This document contains data on a synthetic CDO portfolio including:

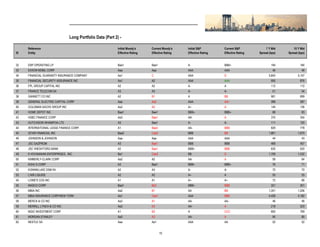

- 93 reference entities in the long portfolio with a total notional amount of $93 million

- No reference entities in the short portfolio

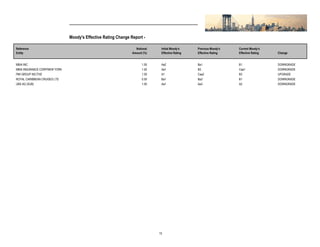

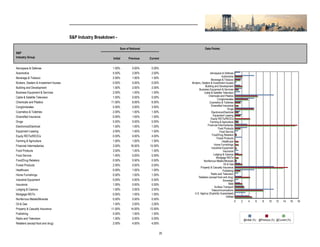

- 3 out of 11 portfolio tests failed including limits on number of reference entities, high yield exposure, and weighted average rating factor

- Ongoing monitoring data is provided on ratings changes, credit events, industry and region breakdowns