Dr Mohan R Bolla Law Lectures Gratuity act

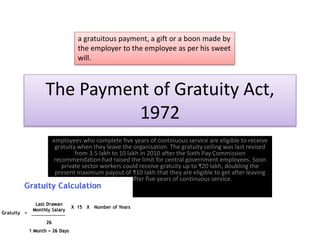

- 1. The Payment of Gratuity Act, 1972 employees who complete five years of continuous service are eligible to receive gratuity when they leave the organisation. The gratuity ceiling was last revised from 3.5 lakh to 10 lakh in 2010 after the Sixth Pay Commission recommendation had raised the limit for central government employees. Soon private sector workers could receive gratuity up to ₹20 lakh, doubling the present maximum payout of ₹10 lakh that they are eligible to get after leaving an organisation after five years of continuous service. a gratuitous payment, a gift or a boon made by the employer to the employee as per his sweet will.

- 2. Social Security William Beveridge William Beveridge, defined ‘social security’ - “security of an income to take the place of earnings when they are interrupted by unemployment, sickness or accident, to provide for retirement through age, to provide against loss of support by death of another person and to meet exceptional expenditure-such as those concerned with birth, death and marriage.”

- 3. Social Security William Beveridge In industrial societies, income insecurity resulting from various contingencies of life such as disablement, old age and death and others, has become a serious problem. The problem has become more acute in view of phenomenal growth of the permanent class of wage-earners. uring such contingencies the income of the earners either stops altogether or is reduced substantially or becomes intermittent causing hardships not only to the earners, but also to their family members. One of the outstanding measures to mitigate the hardship is to make available social security benefits under the coverage of legislation

- 4. S Mukharji J., Shree Sajjan Mills Ltd vs Commissioner Of Income Tax, M.P. AIR 1986 SC 484, Although payment of gratuity is made on retirement or termination of service, It was not for the service rendered during the year In which the payment is made but it is made in consideration of the entire length of service and its ascertainment and computation depend upon several factors.

- 5. S Mukharji J., Shree Sajjan Mills Ltd vs Commissioner Of Income Tax, M.P. AIR 1986 SC 484 The right to receive the payment accrued to the employees on their retirement or termination of their services and the liability to pay gratuity became the accrued liability of the assessee when the employees retired or their services, were terminated. Until then the right to receive gratuity is a contingent right and the liability to pay gratuity continues to be a contingent ability qua the employer. An employer might pay gratuity when the employee retires or his service is terminated and claim the payment made as an expenditure incurred for the purpose of business under section 37. He might, if he followed the mercantile system, provide for the payment of gratuity which became payable during the previous year and claim it as an expenditure on the accrued basis under section 37 of the said Act. Since the amount of gratuity payable in any given year would be a variable amount depending upon the number of employees who would be entitled to receive the payment during the year, the amount being a large one in one year and a small one in another year, the employer often finds it desirable and/or convenient to set apart for future use a sum every year to meet the contingent liability as a provision for gratuity or a fund for gratuity. He might create an approved gratuity fund for the exclusive benefit of his employees under an irrevocable trust and make contributions to such fund every year. Contingent liabilities do not constitute expenditure and can not be the subject matter of deduction even under the mercantile system of accounting. Expenditure which was deductible for income tax purposes is towards a liability actually existing at the time but setting apart money which might become expenditure on the happening of an event is not expenditure.

- 6. The Payment of Gratuity Act 1972 Applicability The Act came into force w.e.f. September 21, 1972. -applies to the whole of India and so far as it relates to ports and plantations it does not apply to the State of Jammu and Kashmir. It applies to: (a) every factory, mine, oilfield, plantation, port and railway company. (b) Every shop or establishment within the meaning of any law for the time being in force in relation to shops and establishment in a State, in which 10 or more persons are or were employed on any day in the preceding 12 months. (c) Such other establishments or class of establishment, in which 10 or more employees are or were employed on any day in the preceding 12 months, as the Central Government may notify in this behalf.

- 7. Salient features- the Payment of Gratuity Act, 1972 The Act is fairly sweeping in coverage, as it applies to all factories, mines, oil fields, plantations, ports and railways irrespective of the number of workmen employed by them. It also covers shops and establishments employing 10 or more persons. The Act gives a statutory right of gratuity to all the employees, who have rendered five years’ continuous service and whose services stand terminated after coming into force of the Act on account of superannuation, or retirement, or resignation, or death or disablement. The Act provides both executive and quasi-judicial machinery for matters pertaining to nomination, determination and recovery of gratuity. The executive machinery pertains to maintenance of records regarding opening, change or closure of establishments, display of notices and maintenance of records by the controlling authority.

- 8. Salient features- the Payment of Gratuity Act, 1972 The quasi-judicial functions have been divided between the employers and the Controlling Authority in as much as for payment of gratuity, the first forum provided is an application to the employer. When the employer has declined or avoided payment of gratuity, then an application is required to be made to the Controlling Authority. The machinery provided for recovery rests with the Controlling Authority. The orders of the Controlling Authority for payment or determination of gratuity are applicable before the appropriate government or the appellate authority.

- 9. P B Sawant J., SC Bakshish Singh vs Darshan Engineering Works AIR 1994 SC 251 These two appeals one by the Union of India and the other by the aggrieved employee are directed against the decision dated March 24, 1983 of the Punjab and Haryana High Court whereby the High Court has struck down Section 4(1)(b) of the Payment of Gratuity Act, 1972 as being violative of Article 19(1(g) of the Constitution of India. On the employee's resignation w.e.f. December 10, 1978 which was accepted by the respondent-employer, he claimed gratuity under Section 4(1)(b) of the Act. His claim not having been accepted, he approached the Controlling Authority under Section 7 of the Act. The claim was resisted by the employer on the ground firstly that the employee was entitled to gratuity only till the date he reached his superannuation age which was 58 years and since he had not completed 5 years of service by the time he attained 58 years of age, he was not entitled to gratuity under Section 4(1) of the Act.

- 10. P B Sawant J., SC Bakshish Singh vs Darshan Engineering Works AIR 1994 SC 251 the contentions were negatived by the Controlling Authority by pointing out that Section 4(1) provided for payment of gratuity to the employee on the termination of his employment after he has rendered continuous service of not less than five years on the occurrence of any of the three events viz., (a) on the employee reaching his superannuation age, or (b) on his retirement or resignation, or (c) on his death or disablement due to accident or disease. In case of the third event, the qualifying continuous service of five years is not necessary.

- 11. P B Sawant J., SC Bakshish Singh vs Darshan Engineering Works AIR 1994 SC 251 Since in the present case the employer had not chosen to superannuate the employee on his attaining 58 years of age and had continued him in service till the employee himself resigned on December 10, 1978 by which date he had completed more than 10 years of service, the employee was entitled to the gratuity for the period of his entire service upto the date of his resignation. The Controlling Authority, therefore, calculated the amount of gratuity due to the employee as Rs 1782 at the rate of 15 days' wages per year of service for all the IO years taking the last drawn wages of Rs 3 35 per month as the basis of the said calculation. This order was challenged by the employer before the Appellate Authority under the Act. The Appellate Authority confirmed the finding of the Controlling Authority and dismissed the appeal. In the writ petition filed before the High Court under Articles 226 and 227 of the Constitution, the High Court held that the provisions of Section 4(1)(b) of the Act which entitles an employee to gratuity on his retirement or resignation after a continuous service of only 5 years was an unreasonable restriction on the employer to carry on his business and, therefore, violative of Article 19(1)(g) of the Constitution.

- 12. P B Sawant J., SC Bakshish Singh vs Darshan Engineering Works AIR 1994 SC 251 The dictionary meaning may suggest that gratuity is a gratuitous payment, a gift or a boon made by the employer to the employee as per his sweet will. It necessarily means that it is in the discretion of the employer whether to make the payment or not and also to choose the payee as well as the quantum of payment. However, in the industrial adjudication it was considered as a reward for a long and meritorious service and its payment, therefore, depended upon the duration and the quality of the service rendered by the employee. At a later stage, it came to be recognised as a retiral benefit in consideration of the service rendered and the employees could raise an industrial dispute for introducing it as a condition of service. The industrial adjudicators recognised it as such and granted it either in lieu of or in addition to other retiral benefit(s) such as pension or provident fund depending mainly upon the financial stability and capacity of the employer. The other factors which were taken into consideration while introducing gratuity scheme were the service conditions prevalent in the other units in the industry and the region, the availability or otherwise of the other retiral benefits, the standard of other service conditions etc. The quantum of gratuity was also determined by the said factors. The recognition of gratuity as a retiral benefit brought in its wake further modifications of the concept. It could be paid even if the employee resigned or voluntarily retired from service. The minimum qualifying service for entitlement to it, rate at which it was to be paid and the maximum amount payable was determined likewise on the basis of the said factors. It had also to be acknowledged that it could not be denied to the employee on account of his misconduct. He could be denied gratuity only to the extent of the financial loss caused by his misconduct, and no more. Thus even before the present Act was placed on the statute book, the courts had recognised gratuity as a legitimate retiral benefit earned by the employee on account of the service rendered by him. It became a service condition wherever it was introduced whether in lieu of or in addition to the other retiral benefit(s). The employees could also legitimately demand its introduction as such retiral benefit by raising an industrial dispute in that behalf, if necessary. The industrial adjudicators granted or rejected the demand on the basis of the factors indicated above.

- 13. P B Sawant J., SC Bakshish Singh vs Darshan Engineering Works AIR 1994 SC 251 It is true that while doing so, the industrial adjudicators insisted upon certain minimum years of qualifying service before an employee could claim it whether on superannuation or resignation or voluntary retirement. This was undoubtedly inconsistent with the concept of the gratuity being an earning for the services rendered. What is, however, necessary to remember in this connection is that there is no fixed concept of gratuity or of the method of its payment. Like all other service conditions, gratuity schemes may differ from establishment to establishment depending upon the various factors mentioned above, prominent among them being the financial capacity of the employer to bear the burden. There has commonly been one distinction between a retiral benefit like provident fund and gratuity, viz. the former generally consists of the contribution from the employee as well. It is, however, not a necessary ingredient and where the employee is required to make his contribution, there is no uniformity in the proportion of his share of contribution. Likewise, the gratuity schemes may also provide differing qualifying service for entitlement to gratuity. It is true that in the case of gratuity an additional factor weighed with the industrial adjudicators and courts, viz. that being entirely a payment made by the employer without there being a corresponding contribution from the employee, the gratuity scheme should not be so liberal as would induce the employees to change employment after employment after putting in the minimum service qualifying them to earn it. But as has been pointed out by this Court in the Straw Board Mfg. Co. Ltd. case" in view of the constantly growing unemployment, the surplus labour and meager opportunities for employment, the premise on which a longer qualifying period of service was prescribed for entitlement to gratuity on voluntary retirement or resignation, was unsupported by reality. In the face of the dire prospects of unemployment, it was facile to assume that the labour would change or keep changing employment to secure the paltry benefit of gratuity.

- 14. P B Sawant J., SC Bakshish Singh vs Darshan Engineering Works AIR 1994 SC 251 Even assuming that the presumption that a longer period of service for entitlement to gratuity on voluntary retirement or resignation is necessary to prevent labour from changing employment frequently, that consideration has no bearing on the question whether a short period of qualifying service is violative of Article 19(1)(g) of the Constitution. That article comes into picture only if, among others, (a) it is shown that the short qualifying period of service throws on any particular employer such financial burden as would force him to close his establishment and (b) the provision is not one of the minimum service conditions which must be made available to the employees. Hence, the provision for a short qualifying period per se is not invalid and cannot be struck down generally as being violative of Article 19(1)(g) of the Constitution as is done by the High Court in the present case. The High Court's reliance on the decisions referred to by it, for the purpose of holding that the provision of a period of service of five years is violative of Article 19(1)(g) of the Constitution, is misplaced for the Court has failed to notice that the view taken by this Court was in a different factual context.

- 15. P B Sawant J., SC Bakshish Singh vs Darshan Engineering Works AIR 1994 SC 251 In the first instance, at that time, gratuity had not come to be accepted as one of the minimum service conditions, much less any particular scheme of gratuity. Secondly, the courts in those cases were concerned with establishments of differing financial capacity in a particular industry and with evolving uniform service conditions for the industry as a whole for the maintenance of industrial peace. Further, except the decision of this Court in Express Newspaper case2 the other decisions which have laid down more than five years' qualifying service, have not based their conclusion on the vulnerability of the shorter qualifying service on the anvil of Article 19(1)(g) of the Constitution. On the other hand, in Wenger and Co. case8 this Court pointed out that in dealing with the financial obligations involved on account of the introduction of the gratuity scheme, it was necessary to bear in mind the actual rather than the theoretical impact of the scheme. Since not more than 3 to 4 per cent of the employees retired every year, the financial burden caused by the gratuity scheme was much less than what its theoretical enunciation would indicate. The Court there also held that the minimum qualifying period of five years' service was reasonable.

- 16. P B Sawant J., SC Bakshish Singh vs Darshan Engineering Works AIR 1994 SC 251 In Delhi Cloth and General Mills Co. Ltd. case9 the Court was at pains to point out that in matters relating to the grant of gratuity and even generally in the settlement of disputes arising out of industrial relations, there were no fixed principles on the application of which the problems arising before the tribunals or the courts could be determined and often precedents of cases determined ad hoc were utilised to win the claims or to resist them. It was, therefore, futile to attempt to reduce the grounds of the decisions given by the courts to the dimensions of any recognised principle.

- 17. P B Sawant J., SC Bakshish Singh vs Darshan Engineering Works AIR 1994 SC 251 In Straw Board Mfg. Co. Ltd. case11 which was decided after the present statute came into operation, as pointed out above, the Court upheld the five years' minimum qualifying period of service for entitlement to gratuity on voluntary retirement or resignation, by stating that the qualifying period of ten years' service prescribed in British Paints case, was not meant to be laid down as a uniform standard to be followed in all cases. This is apart from the fact that the court also stated there that the premise underlying the reasons which impelled the said higher qualifying service was not in conformity with the current reality

- 18. P B Sawant J., SC Bakshish Singh vs Darshan Engineering Works AIR 1994 SC 251 In Straw Board Mfg. Co. Ltd. case11 which was decided after the present statute came into operation, as pointed out above, the Court upheld the five years' minimum qualifying period of service for entitlement to gratuity on voluntary retirement or resignation, by stating that the qualifying period of ten years' service prescribed in British Paints case, was not meant to be laid down as a uniform standard to be followed in all cases. This is apart from the fact that the court also stated there that the premise underlying the reasons which impelled the said higher qualifying service was not in conformity with the current reality

- 19. the Payment of Gratuity Act, 1972 The Payment of Gratuity Act, 1972 which came into force on 16th September, 1972.

- 20. D.M Dharmadhikari, J., Ahmedabad Pvt. Teachers Association vs. Admin. Officer 2004 LLR 97SC This appeal has been preferred by Ahmedabad Private Primary Teacher's Association. The Association complains that in the petition filed by an individual teacher [respondent no. 2 herein] employed in a school run by Ahmedabad Municipal Corporation, the Full Bench of the High Court of Gujarat by impugned judgment dated 04.5.2001 in Special Civil Application No. 5272 of 1987 not only rejected the claim of the teacher for payment of gratuity under the provisions of Payment of Gratuity Act. 1972 but has decided an important question of law against the teachers as a class that they do not fall within the definition of 'employee' as contained in Section 2(e) of the Act and hence can raise no claim to gratuity under the Act.

- 21. D.M Dharmadhikari, J., Ahmedabad Pvt. Teachers Association vs. Admin. Officer 2004 LLR 97SC '2(e). 'employee' means any person (other than an apprentice) employed on wages, in any establishment, factory, mine, olifield, plantation, port, railway company or shop, to do any skilled, semi-skilled or unskilled, manual, supervisory, technical or clerical work, whether the terms of such employment are express or implied, [and whether or not such person is employed in a managerial or administrative capacity, but does not include any such person who holds a post under the Central Government or a State Government and is governed by any other Act or by any rules providing for payment of gratuity].

- 22. D.M Dharmadhikari, J., Ahmedabad Pvt. Teachers Association vs. Admin. Officer 2004 LLR 97SC The Act is a piece of social welfare legislation and deals with the payment of gratuity which is a kind of retiral benefit like pension, provident fund etc. As has been explained in the concurring opinion of one of the learned judges of the High Court 'gratuity in its etymological sense is a gift, especially for services rendered, or return for favours received.' It has now been universally recognized that all persons in society need protection against loss of income due to unemployment arising out of incapacity to work due to invalidity, old age etc. For the wage earning population, security of income, when the worker becomes old or infirm, is of consequential importance. The provisions contained in the Act are in the nature of social security measures like employment insurance, provident fund and pension. The Act accepts, in principle, compulsory payment of gratuity as a social security measure to wage earning population in industries, factories and establishments.

- 23. D.M Dharmadhikari, J., Ahmedabad Pvt. Teachers Association vs. Admin. Officer 2004 LLR 97SC Thus, the main purpose and concept of gratuity is to help the workman after retirement, whether, retirement is a result of rules of superannuation, or physical disablement or impairment of vital part of the body. The expression, 'gratuity' itself suggests that it is a gratuitous payment given to an employee on discharge, superannuation or death. Gratuity is an amount paid unconnected with any consideration and not resting upon it. and has to be considered as something given freely voluntarily or without recompense. It is sort of financial assistance to tide over post-retiral hardships and inconveniences.

- 24. D.M Dharmadhikari, J., Ahmedabad Pvt. Teachers Association vs. Admin. Officer 2004 LLR 97SC Our conclusion should not be misunderstood that teachers although engaged in very noble profession of educating our young generation should not be given any gratuity benefit. There are already in several States separate statutes, rules and regulations granting gratuity benefits to teachers in educational institutions which are more or less beneficial than the gratuity benefits provided under the Act. It is for the Legislature to take cognizance of situation of such teachers in various establishments where gratuity benefits are not available and think of a separate legislation for them in this regard. That is the subject matter solely of the Legislature to consider and decide.

- 25. R. Banumathi, J., S.Seshachalam & Ors.Etc vs Chairman Bar Council of Tamilnadu ... JT 2014 (14) SC 52 The appellants are retired employees either from government service or other organisations qualified with law degree who have enrolled themselves as advocates after retiring from their respective services and now are said to be practising in courts. Challenging the impugned provision and Explanation II (5) of Section 16 of the Tamil Nadu Advocates' Welfare Fund Act, the appellants filed writ petitions contending that the benefit of Welfare Fund Act is denied to the kin of advocates who are in receipt of pension or gratuity or other terminal benefits from any State or Central Government or organization is arbitrary, unreasonable and violative of Article 14 of the Constitution of India.

- 26. R. Banumathi, J., S.Seshachalam & Ors.Etc vs Chairman Bar Council Of Tamilnadu ... JT 2014 (14) SC 52 The Advocates' Welfare Fund Act, 2001 enacted by the Parliament enjoins the appropriate Government to constitute a fund to be called the "Advocates' Welfare Fund" with the object of providing social security in the form of financial assistance to junior lawyers and welfare scheme for indigent or disabled advocates. Advocates' Welfare Fund is administered by a Trustee Committee. As per the provisions of the Welfare Fund Act, the fund shall vest in and be held and administered by the Trustee Committee established under Section 4 of the Act. The functions of the Trustee Committee is enumerated in Section 9 of the Welfare Fund Act.

- 27. R. Banumathi, J., S.Seshachalam & Ors.Etc vs Chairman Bar Council of Tamilnadu ... JT 2014 (14) SC 52 By a careful reading of Section 16, it is evident that prior to 2001 amendment, Explanation II (5) of Section 16 of the Welfare Fund Act contemplated that on the death of a member of the Fund within five years from the date of his admission to the Fund, his nominee or legal heirs was/were eligible for payment at the rate of one thousand rupees for each year of his practice. That was because under Section 16(1) of the Welfare Fund Act, the schedule payment is possible only if as an advocate he has completed five years as a member of the Fund. Explanation II (5) to Section 16 of the Welfare Fund Act stood amended with effect from 1.2.2001as extracted above, as per which lump sum amount of two lakh rupees is payable on the death of a member of the Fund irrespective of the years of membership of the Fund. After GO. Ms. 688 dated 19.9.2012, the above financial assistance of two lakh rupees payable to the nominee/legal heirs of the deceased advocates in terms of Section 16 Explanation II (5) has been enhanced to five lakh and twenty five thousand rupees. This lump sum of two lakh rupees (as per Amendment 2001) is denied to a member of a Fund who has enrolled himself after retirement from government service or any other organization who was in receipt of pension or other terminal benefits.

- 28. R. Banumathi, J., S.Seshachalam & Ors.Etc vs Chairman Bar Council Of Tamilnadu ... JT 2014 (14) SC 52 Contention of the appellants is that as per definition of "advocate" in Section 2 (a) of the Welfare Fund Act, there cannot be a differentiation between the advocates. Reliance was placed upon Section 2(i) of the Welfare Fund Act which defines the term "member of the Fund" and it was submitted that when once the retired employees like the appellants have been admitted as members of the Fund, they should be treated equally with others and there cannot be an artificial classification made amongst one homogeneous group of advocates and such classification is violative of Article 14 of the Constitution of India.

- 29. R. Banumathi, J., S.Seshachalam & Ors.Etc vs Chairman Bar Council of Tamilnadu ... JT 2014 (14) SC 52 The Division Bench of the Madras High Court made meticulous analysis of various provisions of the Welfare Fund Act and referred to various decisions of this Court dealing with interpretation of Article 14 of the Constitution of India and rightly concluded that there is reasonable classification between the advocates who had set up practice after demitting their office from the Central/State government/Organization and advocates who have set up practice straight from the law college. It would be right to say that the retired officials who joined legal profession constitute a separate class and the disentitlement of the benefit of lump sum welfare fund to this group of advocates cannot be said to be unreasonable. We do not find any infirmity in the impugned judgment of the Madras High Court and the appeals are liable to be dismissed accordingly.

- 30. Kurian Joseph, J., Jorsingh Govind Vanjari vs Divisional Controller Maharashtra State RTC Civil Appeal No. 11807 of 2016 arising out of S.L.P. (C) No. 26366 of 2016 The appellant, a bus conductor aggrieved by the termination from service, raised an industrial dispute leading to the award in Reference IDA No. 42 of 2007 dated 20.06.2013 of the Labour Court, Jalgaon, Maharashtra. The Labour Court set aside the dismissal order. However, noticing that the appellant had already crossed the date of superannuation, viz., 31.05.2005, it was ordered that from the date of termination to the date of superannuation, the appellant would be entitled to all service benefits except back wages which were limited to 50 per cent. The respondent challenged the award before the High Court of Bombay. The award was modified by the HC by granting only a one- time compensation of an amount equivalent to 50 per cent of the back wages as awarded by the Labour Court. Thus aggrieved, the appellant is before this Court.

- 31. Kurian Joseph, J., Jorsingh Govind Vanjari vs Divisional Controller, Maharashtra State RTC Civil Appeal No. 11807 of 2016 arising out of S.L.P. (C) No. 26366 of 2016 the High Court itself has granted compensation since the Court felt that the termination was unjustified and since reinstatement was not possible on account of superannuation. In case, the High Court was of the view that termination was justified, it could not have ordered for payment of any compensation. In order to deny gratuity to an employee, it is not enough that the alleged misconduct of the employee constitutes an offence involving moral turpitude as per the report of the domestic inquiry. There must be termination on account of the alleged misconduct, which constitutes an offence involving moral turpitude. Thus, viewed from any angle, the judgment of the High Court cannot be sustained. It is hence set aside. The appeal is allowed. The award dated 20.06.2013 of the Labour Court, Jalgaon, Maharashtra in Reference IDA No. 42 of 2007 is restored. Consequently, the appellant shall be entitled to gratuity in respect of his continuous service from his original appointment till the date of his superannuation.

- 32. Prafulla C. Pant, J., Bindeshwari Chaudhary vs State of Bihar & Ors on 29 November, 2016 appellant was posted as Executive Engineer with Irrigation Department of State of Bihar, in the District of Singhbhum. The Appellant awarded a contract on 29.08.1989 to one M/s. D.K. Road Lines, for bed and slope lining of canal in Galudih. In terms of the contract, the contractor was required to furnish bank guarantee, and the same was submitted by him for an amount of Rs.23,61,500/-. In order to verify the genuineness of the bank guarantee furnished by the contractor, the appellant sent his Accounts Clerk to Punjab & Sindh Bank, Jamshedpur, with letter dated 29.08.1989 (Annexure-P1). In response to said letter, appellant received letter dated 01.09.1989 (Annexure-P-3) from Shri T.S. Gandhok, Branch Manager of the bank, confirming the bank guarantee.

- 33. Prafulla C. Pant, J., Bindeshwari Chaudhary vs State of Bihar & Ors on 29 November, 2016 The appellant made payment of Rs.15,00,000/- on 02.09.1989 towards mobilization advance to the contractor. On 04.09.1989, Superintending Engineer, issued letter (Annexure P-4), directing the appellant not to make mobilization advance. But, subsequently said authority allowed the appellant to make second mobilization advance to the contractor vide its letter dated 27.10.1989, consequently the appellant released payment of Rs.8,60,000/- on 31.10.1989 towards second mobilization advance. After three months, the Superintending Engineer, vide letter dated 23.12.1989 (Annexure-P-5) approved the work done by M/s D.K. Road Lines assessing the work done at Rs.42,79,021/-. On 12.02.1990, the appellant made further payment of Rs.2.55 lacs.

- 34. Prafulla C. Pant, J., Bindeshwari Chaudhary vs State of Bihar & Ors on 29 November, 2016 On 04.04.1991, appellant was placed under suspension in contemplation of departmental proceedings. The appellant challenged order of suspension in Writ Petition before the High Court which was disposed of with the observation that if charge sheet is not served within three weeks on the appellant, the suspension order shall stand quashed. On 13.06.1991 the respondent authorities served charge sheet (dated 02.05.1991) on the appellant, relating to payment of unsecured advance of Rs.14.5 lacs to the contractor. The appellant then filed another Writ Petition C.W.J.C. No. 4439 of 1991 once again seeking quashing of the suspension order, and the High Court vide its order dated 10.10.1991, quashed the same. The respondent authorities vide order dated 05.12.1991 (Annexure– P12) revoked the suspension order, and departmental enquiry was dropped. Consequently on 14.01.1992, the appellant joined his new assignment as a Technical Advisor to Water Nigam Circle, Dumka.

- 35. Prafulla C. Pant, J., Bindeshwari Chaudhary vs State of Bihar & Ors on 29 November, 2016 Meanwhile, when new Manager took over the charge of Jamshedpur Branch of Punjab & Sindh Bank, issued letter dated 13.02.1990 (Annexure-P-7), asking the appellant to send photocopy of the bank guarantee in question. And vide letter dated 20.03.1990 (Annexure-P-8) the new Manager informed the appellant that no such bank guarantee has been issued by the bank. Appellant has pleaded that he received said letter on 10.04.1990, and by then the appellant had released further payment of Rs.7.33 lacs towards bill of the contractor. On 04.05.1990, bank cancelled its earlier communication dated 01.09.1989. The appellant finally released Rs.4.4 lacs towards current bill of the contractor, whereafter he was transferred on 11.06.1990 to Daltanganj. It appears that C.B.I. registered a case RC37(A)/91, Patna in pursuance to the fraudulent/forged bank guarantee furnished by the contractor.

- 36. Prafulla C. Pant, J., Bindeshwari Chaudhary vs State of Bihar & Ors on 29 November, 2016 After investigation, C.B.I. submitted charge sheet against accused T.S. Gandhok, Manager of Punjab & Sindh Bank who confirmed the bank guarantee, and accused Ramdahin Singh, Senior Accounts Clerk of the Irrigation Department who received the bank guarantee from the contractor and verified. The appellant has pleaded that he is not accused in the charge sheet, still on 18.06.1993, after the departmental enquiry was earlier dropped, the respondent authorities awarded punishment against the appellant withholding his three increments with cumulative effect, and also ‘censured’ for the year 1989-90. As such, third C.W.J.C. No. 942 of 1994 was filed by the appellant challenging the above order of punishment. The said writ petition was allowed on 23.03.1995 by the High Court holding that withholding of three increments with cumulative effect is a major punishment, and could not have been awarded without resorting to regular departmental enquiry. However punishment of “Censure’ was not interfered with by the High Court.

- 37. Prafulla C. Pant, J., Bindeshwari Chaudhary vs State of Bihar & Ors on 29 November, 2016 On 20th May, 1995, the respondent authorities initiated fresh departmental enquiry against the appellant, and second charge sheet (Annexure-P13) was served on him relating to the same allegations of release of unsecured advance of Rs. 14.5 lacs to the contractor against the order of Superintending Engineer. The appellant filed his objections and participated in the enquiry. The enquiry report dated 18.10.1996 (enclosure with the Annexure P-17) was submitted by the enquiry officer to the State Government with the finding that part of the charge stood proved. Consequently, show cause notice dated 23.10.1996 was issued to the appellant to which he responded on 07.01.1997. Thereafter the appellant stood retired on 31.01.1997. On 24.09.1997, appellant was awarded punishment of withholding of 100% pension and gratuity.

- 38. Prafulla C. Pant, J., Bindeshwari Chaudhary vs State of Bihar & Ors on 29 November, 2016 Finally, the appellant filed fourth Writ Petition C.W.J.C. No. 11788 of 1997 before the High Court challenging the order of withholding of pension and gratuity. During the pendency of said writ petition, another show cause notice dated 17.06.1998 (Annexure-P18) was issued against the appellant under Rule 43 (b) read with Rule 139 of Bihar Pension Rules, as to why the pension benefits be not decided at zero. The High Court, vide its order dated 04.12.1998, dismissed the writ petition. Aggrieved by said order, Letters Patent Appeal No. 436 of 2000 was filed by the appellant which was disposed of by the High Court vide impugned order dated 20.05.2008 restricting withholding of gratuity and pension to the extent of fifty percent.

- 39. Prafulla C. Pant, J., Bindeshwari Chaudhary vs State of Bihar & Ors on 29 November, 2016 we find force in submission of learned counsel of the appellant that the appellant was bonafide in making the payment in question to the contractor, as he did make enquiries from the bank concerned before releasing mobilizing advance to the contractor. The Enquiry Report dated 18.10.1996 (enclosure to Annexure P-17), in its para 8, shows that though it is mentioned that charge is proved against the appellant in the enquiry, but the finding is based on earlier enquiry report. The earlier enquiry report was in question in C.W.J.C. No. 942 of 1994 in which punishment of withholding of three increments with cumulative effect was quashed. The authorities could not and should not have relied upon said enquiry report as basis in fresh enquiry for holding the appellant guilty of the charge and to award punishment of withholding of pension and gratuity. In the circumstances, we do not find that there was sufficient reason for the respondent authorities to exercise the powers under Rule 43 (b) read with Rule 139 of Bihar Pension Rules as neither there was pecuniary loss to the State, nor the present case is of a grave misconduct on the part of the appellant. For the reasons as discussed above, we are inclined to interfere with the impugned order passed by the High Court. Therefore, the appeal is allowed. The orders dated 24.09.1997 and 17.06.1998, passed by the respondent authorities shall stand quashed.

- 40. Prafulla C. Pant, J., State of Uttar Pradesh And 2 Ors vs Dhirendra Pal Singh , 2016 Dhirendra Pal Singh was Assistant Store Superintendent with the Irrigation Department of the State of Uttar Pradesh. He stood retired on 30.06.2009 on attaining the age of superannuation. At the time of his retirement GPF, leave encashment and 70% of gratuity and pension were cleared, but rest of the 30% of gratuity and computation of pension were held up. The stand of the appellants is that there were some discrepancies in the stock in the store of the department and some enquiries were going on as to loss caused to the public exchequer. After making representations when the remaining amount of gratuity and pension was not cleared, the respondent filed Civil Suit No. 338 of 2012. However, the same was dismissed as withdrawn as the appellants/State authorities, vide order dated 23.07.2015 finally, on the basis of alleged discrepancies withheld the remaining part of gratuity and pension of the respondent and, vide order dated 06.08.2015, directed recovery of Rs.7,26,589/-, from the retiral dues payable to the respondent, which was challenged in the writ petition.

- 41. Prafulla C. Pant, J., State of Uttar Pradesh And 2 Ors vs Dhirendra Pal Singh , 2016 There was no departmental enquiry initiated against the respondent and after about more than six years order as to finally withholding of remaining pension on the ground of alleged misconduct and the recovery was directed to be made from the respondent after serving a notice on him. Learned single Judge of the High Court found that the orders challenged in the writ petition cannot be sustained in law as neither recourse of Article 351-A of UP Civil Service Regulations was resorted to, nor any departmental enquiry was held. Learned single Judge further directed that the remaining amount of gratuity and pension of the respondent shall be released with interest at the rate of 10% p.a. on the sum withheld by the State authorities. The Division Bench, in special appeal filed by the State, found no illegality in the order passed by the learned single Judge.

- 42. Prafulla C. Pant, J., State of Uttar Pradesh And 2 Ors vs Dhirendra Pal Singh , 2016 Article 351-A of UP Civil Service Regulations reads as under: -“351-A. The Governor reserves to himself the right of withholding or withdrawing a pension or any part of it, whether permanently or for a specified period and the right of ordering the recovery from a pension of the whole or part of any pecuniary loss caused to Government, if the pensioner is found in departmental or judicial proceedings to have been guilty of grave misconduct, or to have caused pecuniary loss to Government by misconduct or negligence, during his service, including service rendered on re-employment after retirement.Provided that: such departmental proceedings, if not instituted while the officer was on duty either before retirement or during re- employment – Shall not be instituted with the sanction of the Governor, shall be in respect of event which took place not more than four years before the institution of such proceedings, and shall be conducted by such authority and in such place or places as the Governor may direct and in accordance with the procedure applicable to proceedings on which an order of dismissal from service may be made.Judicial proceedings, if not instituted while the officer was on duty either before retirement or during re-employment, shall have been instituted in accordance with sub-clause (ii) of clause (a), and the Public Service Commission, U.P., shall be consulted before final orders are passed. Explanation – For the purposes of this article – departmental proceedings shall be deemed to have been instituted when the charges framed against the pensioner are issued to him, or, if the officer has been placed under suspension from an earlier date, on such date; and judicial proceedings shall be deemed to have been instituted: in the case of criminal proceedings, on the date on which complaint is made, or a charge-sheet is submitted, to a criminal court; and in the case of civil proceedings, on the date on which the plaint is presented or, as the case may be, an application is made to a civil court.”

- 43. Prafulla C. Pant, J., State of Uttar Pradesh And 2 Ors vs Dhirendra Pal Singh , 2016 Admittedly, no departmental enquiry was initiated in the present case against the respondent for the misconduct, if any, nor any proceedings drawn as provided in Article 351-A of UP Civil Service Regulations. Learned single Judge of the High Court has observed that the document which is the basis of enquiry and relied upon by the State authorities, copy of which was Annexure C.A.1 to counter affidavit filed in the writ petition, itself reflected that the document showing discrepancy in the stock was dated 26.12.2009, i.e. after about more than five months of retirement of the respondent. In the circumstances, keeping in view Article 351-A of UP Civil Service Regulations, we agree with the High Court that the orders dated 23.07.2015 and 06.08.2015 were liable to be quashed and, to that extent, we decline to interfere with the impugned order.

- 44. Prafulla C. Pant, J., State of Uttar Pradesh And 2 Ors vs Dhirendra Pal Singh , 2016 In the light of law laid down by this Court, as above, and further considering the facts and circumstances of the case, we modify the impugned order passed by the High Court in respect of interest directed to be paid on the amount of withheld gratuity and pension. We direct that the appellants shall pay interest at the rate of 6% per annum on the unpaid amount of pension from the date it had fallen due and interest at the rate of 8% per annum on the unpaid amount of gratuity from the date of retirement of the employee.

- 45. A.G.M, Karnataka State Financial Corporation vs Gen.Sec.,Mysore Division Industrial Workers General Union