Outlook for Week of March 12, 2018

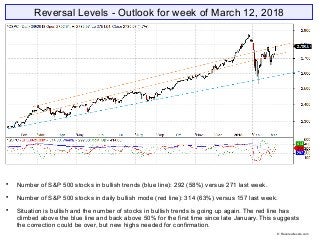

- 1. Reversal Levels - Outlook for week of March 12, 2018 Number of S&P 500 stocks in bullish trends (blue line): 292 (58%) versus 271 last week. Number of S&P 500 stocks in daily bullish mode (red line): 314 (63%) versus 157 last week. Situation is bullish and the number of stocks in bullish trends is going up again. The red line has climbed above the blue line and back above 50% for the first time since late January. This suggests the correction could be over, but new highs needed for confirmation. © Reversallevels.com

- 2. ELC: down = bearish. BMO: down but nearly flat = bearish but trying to bottom out. This is a correction or early stage bear market. BMO is about to turn up from its lowest level in 2 years. If so look for further rebound or sideways. © Reversallevels.com S&P 500 Weekly chart

- 3. S&P 500, Australia AOI and Brazil Bovespa are in bullish trends.Other major world markets stay bearish. Ongoing partial profits signal for Brazil Bovespa. Can still take some profits here. A 32% gain in 34 weeks. Bonds TLT are in bearish trend. Stay out or short. Gold is weak bullish. If MoM turns back up it would be a nice bullish continuation. EURUSD is weak bullish. 1.25 remains as strong overhead resistance. Oil is weak bullish and doing OK. Follow through will be needed. Wheat is in a bullish trend. Hold. © Reversallevels.com Major indices

- 4. Weak Buy signal for Dow Transports. Could be a fake-out move. Weekly MoM stays down for nearly all markets, so patience is still a good idea. Stocks could stay in corrective patterns for several more months. We will get buy signals and bullish continuations when things turn back up again. World markets © Reversallevels.com

- 5. Speculative Buy signal for GE. Weak Buy signal for IBM. Could be a fake-out. Partial profits signal for CSCO. A 41% gain in 27 weeks. Partial profits signal for MSFT. A 79% gain in 86 weeks. 17 stocks bullish, up from 16 last week. Above 20 = bull market. See article: Keeping an eye on the Dow stocks Bullish participation stays weak. If we get back above 20 bullish stocks then we will know the correction or bear market is over. A drop below 15 would be longer term bearish. . 30 Dow Jones Industrials stocks © Reversallevels.com

- 6. No major changes this week. Note: Currencies tend to make long trending moves, so we don’t get weekly Buy or Sell signals very often. Keep trading in the direction of the weekly trend and you are likely to do well in the long run. Currencies © Reversallevels.com

- 7. On Twitter: http://twitter.com/lunatictrader1 On Facebook: https://wwww.facebook/Reversallevels/ On Stocktwits: http://stocktwits.com/LunaticTrader Website: Reversallevels.com For daily comments and questions you can find us here: © Reversallevels.com Disclaimer Investing in stocks, forex or commodities is risky. No guarantee can be given that the opinions or predictions given in this presentation will be correct. Reversallevels.com cannot in any way be responsible for eventual losses you may incur if you trade based on the given information. Simulated trading programs in general are subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. Trade at your own risk and responsibility. Subscription service Daily reversal levels for over 2700 stocks and ETF are available by monthly subscription. For just $1 a day you can become a more efficient investor: click here Comes with full instructions and strategies for using the reversal levels and MoM indicator in your own trading. This is an honest method with limited risk, not a get rick quick formula. Give it a try.