Aurora is a leading cannabis company focused on innovation, execution, and expansion both domestically and globally. The document discusses Aurora's:

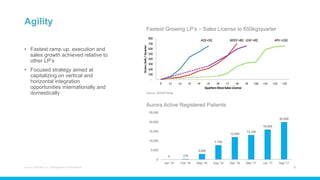

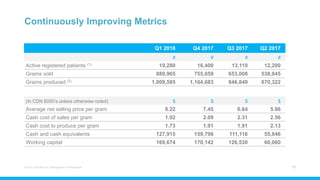

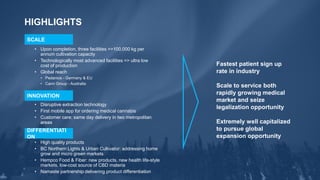

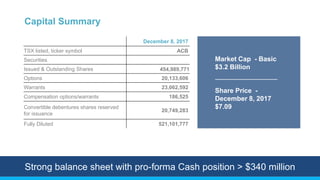

1) Agility in rapidly scaling operations and achieving sales growth through strategic partnerships and acquisitions.

2) Innovation across cultivation, concentrates production, and customer experience.

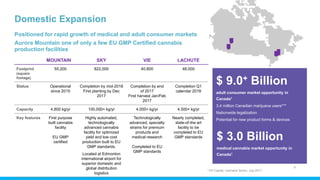

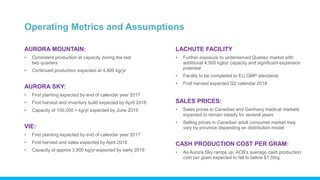

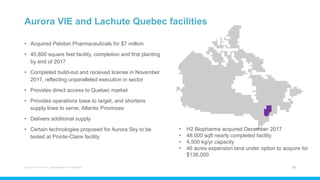

3) Execution on expanding production capacity through multiple facilities in Canada and internationally, with a focus on achieving EU GMP certification.