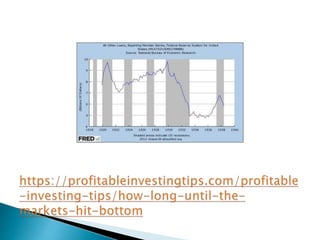

The stock market has seen significant declines this year, with the Nasdaq down 25%, S&P 500 down 20%, and Dow down over 10%, due to high inflation, Fed rate hikes, supply chain issues from Covid and the war in Ukraine, and other geopolitical factors. Historically, market crashes last until their underlying causes are resolved, with the average being 289 days. The 1929 crash lasted from 1929 to 1932 as it was exacerbated by tariffs and trade wars. The current crash may also last months or years until issues with inflation, Covid lockdowns, the Ukraine war, and global energy and commodity markets are remedied.