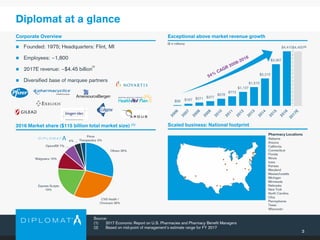

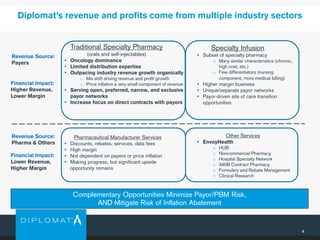

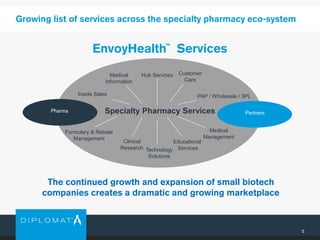

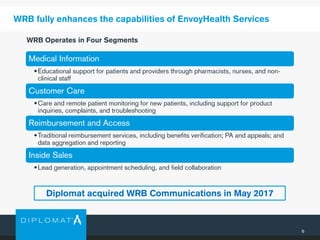

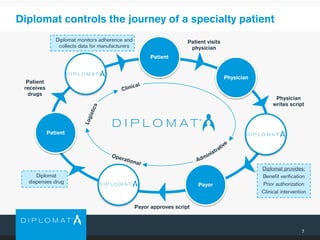

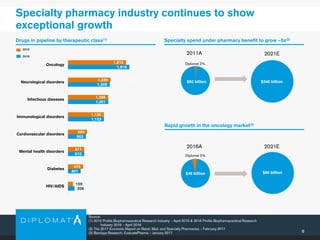

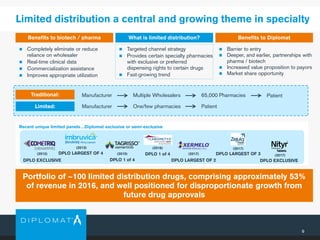

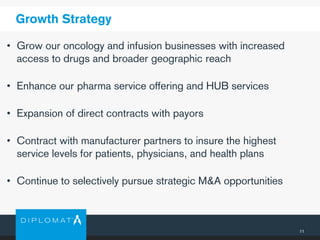

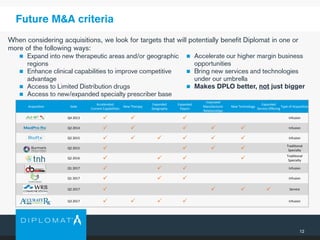

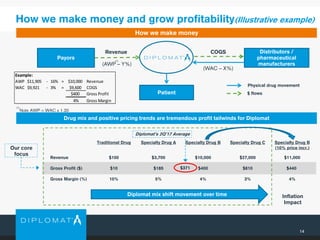

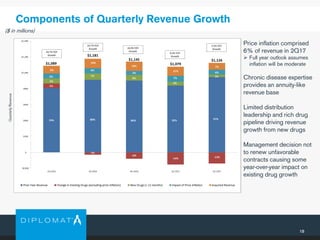

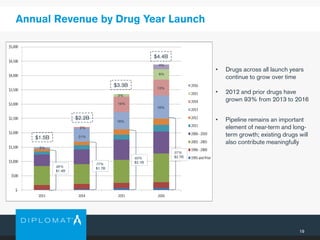

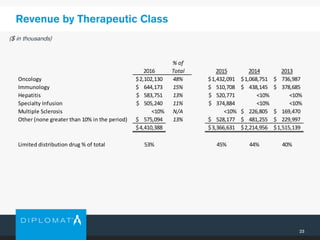

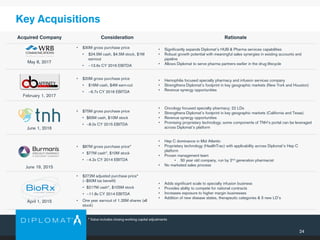

The document discusses Diplomat Pharmacy as a specialty pharmacy company that has experienced significant growth through acquisitions and expanding its services across the specialty pharmacy ecosystem, noting its portfolio includes over 100 limited distribution drugs and it aims to take advantage of continued growth in the specialty pharmacy market through both organic growth and strategic acquisitions. Diplomat generates revenue from multiple sources including traditional specialty pharmacy, specialty infusion, pharmaceutical manufacturer services, and other services to minimize risks from payors and price inflation.