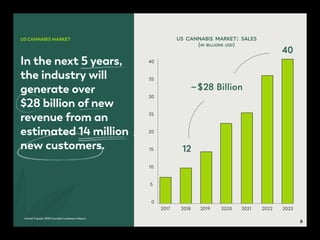

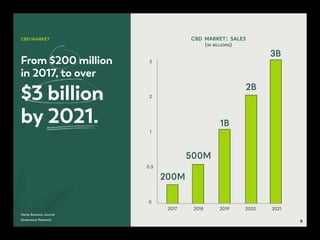

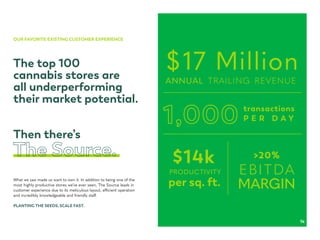

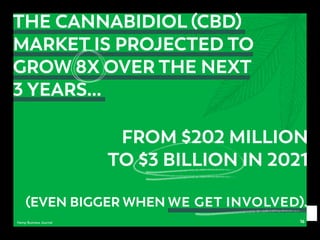

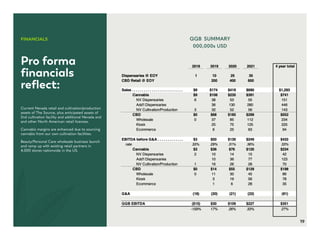

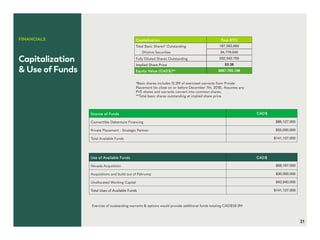

Green Growth Brands provides a summary of its business strategy, leadership team, and financial projections. The company plans to leverage its retail experience from brands like Victoria's Secret to become a leading cannabis and CBD retailer. It will focus on superior customer experiences and digital capabilities. Green Growth Brands currently operates The Source dispensary in Nevada and plans to expand nationally. It also intends to launch CBD personal care brands to tap the fast-growing CBD market. Financial projections show strong revenue and earnings growth from both cannabis retail and CBD wholesale opportunities.