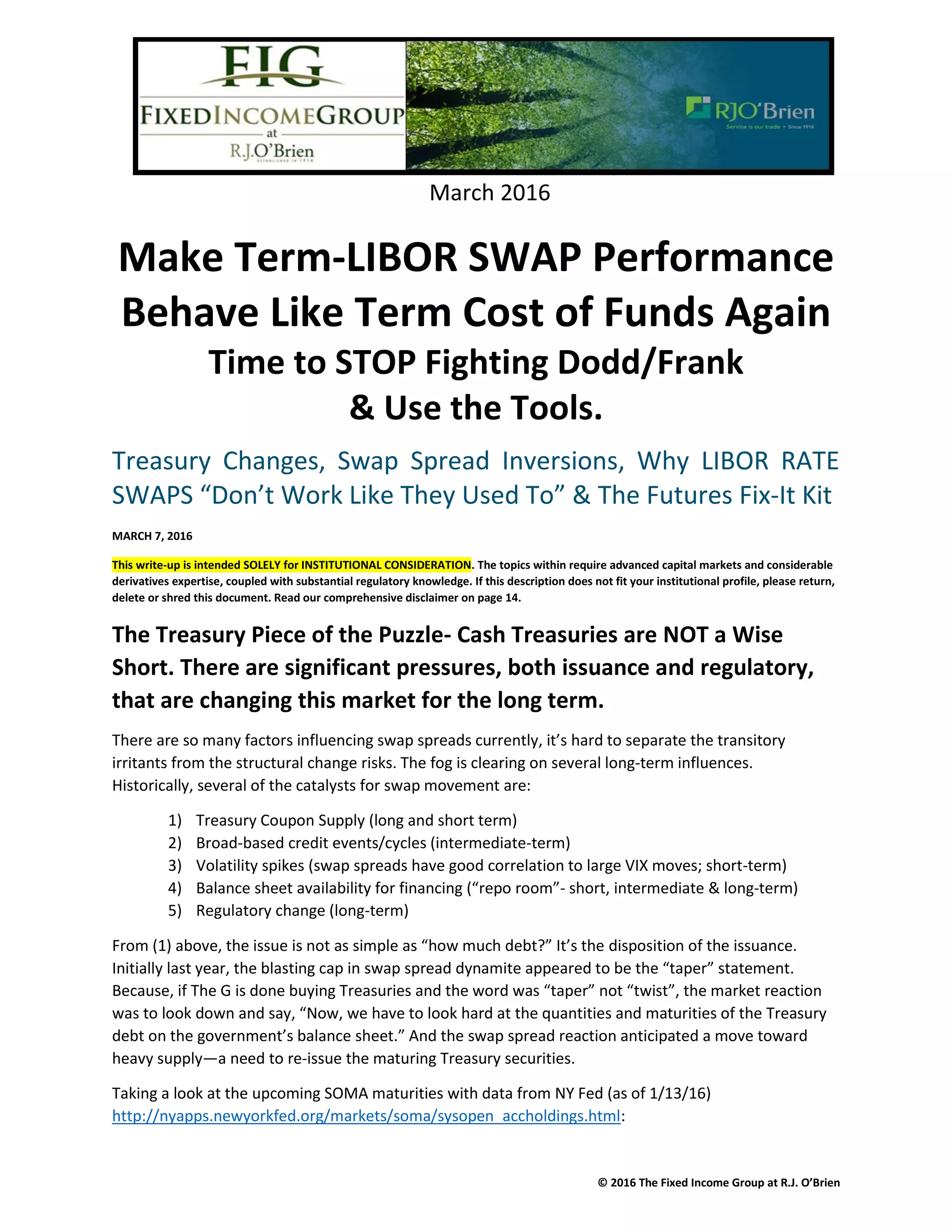

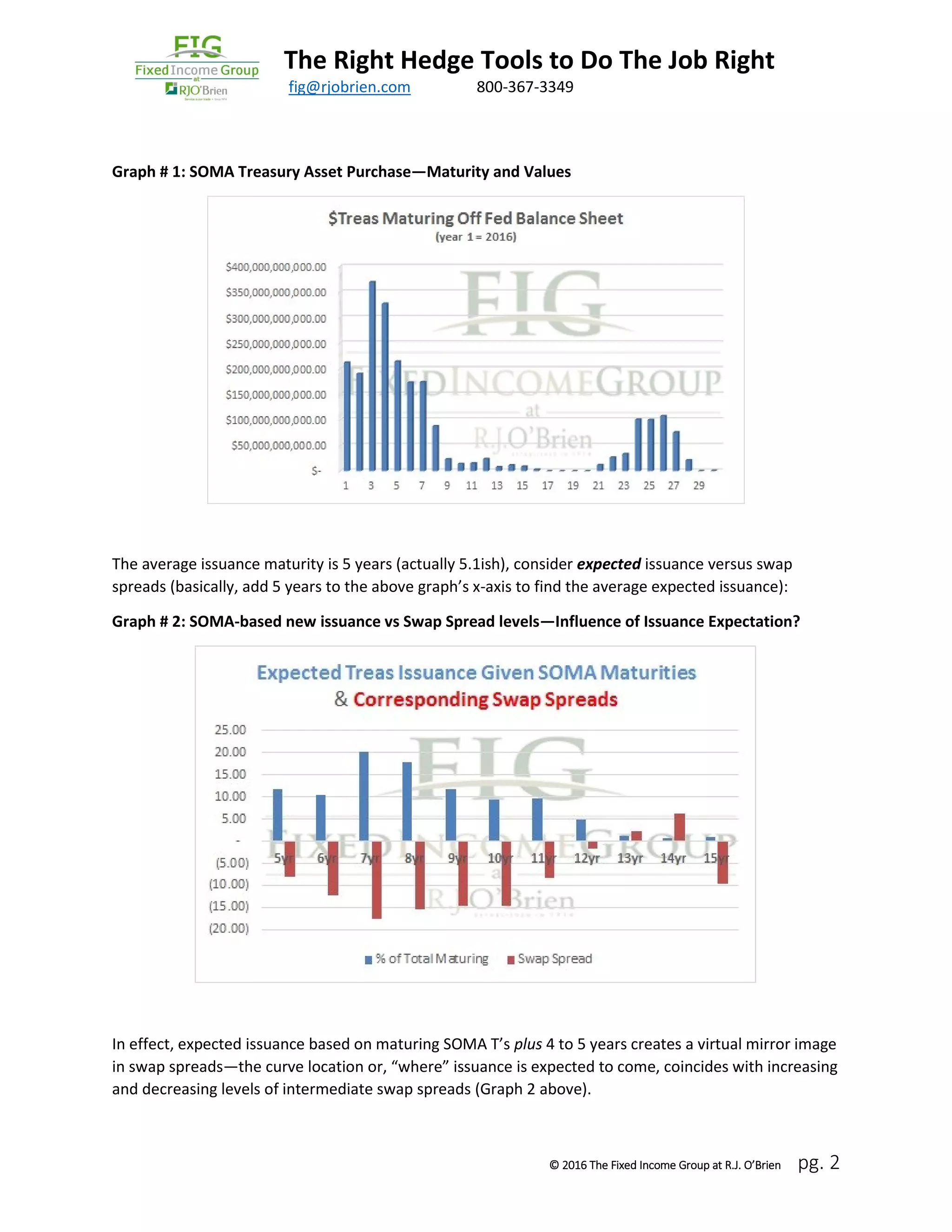

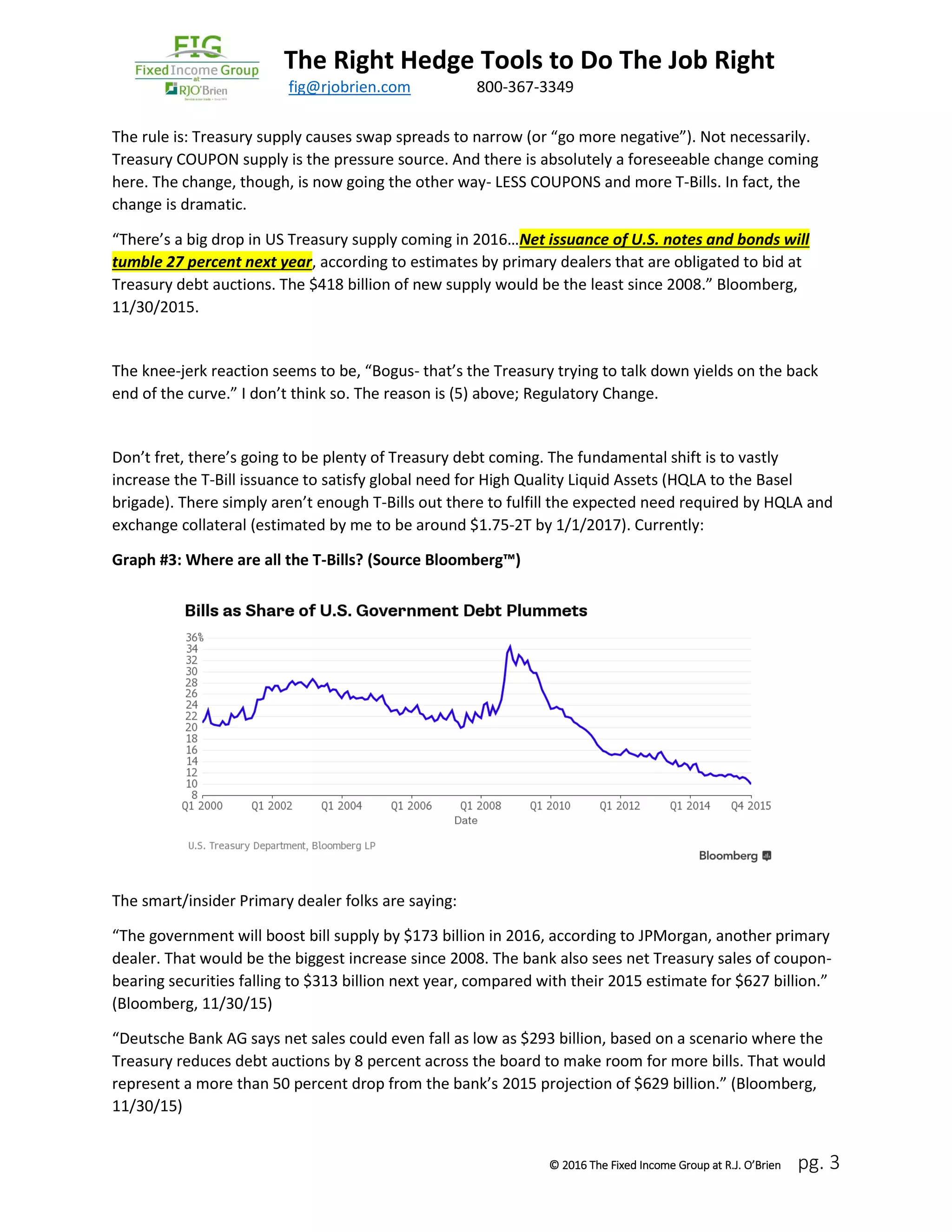

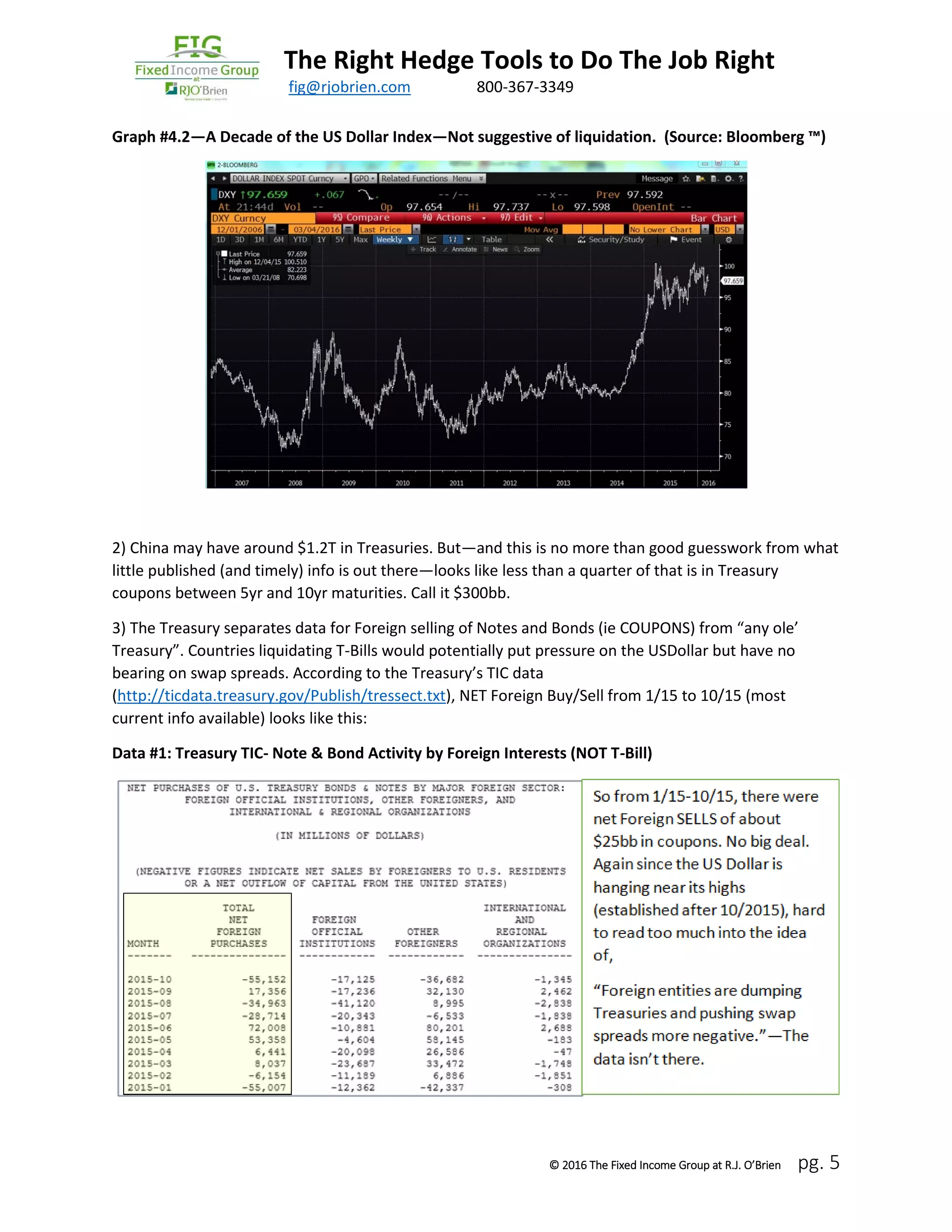

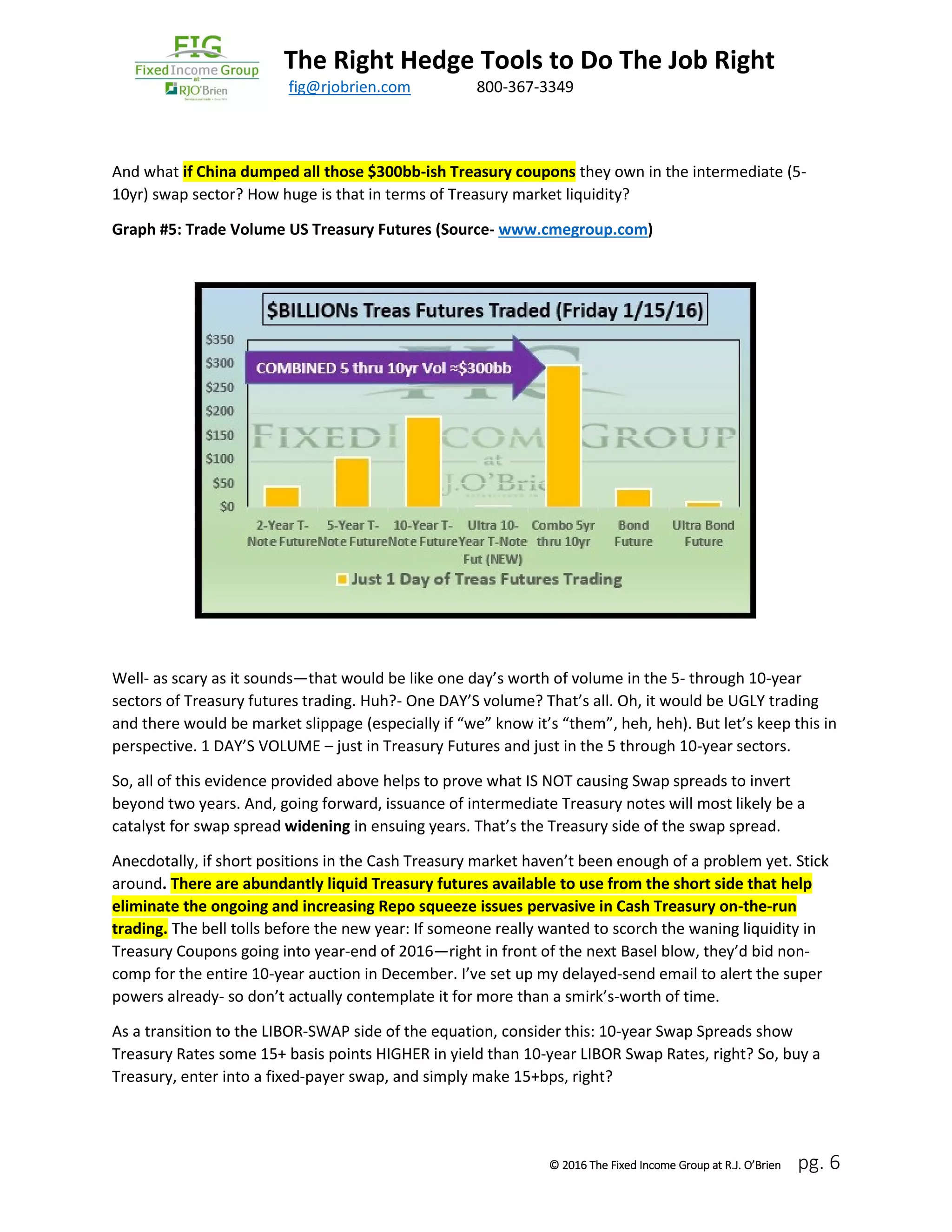

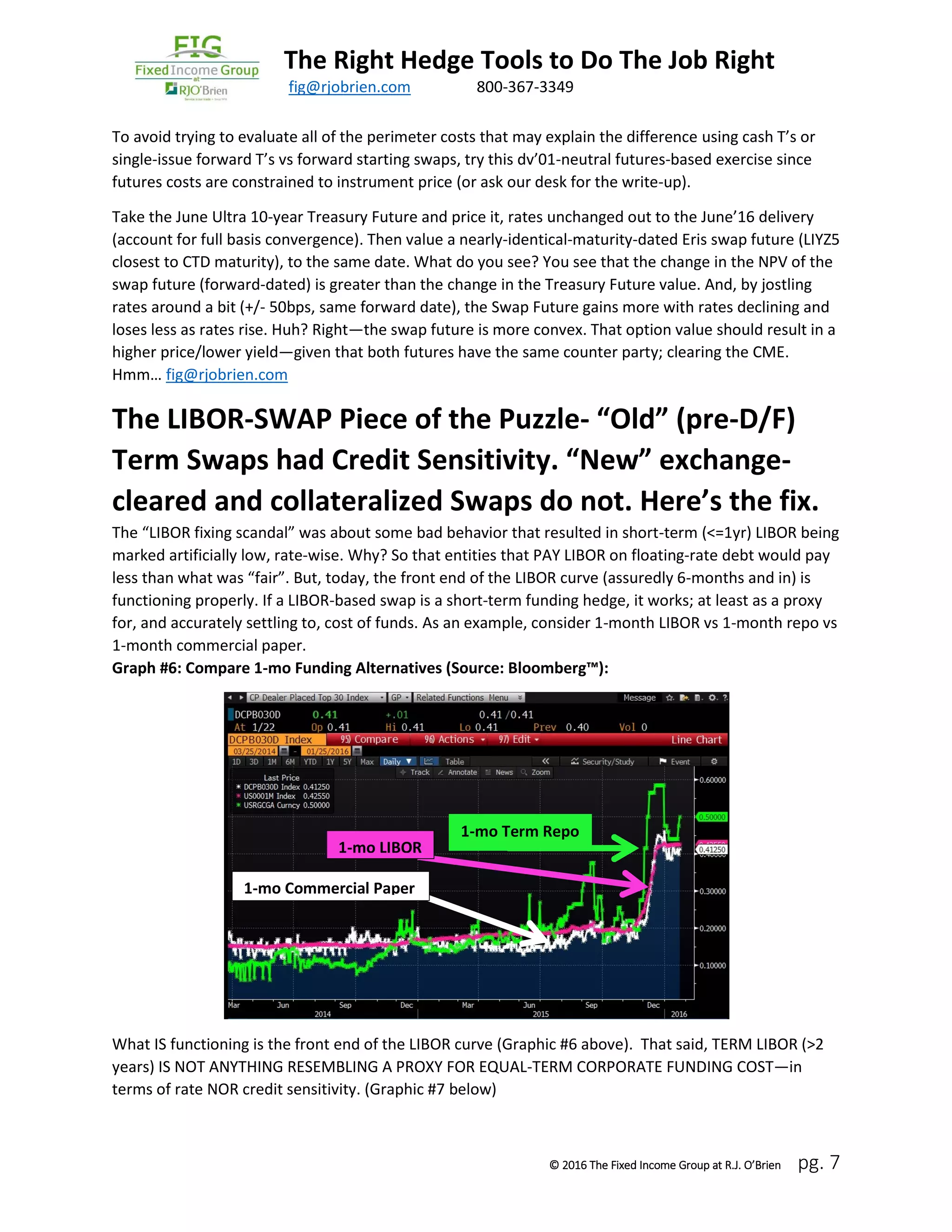

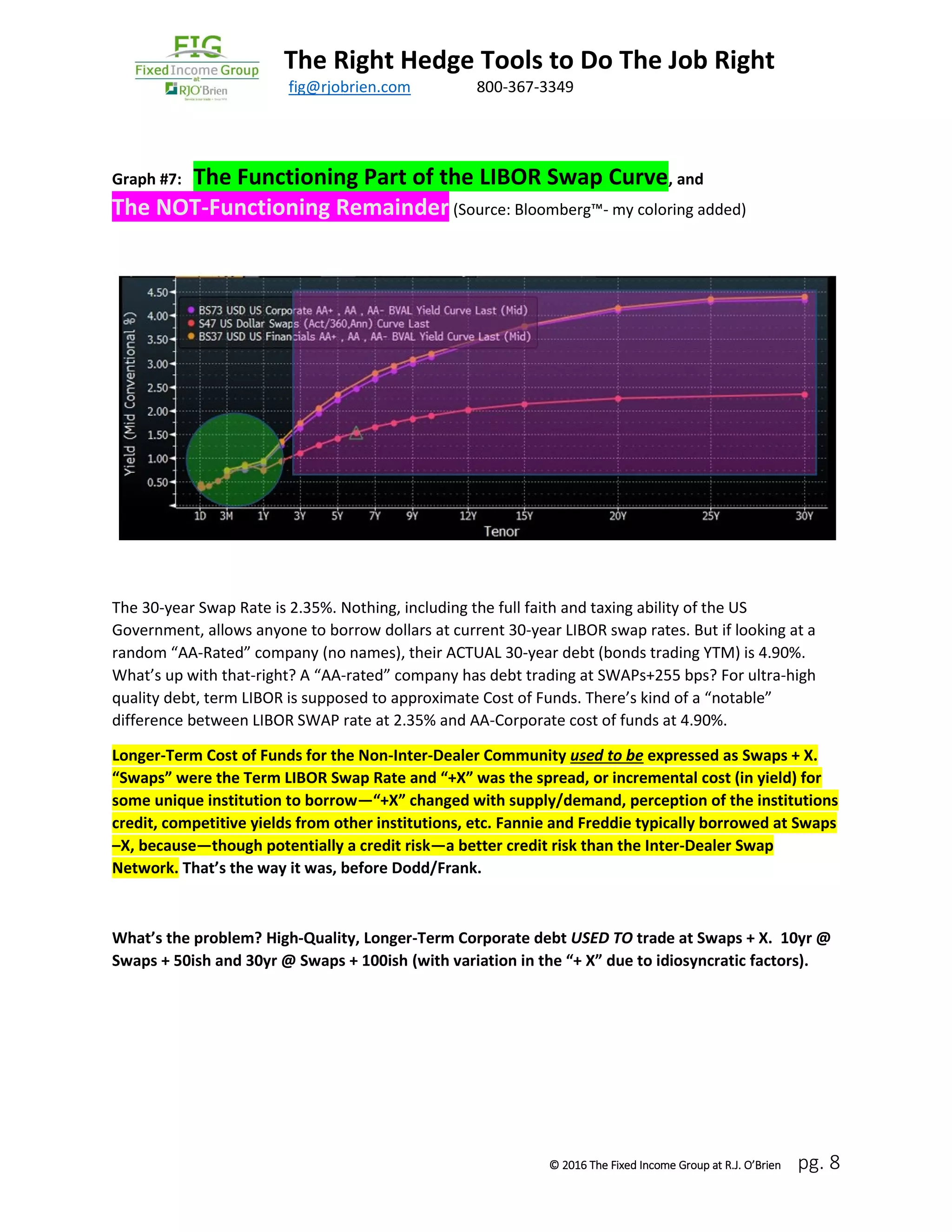

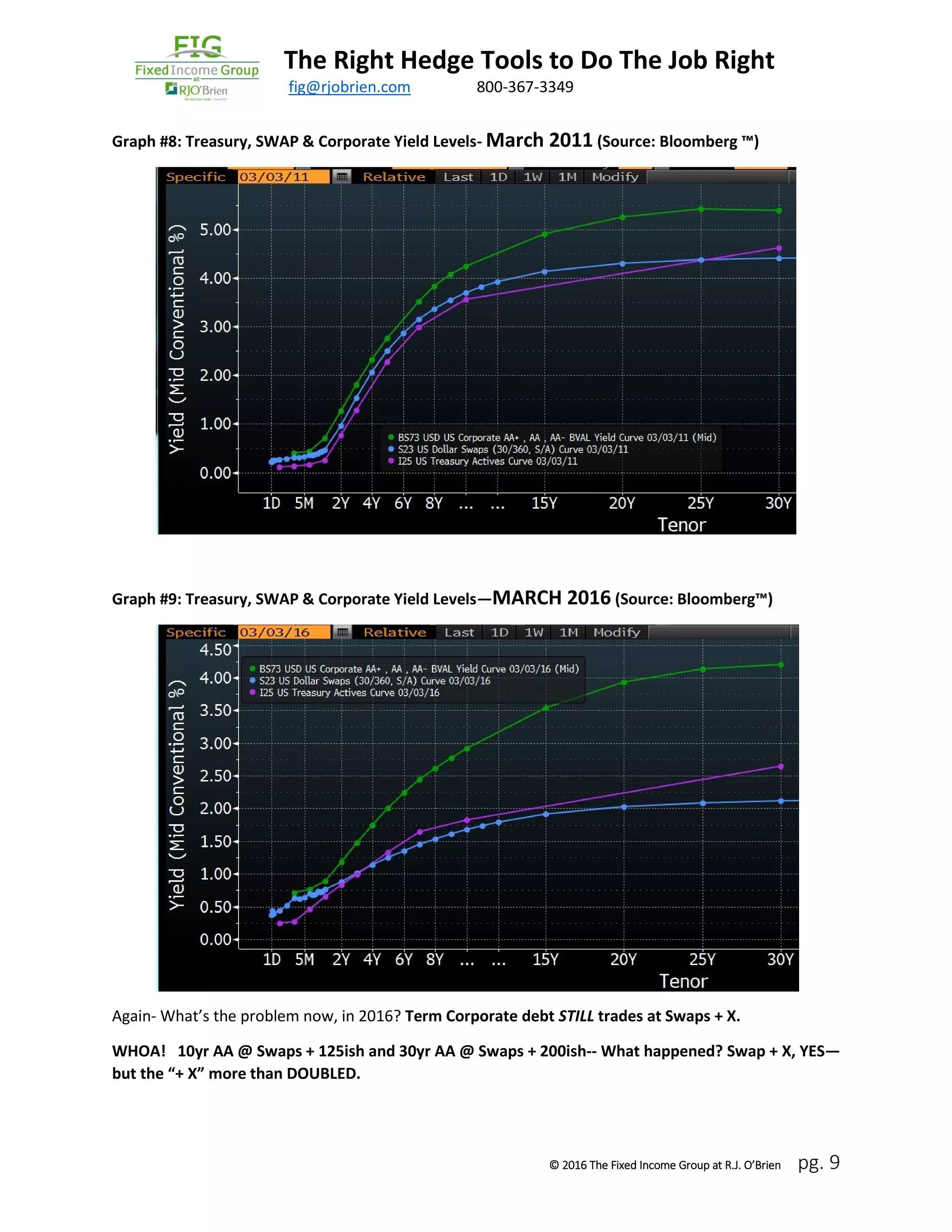

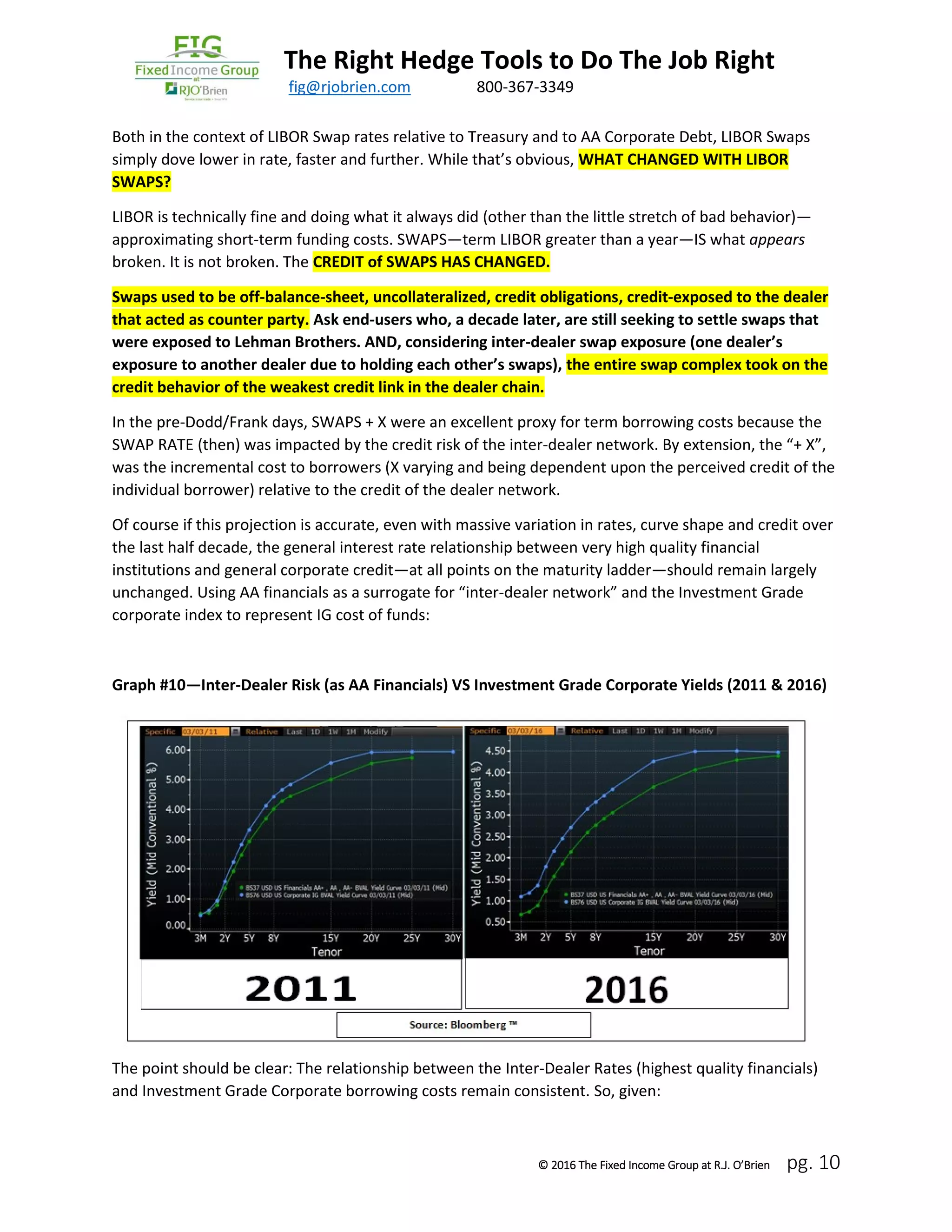

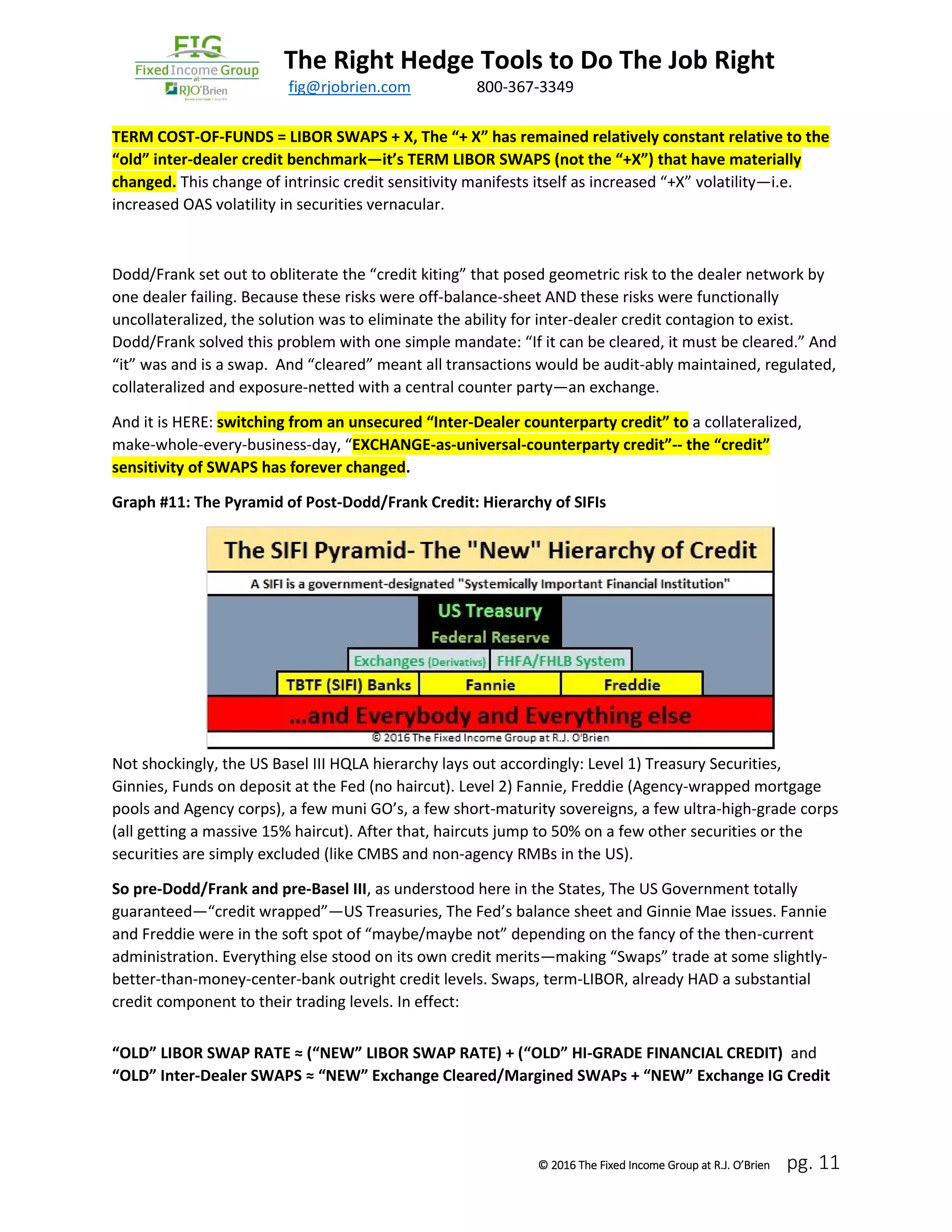

This document discusses changes in the Treasury and LIBOR swap markets that have caused term LIBOR swap rates to no longer behave like corporate term borrowing costs. It argues that regulatory changes have reduced coupon issuance and increased Treasury bill issuance, putting downward pressure on swap rates. Additionally, the credit risk has been removed from LIBOR swaps since they are now cleared and collateralized, causing swap rates to diverge from corporate borrowing costs. The document provides graphs and data to support these assertions and argues for using futures to better hedge term funding costs.