More Related Content Similar to Competitiveness Series - National Technology Trade Similar to Competitiveness Series - National Technology Trade (20) 1. $300

$267

$325 $336 $348 $351

$0

$200

$400

2008 2009 2010 2011 2012 2013

Competitiveness Series

Timely research reports on keeping the United States

competitive in a global economy

Volume 42 ♦ July 2014

Tech Trade Generates Nearly $1 Trillion in Economic Activity

Tech Trade Surplus with $501B in Exports and $496B in Imports

Overview

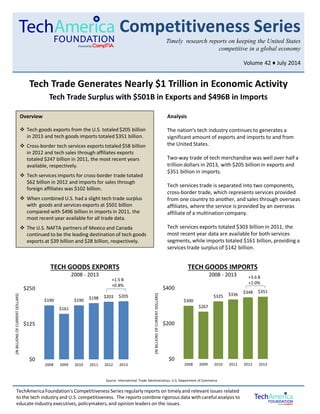

Tech goods exports from the U.S. totaled $205 billion

in 2013 and tech goods imports totaled $351 billion.

Cross-border tech services exports totaled $58 billion

in 2012 and tech sales through affiliates exports

totaled $247 billion in 2011, the most recent years

available, respectively.

Tech services imports for cross-border trade totaled

$62 billion in 2012 and imports for sales through

foreign affiliates was $102 billion.

When combined U.S. had a slight tech trade surplus

with goods and services exports at $501 billion

compared with $496 billion in imports in 2011, the

most recent year available for all trade data.

The U.S. NAFTA partners of Mexico and Canada

continued to be the leading destination of tech goods

exports at $39 billion and $28 billion, respectively.

Analysis

The nation’s tech industry continues to generates a

significant amount of exports and imports to and from

the United States.

Two-way trade of tech merchandise was well over half a

trillion dollars in 2013, with $205 billion in exports and

$351 billion in imports.

Tech services trade is separated into two components,

cross-border trade, which represents services provided

from one country to another, and sales through overseas

affiliates, where the service is provided by an overseas

affiliate of a multination company.

Tech services exports totaled $303 billion in 2011, the

most recent year data are available for both services

segments, while imports totaled $161 billion, providing a

services trade surplus of $142 billion.

TechAmerica Foundation’s Competitiveness Series regularlyreports on timely and relevant issues related

to the tech industry and U.S. competitiveness. The reports combine rigorous data with careful analysis to

educate industry executives, policymakers, and opinion leaders on the issues.

TECH GOODS EXPORTS

2008 - 2013

Source: International Trade Administration, U.S. Department of Commerce

+1.5 B

+0.8%

(INBILLIONSOFCURRENTDOLLARS)

$190

$161

$190 $198 $203 $205

$0

$125

$250

2008 2009 2010 2011 2012 2013

TECH GOODS IMPORTS

2008 - 2013

(INBILLIONSOFCURRENTDOLLARS)

+3.6 B

+1.0%

2. $51

$59

$62

$0

$40

$80

2010 2011 2012

2 © TechAmerica Foundation

Tech Services Trade

Both segments of tech services trade experienced

growth in the most recent years available from the U.S.

Bureau of Economic Analysis. Cross-border tech

services trade totaled $58 billion in exports in 2012 and

$62 billion in imports.

The bulk of services trade is delivered through the

foreign affiliate of the parent company. U.S. exports of

tech sales through foreign affiliate was $247 billion in

2011. This represents a significant surplus over the

$102 billion in sales through foreign affiliate imports.

The categories used to define tech services in both

services segments are available on the last page of this

report. It will be interesting to see if the services trade

through affiliates follows the similar pattern as goods

trade with slowing growth rates in 2012 and 2013.

It is interesting to note that while the largest bulk of

tech imports comes from goods, the largest category of

exports comes from the delivery of services via the

foreign affiliates. Many of the goods imported into the

United States are part of a global supply chain, where

U.S. multinational companies create and design tech

products in the United States and produce the finalized

product overseas. In these cases, the bulk of the profit

from the products are accrued to the U.S. firm. Often

the importation of a technology good represents an

intra-company transfer as U.S. firms brings their

products into the United States for sale from their

overseas production facilities.

(INBILLIONSOFCURRENTDOLLARS)

$47

$55

$58

$0

$40

$80

2010 2011 2012

TECH SERVICES TRADE

CROSS-BORDER TRADE

2010 - 2012

EXPORTS IMPORTS

$97 $102

$0

$150

$300

2010 2011

(INBILLIONSOFCURRENTDOLLARS)

$215

$247

$0

$150

$300

2010 2011

EXPORTS IMPORTS

TECH SERVICES TRADE

SALES THROUGH FOREIGN AFFILIATE TRADE

2010 - 2011

(INBILLIONSOFCURRENTDOLLARS)

$198

$336

$55

$59$247

$102

$0

$300

$600

Exports Imports

Foreign

Affiliates

Cross-

Border

Goods

2011 TECH TRADE BALANCE

EXPORTS VS IMPORTS

Source: U.S. Bureau of Economic Analysis

$501 $496

+4.6 BILLION TRADE SURPLUS

Source: U.S. Bureau of Economic Analysis Source: U.S. Bureau of Economic Analysis

When combined U.S. goods and services exports

totaled $501 billion and imports were $496 billion in

2011, the most recent year that complete data are

available, giving the U.S. a slight tech trade surplus of

$4.6 billion.

Tech Goods Trade

Trade in technology goods declined significant during

the recent recession with the bottom for both exports

and imports hitting in 2009. While both exports and

imports have rebounded since that period, the past

two years have seen a slowdown in the growth rate as

key overseas markets have experienced economic

malaise and the economic recovery in the United States

has been slow. Tech goods exports totaled $205 billion

for the full year of 2013 and imports reached $351

billion in that same year.

3. 3 © TechAmerica Foundation

Leading Destinations of Technology Goods

What may surprise many is that our NAFTA partners of

Mexico and Canada are the leading two destinations for

U.S. technology goods overseas, far exceeding any

single market in Asia and Europe. Mexico received

nearly $39 billion in U.S. tech goods exports and

Canada over $28 billion. Third ranked China had $16

billion in tech goods.

The United States has trade agreements with 20

countries, and is looking to create two new large scale

agreements, one in the Pacific and one in the Atlantic.

These new agreements could expand U.S. free trade

markets to 53 countries, creating significantly new

opportunities for U.S. technology companies.

Tech Goods Exports by States

Tech trade is not something that helps the United

States in the abstract, but provides significant economic

activity in the states throughout the country. The table

on the right shows that there are 31 states with over $1

billion in tech exports.

Texas overtook California in 2012 to become the

leading state by technology goods exports and 2013

shows it expanding its lead, as exports from Texas grew

by 6.7 percent compared to a drop in California by 5.1

percent in 2013. The good news for Illinois is that its

5.8 percent growth of goods exports, increased its rank

to 6th surpassing New York.

As the U.S. tech industry continues to look to overseas

markets for growth, new trade agreements could

directly increase the exports of tech goods for many

states around the country.

$38.6

$28.0

$16.0

$9.8 $8.6

$0

$25

$50

1.

Mexico

2.

Canada

3.

China

4.

Hong Kong

5.

Japan

TOP DESTINATIONS OF TECH GOODS FROM U.S.

2013

Tech Goods Exports by State

2012 – 2013

(in millions of current dollars)

Percent

Rank States 2012 2013 Change

United States $203,155 $204,683 1.0%

1. Texas $45,131 $48,175 6.7%

2. California $44,625 $42,367 -5.1%

3. Florida $14,470 $14,746 1.9%

4. Massachusetts $7,310 $7,268 -0.6%

5. Oregon $6,415 $6,725 4.8%

6. Illinois $6,258 $6,624 5.8%

7. New York $6,627 $6,494 -2.0%

8. Tennessee $4,704 $4,827 2.6%

9. Arizona $4,897 $4,696 -4.1%

10. Minnesota $3,978 $4,032 1.3%

11. Pennsylvania $3,791 $3,888 2.6%

12. New Jersey $3,858 $3,813 -1.2%

13. Washington $3,737 $3,661 -2.0%

14. Michigan $2,590 $3,129 20.8%

15. Ohio $3,222 $3,065 -4.9%

16. Wisconsin $3,043 $2,898 -4.8%

17. North Carolina $2,672 $2,867 7.3%

18. Vermont $2,772 $2,724 -1.7%

19. Idaho $2,859 $2,721 -4.8%

20. Virginia $2,365 $2,583 9.2%

21. Utah $2,038 $2,567 25.9%

22. Georgia $2,256 $2,220 -1.6%

23. Colorado $2,072 $2,095 1.1%

24. Indiana $1,803 $1,908 5.9%

25. Kentucky $1,660 $1,829 10.2%

26. Maryland $1,775 $1,746 -1.6%

27. Nevada $1,415 $1,390 -1.8%

28. Connecticut $1,409 $1,288 -8.6%

29. South Carolina $1,693 $1,213 -28.4%

30. New Hampshire $1,139 $1,193 4.7%

31. New Mexico $1,669 $1,138 -31.8%

32. Mississippi $1,012 $982 -2.9%

33. District of Columbia $368 $960 161.1%

34. Oklahoma $840 $765 -8.9%

35. Delaware $597 $744 24.5%

36. Kansas $633 $676 6.9%

37. Iowa $568 $554 -2.4%

38. Alabama $588 $517 -12.1%

39. Missouri $607 $517 -14.9%

40. Puerto Rico $431 $479 11.1%

41. Louisiana $290 $308 6.2%

42. Nebraska $200 $236 18.3%

43. Maine $590 $229 -61.1%

44. Arkansas $198 $186 -5.8%

45. Rhode Island $177 $182 2.7%

46. South Dakota $122 $141 15.7%

47. West Virginia $114 $116 2.0%

48. North Dakota $62 $50 -19.4%

49. Montana $37 $35 -6.1%

50. Hawaii $44 $26 -41.1%

51. Alaska $23 $25 11.8%

52. Wyoming $24 $18 -24.2%

Unallocated $1,943 $1,733 -10.8%

(INBILLIONSOFCURRENTDOLLARS)

4. 4 © TechAmerica Foundation

TechAmerica Foundation Reports

TechAmerica Foundation produces regular reports covering

timely and relevant issues to the technology industry and to

U.S. competitiveness in a global economy. We combine

rigorous data with careful analysis to provide industry

leaders and policymakers with the informationneeded to

understand the industry.

Previous reports include:

Adopting Cloud Services – May 2014

Tech Trade in the States – Feb 2014

Midyear Tech Employmentfor 2013 – Sept 2013

Cyberstates 2013 – May 2013

Copies of these reports are availableon our website at:

www.techamericafoundation.org/cs

For questions about this publication contact:

Matthew Kazmierczak

matthew@techamericafoundation.org

About TechAmerica Foundation

TechAmerica Foundation educates industry executives,

policy makers and opinion leaders on the promise of

technological innovation to advance prosperity, security, and

the general welfare.

Launched in 1981, the Foundation is a 501(c)(3) non-profit,

nonpartisan affiliateof TechAmerica, which is the public

sector and public advocacy department of CompTIA and the

leading voice and resource for the U.S. tech industry.

TechAmerica Foundation disseminates award-winning

research covering the latest topics of interest to the tech

industry. The Foundation also organizes conferences and

seminars to explore pertinent issues with government and

industry representatives and to share the findings

Copyright © 2014 TechAmerica Foundation

All rights reserved.

TECH EXPORTS FROM UNITED STATES TO WORLD

(in millions of current U.S. dollars)

% Change # Change

Tech Goods Export 2009 2010 2011 2012 2013 2012-13 2012-13

Computer and Peripheral Mfg. $37,975 $44,090 $48,585 $49,394 $48,268 -2.3% -$1,126

Communications Mfg. $23,908 $28,081 $33,331 $35,295 $37,625 6.6% $2,330

Consumer Electronics Mfg. $7,792 $9,753 $10,811 $10,502 $9,703 -7.6% -$798

Electronic Components & Semiconductor Mfg. $51,711 $64,204 $55,220 $52,261 $53,191 1.8% $930

Measuring and Control Instruments Mfg. $38,283 $43,529 $48,623 $51,117 $51,506 0.8% $389

Reproducing Magnetic and Optical Media Mfg. $959 $779 $1,465 $4,586 $4,390 -4.3% -$196

Total Tech Goods Exports $160,628 $190,435 $198,035 $203,155 $204,683 0.8% $1,528

Cross-Border Services Tech Exports 2009 2010 2011 2012 2011-12 2011-12

Telecommunications $10,102 $10,911 $12,851 $14,009 9.0% $1,158

Computer and Information Services $13,714 $14,127 $16,841 $17,340 3.0% 499

R&D and Testing Services $18,636 $22,446 $25,457 $26,663 4.7% 1,206

Total Cross-Border Exports $42,452 $47,484 $55,149 $58,012 5.2% 2,863

Tech Sales Through U.S. Affiliates to Foreign Persons 2009 2010 2011 2010-11 2010-11

Computers and Electronic Products $4,385 $4,499 $5,300 17.8% $801

Software Publishers $24,962 $35,468 $41,712 17.6% $6,244

Telecommunications $31,805 $31,038 $34,674 11.7% $3,636

Internet Services $36,248 $39,724 $50,214 26.4% $10,490

Architectural, Engineering, and Related Services $25,701 $26,324 $29,515 12.1% $3,191

Computer Systems Design and Related Services $70,482 $73,620 $81,162 10.2% $7,542

Scientific Research and Development Services $4,458 $4,306 $4,920 14.3% $614

Total Sales Through U.S. Affiliates $198,041 $214,979 $247,497 15.1% $32,518

Total U.S. Exports $401,121 $452,898 $500,681 10.6% $47,783

Definition and Methodology

The goods trade data come from the InternationalTrade

Administration’sOffice of Trade and Industry Information in the

U.S. Department of Commerce. Goods trade are those physical

products that can be put on a ship for trade and correspond to

NAICS code 334 and its subcomponents.

Tech services trade has two components,cross-border services and

sales through overseas affiliates. Cross-border represents,in the

general sense, a service that is provided from one country to

another, whereas sales through overseas affiliatesrepresents a

service that is provided by a local chapter of a multinational

company that is headquartered in a separate country.

Services trade data are collected and compiled by the U.S. Bureau

of Economic Analysis. Data for services imports was imputed for

Internet services for 2010 and 2011 in order to address a

nondisclosureissue. Services exports represent receipts for

services provided, while imports represent payments for services

provided.

All data are most current at time of publication.