Mck proposal

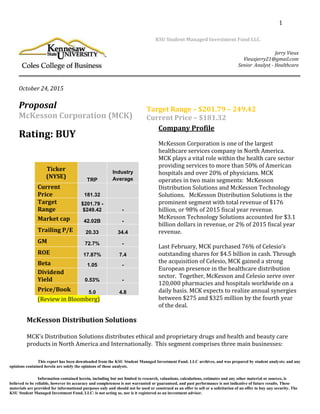

- 1. 1 This report has been downloaded from the KSU Student Managed Investment Fund. LLC archives, and was prepared by student analysts; and any opinions contained herein are solely the opinions of those analysts. Information contained herein, including but not limited to research, valuations, calculations, estimates and any other material or sources, is believed to be reliable, however its accuracy and completeness is not warranted or guaranteed, and past performance is not indicative of future results. These materials are provided for informational purposes only and should not be used or construed as an offer to sell or a solicitation of an offer to buy any security. The KSU Student Managed Investment Fund, LLC. is not acting as, nor is it registered as an investment adviser. McKesson Distribution Solutions MCK’s Distribution Solutions distributes ethical and proprietary drugs and health and beauty care products in North America and Internationally. This segment comprises three main businesses: KSU Student Managed Investment Fund LLC. Jerry Vieux Vieuxjerry21@gmail.com Senior Analyst - Healthcare Target Range – $201.79 – 249.42 Current Price – $181.32 October 24, 2015 Proposal McKesson Corporation (MCK) Rating: BUY Ticker (NYSE) TRP Industry Average Current Price 181.32 Target Range $201.79 - $249.42 - Market cap 42.02B - Trailing P/E 20.33 34.4 GM 72.7% - ROE 17.87% 7.4 Beta 1.05 - Dividend Yield 0.53% - Price/Book 5.0 4.8 (Review in Bloomberg) Company Profile McKesson Corporation is one of the largest healthcare services company in North America. MCK plays a vital role within the health care sector providing services to more than 50% of American hospitals and over 20% of physicians. MCK operates in two main segments: McKesson Distribution Solutions and McKesson Technology Solutions. McKesson Distribution Solutions is the prominent segment with total revenue of $176 billion, or 98% of 2015 fiscal year revenue. McKesson Technology Solutions accounted for $3.1 billion dollars in revenue, or 2% of 2015 fiscal year revenue. Last February, MCK purchased 76% of Celesio’s outstanding shares for $4.5 billion in cash. Through the acquisition of Celesio, MCK gained a strong European presence in the healthcare distribution sector. Together, McKesson and Celesio serve over 120,000 pharmacies and hospitals worldwide on a daily basis. MCK expects to realize annual synergies between $275 and $325 million by the fourth year of the deal. Management Chairman of the Board, CEO since 2008: John Martin President of, CEO since 2008: John Milligan Chief Financial Officer, Executive VP since 2014: Robin Washington Upper-level management ages range from 49-81 yrs.

- 2. 2 This report has been downloaded from the KSU Student Managed Investment Fund. LLC archives, and was prepared by student analysts; and any opinions contained herein are solely the opinions of those analysts. Information contained herein, including but not limited to research, valuations, calculations, estimates and any other material or sources, is believed to be reliable, however its accuracy and completeness is not warranted or guaranteed, and past performance is not indicative of future results. These materials are provided for informational purposes only and should not be used or construed as an offer to sell or a solicitation of an offer to buy any security. The KSU Student Managed Investment Fund, LLC. is not acting as, nor is it registered as an investment adviser. North America pharmaceutical Distribution and Services, International Pharmaceutical Distribution and Services, and Medical Surgical Distribution. MCK’s North America Pharmaceutical Distribution and Services business operates customer locations in all 50 states in the U.S and Puerto Rico, and Canada through a large network of more than 45 distributions centers. MCK is the industry leader in order quality and fulfillment with 99.99 % adjusted accuracy. MCK’s International Pharmaceutical Distribution and Services business provides pharmaceutical and healthcare services to retail pharmacies and institutional customers in Europe. MCK’s European wholesale network, which comes mainly from its acquisition of Celesio, comprises approximately 130 branches and delivers close to 130,000 products to over 65, 000 pharmacies on a daily basis in 10 different countries. Finally, the Medical Surgical Distribution business is a leading provider of medical-surgical supply distribution, equipment, logistics and other services to healthcare providers including physicians’ offices, surgery centers, and homecare. McKesson Technology Solutions The Technology Solutions segment delivers enterprise-wide clinical, patient care, supply chain and strategic management software solutions, as well as connectivity, outsourcing and other services, including remote hosting and managed services, to healthcare organizations throughout North America and Europe. Only 2% of MCK FY 2015 revenue comes from this segment, however this represents a growth opportunity for MCK as healthcare IT continues to gain market share within the sector. Management John H Hammergren (Chief Executive Officer) – Mr. Hammergen is Chairman, president, and Chief Executive Officer of MCK. He was appointed CEO in 2011. Under his tenure as CEO, MCK has more than quadrupled its revenue to $179 billion. Mr. Hammergen has been with MCK since 1996. James Beer (Chief Financial Officer)- Mr. Beer is Executive Vice-President, and Chief Financial Officer of MCK. Prior to joining MCK, he served as the CFO of Symantec Corporation and American Airlines.

- 3. 3 This report has been downloaded from the KSU Student Managed Investment Fund. LLC archives, and was prepared by student analysts; and any opinions contained herein are solely the opinions of those analysts. Information contained herein, including but not limited to research, valuations, calculations, estimates and any other material or sources, is believed to be reliable, however its accuracy and completeness is not warranted or guaranteed, and past performance is not indicative of future results. These materials are provided for informational purposes only and should not be used or construed as an offer to sell or a solicitation of an offer to buy any security. The KSU Student Managed Investment Fund, LLC. is not acting as, nor is it registered as an investment adviser. Recent News Walgreens Will Buy Rival Rite Aid In $17.2 Bil Deal (updated News after proposal) Walgreens Boots Alliance confirmed late Tuesday that it is acquiring smaller rival, No. 3 U.S. drugstore chain Rite Aid, for $9 a share in cash. The deal, worth $17.2 billion in total enterprise value including assumed debt, is seen as adding to adjusted per-share earnings in its first full year after completion, said Walgreens (NASDAQ:WBA), which also expects synergies exceeding $1 billion. (Investors.com) UDG Healthcare to sell two units to McKesson for $466 million UDG Healthcare Plc (UDG.L) said it would sell its Irish drug distribution businesses to U.S. drug wholesaler McKesson Corp (MCK.N) for 407.5 million euros ($466 million) to cut debt and raise funds for acquisitions. (Reuters.com) Industry Outlook The dynamics of the Healthcare have not changed over the past couple years. The key market drivers continue to be: The world’s aging population, the increasing number of people with chronic diseases, technological innovations, and mergers and acquisitions. MCK’s growth strategy incorporates all these components, which is why I believe that MCK is poised for tremendous growth in the future. In 2014, Worldwide and U.S drug sales rose due in part to the volume gains in specialty and generic drugs. According to EvaluatePharma (e.g. see fig.1), Worldwide prescription drug sales is projected to reach $1, 017 billion by 2020 with 10.5 % coming from generic drugs, which are more beneficial to distributors like MCK because generics carry wider margins than branded products. (Fig.1)

- 4. 4 This report has been downloaded from the KSU Student Managed Investment Fund. LLC archives, and was prepared by student analysts; and any opinions contained herein are solely the opinions of those analysts. Information contained herein, including but not limited to research, valuations, calculations, estimates and any other material or sources, is believed to be reliable, however its accuracy and completeness is not warranted or guaranteed, and past performance is not indicative of future results. These materials are provided for informational purposes only and should not be used or construed as an offer to sell or a solicitation of an offer to buy any security. The KSU Student Managed Investment Fund, LLC. is not acting as, nor is it registered as an investment adviser. Given the industry outlook, we strongly believe that MCK is a great buying opportunity for the following reasons: The recent acquisition of Celesio, the agreement expansion with Rite Aid, MCK’s tremendous accuracy in delivering its services, and the company’s specialty business. Celesio Acquisition Last year, MCK agreed to purchase 76% of Celesio’s outstanding shares for $5.4 billion dollar in cash. Celesio is a leading international wholesale and retail company and provider of logistics and services to the pharmaceuticals and healthcare sectors worldwide, especially in Europe. The company operates in 14 countries and serves more than 2 million customers. Celesio’s 133 wholesale branches serve more than 65,000 pharmacies and hospitals every day providing them over 130,000 pharmaceuticals products. The acquisition boosted MCK’s earnings per share by more than $1 per share over the past twelve months and the company expects savings of $275 million to $325 by the fourth year following the combination of the pharmaceuticals giants. One the most appealing aspect to the Celesio acquisition is the opportunity for MCK to dominate the generic drugs distribution market, especially in Europe. McKesson and Rite Aid Agreement In February 2014, MCK and Rite Aid agreed to expand their distribution agreement to include both brand and generic pharmaceuticals. MCK’s agreement with Rite Aid, one of the leading drugstore chain in the United States, extends through 2019 and will improve both companies’ efficiency within the sector. With this new agreement, the “MCK/Celesio/Rite Aid” combination became the largest generic buyer in the world (Fig. 2), eclipsing the combination of Walgreens and AmerisourceBergen. This constitutes a huge opportunity for growth for MCK, given the upcoming afflux of patent expirations of many blockbuster drugs. (Fig. 2)

- 5. 5 This report has been downloaded from the KSU Student Managed Investment Fund. LLC archives, and was prepared by student analysts; and any opinions contained herein are solely the opinions of those analysts. Information contained herein, including but not limited to research, valuations, calculations, estimates and any other material or sources, is believed to be reliable, however its accuracy and completeness is not warranted or guaranteed, and past performance is not indicative of future results. These materials are provided for informational purposes only and should not be used or construed as an offer to sell or a solicitation of an offer to buy any security. The KSU Student Managed Investment Fund, LLC. is not acting as, nor is it registered as an investment adviser. The following table (Fig. 3) is a list of blockbuster drugs known for their global sales, which are set to enter the bio similar market once their patent expires in a couple years. This represents a tremendous growth opportunity for MCK and Rite Aid, who detain the strongest generics purchasing power. Drug Biologic Innovator Global Sales Patent Expiration Avastin Bevacizumab Genentech Inc. $7B EU – 2022 US – 2019 Enbrel Etanercept Amgen Inc./ Pfizer Inc. $8.4B EU – 2015 US -2029 Epogen/Proorit/Eprex Epoetin Alfa Amgen Inc. / Janssen Pharmaceutica $3.3B EU –Expired US – 2015 Herceptin Trastuzumab Gentech Inc. $6.8B EU – 2014 US – 2019 Humira Adalimumab Abbvie Inc. $10.7B EU – 2018 US – 2016 Lantus Insulin Glargine Sanofi $7.6B EU – 2015 US – 2015 Neulasta Pegfilgrastim Amgen Inc. $4.4B EU – 2015 US – 2015 Remicade Infliximab Johnson & Johnson $6.7B EU – 2015 US - 2018 Rituxan/ Mabthera rituximab Roche $7.7B EU – Expire US -2018 (Fig. 3)

- 6. 6 This report has been downloaded from the KSU Student Managed Investment Fund. LLC archives, and was prepared by student analysts; and any opinions contained herein are solely the opinions of those analysts. Information contained herein, including but not limited to research, valuations, calculations, estimates and any other material or sources, is believed to be reliable, however its accuracy and completeness is not warranted or guaranteed, and past performance is not indicative of future results. These materials are provided for informational purposes only and should not be used or construed as an offer to sell or a solicitation of an offer to buy any security. The KSU Student Managed Investment Fund, LLC. is not acting as, nor is it registered as an investment adviser. McKesson Accuracy Nowadays, hospitals and different healthcare providers are looking for ways to cut their costs through efficient inventory management and supply chain operations. MCK provides excellent distributions services from product availability, online capability, and order accuracy. MCK is continually revising their distributions methods in order to help independent providers and suppliers generate more savings. MCK offers a variety of products that encompasses the entire scope of the distributions business. They offer products such as “Central Fill SM” that allows pharmacies to manage their prescription fulfillment efficiently and cut costs. They also offer products like Supplylogix, which develops and delivers practical supply chain intelligence solutions for pharmacy related businesses and services a wide group of healthcare providers nationwide. Using their six- sigma method, MCK recorded a mind-blowing 99.9 adjusted accuracy last year, which is key to maintaining great relationships with providers. One of the premiere examples of how MCK helps companies save money through operations efficiency is MCK’s partnership with The Common Wealth of Pennsylvania. After the company switched from Group Purchasing Organization (GPO) to MCK, it realized $ 2 million in savings on its $20 million annual pharmaceutical budget in one year. McKesson: Leader in Specialty Health Distribution MCK’S specialty business provides oncology-related solutions throughout the United States through its growing network of physicians. MCK also serves pharmaceuticals and a large number of biotech suppliers from commercialization to payment reimbursement. MCK is virtually present in every façade in the specialty industry. MCK’s IKnowMed tool is a well known within the industry. The software is a powerful electronic system that helps physician keeps health records on a daily basis. It helps physicians improve the way the administer cancer care. Also, on top of other functionalities such as tracking patient history and e-prescribing, the device permits physicians to diagnose and stage cancer patients. As hospitals continue to move electronic-based systems (EHR) to keep patient records for financial incentives, MCK’s IknowMed, one of the highest rated EHR systems could generate a lot of profits for MCK. Among other successful specialty drugs products, MCK’s InterQual recently added a variety of expensive treatment that includes Olysio, Sovaldi and Harvoni (Hepatitis A, B, and C). MCK also added Gilotrif and Zelboraf to their specialty drug portfolio.

- 7. 7 This report has been downloaded from the KSU Student Managed Investment Fund. LLC archives, and was prepared by student analysts; and any opinions contained herein are solely the opinions of those analysts. Information contained herein, including but not limited to research, valuations, calculations, estimates and any other material or sources, is believed to be reliable, however its accuracy and completeness is not warranted or guaranteed, and past performance is not indicative of future results. These materials are provided for informational purposes only and should not be used or construed as an offer to sell or a solicitation of an offer to buy any security. The KSU Student Managed Investment Fund, LLC. is not acting as, nor is it registered as an investment adviser. Competitors (Fig. 4) With market cap exceeding $43 billion dollar, MCK is the major player within its industry. In terms of growth, AmerisourceBergen (ABC) is the considerable player that beats McKesson last year with 30.32% growth. However MCK is more than twice as large as ABC. The pharmaceutical distribution industry is more about the volume of business generated. In the future MCK has a greater upside. MCK is also trading at a lower P/E signaling a bigger growth opportunity. On the downside, MCK’s dividend yield (0.53%) is at the lower end when compared to its competitors. However we believe that capital gains will make up for the lack of dividend gains.

- 8. 8 This report has been downloaded from the KSU Student Managed Investment Fund. LLC archives, and was prepared by student analysts; and any opinions contained herein are solely the opinions of those analysts. Information contained herein, including but not limited to research, valuations, calculations, estimates and any other material or sources, is believed to be reliable, however its accuracy and completeness is not warranted or guaranteed, and past performance is not indicative of future results. These materials are provided for informational purposes only and should not be used or construed as an offer to sell or a solicitation of an offer to buy any security. The KSU Student Managed Investment Fund, LLC. is not acting as, nor is it registered as an investment adviser. SWOT Analysis Strengths Weaknesses Largest ethical drug distributor Specialization/Domain expertise Customer Relationship Experience Management Merger and Acquisitions International Exposure Risks Associated with M&A (Synergies, Absorption of new employees) Relatively weak presence in healthcare IT Debt Ratio Opportunities Threats Biogenerics, biogenerics Affordable Care Act Expansion of Medicaid Europe Potential acquisition of Rite A The economy High currency exposure Affordable Care Act Competition Legal proceedings Growth Analysis Over the past 5 years, MCK’s total revenue grew almost 60% to $ 179.045 billion. For fiscal year 2015, the company recorded 30% in total revenue growth, while adjusted EPS grew by 29%. MCK has exceeded their FY2015 EPS guidance. The recent acquisition of Celesio has permitted MCK to significantly increase its global presence especially in Europe, a key market for healthcare services. Moving forward, the realization of the estimated annual synergies ($275 - $325 million) will be a major component in MCK’s growth. Additionally MCK continues to strengthen its relationship with its suppliers and retail pharmacy partners. Last year, MCK added 500 new Health Mart stores to its network and purchased Remedy, which is Canada’s fastest- growing independent pharmacy network. Finally, MCK continues to be a leading distributor of specialty drugs. MCK currently disposes one of the largest networks of integrated, community- based oncology practices in the United States. In addition to a strong oncology network, MCK is well positioned for the potential emergence of bio similar in the United States and globally. The

- 9. 9 This report has been downloaded from the KSU Student Managed Investment Fund. LLC archives, and was prepared by student analysts; and any opinions contained herein are solely the opinions of those analysts. Information contained herein, including but not limited to research, valuations, calculations, estimates and any other material or sources, is believed to be reliable, however its accuracy and completeness is not warranted or guaranteed, and past performance is not indicative of future results. These materials are provided for informational purposes only and should not be used or construed as an offer to sell or a solicitation of an offer to buy any security. The KSU Student Managed Investment Fund, LLC. is not acting as, nor is it registered as an investment adviser. price of biologics represents about 70% of the price of the world top-10 selling drugs. Many patents of these blockbuster drugs are set to expire. According to Thomson Reuters, over $69 billion in biologic is set to undergo patent expiration. For fiscal year 2016, MCK’s total revenue is projected to grow an additional 7.9% to $193.080 billion. However, despite these strong fundamentals MCK’s stock has not performed very well year-to-date (Fig. 5). I attribute this weak performance to recent market conditions that unflavored multinationals like MCK that have significant currency exposure. The recent decline is not reflective of MCK’s strong fundamentals, and I expect the stock perform well for the next twelve months. (Fig. 5) Relative Valuation We believe that MCK is an excellent investing opportunity, especially after the recent selloff. The recent uncertainties about the world economy and the stronger dollar has negatively impacted MCK’s share price. MCK’s share price dropped by more than 28% since May. However, MCK’s fundamentals continue to remain strong as demand for healthcare products continue to grow. MCK is currently valued at 15.6x forward twelve-month P/E, which is considerably less than the distribution industry and the S&P 500. Given MCK’s higher projected growth (Lower PEG ratio) compared to its competitors, we do not expect the company to continue to trade at such a discount.

- 10. 10 This report has been downloaded from the KSU Student Managed Investment Fund. LLC archives, and was prepared by student analysts; and any opinions contained herein are solely the opinions of those analysts. Information contained herein, including but not limited to research, valuations, calculations, estimates and any other material or sources, is believed to be reliable, however its accuracy and completeness is not warranted or guaranteed, and past performance is not indicative of future results. These materials are provided for informational purposes only and should not be used or construed as an offer to sell or a solicitation of an offer to buy any security. The KSU Student Managed Investment Fund, LLC. is not acting as, nor is it registered as an investment adviser. To determine the relative 12-month price of MCK, I used an equally weighted average EPS and EBITDA. The multiples were slightly adjusted down due to risks associated to patent losses and recent mergers among major drug makers that can potentially put pressure on the fees perceived by distributors like MCK. The 12-month target range for MCK is $201.79 - $249.42. EPSx EPS Est. (Next 4Qtrs) Price EBITDAx EBITDA/Shr. (Nest 4Qtrs.) Weighted Price Weighted Price Bull 19.80 $12.95 $257.71 10.79 22.35 $241.14 $249.42 Base 18.00 $12.95 $233.10 9.76 22.35 $218.12 $225.61 Bear 16.10 $12.95 $208.50 8.73 22.35 $195.08 $201.79 Investment Thesis MCK is a great buying opportunity after the recent market selloff. As the largest healthcare distributor in North America, MCK’s fundamentals are as strong as they have ever been. The recent acquisition of Celesio and MCK’s new agreement expansion with Rite aid will accelerate the company’s growth over the next twelve months. Also, MCK’s expertise and their relationship with providers and suppliers will allow them to steadily grow over time. Finally, as the specialty market continues to expand, MCK is at a great place as the leader in the distribution of specialty drugs to healthcare providers in North America. MCK also has the largest oncology network in the U.S. I suggest that the fund purchases 27 shares of MCK at $179/shr. The purchase will constitute a total investment of $4, 833, or 2.9% of our portfolio value. Also, given that this purchase will make us overweight in healthcare, I suggest that the fund sells its shares Thermo Fisher Scientific (TMO) and realized the 40% gains from that investment.

- 11. 11 This report has been downloaded from the KSU Student Managed Investment Fund. LLC archives, and was prepared by student analysts; and any opinions contained herein are solely the opinions of those analysts. Information contained herein, including but not limited to research, valuations, calculations, estimates and any other material or sources, is believed to be reliable, however its accuracy and completeness is not warranted or guaranteed, and past performance is not indicative of future results. These materials are provided for informational purposes only and should not be used or construed as an offer to sell or a solicitation of an offer to buy any security. The KSU Student Managed Investment Fund, LLC. is not acting as, nor is it registered as an investment adviser. I expect potential capital gains ranging from to $615.33 to $ 1,901 or 12.73% to 39.33% from this investment. Also, I expect total dividend gains ranging from $67 - $70 over the same period.

- 12. 12 This report has been downloaded from the KSU Student Managed Investment Fund. LLC archives, and was prepared by student analysts; and any opinions contained herein are solely the opinions of those analysts. Information contained herein, including but not limited to research, valuations, calculations, estimates and any other material or sources, is believed to be reliable, however its accuracy and completeness is not warranted or guaranteed, and past performance is not indicative of future results. These materials are provided for informational purposes only and should not be used or construed as an offer to sell or a solicitation of an offer to buy any security. The KSU Student Managed Investment Fund, LLC. is not acting as, nor is it registered as an investment adviser. Resources: McKesson.com Bloomberg Terminal Morningstar Thomson Reuters Wall Street Journal New York Times Bloomberg.com Thomson