Plan Grader

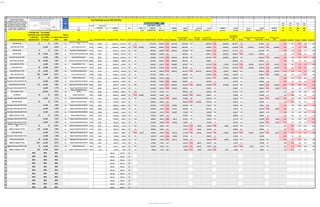

- 1. Confidential 8/25/2017 Page 1 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 AD AE AF AG AJ AP AQ AR AS AT AU AW AY BE BF BH BJ BK BN BQ BR BU BX BY CB CE CF CI CL CM CN CO CP CQ EVAL % OF PLAN: 99% 2016 2015 3 Year 5 Year 11,070,170.65$ 9,260,798.00 =5500 -30% -27% -17% -21% 3% 20 flows 2016 990,843.75$ 100% 4,107.41 990,843.75$ 50% (4,924.64) 8,688,351 (8,462.53) 7,154,108 -$3,566.44 5,010,906 -$214.32 3,690,328 $2,460.75 2016 2015 3 Year 5 Year 1 62.50% 32 9% 10,157,061 (8,210) 9,166,217.00 495,421.88 (289,929) 8,688,351 -$55,414.53 $7,154,107.54 -$216,747.29 5,010,906 -$56,862.22 $3,690,327.55 -$54,969.83 -63% -31% -38% -22% prospectus benchmark if manager beat benchmark, years to determine persistent skill? any manager skill exhibited since 1996 to be <40 yrs? + or - bench since 1996? Index or passive fund name ticker trust assets 2017 DEITZ trust assets 2017 DEITZ 2016 return % of level 1 2017 lag 2017 lag cost trust assets 2016 DEITZ 50% of flows 2016 lag 2016 lag cost trust assets beg 2015 dietz from 5500 2015 lag 2015 lag cost from 5500 trust assets beg 2014 dietz from 5500 2014 lag 2014 lag cost from 5500 trust assets beg 2013 dietz from 5500 2013 lag 2013 lag cost from 5500 trust assets beg 2012 dietz from 5500 2012 lag 2012 lag cost from 5500 fd v bm 2016 fd v bm 2015 fd v bm 3y fd v bm 5y fd v bm 10y S&P 500 TR USD 31 31 2.70% No American Funds Growth Fund of Amer R6 RGAGX 1,533,814 1,533,814.17$ 118,710.70 14% 3.17 1,277,057.00 69,023.24 (3.141) (40,111.49) 1,210,479.63 4.31 996,725.60 (4.06) (40,430.49) 698,130.17 1.90 514,144.34 4.98 (3.14) 4.31 (0.84) 0.76 0.27 Russell 1000 Value TR USD no skill -0.23% No Invesco Equity and Income Y ACETX 1,420,344 1,420,344.44$ 178,652.66 12% (0.38) (5,361.60) 1,120,562.00 60,564.89 (2.215) (24,818.66) 1,062,143.25 1.73 874,583.38 (4.11) (35,964.57) 612,578.88 (7.26) (44,447.04) 451,139.31 (4.35) (19,604.00) (2.21) 1.73 (1.37) (2.99) 0.82 MSCI EM NR USD 13 13 4.14% No Oppenheimer Developing Markets Y ODVYX 978,164 978,163.67$ 62,414.29 9% 0.30 826,416.00 44,666.69 (4.022) (33,236.33) 783,332.09 1.08 645,006.43 (2.37) (15,257.12) 451,777.75 11.28 332,715.86 3.06 (4.02) 1.08 (1.57) 1.77 2.64 S&P 500 TR USD 54 no skill 1.50% No American Funds Fundamental Invs R6 RFNGX 793,631 793,630.94$ 86,611.65 7% 0.75 638,048.00 34,485.65 0.918 604,784.36 2.32 497,987.77 (4.42) (22,018.32) 348,802.41 (0.44) (1,551.16) 256,878.72 1.53 0.92 2.32 (0.32) 0.02 0.46 Russell Mid Cap Value TR USD no skill -1.88% No Vanguard Selected Value Inv VASVX 789,072 789,072.36$ 106,146.43 7% 2.92 616,305.00 33,310.47 (3.658) (22,541.62) 584,174.90 0.98 481,017.66 (8.39) (40,358.96) 336,916.14 8.58 248,124.97 (3.26) (8,087.68) (3.66) 0.98 (3.47) (1.43) (0.10) MSCI ACWI Ex USA NR USD 48 no skill 1.94% No American Funds Europacific Growth R6 RERGX 597,606 597,606.40$ 5,699.58 6% 3.68 534,165.00 28,870.91 (3.483) (18,604.03) 506,317.14 5.18 416,908.51 1.57 292,012.58 5.29 215,055.33 2.81 (3.48) 5.18 1.18 2.22 1.93 Russell 1000 Value TR USD no skill -0.38% No Vanguard Windsor™ II Inv VWNFX 505,483 505,482.62$ 57,202.95 4% 3.13 404,549.00 21,865.34 (3.926) (15,880.88) 383,458.47 0.61 315,744.99 (2.29) (7,242.36) 221,155.25 (1.84) (4,065.38) 162,871.81 (0.79) (1,291.97) (3.93) 0.61 (1.73) (1.57) (0.04) Russell 2000 TR USD 76 no skill 2.93% No Neuberger Berman Genesis Instl NBGIX 498,594 498,594.29$ 74,111.01 4% 0.23 383,074.00 20,704.64 (2.954) (11,314.58) 363,103.03 4.82 298,984.04 (4.94) (14,773.18) 209,415.49 (1.59) (3,339.38) 154,225.95 (6.25) (9,642.58) (2.95) 4.82 (0.84) (2.05) 2.01 Russell 2000 Growth TR USD 63 no skill 2.59% No Lord Abbett Developing Growth I LADYX 373,410 373,410.19$ (9,007.50) 4% 2.92 345,112.00 18,652.85 (13.794) (47,605.73) 327,120.12 (7.26) (23,743.73) 269,355.22 (2.05) (5,510.47) 188,662.76 14.45 138,942.41 (3.86) (5,361.87) (13.79) (7.26) (7.70) (3.72) 0.97 Russell 1000 Value TR USD 395 no skill 0.47% No Invesco Growth and Income Y ACGMX 424,664 424,663.64$ 68,170.99 4% 0.07 321,716.00 17,388.32 2.763 304,943.84 0.93 251,094.96 (3.03) (7,619.48) 175,872.84 1.64 129,523.16 (2.60) (3,362.69) 2.76 0.93 0.21 (0.10) 0.99 BBgBarc US Agg Bond TR USD 24 24 0.96% No PIMCO Total Return Instl PTTRX 331,595 331,594.75$ 8,002.62 3% 1.19 292,025.00 15,783.56 (0.048) 276,800.73 0.18 227,921.54 (1.27) (2,899.82) 159,641.63 0.10 117,569.54 6.15 (0.05) 0.18 (0.37) 0.98 1.28 Morningstar Lifetime Mod 2035 TR USD no skill -1.32% No Vanguard Target Retirement 2035 Inv VTTHX 296,187 296,187.38$ 21,587.56 3% 1.02 247,812.00 13,393.91 (1.802) (4,466.12) 234,892.71 1.32 193,413.89 1.44 135,471.66 0.79 99,769.34 (0.20) (1.80) 1.32 0.36 0.33 (0.31) Russell Mid Cap Growth TR USD 137 no skill 1.68% No Morgan Stanley Inst Mid Cap Growth I MPEGX 236,055 236,054.72$ (34,490.57) 3% 15.98 244,153.00 13,196.15 (20.731) (50,614.84) 231,424.46 (5.66) (13,093.86) 190,558.09 (10.58) (20,155.89) 133,471.39 2.60 98,296.23 (6.31) (6,204.59) (20.73) (5.66) (12.40) (8.92) (2.96) Morningstar Lifetime Mod 2045 TR USD no skill -1.11% No Vanguard Target Retirement 2045 Inv VTIVX 266,942 266,941.53$ 20,771.06 2% 1.19 222,156.00 12,007.24 (1.969) (4,374.46) 210,574.24 1.45 173,389.73 1.91 121,446.27 1.30 89,440.21 (0.26) (233.66) (1.97) 1.45 0.52 0.51 (0.14) S&P Completion TR USD prudent 0.04% Yes Vanguard Extended Market Index Admiral VEXAX 270,606 270,605.63$ 35,998.15 2% 0.02 211,721.00 11,443.24 0.177 200,683.26 0.08 165,245.36 0.06 115,741.75 0.13 85,239.07 0.03 0.18 0.08 0.10 0.09 0.12 Citi WGBI USD 19 19 2.83% No Templeton Global Bond A TPINX 195,926 195,925.76$ 10,948.86 2% (1.25) (2,456.62) 166,932.00 9,022.45 4.622 158,229.26 (0.68) (1,078.17) 130,288.15 2.05 91,256.90 6.22 67,206.98 14.16 4.62 (0.68) 1.93 5.10 3.55 Morningstar Lifetime Mod 2050 TR USD no skill -1.17% No Vanguard Target Retirement 2050 Inv VFIFX 194,035 194,035.29$ 15,067.59 2% 1.06 161,509.00 8,729.35 (2.041) (3,295.93) 153,088.98 1.62 126,055.58 2.18 88,292.30 1.51 65,023.67 (0.35) (230.22) (2.04) 1.62 0.65 0.61 (0.08) MSCI EAFE NR USD 18 18 2.74% No Dodge & Cox International Stock DODFX 179,102 179,101.82$ 13,051.21 2% 0.71 149,852.00 8,099.30 7.263 142,039.70 (10.54) (14,970.69) 116,957.45 4.98 81,919.76 3.54 60,330.56 3.71 7.26 (10.54) 0.27 1.45 1.36 Morningstar Lifetime Mod 2020 TR USD no skill -1.64% No Vanguard Target Retirement 2020 Inv VTWNX 168,692 168,692.42$ 10,459.44 2% 1.21 142,797.00 7,717.99 (0.712) (1,016.80) 135,352.50 1.20 111,451.11 1.24 78,062.99 2.87 57,490.21 (0.18) (0.71) 1.20 0.60 0.88 (0.19) Morningstar Lifetime Mod 2055 TR USD no skill -1.25% No Vanguard Target Retirement 2055 Inv VFFVX 164,393 164,392.99$ 12,799.73 1% 0.95 136,805.00 7,394.13 (2.028) (2,774.37) 129,672.88 1.62 106,774.44 2.45 74,787.34 1.84 55,077.82 (0.42) (228.68) (2.03) 1.62 0.74 0.72 - Morningstar Lifetime Mod 2040 TR USD no skill -1.18% No Vanguard Target Retirement 2040 Inv VFORX 148,946 148,945.88$ 11,424.35 1% 1.18 124,106.00 6,707.76 (1.876) (2,328.57) 117,635.93 1.25 96,863.04 1.63 67,845.17 1.32 49,965.19 (0.15) (1.88) 1.25 0.38 0.45 (0.18) BBgBarc US Credit A+ TR USD 21 21 2.10% No Vanguard Wellesley® Income Inv VWINX 116,792 116,792.42$ 8,336.29 1% 1.44 97,876.00 5,290.07 4.136 92,773.39 0.59 76,390.89 1.08 53,505.98 11.18 39,404.97 1.84 4.14 0.59 1.92 3.79 1.83 Morningstar Lifetime Mod 2025 TR USD no skill -1.81% No Vanguard Target Retirement 2025 Inv VTTVX 102,420 102,420.02$ 6,804.52 1% 1.24 86,288.00 4,663.75 (0.909) (784.13) 81,789.51 1.21 67,346.61 1.13 47,171.16 1.87 34,739.63 (0.37) (129.68) (0.91) 1.21 0.50 0.59 (0.22) Morningstar Lifetime Mod 2030 TR USD no skill -1.42% No Vanguard Target Retirement 2030 Inv VTHRX 98,285 98,285.16$ 6,830.57 1% 1.08 82,533.00 4,460.80 (1.407) (1,160.99) 78,230.27 1.27 64,415.88 1.16 45,118.41 0.85 33,227.86 (0.43) (144.52) (1.41) 1.27 0.38 0.31 (0.33) BofAML US Treasury Current 2 Yr TR USD 16 16 0.43% No Goldman Sachs Short Dur Govt Instl GSTGX 88,076 88,075.52$ 1,177.42 1% 0.35 78,421.00 4,238.55 0.760 74,332.64 (0.26) (195.66) 61,206.52 (0.28) (168.94) 42,870.50 0.02 31,572.37 0.73 0.76 (0.26) 0.07 0.19 0.42 BBgBarc US Agg Bond TR USD 178 no skill 1.30% No Vanguard Target Retirement 2015 Inv VTXVX 66,497 66,497.10$ 3,680.17 1% 3.52 56,689.00 3,063.97 3.511 53,733.61 (1.01) (544.86) 44,244.99 0.60 30,990.24 15.02 22,823.04 7.15 3.51 (1.01) 1.01 4.99 0.51 Russell 3000 TR USD no skill -1.15% No Nationwide Inv Dest Mod Agrsv R6 GMIAX 66,128 66,128.12$ 5,599.41 1% (0.59) (391.72) 54,624.00 2,952.35 (3.010) (1,644.15) 51,776.26 (2.34) (1,210.42) 42,633.29 (7.89) (3,365.56) 29,861.36 (11.40) (3,404.87) 21,991.67 (2.04) (447.70) (3.01) (2.34) (4.37) (5.16) (2.24) Morningstar Lifetime Mod 2060 TR USD no skill -1.04% No Vanguard Target Retirement 2060 Inv VTTSX 47,494 47,493.99$ 3,685.36 0% 0.90 39,535.00 2,136.81 (2.033) (803.89) 37,473.90 1.80 30,856.53 2.63 21,612.64 2.17 15,916.83 - (2.03) 1.80 0.86 - - MSCI ACWI Ex USA NR USD 44 no skill 2.61% No Oppenheimer International Growth Y OIGYX 42,297 42,297.23$ (844.32) 0% 1.65 38,933.00 2,104.28 (6.553) (2,551.11) 36,903.29 9.10 30,386.68 (3.12) (948.68) 21,283.55 10.17 15,674.46 5.27 (6.55) 9.10 (0.19) 2.61 2.59 BBgBarc US Agg Bond TR USD 1,527 no skill 0.37% No Vanguard Target Retirement 2010 Inv VTENX 36,975 36,974.73$ 1,750.53 0% 2.07 31,788.00 1,718.10 2.577 30,130.78 (0.75) (226.53) 24,810.10 (0.04) 17,377.58 11.12 12,797.88 5.91 2.58 (0.75) 0.58 3.74 0.26 BBgBarc US Treasury US TIPS TR USD 73 no skill 0.51% No PIMCO Real Return Instl PRRIX 26,327 26,327.21$ 1,204.42 0% 0.72 22,672.00 1,225.39 0.357 21,490.03 (1.31) (282.30) 17,695.19 (0.22) 12,394.13 (0.44) (54.40) 9,127.77 2.27 0.36 (1.31) (0.41) 0.08 0.24 BBgBarc US Agg Bond TR USD 226 no skill 0.62% No Vanguard Target Retirement Income Inv VTINX 11,618 11,618.24$ 552.78 0% 1.99 9,986.00 539.73 2.604 9,465.40 (0.72) (68.33) 7,793.94 (0.43) (33.47) 5,459.06 7.89 4,020.37 4.01 2.60 (0.72) 0.47 2.67 0.54 #N/A #N/A #N/A #VALUE! #VALUE! 0% - - - - - - #N/A #N/A #N/A #VALUE! #VALUE! 0% - - - - - - #N/A #N/A #N/A #VALUE! #VALUE! 0% - - - - - - #N/A #N/A #N/A #VALUE! #VALUE! 0% - - - - - - #N/A #N/A #N/A #VALUE! #VALUE! 0% - - - - - - #N/A #N/A #N/A #VALUE! #VALUE! 0% - - - - - - #N/A #N/A #N/A #VALUE! #VALUE! 0% - - - - - - #N/A #N/A #N/A #VALUE! #VALUE! 0% - - - - - - #N/A #N/A #N/A #VALUE! #VALUE! 0% - - - - - - #N/A #N/A #N/A #VALUE! #VALUE! 0% - - - - - - #N/A #N/A #N/A #VALUE! #VALUE! 0% - - - - - - # funds Because fund managers underperform 90% of the time the calculation to the right is necessary to determine when the manager adds value and whether it is based on skill or luck. A t-statistic of 2 ensures a 95% confidence level. % Index Calc PlanGrader review: ABC 401k Plan bmck31patent pending PlanGrader for Feeney Brothers Excavation Corp

- 2. Prepared from IRS Forms 5500 filings by Rick Canipe, EA, QKA, MBA; IRS Enrolled Agent 77840; verify at epp@irs.gov or 855.472.5540` www.Fix401k.com www.MiraCenter.com Data from Morningstar.com #VALUE! =COUNTIF(R[1 0 0 0 99% TOTAL PAID OUT $432,523 $12,613 $95,420 $141,393 ? ? $ 681,949 Distributions 2012 2013 2014 2015 2016 2017Q2 -$8,210 -$682,132-$54,970 -$56,862 -$216,747 -$55,415 -$289,929 ABC 401k Plan Federal regulation 2550.408b-2 requires reviewing providers to determine they bring value and are "necessary." Federal regulation 2550.404a-5 requires disclosures to investors so they can evaluate performance versus benchmarks. This document was produced to aid in these efforts. "...emphasizes a duty to diversify, the avoidance of unjustified costs, and the importance of evaluating the portfolio as a whole…" 77% In 2016, what percent of the evaluated trust was invested in lagging funds? Supreme Court May 18, 2015 Ruling No In 2016, were >50% of assets invested in passive institutional shares? The Third Restatement of Trusts Prudent Investor Rule Adherence “The greater the trustee’s departure from one of the valid passive strategies, the greater is likely to be the burden of justification and also of continuous monitoring.” $ Lag 2012 2013 2014 2015 2016 2017Q2 TOTAL $ LAG "Under trust law, a trustee has a continuing duty to monitor trust investments and remove imprudent ones." 38% What % of the investment menu met or beat their benchmarks in 2016? Values from www.efast.dol.gov--also review and refer to your plan's annual 29 CFR 2550.404a-5 notice % of Plan Assets Reviewed: -63% -31% -38% -22% -70% -60% -50% -40% -30% -20% -10% 0% 2016 2015 3 YEAR 5 YEAR % of Funds Lagging Benchmarks (888)PlanLag www.FundLag.com AVERAGE % COST/YR +/- BENCHMARKS 2014-2016 -0.40% -0.71% Participants' Investment Cost v. Return Comparison Prepared using this plan's most recent public IRS/DOL Forms 5500 at www.dol.gov/efast Presented __________________________________ by R. Canipe, J. Holland or approved advisor

- 3. Prepared from IRS Forms 5500 filings by Rick Canipe, EA, QKA, MBA; IRS Enrolled Agent 77840; verify at epp@irs.gov or 855.472.5540` www.Fix401k.com www.MiraCenter.com Data from Morningstar.com % large US mgrs beat benchmark % mid US mgrs beat benchmark % small US mgrs beat benchmark 8% 5% 7% % of this plan's active managers demonstrating skill 1 23% 1 the % of managers' whose performance beat benchmarks (with a <40 year observation period (working life)) Did you know (since 2001)?2 ABC 401k Plan Due Diligence--facts for this plan's fiduciary investment "experts" under ERISA SEC Rule 156 requires mutual fund companies to tell investors NOT to base their expectations of future performance on past performance. Why? Because past performance often does not matter to help prove a manager is good. One of the key measurements of successful active management lies in the ability of a manager to deliver above-average returns consistently.to differentiate a manager’s luck from skill. According to the S&P Dow Jones' Persistence Scorecard, few funds can consistently stay at the top. Out of 568 U.S. stock funds that were in the top quartile as of March 2015, only 1.94% managed to stay in the top quartile at the end of March 2017 (2 years). Also, bad performing funds disappear at a significant rate. When managers’ performance against the prospectus benchmarks is poor, fund companies often close these funds so their poor performance does not taint their overall firm's ratings. Over the 15-year period ending 12/31/2016 the percent (%) of funds that were merged or liquidated were: • 58% of U.S. equity funds • 52% of global/international equity funds • 49% of fixed income funds were either merged or liquidated. 2 https://us.spindices.com/documents/spiva/spiva-us-year-end-2016.pdf 2 https://us.spindices.com/documents/spiva/persistence-scorecard-june-2017.pdf 0 4 2 1 11 0 2 4 6 8 10 12 <10 years >10, <20 >20, <30 >30, <40 >40 years # FUNDS MONITORINGYEARS Skilled Managers' observation years Prepared using this plan's most recent public IRS/DOL Forms 5500 at www.dol.gov/efast Presented __________________________________ by R. Canipe, J. Holland or approved advisor

- 4. Prepared from IRS Forms 5500 filings by Rick Canipe, EA, MBA IRS Enrolled Agent 77840; to verify the status, email epp@irs.gov or call 855.472.5540. www.Fix401k.com www.MiraCenter.com Data from Morningstar.com 99% Prudent Investor Rule Adherence “The greater the trustee’s departure from one of the valid passive strategies, the greater is likely to be the burden of justification and also of continuous monitoring.” Federal regulation 2550.408b-2 requires reviewing providers to determine they bring value and are "necessary." Federal regulation 2550.404a-5 requires disclosures to investors so they can evaluate performance versus benchmarks. This document was produced to aid in these efforts. ABC 401k PlanAmerican Law Institute Prudent Investor Rule "...emphasizes a duty to diversify, the avoidance of unjustified costs, and the importance of evaluating the portfolio as a whole…" 30% In 2016, what percent of the evaluated trust was invested in lagging funds? Supreme Court May 18, 2015 Ruling Yes In 2016, were >50% of assets invested in passive institutional shares? The Third Restatement of Trusts $ Lag 2012 2013 2014 2015 2016 2017Q2 TOTAL $ LAG "Under trust law, a trustee has a continuing duty to monitor trust investments and remove imprudent ones." 70% What % of the investment menu met or beat their benchmarks in 2016? Values from www.efast.dol.gov--also review and refer to your plan's annual 29 CFR 2550.404a-5 notice % of Plan Assets Reviewed: $4,107 -$10,600$2,461 -$214 -$3,566 -$8,463 -$4,925 TOTAL PAID OUT $432,523 $12,613 $95,420 $141,393 ? ? $ 681,949 Distributions 2012 2013 2014 2015 2016 2017Q2 -30% -27% -17% -21% -35% -30% -25% -20% -15% -10% -5% 0% 2016 2015 3 YEAR 5 YEAR % of Funds Lagging Benchmarks (888)PlanLag www.FundLag.com AVERAGE % COST/YR +/- BENCHMARKS 2014-2016 -0.17% -0.14% Participants' Investment Cost v. Return Comparison Prepared using this plan's most recent public IRS/DOL Forms 5500 at www.dol.gov/efast Presented __________________________________ by R. Canipe, J. Holland or approved advisor

- 5. Prepared from IRS Forms 5500 filings by Rick Canipe, EA, MBA IRS Enrolled Agent 77840; to verify the status, email epp@irs.gov or call 855.472.5540. www.Fix401k.com www.MiraCenter.com Data from Morningstar.com Prepared using this plan's most recent public IRS/DOL Forms 5500 at www.dol.gov/efast Presented __________________________________ by R. Canipe, J. Holland or approved advisor