IDFC Hybrid Equity Fund_Quarterly note

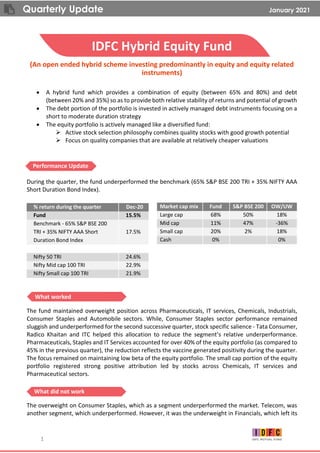

- 1. Quarterly Update January 2021 1 IDFC Hybrid Equity Fund (An open ended hybrid scheme investing predominantly in equity and equity related instruments) • A hybrid fund which provides a combination of equity (between 65% and 80%) and debt (between 20% and 35%) so as to provide both relative stability of returns and potential of growth • The debt portion of the portfolio is invested in actively managed debt instruments focusing on a short to moderate duration strategy • The equity portfolio is actively managed like a diversified fund: ➢ Active stock selection philosophy combines quality stocks with good growth potential ➢ Focus on quality companies that are available at relatively cheaper valuations During the quarter, the fund underperformed the benchmark (65% S&P BSE 200 TRI + 35% NIFTY AAA Short Duration Bond Index). % return during the quarter Dec-20 Fund 15.5% Benchmark - 65% S&P BSE 200 TRI + 35% NIFTY AAA Short Duration Bond Index 17.5% Nifty 50 TRI 24.6% Nifty Mid cap 100 TRI 22.9% Nifty Small cap 100 TRI 21.9% The fund maintained overweight position across Pharmaceuticals, IT services, Chemicals, Industrials, Consumer Staples and Automobile sectors. While, Consumer Staples sector performance remained sluggish and underperformed for the second successive quarter, stock specific salience - Tata Consumer, Radico Khaitan and ITC helped this allocation to reduce the segment’s relative underperformance. Pharmaceuticals, Staples and IT Services accounted for over 40% of the equity portfolio (as compared to 45% in the previous quarter), the reduction reflects the vaccine generated positivity during the quarter. The focus remained on maintaining low beta of the equity portfolio. The small cap portion of the equity portfolio registered strong positive attribution led by stocks across Chemicals, IT services and Pharmaceutical sectors. The overweight on Consumer Staples, which as a segment underperformed the market. Telecom, was another segment, which underperformed. However, it was the underweight in Financials, which left its Market cap mix Fund S&P BSE 200 OW/UW Large cap 68% 50% 18% Mid cap 11% 47% -36% Small cap 20% 2% 18% Cash 0% 0% What worked What did not work Performance Update

- 2. Quarterly Update January 2021 2 deepest mark on the portfolio, undoing to some extent, the improvement in performance since Apr’20. While banking sector results were better than expected, leading to upgrades, it was largely driven by lack of fresh NPA slippages – curtailed due to the Moratorium and Supreme Court ruling. Also, Banks were amongst the better performing sectors globally, a direct correlation of the vaccine “trade”, post the announcement of Pfizer/BionTech and Moderna vaccines. Sep-20 Sector/Weight Fund BSE 200 OW/UW Fund Health Care 14.0% 5.6% 8.4% 14.3% -0.3% Consumer Staples 14.6% 9.2% 5.4% 17.8% -3.1% Industrials 8.0% 4.4% 3.6% 6.1% 1.9% Auto 8.4% 5.8% 2.6% 8.7% -0.3% Telecommunication Services 3.6% 2.1% 1.6% 2.6% 1.0% Information Technology 15.3% 13.8% 1.5% 15.3% 0.0% Commodities 5.1% 4.0% 1.1% 7.7% -2.5% Cement / Building Mat 3.1% 2.5% 0.5% 2.6% 0.5% Consumer Discretionary 6.0% 5.6% 0.4% 7.0% -1.0% Utilities 0.0% 3.3% -3.3% 0.0% 0.0% Energy 2.0% 9.7% -7.7% 2.3% -0.3% Financials 19.9% 34.0% -14.1% 15.8% 4.1% Dec-20 Change during the Qtr During the quarter, the fund increased exposure towards Financials, Industrials and Telecommunication Services primarily, while reducing exposure towards Consumer Staples, Commodities and Consumer Discretionary. Health Care The sector is expected to sustain its H1 FY21 robust performance going forward as well. On the international front, stable generic pricing in the US and shortage in RoW (rest of world) on account of this horrific pandemic should boost margins. The domestic business will be boosted by lower selling costs and lower promotional spend. Moreover, with limited capital spending and improving margins, profitability ratios which had been on a decline after peaking in FY16 should see an upswing. Consumer Staples While the elevated valuations and modest y-o-y growth could result in muted investor response to this sector based on Q3 FY21 results expectations. However, this is a sector best used as a “shock absorber” in case of any market gyrations going forward. Financials Financials, as a sector, clearly benefitted from better than expected Q2 FY21 results. Whether those quarterly results reflected a “true and fair” picture of the sector, could be debated – Supreme Court ruling on no fresh NPA recognition and retail lending buoyed by Moratorium. If this was not enough, globally, Banking made a strong comeback on positive development on the vaccine front. While, the Portfolio stance – Key sectors Key changes during the quarter

- 3. Quarterly Update January 2021 3 underweight in Financials largely contributed to the underperformance of the fund, we may look to raise the weight of Financials going ahead and the key issue would be of timing, such a move! Portfolio Metrics Fund S&P BSE 200 Commentary PB Ratio 3.8 3.0 P/B ratio appears higher due to exposure to the private sector Financials. Source: Bloomberg, Based on trailing 12 months data The fund’s equity portfolio, will continue on the path to make the portfolio more “stable”. The recent AMFI classification of market cap, saw more than half of our Small cap portfolio graduate to Mid-Caps as on 01 Jan’21. Going ahead, we will be more selective and “strategic” in adding names in this segment, with a focus to raising our Large Cap exposure to over 70%. As mentioned earlier, the other focus would be to add Financials to the portfolio. Clearly our “flanking” weight in Industrials / Consumer Discretionary has not been able to match the move in Financials. Moreover, as economic activity normalises and fears on the NPA front subside, we believe Financials may further gain momentum. On the debt front, our portfolio maintains a conservative stance as reflected in its strong preference for AAA rated debt. Data as on 31st December 2020 Stable Sectors: Retail Banks & NBFC’s, IT, Consumer Staple & Discretionary, Auto, HealthCare Cyclical Sectors: Corp Banks & NBFC’s, Energy & Utilities, Industrials, Cement, Commodities, Telecom All data as on 31st December 2020 Asset Allocation of the Fund Equity 77.3% Debt 18.1% Cash & Others 4.6% Debt Quants of the Fund Average Maturity 2.39 years Modified Duration 2.02 years Yield to Maturity 4.32% Fund Stable Cyclical Total Large Cap 40% 28% 68% Mid Cap 10% 1% 11% Small Cap 12% 8% 20% Total 62% 38% S&P BSE 200 Stable Cyclical Total Large Cap 56% 32% 88% Mid Cap 6% 6% 12% Small Cap 0% 0% 0% Total 61% 39% Fund Manager Commentary Fund – Key metrics Portfolio Features Fund positioning – Stable & Cyclical Framework

- 4. Quarterly Update January 2021 4 Fund Performance Since the scheme has completed more than 3 year but less than 5 years, performance of the scheme for 1 year, 3 years and since inception has been shown. Performance based on NAV as on 31/12/2020. Past performance may or may not be sustained in future. The performances given are of regular plan growth option. Regular and Direct Plans have different expense structure. Direct Plan shall have a lower expense ratio excluding distribution expenses, commission expenses etc. #Benchmark Returns ##Alternate Benchmark Returns. The fund has been repositioned from Balanced category to Aggressive Hybrid category w.e.f. April 30, 2018. Equity portion of the Scheme is managed by Mr. Anoop Bhaskar (w.e.f December 30, 2016) and Debt Portion is managed by Mr. Anurag Mittal (w.e.f. December 30, 2016). Other Funds managed by the Fund Manager Performance based on NAV as on 31/12/2020. Past Performance may or may not be sustained in future. The performance details provided herein are of regular plan growth option. Regular and Direct Plans have different expense structure. Direct Plan shall have a lower expense ratio excluding distribution expenses, commission expenses etc. 4The fund has been repositioned from Balanced category to Aggressive Hybrid category w.e.f. April 30, 2018. 7The fund has been repositioned from a floating rate fund to a money market fund w.e.f. June 4, 2018. 6The fund has been repositioned from an ultra-short term fund to a low duration fund w.e.f. may 28, 2018.

- 5. Quarterly Update January 2021 5 Performance based on NAV as on 31/12/2020. Past Performance may or may not be sustained in future. The performance details provided herein are of regular plan growth option. Regular and Direct Plans have different expense structure. Direct Plan shall have a lower expense ratio excluding distribution expenses, commission expenses etc. 1The fund has been repositioned from a Mid cap fund to a value fund w.e.f. May 28, 2018. 4The fund has been repositioned from Balanced category to Aggressive Hybrid category w.e.f. April 30, 2018. IDFC Hybrid Equity Fund (An open-ended hybrid scheme investing predominantly in equity and equity related instruments) Disclaimer: MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY. The Disclosures of opinions/in house views/strategy incorporated herein is provided solely to enhance the transparency about the investment strategy / theme of the Scheme and should not be treated as endorsement of the views / opinions or as an investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document has been prepared on the basis of information, which is already available in publicly accessible media or developed through analysis of IDFC Mutual Fund. The information/ views / opinions provided is for informative purpose only and may have ceased to be current by the time it may reach the recipient, which should be taken into account before interpreting this document. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision and the security may or may not continue to form part of the scheme’s portfolio in future. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. The decision of the Investment Manager may not always be profitable; as such decisions are based on the prevailing market conditions and the understanding of the Investment Manager. Actual market movements may vary from the anticipated trends. This information is subject to change without any prior notice. The Company reserves the right to make modifications and alterations to this statement as may be required from time to time. Neither IDFC Mutual Fund / IDFC AMC Trustee Co. Ltd./ IDFC Asset Management Co. Ltd nor IDFC, its Directors or representatives shall be liable for any damages whether direct or indirect, incidental, punitive special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information.