recommendation: stock is expected to trade in a narrow range from its current price level in the next 12 months. SELL : recommendation: stock is expected to decline from its current price level at least 10-20% in the next 12 months. U/R : Under Review N/R : No Rating TENDER: Investors are guided to tender to the terms of the takeover offer. Analyst recommendations and targets are based on the stock’s expected return over a 12-month period or may be based on the company achieving specific fundamental results. Under certain circumstances, and at the discretion of the analyst, a recommendation may be applied for a shorter time period. The basis for the variability in the expected percentage change for a recommendation, relates to the differences in the risk ratings applied to individual stocks. For instance stocks that are rated Speculative must be expected to appreciate at the high end of the range of 10-20% over a 12- month period. SPECULATIVE : The Company has no established operating revenue, and/or balance sheet or cash flow concerns exist. Typically low public float or lack of liquidity exists. Rated for risk tolerant investors only. ABOVE AVERAGE : Revenue and earnings predictability may not be established. Balance sheet or cash flow concerns may exist. Stock may exhibit low liquidity. AVERAGE : Average revenue and earnings predictability has been established; no significant cash flow/balance sheet concerns are foreseeable over the next 12 months. Reasonable liquidity exists. Price Volatility/Risk analysis while broad based includes the risks associated with a company’s balance sheet, variability of revenue or earnings, industry or sector risks, and liquidity risk. Analyst Certification I, Philip Ker, hereby certify that all of the views expressed in this report accurately reflect my personal views about the subject securities or issuers. I also certify that no part of my compensation was, is, or will be, directly or indirectly related to the specific recommendations or views expressed in this report. I am the research analyst primarily responsible for preparing this report. Research Disclosures Applicability 1) PI Financial Corp. and its affiliates’ holdings in the subject company’s securities, in aggregate exceeds 1% of each company’s issued and outstanding securities. 1) No 2) The analyst(s) responsible for the report or recommendation on the subject company, a member of the research analyst’s household, and associate of the research analyst, or any individual directly involved in the preparation of this report, have a financial interest in, or exercises investment discretion or control over, securities issued by the following companies. 2) No 3) PI Financial Corp. and/or its affiliates have received compensation for investment banking services for the subject company over the preceding 12-month period. 3) No 4) PI Financial Corp. and/or its affiliates expect to receive or intend to seek compensation for investment banking services from the subject company. 4) Yes 5) PI Financial Corp. and/or its affiliates have managed or co-managed a public offering of securities for the subject company in the past 12 months. 5) No 6) The following director(s), officer(s) or employee(s) of PI Financial Corp. is a director of the subject company in which PI provides research coverage. 6) No 7) A member of the research analyst’s household serves as an officer, director or advisory board member of the subject company. 7) No 8) PI Financial Corp. and/or its affiliates make a market in the securities of the subject company. 8) No 9) Company has partially funded previous analyst visits to its projects. 9) Yes 10) Additional disclosure: 10) No General Disclosure The affiliates of PI Financial Corp. are PI Financial (US) Corp., PI Financial Services Corp., and PI Capital Corp. Analysts are compensated through a combined base salary and bonus payout system. The bonus payout is amongst other factors determined by revenue generated directly or indirectly from various departments including Investment Banking. Evaluation is largely on an activity-based system that includes some of the following criteria: reports generated, timeliness, performance of recommendations, knowledge of industry, quality of research and investment guidance, and client feedback. Analysts are not directly compensated for specific Investment Banking transactions. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of PI Financial Corp. PI Financial Corp.’s policies and procedures regarding dissemination of research, stock rating and target price changes can be reviewed on our corporate website at www.pifinancial.com (Research: Research and Conflict Disclosure).

- 7. Bluestone Resources Inc. (V-BSR) – January 29, 2019 Philip Ker, P.Geo, MBA | Neehal Upadhyaya, BAFM, MAcc CORPORATE UPDATE | 7 The attached summarizes PI’s analysts review of the material operations of the attached company(s). Analyst Company Type of Review Operations / Project Date Philip Ker Bluestone Resources Inc. Update w/Management Cerro Blanco 1/19 Disclosure to US Residents PI Financial (US) Corp. is a U.S. registered broker-dealer and subsidiary of PI Financial Corp. PI Financial (US) Corp. accepts responsibility for the contents of this research report, subject to the terms and limitations as set out above. U.S. residents seeking to effect a transaction in any security discussed herein should contact PI Financial (US) Corp. directly. Recommendations Number of Recommendations Percentage BUY 67 88.16% NEUTRAL 5 6.58% SELL 0 0.00% TENDER 3 3.95% U/R 1 1.32% N/R 0 0.00% TOTAL 76 Stock Rating and Target Changes For reports that cover more than six subject companies, the reader is referred to our corporate web site for information regarding stock ratings and target changes. www.pifinancial.com (Research: Research and Conflict Disclosure). Bluestone Resources Inc. (Initiated Coverage: May 3/18) Date Rating Change Target Change Share Price May 3/18 Buy $2.40 $1.30 $0.00 $0.20 $0.40 $0.60 $0.80 $1.00 $1.20 $1.40 $1.60 $1.80 $2.00

- 8. Participants of all Canadian Marketplaces. Members: Investment Industry Regulatory Organization of Canada, Canadian Investor Protection Fund and AdvantageBC International Busi- ness Centre - Vancouver. Estimates and projections contained herein are our own and are based on assumptions which we believe to be reasonable. Information presented herein, while obtained from sources we believe to be reliable, is not guaranteed either as to accuracy or completeness, nor in providing it does PI Financial Corp. assume any responsibility or liability. This information is given as of the date appearing on this report, and PI Financial Corp. assumes no obligation to update the information or advise on further developments relating to securities. PI Financial Corp. and its affiliates, as well as their respective partners, directors, shareholders, and employees may have a position in the securities mentioned herein and may make purchases and/or sales from time to time. PI Financial Corp. may act, or may have acted in the past, as a financial advisor, fiscal agent or underwriter for certain of the companies mentioned herein and may receive, or may have received, a remuneration for their services from those companies. This report is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities and is intended for distribution only in those jurisdictions where PI Financial Corp. is registered as an advisor or a dealer in securities. Any distribution or dissemination of this report in any other jurisdiction is strictly prohibited. For further disclosure information, reader is referred to the disclosure section of our website. Capital Markets Group Research Analysts Special Situations Bob Gibson, B.Comm, CFA 416.883.9047 Mining Chris Thompson, P. Geo Head of Mining Research 604.718.7549 Philip Ker, P.Geo, MBA 647.789.2407 Special Situations & Cannabis Jason Zandberg, B.BA, CFA 604.718.7541 Industrials & Cannabis Devin Schilling, CFA 604.718.7557 Technology David Kwan, CFA 604.718.7528 Associate Analyst Justin Stevens, EIT 604.718.7542 Research Associates Fayassir Haqna, B.BA 604.718.7556 Neehal Upadhyaya, BAFM, MAcc 416.775.5107 Marketing and Publishing Michelle Kwok 604.664.2724 Institutional Sales Vancouver Jim Danis, B.Sc. (Hons.) 604.718.7551 Jeremiah Katz 604.664.2916 David Goguen, CFA 604.664.2963 Doug Melton, FCSI 604.718.7532 Brodie Dunlop 604.718.7533 Toronto Jose Estevez, CFA 416.883.9042 John McBride 416.883.9045 InstitutionalTrading Vancouver Darren Ricci 604.664.2998 or 800.667.6124 (US) or 877.682.7233 (CDN) Adam Dell, CFA 604.718.7517 or 888.525.8811 Calvin Buchanan 604.718.7535 Toronto Lucas Atkinson 416.883.9048 Scott Brophy 416.883.9043 Investment Banking Mining Dan Barnholden, MBA 604.664.3638 Russell Mills, CFA, MFin 647.789.2405 Tim Graham, B.Comm 604.664.3656 Jim Locke, CFA 604.664.2670 Technology Blake Corbet, BA 604.664.2967 Vay Tham 647.789.2417 Equity Capital Markets/Syndication Tim Johnston 416.775.5112 Trina Wang 604.664.3637 Investment Banking Associate Joe Brunner 604.664.3633 Aaron Eisenberg 647.789.2411 Investment Banking Analyst Trevor Anderson 604.718.7516 Head Office Suite 1900, 666 Burrard Street Vancouver, BC V6C 3N1 ph: 604.664.2900 fx: 604.664.2666 Calgary Office Suite 1560, 300 5th Avenue SW Calgary, AB T2P 3C4 ph: 403.543.2900 fx: 403.543.2800 Toronto Office Suite 3401, 40 King Street West Toronto, ON M5H 3Y2 ph: 416.883.9040 fx: 647.789.2401 PI Financial Corp. www.pifinancial.com Managing Director, Head of Research Bob Gibson, B.Comm, CFA 416.883.9047 Managing Director, SVP Capital Markets Jeremiah Katz 604.664.2916 Managing Director, Head of Institutional Sales &Trading Jim Danis, B.Sc. (Hons.) 604.718.7551 Managing Director, Co-Head of Investment Banking Blake Corbet, BA 604.664.2967 Managing Director, Co-Head of Investment Banking Dan Barnholden, MBA 604.664.3638 For a complete list of branch office locations and contact information, please go to www.pifinancialcorp.com