COST OF CAPITAL.pptx

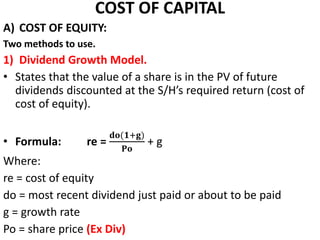

- 1. COST OF CAPITAL A) COST OF EQUITY: Two methods to use. 1) Dividend Growth Model. • States that the value of a share is in the PV of future dividends discounted at the S/H’s required return (cost of cost of equity). • Formula: re = 𝐝𝐨(𝟏+𝐠) 𝐏𝐨 + g Where: re = cost of equity do = most recent dividend just paid or about to be paid g = growth rate Po = share price (Ex Div)

- 2. Cost of Equity Cont’d. •Example 1: •Co. B has just paid a div of 9c. Dividends are expected to grow at a rate of 6% pa in the future and the current share price is $1.85. Calculate the cost of equity. •Example 2. •JP Co will pay a Div of 20c in the near future. The current share price is $1.55 and the Dividends are expected to grow at 7% pa. Calculate the cost of equity.

- 3. Estimating g. • Two methods i) Past Dividend Growth (growth formula). Assumption here is that past growth will continue into the future. Growth formula; g = 𝒏−𝟏 𝒎𝒐𝒔𝒕 𝒓𝒆𝒄𝒆𝒏𝒕 𝑫𝒊𝒗 𝑬𝒂𝒓𝒍𝒊𝒆𝒔𝒕 𝑫𝒊𝒗 - 1 (%) Where n = number of years. Example 3: Dividend paid in the recent years are as follows: 2007 14.8c 2008 15.2c 2009 16.8c 2010 18.6C Calculate the average annual growth rate.

- 4. Estimating g Cont’d • ii) Gordon Growth Approximation. •Formula; g = bre. Where; b = proportion of profits retained re = cost of equity. NB: If the cost of equity is not known, then use some given measure of accounting return. Example 4: Co. A has a share price of $4 and is about to pay a dividend of 30c per share. The rate of return on reinvested funds is 14% and the company has a pay out ratio of 30%. Estimate growth (g) and calculate the cost of equity.

- 5. Cost of Equity Cont’d •2) The CAPM •The Background of the CAPM is the Portfolio Theory (PT). •The PT considers Total Risk. •Whenever an investment is done, there is a risk that the actual return will be different from the expected return. •Investors take this risk into account when they decide on the return they wish to receive from making the investment. •The CAPM is a method of calculating the return required based on the assessment of the risk.

- 6. Cont’d •Total Risk= Systematic + Unsystematic Risk •Investors create a portfolio of different investments to reduce the risk. •The amount of risk reduced depends on the Correlation Coefficient between the investments. •If the correlation is high, there is little risk reduction and V/V (give E.gs).

- 7. What Type of Risk is Reduced/diversified? Types of Risks: •Unsystematic Risk. •Also called specific Risk or diversifiable risk, this is the risk specific/unique to the company, investment or segment. •It is caused by factors specific to the particular company/investment/segment e.g strikes in universities, in cement industry… •This risk can be diversified away or reduced by diversifying.

- 8. Systematic Risk •Is the risk of the entire system/market as a whole. •Caused by factors which impact on the whole market e.g inflation rates, unemployment rates, oil prices, exchange rates. •These factors affect every body in the market although differently. •This risk cannot be diversified away.

- 9. What Risk is Reduced. Unsystematic Risk Total Risk Systematic Risk Number of investments/shares

- 10. CAPM •CAPM assumes that investors are rational and so well diversified. •Required Return = Rf + Average Systematic Risk •Average Systematic Risk = E(Rm) – Rf •Problem: Some Co.s suffer more systematic Risk than others and so, companies don’t get the same risk premium. •Therefore, we need to measure this systematic risk for the different companies or investments. •This is done by use of an index called beta (β). •CAPM formula: E(ri) = Rf + βi(E(Rm) – Rf)

- 11. CAPM CONT’D • Example 5. •Company B has a beta of 1.25. The return on government guilt is 5% while return on the market is 11%. •Calculate the cost of equity. • Example 6. Risk on government security = 4%, Equity risk premium = 5% and the beta value of Roy Co = 1.2 •Calculate the cost of Equity. •Total MV of Equity = Share Price (ex div) x Total no. of shares.

- 12. Cost of Debt. •1) Preference Shares: •Cost of pref. shares – Use DGM but g = 0 (since there is no growth). •Total MV – same of ordinary share i.e Price x number of shares. • Using DGM, rd= 𝐝𝐨(𝟏+𝐠) 𝐏𝐨 + g •Since g =0, rd = do Po x 100% • Example7. Co D. has 7% $1 irredeemable shares which currently trade at $1.23. •Calculate the cost of preference shares.

- 13. Cont’d • True Debt (Preference shares is not true debt) •1) Bonds/loan Stock. •These are long-term debts •Key features: •Assume $100 nominal/face/par value. •Interest is fixed on the date of issue. •Bonds may be issued or redeemed at a premium or at a discount to par value. •Bonds may be convertible into shares. •Bonds may be redeemable or irredeemable. •Market Value of the bond will vary over time •Key note: If Market interest rates rise the value of the bond will fall and V/V. (why?)

- 14. Cont’d •2) Irredeemable Debt/Bond. •Has no specific redemption/maturity date. •Borrower pays interest but provides no information on principle payment •In many cases, the principle may never be paid •Cost of the debt: (we need 2 things) i) Cost (Post-tax) = 𝐢(𝟏−𝐓) Po x100% Where, i = annual interest on the bond in $s. Po = Current value/price of the bond. (Ex-interest)

- 15. Cont’d •Example 8. •TK Co has irredeemable loan notes of 8% which are currently trading at $79. The total book value of the loan is $80m. Corporation Tax is 28%. Calculate the Post-tax cost of the loan notes. ii) We also need Total Market Value of the Loan. Total MV = Total book value x Po 𝟏𝟎𝟎 Example 9. •Calculate the total MV in example 8 above.

- 16. Cont’d •3) Redeemable Debt: 1) Post-tax cost = IRR of the cash flows from the company’s point of view. 2) Total MV = Like irredeemable debt. Example 10. TK company has issued 9% debentures which are due to be redeemable at par in 6 years. The debentures have a current market value of $102. Corporation Tax is 30%. Calculate the post tax cost of these redeemable debentures.

- 17. Cont’d • Solution: (IRR – use 5%, 10% or 15% or less than 5%) 5% PV 10% PV Cash flows df/af df/af To Total MV (102) 1 (102) 1 (102) T1-6 Interest saved =100*9%*(1-t) 100*.09*.7 = 6.3 5.076 32. 4.355 27.4 T6 Redemption Value = 100 0.746 74.6 0.564 56.4 NPV 4.6 (18.2) Cost =IRR = 5 + 𝟒.𝟔 𝟒.𝟔+𝟏𝟖.𝟐 (5) = 6%

- 18. Cont’d • Solution: • Cost =IRR = 5 + 𝟒.𝟔 𝟒.𝟔+𝟏𝟖.𝟐 (5) = 6% • 4) Convertible Bonds This is like Redeemable debt but the redemption value is higher of; i) cash redemption value ii) Forecast value if converted. Assignment: A company has convertible loan notes in issue which have a coupon rate of 7% and are currently trading at $90. The bonds are redeemable at a premium of 10% in 4 years. Alternatively each loan note is convertible into 20 shares. The shares are currently trading at $4.70 and are expected to grow in value at 5% pa. Corporation tax is 30%. Calculate the post-tax cost of these convertible loan notes.

- 19. Cont’d •4- Non Tradable Debt: •i) Bank Loan/Overdraft i) Post-tax cost = %ge rate charged by the bank x(1-T) ii) Total MV – Use book Value. Example 11. AB Company has a fixed rate bank loan on which it is charged 8% pa. Corporation tax is 30%. Calculate the post-tax cost of the loan. 5.6%

- 20. Cont’d •WACC Example. •XYZ Co has $ 3m of 25c ordinary shares which are trading at $1.70 each. A dividend of 10c is due to be paid soon. The company also has $9m par value of 11% irredeemable bonds. These bonds are currently trading at $105. The company has an accounting return of 9% and retains 60% of its available profits . Corporation Tax is 28%. Calculate the WACC for the company.

- 21. Cont’d • Solution. a) Cost of Equity – DGM. g not given - to be estimated. g = bre, (b = proportion retained, re = cost of equity) re = 𝐝𝐨(𝟏+𝐠) 𝐏𝐨 + g g= 0.6x0.09 = 5.4% re = 𝟏𝟎(𝟏+.𝟎𝟓𝟒) 𝟏𝟔𝟎 + 0.054 = 12% b) Cost of the 11% irredeemable debt. Post – tax cost = 𝐢(𝟏−𝐓) Po x100% = 𝟏𝟏 (𝟏−𝟎.𝟐𝟖) 105 x100% = 7.5%

- 22. Cont’d •Total Market values. Equity: Ex Dive price = 170 – 10 = 160c Number of shares = 3,000,000/ 0.25 = 12,000,000 shares Total MV = 1.6*12,000,000 = 19,200,000 Debt: Total MV = Book value x Po 𝟏𝟎𝟎 = 9,000,000*105 𝟏𝟎𝟎 = 9,450,000 Total MV (‘000) = 19,200 + 9,450 = 28,650 WACC = ( 19,200 28,650 x 12%) + ( 9,450 28,650 x 7.5%) = 10.5%

- 23. •END