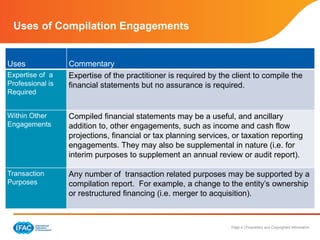

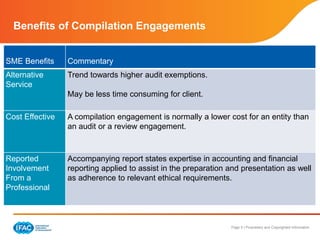

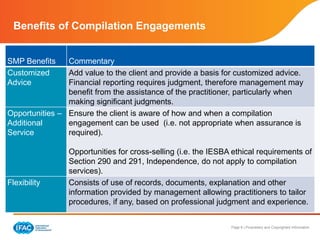

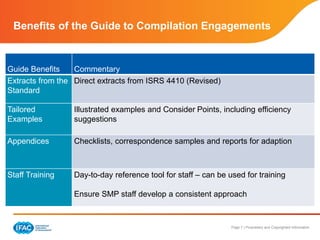

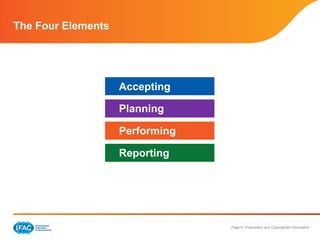

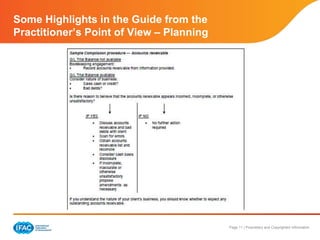

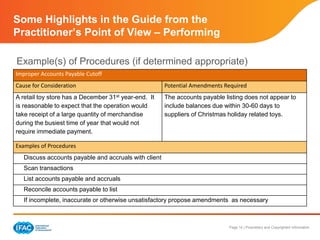

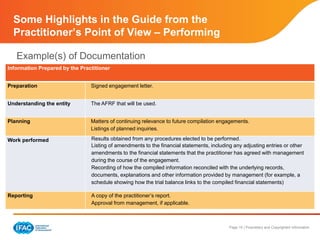

The document discusses the IFAC Guide to Compilation Engagements. It provides an overview of the IFAC SMP Committee, which developed the guide. The guide assists small- and medium-sized accounting practices in performing compilation engagements. It discusses the uses and benefits of compilation engagements for both SME clients and SMPs. It also summarizes the key elements of accepting, planning, performing and reporting on a compilation engagement as outlined in the guide from the practitioner's point of view.